Electric two-wheeler sales in July cross 100,000 units after four months

With e-scooter and bike buyers advancing their purchases before the now-extended EMPS ended, this segment accounted for 60% of overall India EV Inc retails in July. While Ola Electric sells over 41,500 units for a 39% share of the market, the numbers battle between TVS and Bajaj Auto is getting intense.

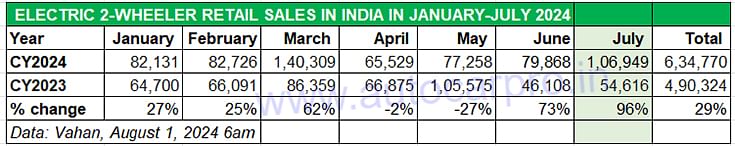

Retail sales of electric two-wheelers saw a smart month-on-month rise in July 2024 to 106,949 units, up 34% on June’s 79,868 units, and 96% year on year (July 2023: 54,616 units). This strong growth was expected as the now-extended Electric Mobility Promotion Scheme 2024 (EMPS) was to have ended on July 31, with e-scooter and bike buyers advancing their purchase decisions ahead of that date. However, on July 26, the government extended the EMPS subsidy scheme by another two months till the end of September.

This segment, which is the volume driver for India EV Inc, maintained the strong ratio at a 60% share of the total 1,78,948 EVs sold in India in July 2024, and helped drive overall industry numbers by 53% YoY, as per data published on the government of India’s Vahan website (as of August 1, 6am).

E2W OEMs are well set to hit the million milestone for the first time in 2024. Sven-month retails at 634,770 units are already 74% of 2023’s record sales.

E2W OEMs are well set to hit the million milestone for the first time in 2024. Sven-month retails at 634,770 units are already 74% of 2023’s record sales.

Like the e-three-wheeler industry, e-two-wheeler OEMs have been impacted by the now-reduced subsidy which saw most EV makers hike product prices. While this can somewhat dampen demand, the wallet-friendly long-term USP of an EV remains a big draw when compared to the high price of petrol, which currently costs Rs 103.44 a litre in Mumbai (on July 31).

This segment, which delivers the maximum volumes for India EV Inc and sold a record 860,365 units in CY2023, is well on its way to sell over a million units for the first time in a calendar year in CY2024. Seven months down the line, total retails at 634,770 units are up 29% YoY and already 74% of CY2023’s record number.

The seven-month retail sales data table above reveals that the lowest monthly sales in the year to date were in April 2024 – 65,529 units – following the closure of the FAME II subsidy scheme on March 31. This also explains why March 2024 with 140,309 units was the month with the highest-ever e-two-wheeler sales.

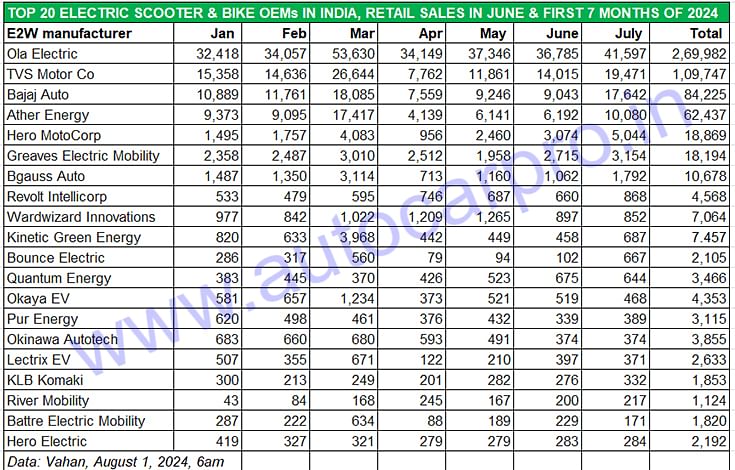

Let’s take a closer look at the top six movers and shakers of the industry in June and for the first six months of CY2024.

OLA ELECTRIC – July 2024: 41,597 units, up 114%

OLA ELECTRIC – July 2024: 41,597 units, up 114%

Market share: 39%

Jan-July 2024: 269,982 units, up 85% YoY (Jan-July 2023: 145,477 units)

Market leader Ola Electric, whose IPO is set to open on August 2, registered strong retail sales of 41,597 units in July 2024, up 114% YoY (July 2023: 19,406 units). The company continues in the same rich vein it opened CY2024 with 32,418 units in January units, hit a high of 53,630 units in March and maintained stellar month-on-month growth right from April through to July.

While Ola’s market share in July is 39%, its cumulative seven-month sales (269,982 units, up 85%) give it an overall market share of 42.53%, up from 29% a year ago.

Ola Electric’s move to enter the mass-market segment with the S1 X portfolio has paid off in the form of accelerated sales. Available in three battery configurations (2 kWh, 3 kWh, and 4 kWh), the scooters are priced at Rs 74,999, Rs 84,999, and Rs 99,999, respectively. The company has also recently revised the prices of its S1 Pro, S1 Air, and S1 X+ to Rs 129,999, Rs 1,04,999, and Rs 89,999, respectively.

TVS MOTOR CO – July 2024: 19,471 units, up 87%

Market share: 18%

Jan-July 2024: 109,747 units, up 25% YoY (Jan-July 2023: 87,490 units)

TVS Motor Co sold 19,471 iQube e-scooters in July 2024, improving 87% on year-ago sales (July 2023: 10,398 units) and 39% on June 2024’s 14,015 units. This gives it a market share of 18% in July. The company’s cumulative January-July 2024 sales at 109,747 units are up 25% YoY and give it a 17% market share in the year to date but marginally down on the 18% it had in the year-ago January-July 2023 period.

On May 13, two years after the iQube got its first refresh, TVS launched more variants, both at the lower and upper end of the spectrum. The iQube line-up now starts with a base variant with a 2.2kWh battery, 75km real-world range, charging time of 2 hours from 0-80 percent with a 950W charger and a slightly smaller than the rest 30-litre underseat storage area. This base variant is now the most affordable iQube at Rs 94,999. There is also a larger variant with a 3.4kWh battery. Both these models get a 5-inch TFT display with tow and theft alerts and turn-by-turn navigation.

The iQube ST line-up has expanded to include variants with two capacities – 3.4kWh and 5.1kWh. The iQube ST 3.4 variant (Rs 155,555) has a claimed real-world range of 100km. The range-topping ST 5.1 variant has the largest battery capacity of any Indian electric scooter and TVS claims a real-world range of 150km on a single charge. The iQube ST 5.1 also has a higher 82kph top speed, and the claimed charging time is 4 hours and 18 minutes from 0 to 80 percent. The ST 5.1 gets all the same features as the ST 3.4, but at Rs 185,373, it's the most expensive model in the line-up.

On June 9, TVS issued a first-ever voluntary recall for the iQube for the units manufactured between July 10, 2023 and September 09, 2023 to sort out an issue related to the bridge tube component in the iQube's chassis. While the specific number of recalled iQubes was not revealed, sales data for that period show that around 45,000 units were sold.

The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, is targeting a big jump in the contribution of EV sales to its overall volumes over the next two years.

BAJAJ AUTO – July 2024: 17,642 units, up 327%

BAJAJ AUTO – July 2024: 17,642 units, up 327%

Market share: 16.49%

Jan-July 2024: 84,225 units, up 213% YoY (Jan-July 2023: 26,916 units)

Bajaj Auto seems to have cemented its position as the No. 3 e-two-wheeler OEM, after Ola and TVS. July, which saw 17,642 Chetaks being retailed, which makes for a 375% YoY increase on a low year-ago base (July 2023: 4,128 units) was the seventh month in a row that Bajaj has outsold Ather Energy. What’s more, it is now hard on the heels of TVS Motor Co.

In the January-July 2024 period, Bajaj Auto has sold a total of 84,225 Chetaks, 57,309 units more than the 26,916 units in the year-ago period and registering handsome growth of 213% YoY. This stellar performance gives Pune-based auto major a market share of 16.49%, a big jump over its 5.51% share in the year-ago period.

Bajaj Auto, which markets the two Chetak variants – Urbane (Rs 123,319) and Premium (Rs 147,243) – continues to see strong demand. This is thanks to a ramped-up production and a growing dealer network, which is to be expanded from its existing presence in 164 cities and 200 touchpoints to around 600 showrooms in the next three to four months. Bajaj Auto is also soon to further up the ante with the launch of a new mass-market e-scooter under the Chetak brand umbrella.

In July 2024, the Bajaj Chetak rode past the 200,000-unit wholesales milestone in the domestic market, news of which Autocar Professional broke. Launched just before the pandemic struck, Bajaj Auto’s first electric scooter took four years to achieve 100,000 sales. The next 100,000 though have come in a scant eight months as a result of new variants and an expanded retail sales network, with June 2024’s 16,691 units its highest monthly dispatches yet.

ATHER ENERGY – July 2024: 10,080 units, up 51%

Market share: 9.42%

Jan-July 2024: 62,437 units, down 5.40% YoY (Jan-July 2023: 66,004)

Ather Energy sold a total of 10,080 units in July 2024, which gives it an e-two-wheeler market share of 9.42 percent. Its cumulative January-July sales at 62,437 units are down 5% (January-July 2023: 66,004 units), which could reflect the heat of growing competition for the company.

Four months ago, on April 6, Ather launched the new Rizta at a starting price of Rs 109,999 (Rizta S) through to Rs 149,999 (Rizta Z). Deliveries of the Rizta began on July 4. While the S version is equipped with a 2.9 kwH battery and has a 123km range, the Z variant with a 3.7 kWH battery has a 160km range. Key highlights for the family EV include the largest two-wheeler seat in India and storage space aplenty.

In June, Ather Energy announced plans to set up its third India plant in Maharashtra. The facility, which will come up in the Aurangabad Industrial City (AURIC), calls for an investment of over Rs 2,000 crore and will annually produce up to a million units of both EVs and battery packs.

HERO MOTOCORP – July 2024: 5,044 units, 409%

HERO MOTOCORP – July 2024: 5,044 units, 409%

Market share: 4.71%

Jan-July 2024: 18,869 units, up 506% YoY (Jan-July 2023: 3,111 units)

The world’s largest two-wheeler manufacturer and the last of the big legacy players to enter the EV market is seeing demand pick up for its Vida brand of e-scooters. The company, which sold 5,044 units in July, clocked 409% YoY growth on a low year-ago base of 990 units. Market share has risen to 2.68% from 0.51% in G1 2023.

In June, Hero MotoCorp, which is an early investor in Ather Energy and has been a part of the Bengaluru-based smart electric scooter manufacturer's growth story since 2016, hike its stake by 2.2% and is banking on demand growing for Ather products.

GREAVES ELECTRIC MOBILITY – July 2024: 3,154 units, up 46%

Market share: 3%

Jan-July 2024: 18,194 units, up 207% YoY (Jan-July 2023: 5,928 units)

Having launched its new Ampere Nexus e-scooter, Greaves Electric Mobility saw a smart rise in its July sales to 3,154 units, up 46 percent. The company’s cumulative seven-month sales at 18,194 units are a sizeable increase over the 5,928 units sold a year ago. Nevertheless, this performance is reflected in market share which has risen to 3% from 0.56% a year ago.

Targeted at families, the Ampere Nexus has been designed and developed in-house at the Ranipet facility in Tamil Nadu. Equipped with a 3 kWH LFP battery, the Nexus has a claimed top speed of 93kph and a certified range of 136km. Sold in two variants, prices start at Rs 110,000 (ex-showroom) and go up to Rs 120,000.

GROWTH OUTLOOK FOR E2W INC

July 2024 overall was a good month for the e-two-wheeler industry and month-on-month growth was to be had by most players. On the Top 20 OEMs, only two saw a MoM decline. With the EMPS scheme now extended till September 30, expect OEMs to continue with their special offers which include discounts. With Ganesh Chaturthi on September 7, next month should see demand once again perk up. Will the government introduce FAME III after that? We’ll have to wait for that.

ALSO READ:

Electric 3Ws clock best-ever monthly sales in July: over 63,000 units

Electric car & SUV OEMs sell 7,500 units in July, 56,000 EVs in first 7 months of 2024

RELATED ARTICLES

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

01 Aug 2024

01 Aug 2024

42846 Views

42846 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal