Electric 3Ws clock best-ever monthly sales in July: over 63,000 units

The segment, which is seeing the fastest shift to e-mobility, scales a new high in July with over 63,000 units sold. While Mahindra Last Mile Mobility maintains its stranglehold on the market with nearly 7,000 units and an 11% share, ahead of YC Electric, Bajaj Auto gets onto the podium for the first time.

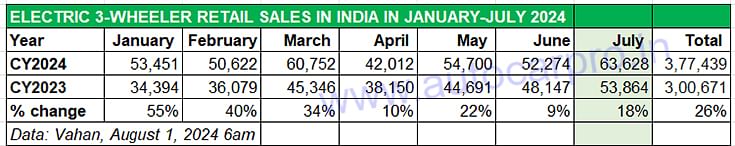

July 2024 has turned out to be a celebratory month for India 3-Wheeler Inc. That’s because this sub-segment of the EV industry has hit its best-ever monthly sales – 63,628 units, up 18% YoY (July 2023: 53,864 units), beating the previous best of 60,752 units in March 2024.

After the FY2024-ending March, sales had slowed down in April (42,010 units, up 10%), picked up in May (52,274 units, up 22%), then slowed down in June (52,274 units, up 9%). Clearly, the boost for July 2024 sales has been the EMPS subsidy, which was originally slated to end on July 31but has now received an extension till September 2024. Typically, buyers would have advanced their purchases to before July ended.

Nevertheless, as per Vahan data (August 1, 2024, 6am), cumulative seven-month retails at 377,439 units are a strong 26% YoY increase (January-July 2023: 300,671 units) and already 64% of CY2023’s record sales of 583,601 units.

Like the e-two-wheeler industry, e-three-wheeler OEMs have been impacted by the now-reduced subsidy which has a number of OEMs increase their product prices. While this can somewhat dampen demand, the wallet-friendly long-term USP of an EV remains a draw in the electric three-wheeler segment, which has seen the fastest transition to e-mobility amongst all vehicle segments.

On July 26, the government extended the duration of the Electric Mobility Promotion Scheme 2024 (EMPS 2024) by two months – from July 31 up to September 30, 2024 – with enhancement of the outlay to Rs 778 crore from the previous Rs 500 crore. The eligible EV categories are two- and three-wheelers (including registered e-rickshaws, e-carts and L5 category e-3Ws).

The scheme now targets to support 560,789 EVs, comprising 500,080 e-two-wheelers and 60,709 ethree-wheelers (e-3Ws). This includes 13,590 rickshaws and e-carts, as well as 47,119 e-3Ws in the L5 category.

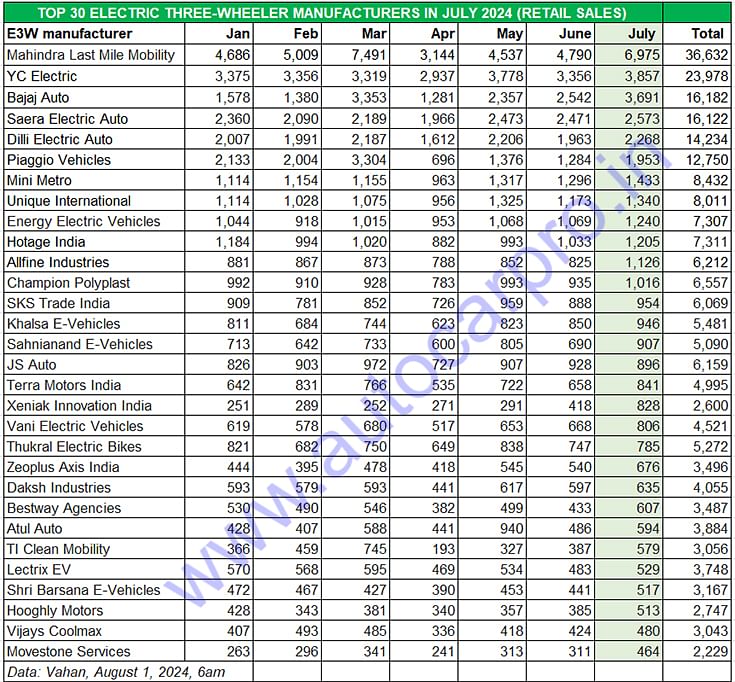

Mahindra Last Mile Mobility, which had a special offeer in July, sales maintained its strong grip with sales of 6,975 units for an 11% market share.

Mahindra Last Mile Mobility, which had a special offeer in July, sales maintained its strong grip with sales of 6,975 units for an 11% market share.

MAHINDRA SHARE RISES TO 11%, BAJAJ AUTO TAKES NO. 3 POSITION

This segment of the EV market is the one which is witnessing the fastest transition to e-mobility and at present each second three-wheeler sold in India is a zero-emission model. This is also the segment which has the highest number of players – 512 – as per Vahan company-wise data. Despite this big number, 10 players dominate the market and in July, they accounted for 42% of total sales.

Electric three-wheeler market leader Mahindra Last Mile Mobility maintains its strong grip and was over 3,000 units ahead of the No. 2 player. MLMM sold a total of 6,975 units, which gives it an 11% market share.

In July, ahead of the government extending the EMPS subsidy, the had aggressively pushed its five models (see pic above) comprising the Treo, Treo Plus, Treo Zor, Treo Yaari, Zor Grand, e-Alfa Super and e-Alfa Cargo which cater to multiple mobility operations in the passenger and cargo domains. To ensure sustained supplies to meet growing demand, MLMM has tripled its production capacity, leveraging its manufacturing plants in Bengaluru, Haridwar, and Zaheerabad.

In the first seven months of CY2024, MLMM has sold a total of 36,632 units, which makes for average monthly sales of 5,194 units. Last month saw MLMM sign an MoU with Ecofy to offer ease of finance for 10,000 units through leasing and subscription schemes.

MLLM, which sold a total of 54,599 units in CY2023, has already achieved 67% of that in the first seven months of 2024, and is headed for record sales this year. Given the monthly average it is currently registering, MLMM could end the year with estimated retails between 60,000 to 65,000 units.

The firm No. 2 player is YC Electric Vehicles, which sold 3,857 units in July – this is its best monthly sales yet and takes its January-July 2024 total to 23,978 units, 59% of its total CY2023 sales of 40,788 units. Like MLMM, YC Electric has five products – the Yatri Super, Yatri Deluxe and Yatri for passenger duties and E-Loader and Yatri Cart for cargo operations. Low initial cost, from Rs 125,000 to 170,000 for passenger EVs, and Rs 130,000 to Rs 165,000, is what is driving demand for this company.

Bajaj Auto, which is the IC engine three-wheeler market leader, has two products on sale – the Bajaj RE E-Tec 9.0 passenger EV and Maxima XL Cargo E-Tec 12.0. July 2024, with 3,691 units sold, marks the first time that Bajaj Auto has taken the No. 3 rank for a month. July retails are also Bajaj’s best monthly figures yet. While its January-July 2024 total of 16,182 units remains below Saera Electric Auto, Bajaj Auto is clearly making its presence felt. Since its e3W market entry in June 2023, Bajaj Auto has seen demand rising month on month, which is reflected in the company’s 5.80% market share in July.

In CY2023 (six months since market entry in June 2023), Bajaj Auto was ranked 28th. In FY2024, in just 10 months after its EV rollout, Bajaj grabbed a 2% market share and was ranked No. 13. Fourteen months down the line, it is now No. 3 and a 6% market share. With growing demand for both its products, ramped-up production and an expanded EV sales network, expect the Pune-based auto major to achieve higher numbers.

Saera Electric Auto is ranked fourth with 2,573 units in July and cumulative retails of 16,122 units for the first seven months of 2024.

Dilli Electric Auto maintains its fifth position on the OEM ladder-board with 2,268 units in July, and 14,234 units in January-July 2024.

Piaggio Vehicles, which sold 1,953 units in July, is ranked sixth on the cumulative seven-month scale with 12,750 units.

ALSO READ:

Electric two-wheeler sales in July cross 100,000 units after four months

Electric car & SUV OEMs sell 7,500 units in July, 56,000 EVs in first 7 months of 2024

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

01 Aug 2024

01 Aug 2024

20090 Views

20090 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau