Chip shortage sees new car sales slump by 21% in October

Supply of new cars to dealers suffers due to production constraints at major OEMs.

Just when things were beginning to look slightly good for passenger vehicle OEMs in India, the ongoing shortage of semiconductors has proven to be a major spoilsport. With plenty of them used in electronics components that today’s high-on-connectivity and infotainment vehicles are flooded with, any supply chain hitch can drive production schedules asunder. It’s a nightmare that refuses to end. And October saw some leading carmakers impacted.

All this is happening just when the festive season has opened and consumers are willing to spend once again, albeit somewhat gingerly.

The month of October saw most passenger vehicle (PV) OEMs in India struggle to fulfil the increased consumer demand during the festive season – which is also coupled with a largely-controlled Covid situation this year.

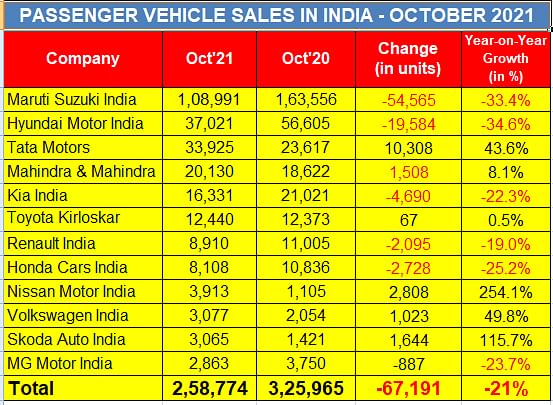

As per the wholesales numbers released by 12 carmakers, October 2021’s total PV count was 258,774 units, down a substantial 21% year on year (October 2020: 325,965 units). While the country’s largest carmaker – Maruti Suzuki India – registered a 33% decline in despatches to its dealers, Tata Motors, on the other hand,, made the best of the situation by stepping up its supply chain coordination and registering as much as 44%YoY sales growth. Here’s taking a closer look at the company-wise sales last month:

Maruti Suzuki India: 108,991 units / -33.4%

The bellwether of India’s PV industry recorded a sharp 33.4% YoY decline in sales which were pegged at 108,991 units (October 2020: 163,556). The company says it took all possible measures to minimise the impact of the chip shortage, and was able to perform better than expected at the start of the month.

Its entry-level duo of Alto and S-Presso sold 21,831 units (October 2020: 28,462 / -23%), while the compact-segment cars that include the Baleno, Dzire Ignis, Swift, Tour S, WagonR and Celerio registered a substantial drop of 49 percent to clock only 48,690 units (95,067).

Maruti Suzuki’s UV models were the only saving grace at 27,081 units (25,396 / +7%). These models include the Vitara Brezza, Ertiga, Gypsy, S-Cross and XL6.

The carmaker has already cautioned that November would see opportunities getting lost too, as production this month is projected at 85 percent of normal output.

Hyundai Motor India: 37,021 units / -34.6%

The Korean carmaker and the No. 2 PV OEM by sales volumes too was severely impacted by the chip shortage last month. It sold 37,021 units (October 2020: 56,605 / -34.6%). With its high-on-demand models such as the Creta, Venue, i20 and Aura being also electronics-intensive products, the company is staring at high waiting periods for its best-selling models.

Tata Motors: 33,925 units / +43/6%

If any carmaker has shown resilience and absolute stepping up of coordination during the entire global chip upheaval, it is homegrown major Tata Motors. The company registered a significant 43.6 percent YoY sales uptick to sell 33,925 units (23,617).

Of these 33,925 units, 1,586 comprised its full-electric models – the Tata Nexon EV, Tigor EV and Xpres-T EV. The company’s EV cars registered a notable 276 percent YoY growth as well (October 2020: 1,078).

Despite the semiconductor shortage, Tata Motors, in fact, went ahead and launched its latest mass-market sub-compact SUV – the Tata Punch – on October 18, eyeing more month volumes on a monthly basis and cement its position in the Top 3 tier in the PV segment in India.

Mahindra & Mahindra: 20,130 units / +8.1%

The Indian UV major too was able to buck the trend and reported an 8.1% YoY sales uptick at 20,130 units (18,622) last month. The company received a robust market response to the XUV700, and is already looking at a 50,000-unit-strong order book.

According to Veejay Nakra, CEO, Automotive Division, M&M, “Demand for vehicles across our product portfolio remains robust. We have received an unprecedented response for XUV700 and as per our commitment, we have commenced deliveries of the petrol variant to customers.The supply chain issues around semi-conductor related parts continues to be dynamic as we focus on managing the situation in the short term.”

Kia India: 16,331 units / -22.3%

The Hyundai Group company reported a decline of 22.3 percent in sales on a YoY basis to conclude dealer despatches in the month at 16,331 units (October 2020: 21,021). Its mid-sized SUV Seltos garnered sales of 10,488 units, while the smaller Sonet clocked 5,443 units.

According to Tae-Jin Park, MD and CEO, Kia India, "The adverse supply chain situation has been an opportunity lost for us; however, our customers' and vendors' continuous support has enabled us to maintain a healthy performance throughout the year.”

“As we foresee the issue to continue for the next few months, we assure our customers to keep optimising our production to the maximum level and ensure delivery at the earliest. We are keeping a close eye on the situation and are ready to take the necessary steps as and when required," Park added.

Toyota Kirloskar Motor: 12,440 units / +0.5%

Toyota saw a flat sales performance with despatches standing at 12,440 units (12,373) last month. The company is witnessing uptick in consumer demand with increasing normalcy in the Covid situation across the country. The Toyota Fortuner and Innova Crysta have been the drivers of demand for the company, with an added push from the Glanza and Urban Cruiser at the entry-level space.

Renault India: 8,910 units / -19%

French carmaker clocked total dealer despatches of 8,910 units (11,005), registering a 19 percent YoY sales drop owing to the semiconductor shortage. The company is witnessing strong demand for the RenualtTriber MPV and Kiger sub-four-metre SUV, both of which are pitched as value-for-money offerings in their respective segments.

Honda Cars India: 8,108 units / -25.2%

The Japanese carmaker was considerably impacted by the chip shortage, to register a 25.2 percent YoY sales decline to 8,108 units (10,836). The company witnessed consumer demand and buyer sentiment to consistently follow an improving trajectory.

“However, the situation remains dynamic due to the ongoing supply-side challenges, and we were able to wholesale the entire factory stock in October. We continue to make all possible efforts to maintain a steady delivery pace and cater to the market demand effectively,” said Rajesh Goel, SVP and Director, Marketing and Sales, Honda Cars India.

Nissan Motor India: 3,913 units / +254%

Nissan clocked wholesales of 3,913 units (1,105) on the back of the Magnite compact SUV, and registering a four-fold jump in sales over last year, when it didn’t have its make-or-break model in the country.

“In continuation of the positive momentum, this festive season has been very good with the channel partners delivering highest monthly retail sales. Going forward on the strength of strong bookings of the Nissan Magnite and support of the supply chain, our endeavour will be to maintain this growth momentum for the upcoming months,” said Rakesh Srivastava, MD, Nissan Motor India.

Volkswagen India: 3,077 units / +49.8%

The India 2.0 strategy has worked in favour of the German carmaker which reported wholesales of 3,077 units (2,054) last month, registering a significant 49.8 percent YoY sales uptick. The launch of the Taigun midsize SUV, which is garnering strong bookings for the company is a good sign of its revival in the Indian market.

Skoda Auto India: 3,065 units / +115.7%

Volkswagen’s cousin – Skoda – too is the beneficiary of the Group’s India 2.0 strategy, with the Skoda Kushaq midsize SUV reviving the brand to clock 3,065 units (1,421) last month and multiply sales by almost two times. The Kushaq has received 15,000 bookings so far in India.

MG Motor India: 2,863 units / -23.7%

MG Motor India sold 2,863 cars to customers in October, registering a YoY sales decline of 23.7 percent (October 2020: 3,750), owing to the semiconductor shortage. The company is seeing consumer demand on the rise, and received over 4,000 bookings for the Hector, 600 for the ZS EV and 5,000 bookings for the newly-launched Astor on October 11.

Growth outlook

With Diwali barely three days away and considerable improvement in consumer sentiment, PV manufacturers are keeping their fingers firmly crossed that there is a positive rub-off on sales. However, this time around, due to the paucity of most popular models, thu usual handsome discounting at festive season time are not there.

What could and will likely play spoilsport in the PV growth story is the ongoing semiconductor shortage, rising commodity prices and skyhigh fuel prices. Inability to get a vehicle of their choice on demand and far feweer discounts are also driving car buyers to consider pre-owned cars. Not surprisingly, the used car market in India is booming.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

01 Nov 2021

01 Nov 2021

6846 Views

6846 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal