Car and SUV makers capture festive demand, October sales soar to record 391,000 units

Strong growth tailwinds in the form of the ongoing festive season, ramped-up production, new models aplenty particularly SUVs and MPVs, and an improved economic sentiment pump up passenger vehicle volumes to a record monthly high.

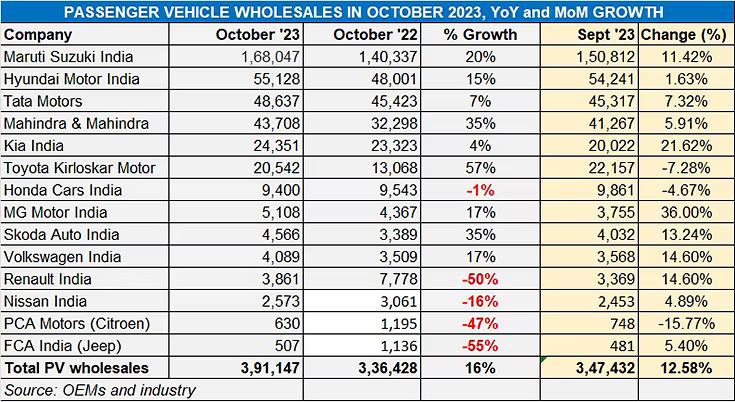

As expected, Diwali has come early for India Passenger Vehicle Inc. Combined wholesale numbers of 14 manufacturers for October 2023 have totalled a staggering 391,147 units, only a few thousand units shy of the 400,000-unit mark. Not only does this big number constitute strong 16% year-on-year growth (October 2022: 336,428) on a high year-ago base but, importantly, is 12% up month on month too (September 2023: 347,432 units).

These numbers are dispatches from vehicle OEMs in a month that saw the festive season, which had begun with Onam in end-September, continuing from Navratri (October 15-24) and will heighten with Dhanteras and Diwali in mid-November.

October marks the 10th month in a row that PV numbers have surpassed the 325,000-unit mark and the fourth straight month of 350,000-plus wholesales.

October marks the 10th month in a row that PV numbers have surpassed the 325,000-unit mark and the fourth straight month of 350,000-plus wholesales.

The India PV Inc growth story is real and OEMs can take pride in the fact that October 2023 is the 10th straight month of record dispatches from OEMs. Cumulative sales in the January-October 2023 period are an estimated 3.47 million units (34,73,990). With November being a festive month too, sales are expected to maintain the strong momentum, which means total CY2023 wholesales are set to cross the 4 million-units mark, driving ahead of CY2022’s record 3.79 million units.

For the first seven months of FY2024, cumulative sales are an estimated 2.45 million units (24,56,466), marking 10% YoY growth (April-September 2022: 22,27,853). With five months still to go in the fiscal year, the PV industry has already clocked 63% of FY2023’s record 3.89 million units and, as forecast in the calendar year 2023, will cross the 4-million mark in FY2024 too.

It is estimated that UV sales account for 1.35 million units, or over 55%, of the 2.45 million PVs sold in between April and October 2023.

It is estimated that UV sales account for 1.35 million units, or over 55%, of the 2.45 million PVs sold in between April and October 2023.

SUV-vival of the fittest

October 2023 marks the 10th month in a row that PV sales have surpassed the 325,000-unit mark and the fourth straight month of 350,000-plus sales, a performance which has been powered by sales of the utility vehicle segment which comprises SUVs and MPVs.

With every second car sold in India being a utility vehicle, SUV or an MPV and the rate of growth in this segment far above that of hatchbacks or sedans, the UV sub-segment continues to be the number-driver for nearly all OEMs.

Given that the utility vehicle (UV) segment, which comprises SUVs and MPVs, accounted for 57% of total PV sales in April-September 2023, it can be surmised that over 215,000 units sold in October were UVs. In FY2023, UVs accounted for a 51% share of the total 3.89 million PVs sold, which is indicative of the rapid growth in the ongoing fiscal year.

This is amply reflected in the growth that the leading players have achieved in October. The top six OEMs – Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Kia India and Toyota Kirloskar Motor – have all recorded strong growth, four of them in double digits. What’s more, other than Toyota, the other five OEMs have also seen month-on-month growth over their September sales (see data table above). And, it’s not surprising that all these six OEMs product portfolios are armed with a strong armoury of SUVs and MPVs.

INDIA PASSENGER VEHICLE INC DRIVING TOWARDS RECORD 4.15 MILLION SALES IN FY2024

With the wave of surging demand for SUVs continuing to grow, and the two-month festival season at its peak, India PV Inc can be assured of sustained demand in the coming months. With the current strong momentum, the sector is driving towards over 4 million sales for the entire fiscal. Not only will it surpass FY2023’s record 3.89 million units but it could well set a new benchmark at around 4.15 million units.

What is accelerating sales is recent new product launches and all of them UVs – the facelifted Tata Nexon and Nexon.ev, facelifted Seltos midsize SUV, Maruti Invicto MPV, Hyundai Exter compact SUV, Tata Punch CNG, Toyota Rumion MPV and the Honda Elevate midsize SUV. Each of these UVs have the potential to expand the market as well as eat into rivals’ market share.

What comes as sweet news for India Auto Inc is the improving economy – GDP growth for the first quarter of FY2024 has accelerated to 7.8% from 6.1% in the preceding quarter with rural demand in recovery mode. This should give a fillip to vehicle sales albeit growth is expected to moderate subsequently given the somewhat inflationary conditions, a below-normal monsoon and high interest rates.

While demand in the entry level hatchback market remains tepid, demand is better in the mid-level and premium hatchback categories. Consumer demand for CNG-powered PVs had slackened in the first-half of CY2023 albeit that could be due to OEM supply constraints. Demand however has bounced back in the past three months and retail sales of CNG-powered cars and SUVs, at 265,815 units in the January-September 2023 period were up 9% year on year. Meanwhile, the few OEMs, which have electric cars and SUVs, are also seeing demand grow month on month.

India Passenger Vehicle Inc, which currently has an estimated order backlog of over 600,000 units, has ramped up factory production to cater to the surging demand in the ongoing festive season. Nearly all carmakers have put the chip crisis behind them and remain confident of significantly improved semiconductor supplies.

Captains of industry expect PV sales to cross a million units in the festive season, which is absolutely good news for India PV Inc and the entire automotive ecosystem. Diwali has come early this year in October, and November should provide even more fireworks.

ALSO READ:

Tata, Toyota and VW buck industry decline in car and sedan sales in H1 FY2024

SUVs capture 57% of India's PV market: Maruti leads with 26% market share, M&M at 18% in H1 FY2024

India Auto Inc well set for a strong FY2024, dispatches 11.61 million units in H1

Maruti Suzuki takes big lead in car and SUV exports in H1 FY2024

EV sales in H1 FY2024 jump 51% to 738,000 units, fiscal headed for record 1.5 million

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

02 Nov 2023

02 Nov 2023

15456 Views

15456 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau