Bajaj Auto, Piaggio and Mahindra power three-wheeler sales in April-November

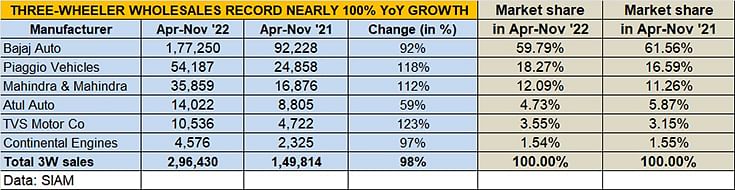

Three-wheeler despatches are up 98% in the first eight months of FY2023 to 296,430 units and the top three OEMs – Bajaj Auto, Piaggio and Mahindra – command 90% of the market,

India Auto Inc is on a roll and as per the cumulative wholesale numbers released by apex industry body SIAM for April-November 2022 for three vehicle segments, total despatches of over 14 million units are a strong 26% year-on-year growth over April-November 2021’s 11.14 million units.

While the passenger vehicle segment continues its speed run with 37% YoY growth and 2.5 million units and utility vehicles maintaining a 50% market share, demand for two-wheelers is returning with a 22% increase to 11.2 million units. However, the subject of this analysis is the three-wheeler category, which is also leading the charge for the electric vehicle category along with two-wheelers.

Three-wheeler despatches from OEMs have nearly doubled in the first eight months of FY2023 to 296,430 units, up 98% (April-November 2021: 149,814). Seventy-three percent constitute passenger carriers (216,652) while goods carriers account for 21% (63,208). Electric three-wheelers with 17,470 units constitute the remaining 5.89%, a sizeable increase from the 3.9% a year ago – 5,844 units in April-November 2021 and reflective of the shift to electric mobility.

Given the current robust demand, all six three-wheeler SIAM member companies have recorded strong growth (see data table below).

A macro look at SIAM’s overall wholesales data table reveals that the top three OEMs – Bajaj Auto, Piaggio and Mahindra – command 90% of the market: 267,296 units of the total 296,430 units sold. Bajaj Auto has a commanding 60% share of the three-wheeler market with 177,250 units, up 92%, in April-November 2022 albeit it has lost marginal market share (April-November 2021: 61.56%). No. 2 player Piaggio Vehicles, with 54,187 units, up 118%, has increased its share to 18.27% from 16.59% a year ago. Mahindra & Mahindra too has done well with 35,859 units, up 112%, and also grown market share to 12% from 11.26% a year ago.

A macro look at SIAM’s overall wholesales data table reveals that the top three OEMs – Bajaj Auto, Piaggio and Mahindra – command 90% of the market: 267,296 units of the total 296,430 units sold. Bajaj Auto has a commanding 60% share of the three-wheeler market with 177,250 units, up 92%, in April-November 2022 albeit it has lost marginal market share (April-November 2021: 61.56%). No. 2 player Piaggio Vehicles, with 54,187 units, up 118%, has increased its share to 18.27% from 16.59% a year ago. Mahindra & Mahindra too has done well with 35,859 units, up 112%, and also grown market share to 12% from 11.26% a year ago.

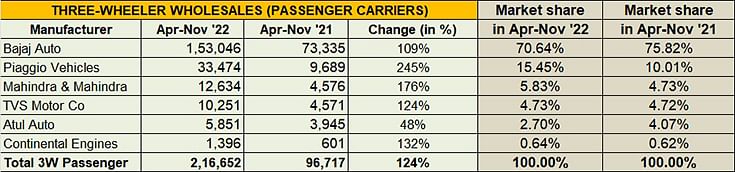

Passenger-carrying 3Ws have 73% of market

With India back on the move and three-wheelers offering an affordable mode of passenger transportation in town and country, it’s no surprise that sales of passenger carrying three-wheelers are up 124% to 216,652 units and account for 73% of total three-wheeler wholesales.

Bajaj Auto’s overall market leadership is thanks to this segment where with 153,046 units it has a 70% share with its Maxima and RE models. However, a closer look at the data sheet reveals that Bajaj Auto’s passenger carrier share has reduced by 5 percentage points.

A hard-charging Piaggio Vehicles, which recorded 245% YoY growth to 33,474 units (albeit on a low base) seems to have eaten into Bajaj’s share, given that Piaggio has increased its market share to 15.45% from 10% a year ago with its Ape Auto and Ape City models.

Mahindra & Mahindra, with 12,634 units, recorded 176% YoY growth with its Alfa and Treo models and has seen its share grow to 5.83 percent.

Chennai-based TVS Motor Co is the other OEM with five-figure sales: 10,251 units, up 124%, and a market share of 4.73% in the April-November period with a single product: the TVS King 4S.

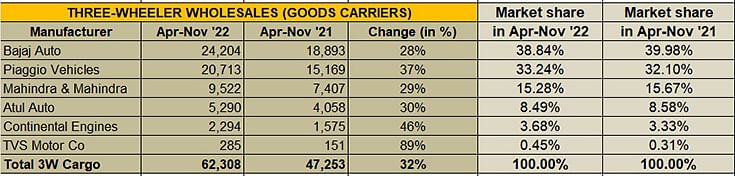

Piaggio hard on Bajaj’s wheels in 3W goods carriers

Piaggio hard on Bajaj’s wheels in 3W goods carriers

With fast-rising demand for last-mile delivery, particularly urban India, the hub-and-model is now accelerating demand for cargo-ferrying three-wheelers. The wholesales of 62,308 units, up 32% in April-November 2022, account for 21% of total three-wheeler sales in this period.

Of the six SIAM member companies in this segment, Bajaj Auto also tops here with 24,204 units of the Maxima model. This is a YoY increase of 28% and gives the company a market share of 39 percent.

Piaggio Vehicles, which has performed strongly in the passenger three-wheeler category, has also delivered a strong performance on the cargo front with its Ape Xtra. With 20,713 units and 37% YoY growth, it is 3,491 units behind the market leader Bajaj Auto.

Piaggio Vehicles, which has performed strongly in the passenger three-wheeler category, has also delivered a strong performance on the cargo front with its Ape Xtra. With 20,713 units and 37% YoY growth, it is 3,491 units behind the market leader Bajaj Auto.

Mahindra & Mahindra sold 9,522 units of its Alfa model, recording 29% YoY growth. The company has a 15% share of the ICE three-wheeler goods carrier market.

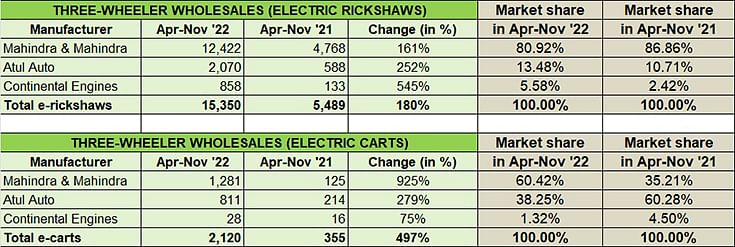

Electric three-wheelers increase market share to 6%

The electric three-wheeler market, along with electric two-wheelers, have been the growth aggregators in India’s EV industry. Proof of this can be seen in this segment’s performance in April-November 2022: a total of 17,470 units sold, which marks solid 179% growth (April-November 2021: 5,489). This performance sees it increase its share of the overall market to 5.89% from 3.90% a year ago.

Mahindra & Mahindra, which has one of the largest portfolios with the Treo Auto, Treo Yaari, Treo Zor, e Alfa Mini and e-Alfa Cargo, has sold a total of 13,703 units (comprising 12,422 passenger and 1,281 cargo), accounting for 78% of overall e-three-wheeler sales.

Growth outlook: huge potential for growth

At 296,430 units, overall three-wheeler sales have already crossed the 260,995 units of entire FY2022. However, there is huge potential for growth given that this industry segment saw its best-ever sales of 701,005 units in FY2019.

FY2023: 296,430 units (April-Nov 2022)

FY2022: 260,995 units

FY2021: 219,446 units

FY2020: 636,569 units

FY2019: 701,005 units

FY2018: 635,698 units

FY2017: 511,879 units

With India back in full work mode, demand for this segment will continue to come from passenger transportation even as cargo carriers will see growth from last-mile delivery operators who are catering to the boom in e-commerce and demand from urban India for speedy deliveries of food, groceries and other consumables.

If there’s a growth story which shows immense potential, particularly in view of the shift to electrification, then it’s the three-wheeler segment which is witnessing the highest growth rate. The shift to electric three-wheelers is gaining momentum, particularly in view of the high price of diesel and petrol, and increasingly of CNG, which has seen all of eight price hikes this year. Low total cost of ownership is a key USP in this segment, particularly for single-owner three-wheelers and is what will continue to drive buying trends.

All data: SIAM

ALSO READ:

Piaggio launches new electric Ape FX Max 3W range, bags orders for 24,000 units

Electric two-wheeler sales charge past 435,000 units in April-November

Electric car sales speed to 25,000 units in April-November

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

17 Dec 2022

17 Dec 2022

43135 Views

43135 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi