Ashok Leyland’s strong domestic and export sales drive 145% revenue growth in Q1

CV major reports net profit of Rs 68 crore for Q1 FY2023 versus net loss of Rs 282 crore a year ago.

Growing demand for medium and heavy commercial vehicles (M&HCVs) as well as light commercial vehicles (LCVs) have powered Chennai-based Ashok Leyland’s robust performance in the first three months of the ongoing fiscal year. Importantly, the growth has come across both domestic and export markets.

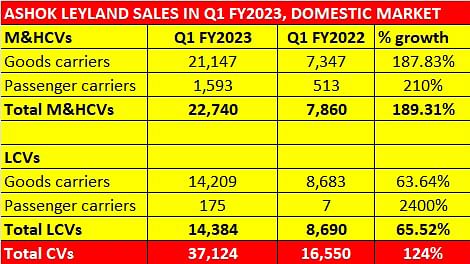

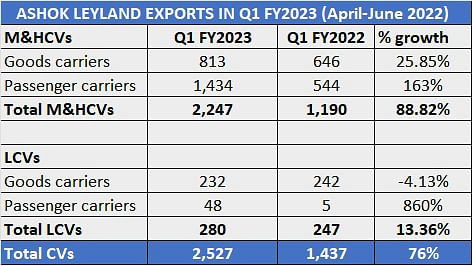

The CV major has reported a 145% increase in YoY quarter revenues in Q1 FY2023 to Rs 7,223 crore (Q1 FY2022: Rs 2,951 crore) which comes on the back of domestic market wholesales of 37,124 units, a year-on-year increase of 124% (Q1 FY2022: 16,550 units) and overseas shipments of 2,527 units, up 76% (Q1 FY2022 exports: 1,437 units).

EBITDA for Q1 FY2023 was at Rs 320 crore as against a loss of Rs 140 crore in Q1 FY2022. Ashok Leyland has reported a net profit of Rs 68 crore for Q1 FY2023 compared to a net loss of Rs 282 crore in Q1 FY2022. Net Debt to Equity was at 0.3 times compared to 0.6 times in Q1 last year.

Uptick in Indian economy and spend powers demand

As per official SIAM industry domestic market wholesales data, in the first quarter of FY2023 (April-June 2002), Ashok Leyland’s domestic M&HCV volumes grew at 189 % to 22,740 units (Q1 FY2022: 7,860) while market share rose to 305 from 27% a year ago. Truck market share stands at 31.1% for Q1 FY2023 as against 26.2% in Q1 FY2022.

Medium and heavy commercial vehicles, which are known to be the barometer of the economy, are reflecting the improved market sentiment. There has been gradual demand recovery in M&HCVs with transporters reporting improving fleet utilisation levels, the multiplier effect of the large government spending on road construction projects across the country and also higher consumption of cement for infrastructure projects. This is reflected in the surge in demand for tippers and tractor-trailers. Ashok Leyland’s tally of 21,147 goods carriers in Q1 (187%) is reflective of that trend.

There continues to be sustained demand for the AVTR range, which is built on a modular truck platform. The company says “this demand is expected to further improve consequent to anticipated growth in the total industry volume.”

Meanwhile, the company’s domestic LCV volumes in Q1 FY2023 totalled 14,384 units, which constitutes 66% YoY growth (Q1 FY2022: 8,690 units). Like other CV makers, Ashok Leyland is too is benefiting from the massive boom from the e-commerce industry, which is seeing a surge in online booking for scores of products from both urban India as well as Tier 1-2-3 towns, is driving sustained growth. While bigger LCVs handle the logistics deliveries across the country, smaller LCVs like pickups and mini-trucks are catering to door-to-door deliveries.

The Bada Dost LCV has received a good market and customer response and production is being ramped up in line with market demand. Last-mile connectivity propelled by e-commerce is likely to maintain the demand for SCV trucks. The volume of LCVs could have been better but for the inadequate availability of ECUs, which is now gradually improving, says the company statement.

Export demand also on the rise

Export volumes (M&HCVs and LCVs combined) for Q1 FY2023 at 2,527 units is higher than same period last year by 76% (1,437 units).

Commenting on the Q1 numbers, Dheeraj Hinduja, Executive Chairman, Ashok Leyland, said: “The industry has seen strong volume growth in Q1 FY2023, and we expect this trend to continue going forward. The team is focused on market performance while reining in costs this quarter. Our digital-first approach is helping Ashok Leyland customers increase their business efficiency and we are continuing to expand our offerings. We are pleased that we have continued to grow our market share. With our robust LHD portfolio, we are intensifying our international expansion strategy.”

He added, “Through our Electric Vehicle subsidiary – Switch Mobility – we are taking strategic steps to move towards net zero carbon mobility. The EV market is expanding fast and we are ready for participating in this growth. We are committed to achieve our sustainability agenda with a clear road map.”

Gopal Mahadevan, Director & CFO, Ashok Leyland, said:, “With expansion in revenues and efficient cost management we have seen our bottom-line improving. The softening of commodity prices, in particular for steel, should impact our margins positively.”

ALSO READ:

Ashok Leyland evaluating a second LCV platform

M&HCV and LCV goods carriers deliver the goods in strong Q1 FY2023

Ashok Leyland powers AVTR range with 250hp H6 4V engine

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

29 Jul 2022

29 Jul 2022

11499 Views

11499 Views

Shahkar Abidi

Shahkar Abidi