Three-wheeler sales take a hit in FY2017

Bajaj Auto, Mahindra & Mahindra and TVS Motor’s three-wheelers sale decline as aggressively priced four-wheeled mini-trucks draw buyers.

While overall automotive sales for 2016-17 remained positive as a result of the uptick in demand for passenger vehicles, commercial vehicles and two-wheelers in the domestic market, one segment that took a hit was three-wheelers.

All three-wheeler manufacturers saw a sizeable drop in both their domestic and export sales, a trend which is attributed to three-wheelers being replaced by aggressively priced, small four-wheeled mini-trucks.

Over the past few years, manufacturers like Tata Motors and Mahindra & Mahindra have been expanding the mini truck segment to every load and price point. This is taking a toll on the three- wheeler segment which is seeing transport operators preferring to buy a four-wheeler which offers better operating economics and also social status in the Indian context.

Overall three-wheeler sales in FY2016-17 fell 4.93% to 511,658 units (2015-16: 538,208). While sales of passenger carriers, the biggest segment in the three-wheeler segment, declined 8.83% to 402,034 units (2015-16: 440,978), the goods carrier segment registered 12.75% growth with sale of 109,624 units (2015-16: 97,230).

How the OEMs fared

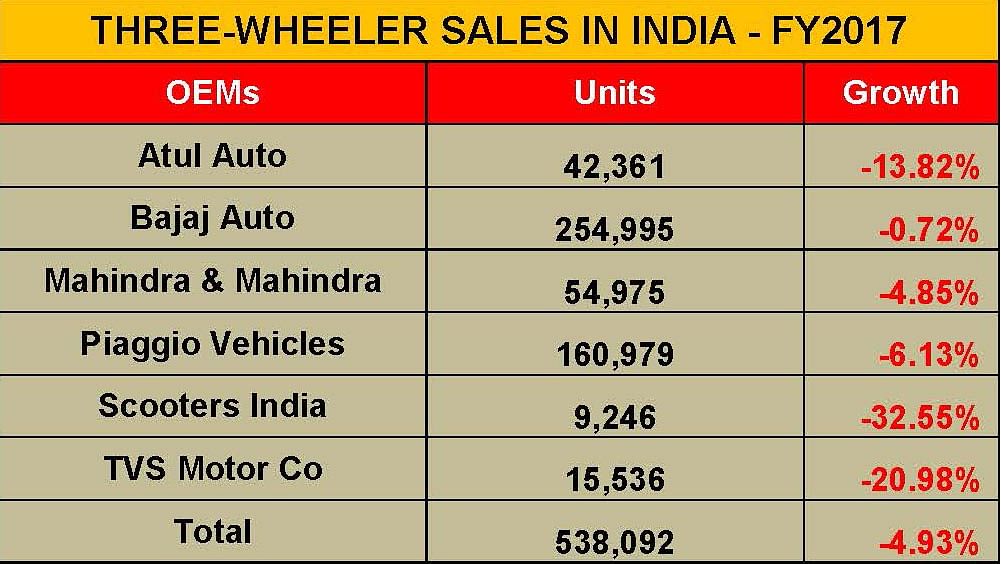

All the key three-wheeler OEMs comprising Bajaj Auto, Mahindra & Mahindra, TVS Motors, Atul Auto and Piaggio have felt the impact of slowing sales.

Bajaj Auto, the largest player in the three-wheeler industry with a dominating presence in the passenger carrier segment, posted flat sales. Its India market sales were a total of 253,147 units, down 0.72%. Its exports though took a bigger hit – down 31.70% with total shipments of 191,236 units.

Piaggio Vehicles, the No. 2 player, sold 151,106 units during 2016-17 which marks a fall of 6.13%. Its exports dropped sharply by 28.07% to 17,592 units.

Mahindra & Mahindra, the No. 3 OEM, saw its sales decrease by 4.85% with total sales of 52,306 units, its exports is minuscule of just 1,425 units up by 17.77%.

The Rajkot-based Atul Auto sold a total of 36,507 units during 2016-17, lower by 13.82% than the year before; its exports were up 49.35% at 2,288 units.

While Scooters India sold 6,315 units, down 32.55%, TVS Motor saw its domestic sales fall by 20.98% during 2016-17 with total sales of 12,277 units.

Unlike the LCV trucks where the goods carrier segment dominates, in the three-wheeler segment the passenger carrier model is the best-seller with good demand for transporting passengers across short distances in Indian cities. In the passenger carrier segment, Bajaj Auto remains the market leader with a 59.9% share, followed by Piaggio Vehicles (24%), M&M (7.9%), Atul Auto (4.5%) and TVS Motor (3%). In the goods carrier segment, Piaggio has the leadership with 49.7% market share, followed by M&M, Atul Auto, Bajaj Auto and Scooter India with 18.6%, 16.5%, 12% and 2.9% respectively.

Slackening demand in the export market

The export market for three-wheelers mirrored the domestic market scenario. Overseas shipments fell by a substantial 32.77% to 271,894 units as compared to 404,441 units in FY2016. The passenger carrier segment registered a fall of 33% while growth in the goods carrier segment was flat. Bajaj Auto remains the largest export player with a 70% share of total export, followed by TVS Motor with 20.9% and Piaggio with a 6% share.

RELATED ARTICLES

Toyota Vellfire Hits a New High in FY2026 With 1,259 Units Sold in Past 11 Months

Toyota India’s ultra-luxury hybrid MPV, the Vellfire, sold 1,259 units in 11 months, posting strong demand for the secon...

Maruti Ertiga and Brezza Each Surpass 1.4 Million Sales in February

Launched four years apart, India’s highest-selling MPV and compact SUV each notch individual milestones, account for a 6...

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

15 May 2017

15 May 2017

40675 Views

40675 Views

Ajit Dalvi

Ajit Dalvi