INDIA SALES ANALYSIS: DECEMBER 2014

As 2014 drew to a close, carmakers had to handle a rush of buyers, more so as the government decided not to continue with the extension of excise duty sops

As 2014 drew to a close, carmakers in India had to handle a rush of buyers, more so as the government decided not to continue with the extension of excise duty sops, which will hike vehicle prices by an average of 4-6 percent. Typically, December is a month when buyers in India postpone vehicle purchases to the new year but the last month of 2014 seems to have been different.

Maruti Suzuki India, the country’s largest carmaker, has sold a total of 11,52,128 cars in calendar year 2014, up 8.29 percent over sales in 2013 (10,63,964), its highest ever in a colander year before this. Just before Christmas, Maruti had given a clue to the numbers it was set to clock, pointing out to a figure of 1.48 lakh cars in CY2014. Clearly, Indian consumers’ last-minute rush to buy Marutis before the year was out has given a fillip to the numbers.

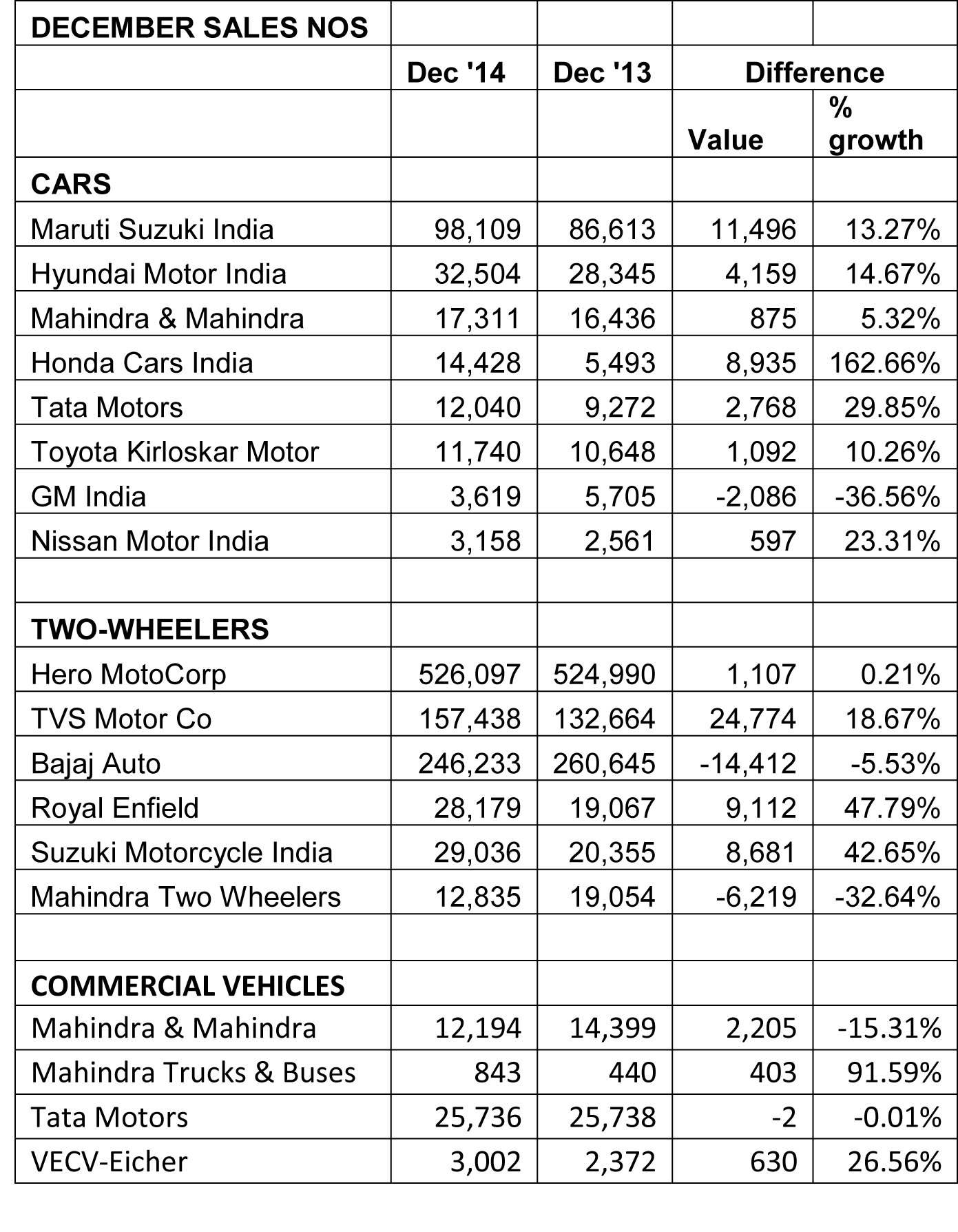

In December 2014, the company posted an overall sales increase of 13.3 percent with sales of 98,109 units (December 2013: 86,613). Its passenger cars notched a growth of 11.5 percent, with 81,564 cars going home to new buyers (December 2013: 73,155). While the Alto and Wagon R saw a dip of 9.6 percent and sales of 34,625 units (December 2013: 38,286), the quartet of compact cars (Swift, Ritz, Celerio and Dzire) saw handsome growth of 23 percent on sales of 41,532 units (December 2013: 33,766), with the AMT-equipped Celerio clearly driving up volumes in this segment. The Celerio continues to have a waiting period of 14-odd weeks for delivery. The premium Ciaz sedan, which was launched in October 2014, sold the bulk of the 3,731 units recorded in the midsize segment (along with the outgoing SX4) and has a waiting period of 2-3 months. Meanwhile, of Maruti’s UVs, the Ertiga and the Gypsy together sold 5,774 units (December 2013: 5,146), up 12.2 percent year on year. On the vans front, Maruti sold a total of 10,771 units, up 29.6 percent (December 2013: 8.312), proving that demand for the Omni and Eeco continues to be there, particularly in Tier 2 and 3 towns.

Hyundai Motor India recorded domestic sales of 32,504 units last month, up 14.7 percent (December 2013: 28,345). Commenting on the December sales, Rakesh Srivastava, senior vice-president (Sales and Marketing), HMIL, said, “In the challenging market conditions of CY 2014, Hyundai did an all-time record high sales of 4.11 lakh units with all-time high projected market share of 21.8 percent in passenger cars.”

Mahindra & Mahindra’s passenger vehicles division (which includes utility vehicles and the Verito) sold a total of 17,311 units in December 2014, registering a growth of 5 percent (December 2013: 16,436). Speaking on the monthly sales, Pravin Shah, chief executive, Automotive Division & International Operations (AFS), M&M, said : “We are happy to have achieved a growth of 5 for our passenger vehicle segment in December with 2014 being an immensely challenging year for the auto industry. The industry, which was showing early signs of recovery, would however be severely impacted by the withdrawal of the excise duty concessional rate which would affect overall business sentiment, as it will lead to an increase in vehicle prices. At Mahindra, we continue to remain optimistic going forward on the back of our new product launches during 2015”.

Meanwhile, Toyota Kirloskar Motor (TKM) sold 11,740 units in December 2014, posting a growth of 10 percent (December 2013: 10, 648). It also exported 1,888 units of the Etios series in the month. According to N Raja, director and senior vice-president (sales and marketing), “In continuation of the November upswing, we have registered growth in the domestic and overall sales in December as well. This momentum can be attributed to the year ending.” As regards the discontinuation of excise duty concessions, he added, “We will study the market reaction and announce the price revision of our products accordingly. We would have expected the government to continue the excise duty concessions as this was supporting the revival of the auto industry after a rather sluggish two years. We hope that government would give deeper consideration for the next fiscal Budget on structural reforms for the auto sector which is an important part of the ‘Make in India’ campaign.”

A hard-charging Honda Cars India recorded sales of 14,428 units in December 2014, marking an increase of 163 percent year on year (December 2013: 5,493). The new City sedan continues to be the favourite Honda with consumers, selling 6,012 units while the Amaze sold 5,176 units. While the Mobilio MPV sold 2,098 units, the Brio sold 1,120 unit and the CR-V chipped in with 22 units sold.

With this, Honda Cars India registered its highest ever domestic sales in a calendar year with 179,816 units sold, marking an overall growth of 67 percent as against 107,661 units during January-December 2013. Commenting on the company’s performance, Jnaneswar Sen, senior vice-president (marketing & sales) said: “Year 2014 has been a very successful year for HCIL business with record sales of crossing 179,000 units in the domestic market in a calendar year. The two successful launches of the City and Mobilio coupled with strong demand for all models throughout the year have contributed to 67 percent growth in HCIL sales in 2014. Honda’s fast expanding dealer network in Tier 3 markets has further contributed to this sales growth.”

In December 2014, Tata Motors sold a total of 12,040 units, a growth of 30 percent (December 2013: 9,272), the Zest sedan playing a strong role in giving sales a fillip.

While GM India sold a total of 3,619 cars, down 36 percent (December 2013: 5,705), Nissan Motor India sold 3,158 cars last month, up 23.3 percent over sales a year ago (December 2013: 2,561). The carmaker posted 45.5 percent growth in the calendar year, selling 35,047 units in 2014 as against 24,095 units in 2013.

TWO-WHEELER SALES KEEP UP THE MOMENTUM

Two-wheeler sales, particularly scooters, have been riding smoothly along the growth curve for the past year and December was no different as the bulk of players notched good numbers.

Hero MotoCorp’s sales for December were flat at 0.21 percent, the manufacturer recording a tally of 526,097 units (December 2013: 524,990). In calendar year 2014, the company sold a cumulative total of 66,45,787 two-wheelers, which translates into a growth of 8 percent compared to 2013’s total of 61,83,849 units.

Pune-based Bajaj Auto saw de-growth of 5.53 percent during December 2014 when it sold 246,233 units (including exports). The company had sold 260,645 units in December 2013. However, cumulative sales data for April-December 2014 shows that the company has sold a total of 26,19,115 units as against 25,97,112 motorcycles sold during April-December 2013, indicative of near-flat growth of 0.85 percent.

TVS Motor Company’s domestic two-wheeler sales grew by 18.67 percent, increasing from 132,664 units in December 2013 to 157,438 units in December 2014. According to the latest release issued by the company, its scooter sales has gone up by 25.33 percent, growing from 41,817 units in December 2013 to 52,411 units in December 2014. Its motorcycles, which registered sales of 70,188 units in December 2014 against 57,576 units sold during December last year, grew by 21.90 percent YoY.

TVS’ third quarter two-wheeler sales (Q3 FY2014-15) are also impressive. Total two-wheeler sales (domestic and exports) have grown by close to 25.25 percent, increasing from 499,000 units sold in Q3 FY2013-14 to 625,000 units in Q3 FY2014-15.

Royal Enfield posted a strong sales growth of 48 percent during December 2014 when it domestically sold 28,179 units (December 2013: 19,067). Gaining a healthy momentum, the company has posted an increase of 70 percent in its year-to-date sales in 2014 compared to 2013. The bikemaker’s YTD (April-December 2014) sales stand at 296,370 units as against 173,864 units during the corresponding period in 2013.

Mahindra Two Wheelers (MTWL) has sold 12,835 units in December 2014, which includes healthy numbers contributed by its recently launched scooter Gusto. Commenting on MTWL’s sales, Viren Popli, chief of operations, said: “The Gusto has received a good response in North India and will now be rolled out in the southern and eastern parts of the country in January 2015. We now have a reasonable size product portfolio in the mass segment with the Centuro and Gusto. We will be investing significantly over the next few months to expand our market share in India and internationally.”

Suzuki Motorcycle India registered a 42.65 percent increase in its December 2014 sales figures of 29,036 units (December 2013: 20,355). According to Atul Gupta, executive vice-president, “Our concerted efforts to promote the Gixxer motorcycle and Let’s scooter have met with positive customer sentiment. Customer satisfaction and word-of-mouth publicity are key factors that work in our favour. Growth in sales indicates that the market is responding favourably to our products. We hope this trend continues into 2015.”

COMMERCIAL VEHICLE PLAYERS OPTIMISTIC ABOUT M&HCV SALES

While the government’s decision not to extend the excise duty sops may will impact overall automotive sales, commercial vehicles manufacturers are optimistic about a recovery with medium and heavy commercial vehicles (M&HCVs) leading the way. Continuing with the past few months’ positive momentum, most CV players have notched higher sales in the M&HCV segment. On the other hand, sales in the light commercial vehicle segment continue to see a dip and it seems they will take time to before return to positive territory.

Factors like dipping diesel prices, renewals of fleet contracts by corporates with an emphasis on younger fleets and rising manufacturing activities are providing a new momentum to truck sales.

According to IFTRT, following November month’s drop of 4-5 percent, truck rentals during December 2014 further dropped by 2.5-3.5 percent on trunk routes on the back of Rs 2.84/litre diesel price cut in December 2014 (Rs 0.84/litre on December 1 and Rs 2/litre on December 15) due to tepid cargo offerings.

In terms of company-specific sales last month, Tata Motors’ overall domestic sales remain flat. The company sold 25,736 units (December 2014: 25,738). However, its M&HCVs recorded handsome 62 percent growth with the company selling 12,438 units as compare to 7,659 in December 2013. LCV numbers though declined 26 percent – 13,298 units as against 18,079 units in December 2013.

VE Commercial Vehicles posted 26.55 percent growth, selling 3,002 trucks in the domestic market in the 5 tonnes and above category.

Mahindra Trucks and Buses recorded a 92 percent increase albeit on a low base. The company sold 843 units last month compared to 440 in December 2013.

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

By Autocar Pro News Desk

By Autocar Pro News Desk

02 Jan 2015

02 Jan 2015

12948 Views

12948 Views