Cooling Rubber Prices Offer Margin Relief for Automakers

Rubber price trends in December 2025 offer a rare moment of cost relief for manufacturers facing margin pressures elsewhere.

While the automotive industry grapples with triple-digit inflation in battery minerals, the commodities that literally hit the road—natural and synthetic rubber, are providing a much-needed financial cushion. According to the latest data from the Society of Indian Automobile Manufacturers (SIAM), rubber price trends in December 2025 offer a rare moment of cost relief for manufacturers facing margin pressures elsewhere.

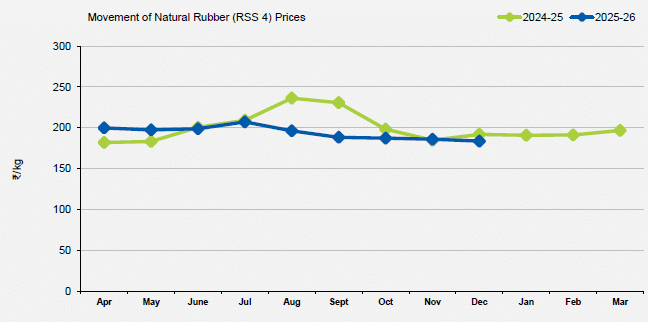

As per SIAM commodity data for the month of December 2025, natural tree-derived rubber (RSS 4) saw its average price settle at Rs 183.74 per kilogram, representing a 4% decline compared to last year. More importantly for quarterly planning, prices are now 11% lower than the peak witnessed in July 2025. While global consumption is slightly outstripping production (15.57 Mt versus 14.89 Mt), growth in key regions such as India and Thailand has helped stabilise the local supply chain.

The story for petroleum-based synthetic rubber (SBR) is even more favourable for the industry’s bottom line. Prices for this critical tyre component fell to Rs 161.70 per kilogram, a 9% year-on-year drop and a significant 17% decrease from the May 2025 peak. This price softening arrives at a critical time: while tyre production for light passenger vehicles (LMVs) has dipped by 12.8%, the two-wheeler and three-wheeler tyre segment has surged by 17.5%, keeping demand for synthetic varieties robust.

Specialised materials such as weather-resistant rubber (EPDM), which are crucial for tractor tyres and construction equipment, are also trending downward, with prices 6% lower than last year. This has supported a massive 54.4% jump in tractor tyre production, helping manufacturers capitalise on agricultural demand without the sting of high raw material costs.

However, industry insiders remain cautious. While commodity prices are cooling, the Indian rupee’s depreciation to 89.52 against the US dollar adds an import tax on synthetic rubber sourced from Korea and Japan. Nevertheless, in a year defined by margin-killing mineral inflation, the current rubber market remains a vital stable ground for the automotive sector.

RELATED ARTICLES

ZELO Electric Introduces Limited-Edition Pink Scooter to Mark International Women's Day

The Knight+ Rani Edition, priced at ₹69,990, is limited to 999 units and features a baby pink colourway with white contr...

Uber Launches Intercity Bus Ticketing in India, Its First Market Globally for the Service

The ride-hailing platform partners with AbhiBus to offer long-distance bus bookings, expanding its intercity travel port...

Asian Automakers Brace for Billions in Losses as Middle East Conflict Chokes Key Shipping Route: Reuters

Fears of Iranian attacks have caused cargo movement along the Strait of Hormuz to grind to a halt, sending shockwaves th...

By Shahkar Abidi

By Shahkar Abidi

21 Jan 2026

21 Jan 2026

1455 Views

1455 Views

Sarthak Mahajan

Sarthak Mahajan

Autocar Professional Bureau

Autocar Professional Bureau