Texas Instruments eyes India’s growing e-2W market for power supplies, MCUs

The semiconductor giant is bullish about the growth potential of India’s automotive market which is witnessing robust demand for cost-effective, advanced chipsets that drive various electronics and connectivity functionalities in modern-day vehicles.

US-headquartered semiconductor giant Texas Instruments (TI) is eyeing the growing demand for its controllers and chip-based power supply solutions from the Indian automotive market, which is poised for significant growth and increased manufacturing capacities in the coming decade, both in conventional and electrified vehicle segments.

While over 30 percent of Texas Instruments’ new product introductions in the last year have been for the automotive industry globally and that too in the core areas of components driving functional safety systems, the company is particularly eyeing the strong opportunity posed by the electric-two-wheeler (e-2W) segment in India.

Elizabeth Jansen: "Several Indian startups as well as traditional OEMs are offering cost-effective electric two-wheelers, and TI plays there with its motor controllers, BMS, sensing solutions, and power supply chips."

Elizabeth Jansen: "Several Indian startups as well as traditional OEMs are offering cost-effective electric two-wheelers, and TI plays there with its motor controllers, BMS, sensing solutions, and power supply chips."

“The two-wheeler segment is a big market in India, and what is interesting is that several Indian startups as well as traditional OEMs are offering cost-effective electric two-wheelers, and TI plays there with its motor controllers, BMS, sensing solutions, and power supply chips,” Elizabeth Jansen, India Sales and Applications Director, Texas Instruments, told Autocar Professional.

“While the increasing electrification of two-wheelers in India is an opportunity from a semiconductor supply perspective, even in the conventional two-wheeler space, the growing foray of electronics such as digital instrument clusters, and sensors is driving demand for our products. These are also things that we offer in our portfolio and we are supplying to our customers,” she added. In the electric-3W and passenger vehicle segments, TI is working closely with Tier-1 suppliers across the infotainment, body control, or even the lighting domains.

Jansen explained that TI is looking at the automotive industry from a powertrain-agnostic perspective, and be it ICE or EVs, its solutions such as on-board chargers, BMS, or connectivity devices, are relevant for application in future EV as well as ICE products. However, the company says that while it was a niche player in the automotive industry 7-8 years ago, TI has now become a very broad player in the sector, and is also engaging into direct-sourcing contracts with automotive OEMs after the chip crisis that plagued the industry during the pandemic.

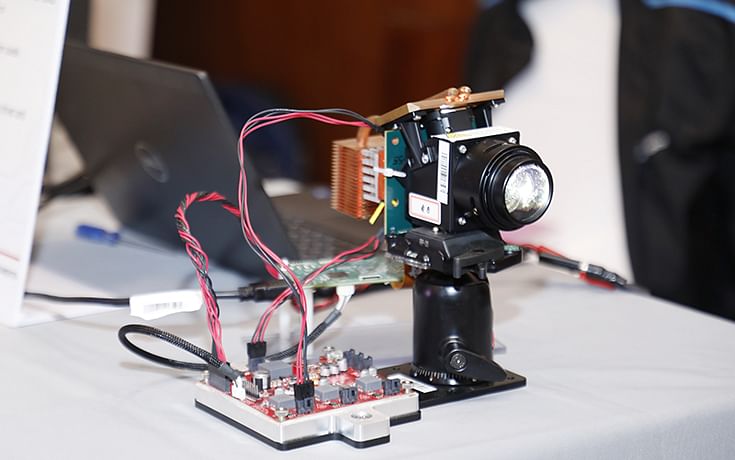

DLP headlight projection.

DLP headlight projection.

India as a global R&D hub

TI, which entered India in 1985, has grown to over 3,000 engineers at its Bengaluru R&D campus which currently serves as the global engineering hub for the company. “India is a significantly important site for TI globally because firstly, we have end-to-end chip design in Bengaluru, and secondly, India enables cost-effective design, which is a key strength of this location. Also unique to India is that we have a strong sales and applications team spread across Bengaluru, Delhi-NCR, Pune, and Ahmedabad,” Jansen highlighted.

According to Jansen, the country also benefits from the sales-R&D feedback loop, which ensures that new product iterations are distinctly focused on meeting the consumer requirements. “We have a healthy exchange between sales and R&D, and this feedback loop means our new products are driven by customer demand. We have built our competencies in India meticulously over the last four decades,” she added.

The importance of India in the global TI ecosystem also stems from the fact the chips designed in India with cost and customers at the focal point, also find applications in other global markets for the company. In the automotive context, TI’s latest MSPM0 series, which is a high-performance dual-CAN system, finds great application in cars for managing small controls or MCU housekeeping. And the company’s C2000 64-bit MCU also enables real-time control, for instance, in case of a motor’s acceleration or deceleration in an EV.

The company is also increasing reliance on in-house chip supplies, and while it has a total of 7 wafer fabrication sites in the US and Malaysia, its upcoming LFAB2 site in Lehi (Utah) will be the centre of excellence for TI’s MCU and connectivity portfolio that is finding strong application in the automotive space, especially in India. The semiconductor fab will commence production in 2026.

ALSO READ: Electric 2W sales jump 37% to 1.07 million units in January-November 2024

Electric 3Ws maintain double-digit growth in November, 11-month sales at record 631,000 units

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

09 Dec 2024

09 Dec 2024

8202 Views

8202 Views

Autocar Professional Bureau

Autocar Professional Bureau