Retail sales in festive season up 4%, FADA maintains cautious approach

Though retail sales in October 2019 showed positive momentum due to the festive season, they remain muted the entire 42-day festive season is taking into account. FADA advises dealers to tread with caution.

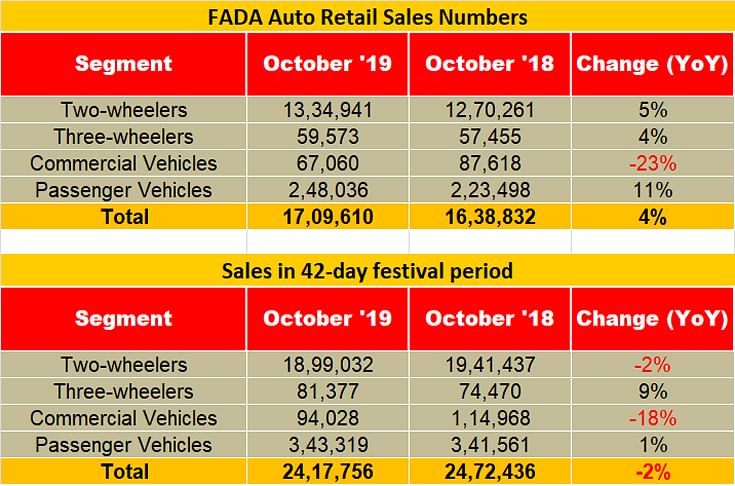

Belying the hopes of India Auto Inc, which was expecting vehicle sales of a high order in October 2019, which had Dhanteras, Navratri and Diwali all bundled into 31 days, on-ground retail sales across vehicle segments saw an estimated 4% growth. Deep discounting by vehicle manufacturers and retailers helped spur this demand, reveals latest data released by the Federation of Automobile Dealers Association (FADA).

As per the data, two-wheeler sales rose by 5 percent (1,334,941 units) on a year-on-year (YoY) basis. Similarly, three-wheelers and passenger vehicles (PVs) reported 4 percent (59,573 units) and 11 percent (248,036 units) respectively. However, commercial vehicles (CVs), which have been worst hit in the ongoing industry slowdown, continued to see a decline – down by a substantial 23 percent (67,060 units). Cumulative retail sales across segments were up by 4 percent (1,709,610 units).

According to Ashish Kale, president, FADA, “Strong support from banks and NBFCs helped convert the festive mood of the consumer into retails. With continued liquidity easing, the business appetite of banks and NBFCs has grown and will surely aid the industry in the path to recovery as the consumer sentiment strengthens in the coming days.”

While the registration data of October paints a positive picture about an uptick in sales, the 42-day festive period starting first day of Navratri to 15 days after Dhanteras (there is a lag of 10-12 days between delivery and registration) helps get a clearer perspective about the sales figures. The data reveals that overall registration of vehicles declined by 2 percent (2,417,756 units) in comparison to October 2018. The two-wheeler segment recorded a 2 percent decline (1,899,032 units) and CVs 18 percent (94,028 units). PV sales grew marginally by 1 percent (343,319 units) while the 3-wheeler segment was up by 9 percent (81,377 units).

Industry experts are of the view that the October 2019 retail sales figures need to be seen in the light of two factors – it is not very often that Navratra and Diwali fall in the same month and spill over to November, thereby splitting sales into two months, and the “unusually high discounts” offered by most OEMs, which has now been stopped in November.

Over the past several quarters, automotive retail demand has come under severe pressure due to a confluence of multiple factors like liquidity crunch and tighter financing environment, weak rural income and overall slowdown in economic activity. Further, prices and cost of vehicle ownership has also increased due to regulatory changes (safety, emission, insurance) and fuel prices. All of these put together have negatively impacted consumer sentiment.

On November 11, ratings agency ICRA ticked ‘Negative’ outlook to the domestic auto dealership sector, given the expected decline in credit profile of industry participants amid slowing sales and high working capital debt. “The ongoing downturn in the automotive industry has severely impacted the profitability of automobile dealerships, which is expected to be at a five-year low. As the sector endures one of the worst impacts in the current fiscal, the credit profile of industry participants has weakened, as reflected in some players in their rated portfolio being downgraded or their outlook revised to negative,” reads an ICRA report.

Reduced inventory levels bring relief to dealers

According to FADA officials, almost all the OEMs in India have taken efforts to reduce inventory at the retail level, which is expected to bring relief to dealership owners. Although not at FADA-recommended levels of 21 days, two-wheeler inventories stand reduced to 35-40 days from the previously alarming level. Similarly, PV inventory, which was already at reasonable levels, has further reduced to 25-30 days and is now almost at the recommended level. CV inventory has also reduced to 40-45 days although with retail continuing to be weak, further wholesale regulation is required to reach FADA’s recommended level of 21 days.

As the industry drives towards what FADA calls “unknown territory” of BS VI transition, it expects vehicle manufacturers to further correct inventory so as to avoid dealer losses. FAFA remains cautiously optimistic, recommending that dealers tread discreetly, especially with regard to inventory and costs during this dynamic time of fluctuating consumer sentiment due to an overall weak economic situation and the much-vaunted BS VI transition.

Also read: Festive cheer for UVs in October but future industry growth still uncertain

India’s Top 10 PVs – October 2019 | Kia Seltos and Maruti S-Presso break into bestsellers' list

New models power UV market share growth for Hyundai, Kia, MG and Renault

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

19 Nov 2019

19 Nov 2019

9006 Views

9006 Views

Autocar Professional Bureau

Autocar Professional Bureau