BYD outsells Tesla for the first time in Europe in April

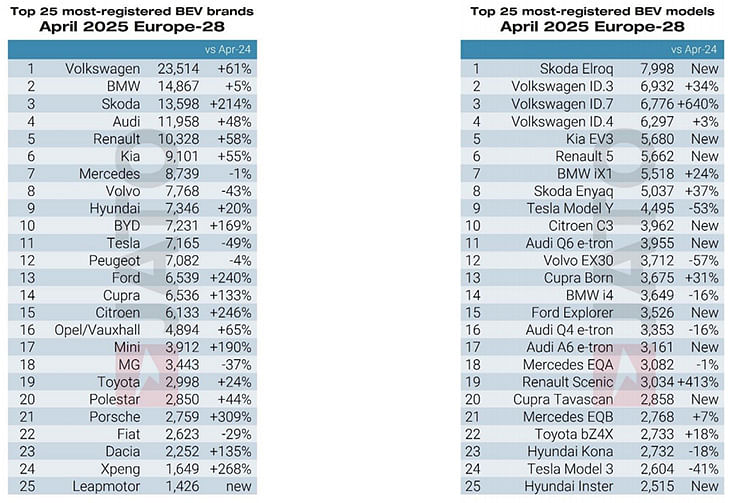

With retail sales of 7,231 BEVs in Europe in April, BYD sold 66 more all-electric cars than Tesla, which registered 7,165 units last month, states a JATO Dynamics report. This looks to be a watershed moment for the European car market since Tesla has led the European BEV market for years, while BYD only officially began operations beyond Norway and the Netherlands in end-2022.

Chinese electric vehicle manufacturer and the world’s largest EV major BYD is going from strength to strength. In April 2025, BYD outsold Tesla in Europe for the first time, an achievement made even more remarkable when viewing PHEV and BEV volumes separately. According to JATO Dynamics’ data, BYD registered 7,231 BEVs in Europe last month, while Tesla registered 7,165 units – a slender lead of 66 cars.

“Although the difference between the two brands’ monthly sales totals may be small, the implications are enormous. This is a watershed moment for Europe’s car market, particularly when you consider that Tesla has led the European BEV market for years, while BYD only officially began operations beyond Norway and the Netherlands in late 2022,” Munoz noted.

Tesla reported another monthly drop in April, with total volumes down 49% year on year. In contrast, BYD saw an increase of 359% over the same period, benefiting from its broad and competitive line-up of fully electric vehicles and plug-in hybrids. BYD’s rapid expansion has already pushed it ahead of established European car brands – outselling Fiat, Dacia, and Seat in the UK; Fiat and Seat in France; Seat in Italy; and Fiat in Spain. This growth comes even before production begins at its new plant in Hungary.

In April 2025, BEVs and PHEVs combined accounted for 26% of new car sales in Europe, a new record, with Chinese car brands behind much of this growth.

In April 2025, BEVs and PHEVs combined accounted for 26% of new car sales in Europe, a new record, with Chinese car brands behind much of this growth.

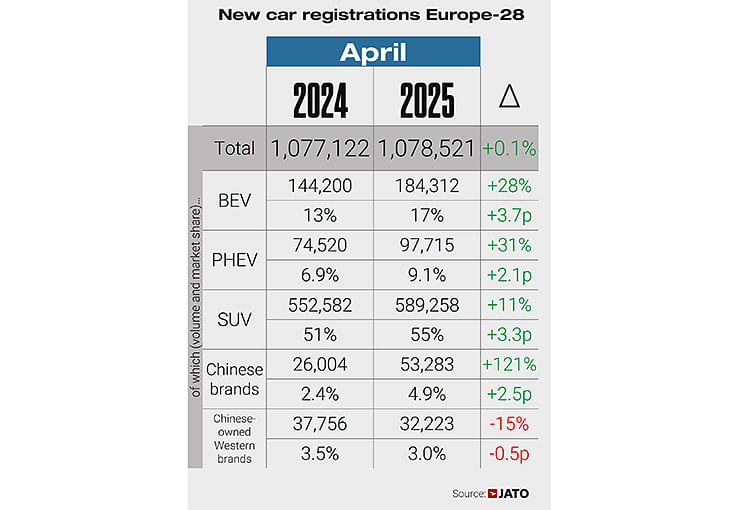

According to JATO Dynamics’ data for 28 European nations, new passenger car registrations in Europe remained stable last month. In April, a total of 1,078,521 new cars were sold, 1,399 more units than in April 2024. Year-to-date registrations, covering the four-month period between January and April 2025, totalled 4,467,681 units, or just 6,560 more than during the same period of 2024.

“While the EV segment was a bright spot for Europe’s new passenger car market last month, these gains were offset by significant declines among ICE vehicles. EV sales need to grow much faster to have a genuine impact on the wider European car market,” said Felipe Munoz, Global Analyst at JATO Dynamics.

Despite the imposition of tariffs by the EU, sales of electric cars made by Chinese automakers in April rose by 59% year on year, reaching almost 15,300 units.

Despite the imposition of tariffs by the EU, sales of electric cars made by Chinese automakers in April rose by 59% year on year, reaching almost 15,300 units.

China’s Plan B in Europe

Tariffs imposed by the European Union on EVs made in China earlier this year had an initial negative impact on the sales of Chinese automakers, forcing these carmakers to look for other solutions. Many of its carmakers selling cars in Europe have since responded by expanding and diversifying their European line-up with the introduction of plug-in hybrids, which have not yet been targeted by EU tariffs.

“China is not only the world leader in BEVs; its automakers are global leaders in plug-in hybrid vehicles too. To gain traction in Europe, its carmakers have responded to the threat posed by tariffs by focusing on other powertrains, such as plug-in hybrids, to maintain the momentum behind their global expansion plans,” Munoz added.

In April 2025, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) combined accounted for 26% of new car registrations in Europe, a new record, with Chinese car brands behind much of this growth. BEVs accounted for 17% of this total, up from 13.4% in April 2024, while plug-in hybrids represented 9% of monthly registrations, up from 6.9% in the corresponding month last year.

Despite the imposition of tariffs by the EU, registrations of electric cars made by Chinese automakers in April rose by 59% year on year, reaching almost 15,300 units. Within this segment, carmakers from Europe, Japan, Korea and the US recorded an increase of 26%.

The PHEV segment saw a notable development, as volumes from Chinese players increased by 546% year on year, from 1,493 units in April 2024 to 9,649 units in April 2025, meaning Chinese car brands now account for almost 10% of the total number of PHEVs registered in Europe. “It remains to be seen whether the EU will respond to the boom in Chinese-made PHEVs by imposing tariffs on these vehicles too,” Munoz commented.

Renault Clio leads for the first time since 2020 but VW Tiguan sales up 32%

Renault Clio leads for the first time since 2020 but VW Tiguan sales up 32%

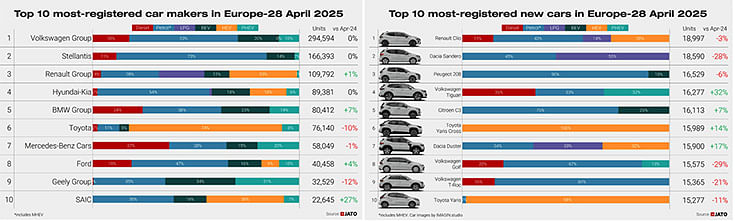

The Renaut Clio was Europe’s best-selling car in April, with 19,000 units of the French subcompact registered. The Clio has not led the model rankings since June 2020, having lost ground in recent years to its low-cost rival, the Dacia Sandero – Europe’s best-seller in 2024.

However, the standout performer of the month was arguably the Volkswagen Tiguan, in fourth position, with registrations up by 32% to 16,300 units. Other strong performers include the Toyota Yaris Cross, Dacia Duster, Opel/Vauxhall Corsa, Peugeot 3008, Jeep Avenger and Mini Cooper.

The Skoda Elroq led the BEV model rankings for the first time, with 8,000 units – vindicating the brand’sdecision to introduce an SUV that sits between the B and C segments. Three Volkswagen models followed in the rankings, while the Volkswagen ID.7 increased its volumes by 640% to occupy third position. Renault registered more than 5,600 units of the Renault 5, the sixth most registered electric vehicle in Europe last month, while Kia’s recently launched EV3 also made the top ten. By contrast, volumes of the Tesla Model Y and the Volvo EX30 dropped by 53% and 57%, respectively.

ALSO READ:

India electric car & SUV sales jump 58% to 12,330 units in April

RELATED ARTICLES

Autoliv Plans JV for Advanced Safety Electronics With China’s HSAE

The new joint venture, which is to be located strategically near Shanghai and close to several existing Autoliv sites in...

JLR to Restart Production Over a Month After September Hacking

Manufacturing operations at the Tata Group-owned British luxury car and SUV manufacturer were shut down following a cybe...

BYD UK Sales Jump 880% in September to 11,271 units

Sales record sets the UK apart as the largest international market for BYD outside of China for the first time. The Seal...

24 May 2025

24 May 2025

14175 Views

14175 Views

Ajit Dalvi

Ajit Dalvi