SUV and Car Makers Sell 388,000 Units in November, Mahindra Regains No. 2 Position From Tata

After record retail sales in October, PV sales delivered the year’s third-highest tally in November. Maruti Suzuki stays firmly No. 1, while Mahindra regains the No. 2 spot from Tata Motors.

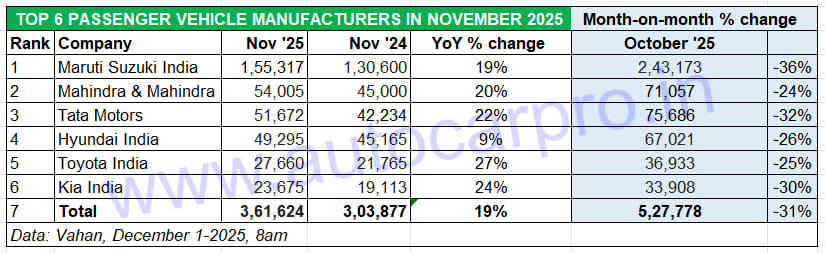

After a record-breaking festive month of October 2025, when the passenger vehicle (PV) industry delivered a record 565,326 units, November 2025 retail sales at an estimated 388,624 units are a more sobering market reality. Nevertheless, they are the third highest monthly sales in the current calendar year, with January 2025 (473,520 units) being the second highest.

While PV market leader Maruti Suzuki remains head and shoulders above the rest of the competition with 155,317 units, 19% YoY growth and a 40% market share, the latest retail sales data on the Vahan portal (December 1, 2025) reveals that Mahindra & Mahindra (M&M) has regained the No. 2 podium position it had lost to Tata Motors in September and October. In November 2025, M&M delivered a total of 54,005 SUVs, including 2,767 electric SUVs to its customers. This marks a 20% YoY increase (November 2024: 45,000 SUVs) and gives it a lead of 2,333 vehicles over Tata Motors. In November 2025, M&M had an overall PV market share of 14% to Tata Motors’ 13 percent. M&M, which currently has a 11-model portfolio, led by the Scorpio, has seen sales accelerate with surging demand for the Thar Roxx and more recently the new three-door Thar.

Tata Motors, which has sold 51,672 cars and SUVs including 6,083 EVs last month, posted 22% YoY growth (November 2024: 42,234 units). The manufacturer of the Nexon, Punch, Harrier, Curvv, Safari, Altroz, Tiago and Tigor, had outsold M&M in September (41,641 PVs to M&M’s 39,961 SUVs) and October (75,686 PVs to M&M’s 71,057 SUVs).

Meanwhile, Hyundai Motor India, which has dropped to fourth rank, has delivered 49,295 PVs last month, up 9% YoY, for a 13% market share The company’s 10-model car and SUV portfolio is led by the Creta midsize SUV, followed by the Venue, Exter and Aura sedan.

Toyota Kirloskar Motor, with retail sales of 27,660 units, has registered 27% YoY growth, which gives it a 7% market share for November. The company, whose leading model is the Innova Hycross / Crysta, has seen surging demand for the Hyryder midsize SUV which outsold the popular MPV for the first time in October on the wholesales front.

Kia India, which is witnessing a good run in the PV market, has retailed 23,675 units in November 2025, up 24% YoY (November 2024: 19,113 units) for a 6% market share. The Sonet compact SUV remains the No. 1 product the company, followed by the Carens MPV recently bolstered by the Carens Clavis and Clavis EV, and the Seltos midsize SUV.

While Maruti Suzuki had a 40% PV market share, M&M with 54,005 SUVs delivered in November regained the No. 2 spot it lost to Tata Motors in September and October.

TOP 6 OEMs HEADED FOR RECORD SALES IN CY2025

These Top 6 PV OEMs – Maruti Suzuki India, Mahindra & Mahindra, Tata Motors, Hyundai Motor India, Toyota Kirloskar Motor and Kia India – with their combined sales of an estimated 361,624 units, account for 93% of the total PV sales last month. This is the same ratio for their PV wholesales last year.

In CY2024, total passenger vehicle wholesales were 4.27 million units (42,74,793 units), up 4% YoY. Of this, these top six PV OEMs accounted for 3.99 million units (39,96,671 units) or a 93% share, leaving the balance 7% to be fought over by the 10 other car and SUV manufacturers.

Eleven months into the year, each of these six PV manufacturers is well set to achieve new highs in both wholesales and retails. What has added strong tailwinds to their growth is the reduced GST, which has helped slash prices of most cars, SUVs and even MPVs and brought pent-up consumer demand to the fore.

ALSO READ: Utility Vehicle Industry Poised for Record Sales of 2.8 Million Units in CY2025

RELATED ARTICLES

Hyundai Alcazar Crosses 100,000 Units 55 Months After Launch, Sees Lowest Sales in December

Launched in June 18, 2021, the Creta-based Alcazar has taken four-and-a-half years to achieve the 100,000 sales mileston...

Royal Enfield Sells Record Million-Plus Motorcycles in CY2025

Midsize motorcycle market leader sells 10,71,809 units in the domestic market in CY2025 to achieve the million milestone...

Skoda Sells a Million Vehicles Globally in CY2025, Kylaq Success Makes India a Key Growth Market

Germany remains Skoda’s largest market, with 211,100 vehicle deliveries, followed by the Czech Republic, the United King...

By Ajit Dalvi

By Ajit Dalvi

01 Dec 2025

01 Dec 2025

16610 Views

16610 Views