PV Makers Cut August Production by 4.1% Ahead of Expected GST Relief on Sub-4m Models

Strategic inventory management sees manufacturers hold back smaller vehicles in anticipation of September tax cuts.

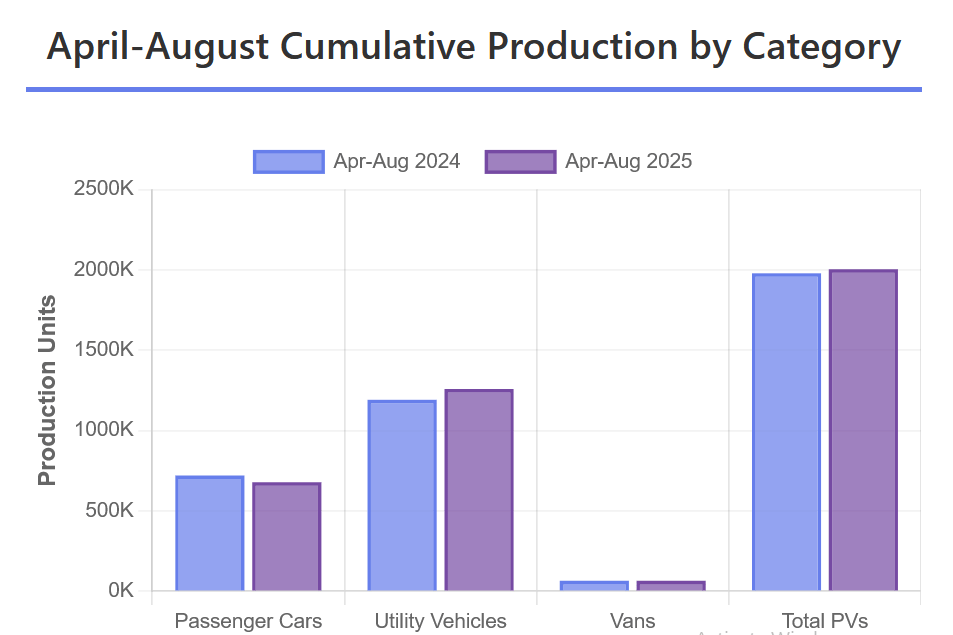

India's passenger vehicle production declined 4.1% year-on-year to 361,341 units in August 2025, primarily driven by manufacturers deliberately slowing production of smaller vehicles ahead of an anticipated GST rate cut in September, according to data released by the Society of Indian Automobile Manufacturers (SIAM). Despite the tactical August slowdown, cumulative April-August production grew 1.3% to 20,03,786 units.

The production adjustment was particularly pronounced in segments that would benefit from the expected tax relief, with compact cars and sub-4 meter SUVs seeing the sharpest cuts as manufacturers avoided pushing inventory into dealer channels before the anticipated price reduction.

Smaller petrol and diesel cars and SUVs are set to become cheaper by around 10% from Sep 22 due to a steep cut in the goods and services tax on cars under 4 meters and with an engine capacity of up to 1,200cc (petrol) and 1,500cc (diesel).

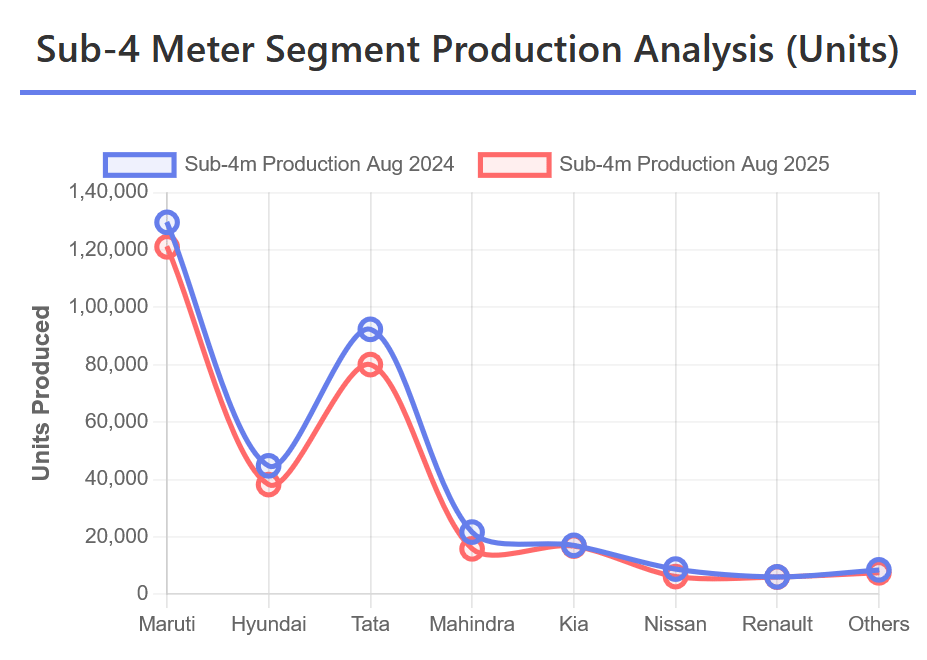

Sub-4 Meter Segments Bear Brunt of Strategic Slowdown

The data reveals a clear pattern of production cuts in tax-sensitive segments. The UVC segment (sub-4 meter SUVs) saw the steepest decline, with production falling 15.5% to 87,977 units in August from 104,091 units a year ago. Most of the models in this segment, which includes popular models like Hyundai Venue and Tata Nexon, would be among the biggest beneficiaries of the GST cut.

Similarly, the compact car segment (3600-4000mm) – home to volume drivers like Swift, Baleno, and i20 – saw production drop to 98,064 units from 102,180 units. The mini segment (sub-3600mm) production fell 12.1% to 10,962 units from 12,465 units.

In contrast, larger vehicles unaffected by the anticipated tax change showed resilience. The UV1 segment (4-4.4 meter SUVs) grew 7.0% to 79,750 units, while the UV2 segment (4.4-4.7 meter) surged 20.0% to 44,015 units from 36,697 units, indicating manufacturers shifted focus to segments outside the expected GST relief zone.

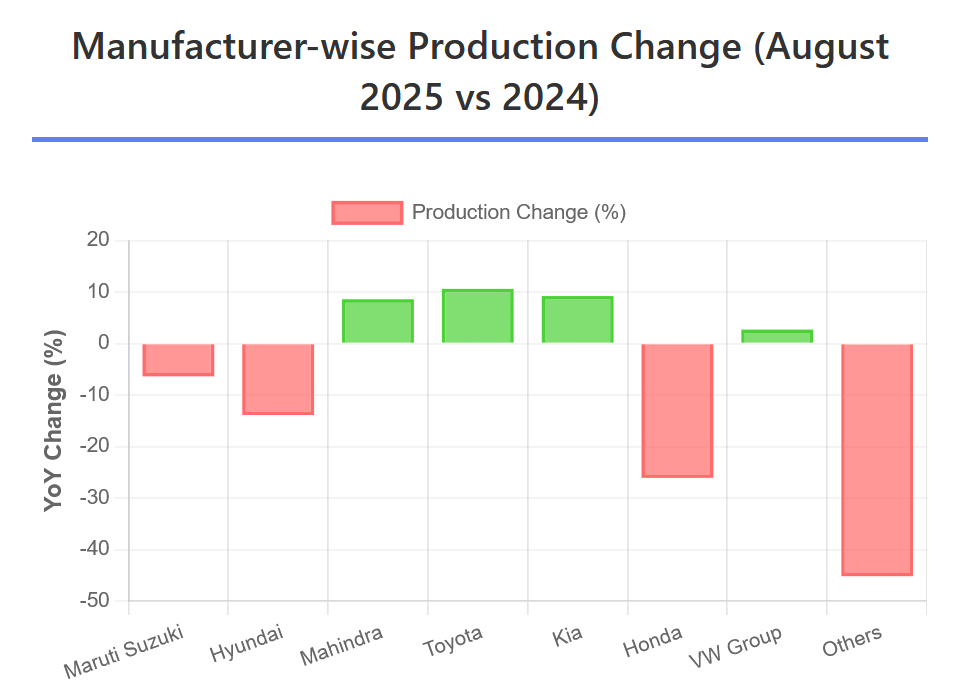

Maruti and Hyundai Lead Strategic Production Cuts

Maruti Suzuki, with its heavy exposure to sub-4 meter segments, reduced overall production by 6.4% to 155,238 units in August. The company's compact car production – including models like Swift, Baleno, and Dzire – remained relatively stable at 75,923 units, but its sub-4 meter SUV production (Brezza, Fronx) fell sharply to 35,660 units from 46,204 units, a 22.8% decline.

Hyundai Motor India, another major player in the sub-4 meter space, saw overall production fall 13.9% to 60,613 units. The company's sub-4 meter SUV production (Venue, Exter) dropped to 15,114 units from 19,050 units, while its compact car production (Grand i10, i20) fell to 19,559 units from 25,701 units.

Manufacturers Pivot to Larger Vehicles

Companies with stronger portfolios in larger vehicles showed contrasting trends. Mahindra & Mahindra, primarily focused on SUVs above 4 meters, increased production by 8.6% to 49,320 units in August. The company's UV2 segment production (including Scorpio, XUV700) jumped to 28,522 units from 23,698 units.

Toyota Kirloskar Motor posted a 10.6% production increase to 37,136 units, driven by its larger SUVs and MPVs like Innova HyCross and Fortuner, which wouldn't be affected by sub-4 meter GST changes.

Kia India managed a 9.2% production increase despite the industry headwinds, focusing on models like Seltos and Carens that straddle different segments. However, its sub-4 meter Sonet production declined to 9,640 units from 11,356 units.

Cumulative Production Shows Underlying Strength

Despite August's tactical slowdown, the April-August cumulative data reveals healthy underlying demand. Overall PV production grew 1.3%, with utility vehicles driving growth at 5.7% to 12,58,763 units. Even in sub-4 meter segments, cumulative production remained robust – the UVC segment grew marginally to 5,88,483 units from 5,84,184 units.

This suggests the August decline was indeed a temporary inventory adjustment rather than a demand concern. Manufacturers appear to have maintained normal production through July before pulling back in August as the GST cut expectations solidified.

Segment Shifts Accelerate

The production data, even accounting for the GST-related adjustments, confirms the continuing shift toward SUVs. Utility vehicles now account for 62.3% of August production compared to 34.6% for passenger cars, a dramatic shift from just five years ago when the ratio was nearly reversed.

Within passenger cars, the premium shift is evident. Despite overall car production declining 7.9%, the mid-size segment (including Verna, City) maintained relative stability. The mini segment's 12.1% decline reflects both the GST anticipation and structural decline in entry-level demand.

Electric Production Gains Despite Overall Slowdown

Electric vehicle production showed momentum even amid the broader slowdown. Mahindra's Electric Origin SUV contributed 4,921 units in August, while Tata Motors' EV variants (included in their cumulative data) showed steady growth. The sub-4 meter electric models would also benefit from the GST reduction, adding another dimension to the inventory management strategy.

Smaller Players Struggle Beyond GST Factors

While GST anticipation explains much of the August decline, some manufacturers faced deeper challenges. MG Motor India's production collapsed to 408 units from 1,855 units, while Honda Cars India fell 26.1% to 7,828 units – declines too steep to attribute solely to GST-related inventory management. Stellantis India (Citroen) and FCA India (Jeep) also saw significant production cuts, suggesting brand-specific challenges beyond the tactical industry-wide adjustment.

Post-GST Outlook: Production Revival Expected

SIAM Director General Rajesh Menon acknowledged the tactical nature of the production adjustment, stating that the "recalibration of dispatches" was temporary. "The landmark decision of Government of India to reduce the GST rates on vehicles will go a long way in enabling broader access to mobility and inject fresh momentum into the Indian automotive sector in the upcoming festive season," he said.

Industry experts expect a sharp production rebound in September and October as manufacturers rush to capitalize on improved affordability post-GST reduction. The sub-4 meter segments, which saw the steepest August cuts, are likely to see the strongest revival.

The April-August cumulative growth of 1.3%, combined with the strategic nature of August's decline, suggests the industry remains on track for a strong fiscal year. With the GST relief now confirmed, the festival season spanning October-November could see production hitting new peaks as manufacturers race to meet expected surge in demand for newly affordable sub-4 meter vehicles.

The production data for September, when released, will be crucial in confirming whether the August slowdown was indeed purely tactical and whether the GST cuts deliver the expected demand stimulus for India's crucial small car and compact SUV segments.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

By Shruti Shiraguppi

By Shruti Shiraguppi

15 Sep 2025

15 Sep 2025

7503 Views

7503 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal