India-EU FTA: What We Know so Far

Two of the world’s top economies ink a mega trade deal that can supercharge growth in a multitude of sectors, including auto and autocomponents.

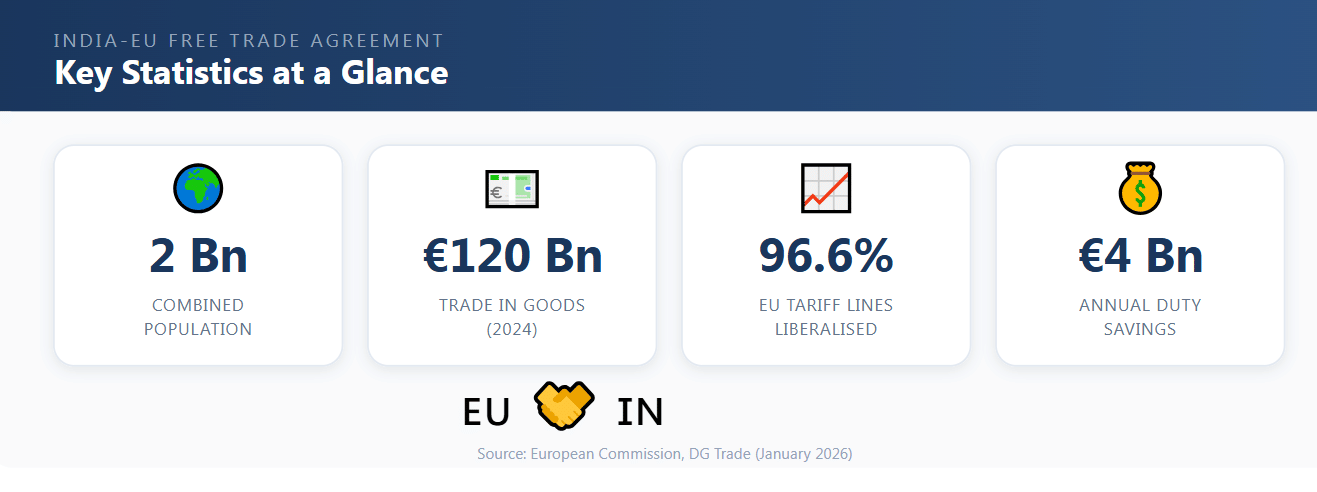

On 27 January 2026, the European Union and India concluded negotiations for what the European Commission has described as a historic, ambitious and commercially significant free trade agreement (FTA) and the ‘mother of all deals’. This represents the largest trade agreement that both parties have ever concluded, creating a free trade zone encompassing two billion people and close to a quarter of global GDP.

The agreement comes after a long negotiating history. The EU and India first launched negotiations in 2007, but talks were suspended in 2013 due to disagreements on key issues. Negotiations were relaunched in June 2022, following the EU-India Leaders' Meeting in May 2021 where both sides agreed to resume discussions for a balanced, ambitious, comprehensive and mutually beneficial trade agreement.

The final formal negotiating round (the 14th) took place in October 2025, followed by intensive intersessional discussions at technical and political levels. European Commission President Ursula von der Leyen characterised the agreement as sending a signal to the world that rules-based cooperation still delivers great outcomes.

Strategic and Economic Context

The agreement strengthens economic and political ties between the world's second and fourth largest economies at a time of rising geopolitical tensions and global economic challenges. According to the European Commission, the deal highlights both parties' joint commitment to economic openness and rules-based trade.

The EU is India's largest trading partner, accounting for €120 billion worth of trade in goods in 2024, representing 11.5% of India's total trade. India ranks as the EU's 9th largest trading partner, accounting for 2.4% of the EU's total trade in goods. Trade in services between the two parties reached €59.7 billion in 2023, nearly doubling from €30.4 billion in 2020.

The EU's foreign direct investment stock in India reached €140.1 billion in 2023, up significantly from €82.3 billion in 2019, making the EU a leading foreign investor in India. Approximately 6,000 European companies currently operate in India. EU exports to India support close to 800,000 EU jobs.

The European Commission describes this as the most ambitious trade opening that India has ever granted to a trade partner. India will grant the EU tariff reductions that none of its other trading partners have received, giving EU companies a significant competitive advantage for access to the world's most populous country.

Tariff Elimination

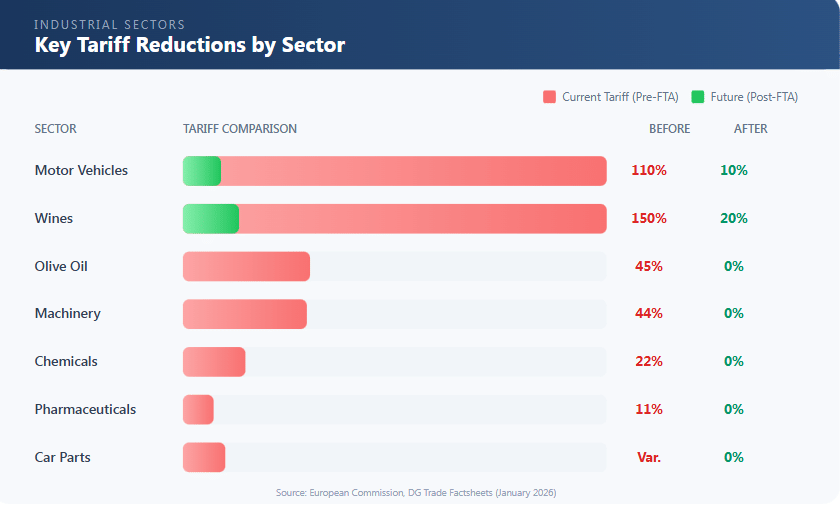

Under the agreement, the EU will eliminate tariffs on over 90% of tariff lines (91% in terms of value), while India will eliminate tariffs on 86% of tariff lines (93% in terms of value). Both sides will additionally partially liberalise a significant number of additional lines, bringing overall coverage to 96.6% for India and 99.3% for the EU. The Commission estimates this will save around €4 billion per year in duties on European products and is expected to double EU goods exports to India by 2032.

Benefiting Sectors

According to EU documentation, the agreement delivers strong benefits for key economic sectors:

- For the EU: agri-food, chemicals, pharmaceuticals, machinery, medical devices, avionics, and automotive industries

- For India: fisheries, chemicals, textiles, footwear, and pharmaceuticals

Implications for Automotive Sector

The automotive sector represents one of the most significant aspects of the India-EU FTA, given India's traditionally protectionist stance on automobile imports and the substantial presence of European automakers in the global market.

Prior to this agreement, India maintained one of the highest automotive tariff regimes in the world. Complete built-up units (CBUs) of passenger vehicles attracted import duties of up to 110%, effectively making imported vehicles prohibitively expensive for the Indian market. This high tariff wall has been a major barrier for European luxury and premium vehicle manufacturers seeking to access India's growing automotive market.

Transport equipment constitutes one of the EU's main export categories to India, making automotive market access a key offensive interest in the negotiations.

The European Commission's official documentation outlines the following automotive provisions:

Complete Vehicles (Motor Vehicles)

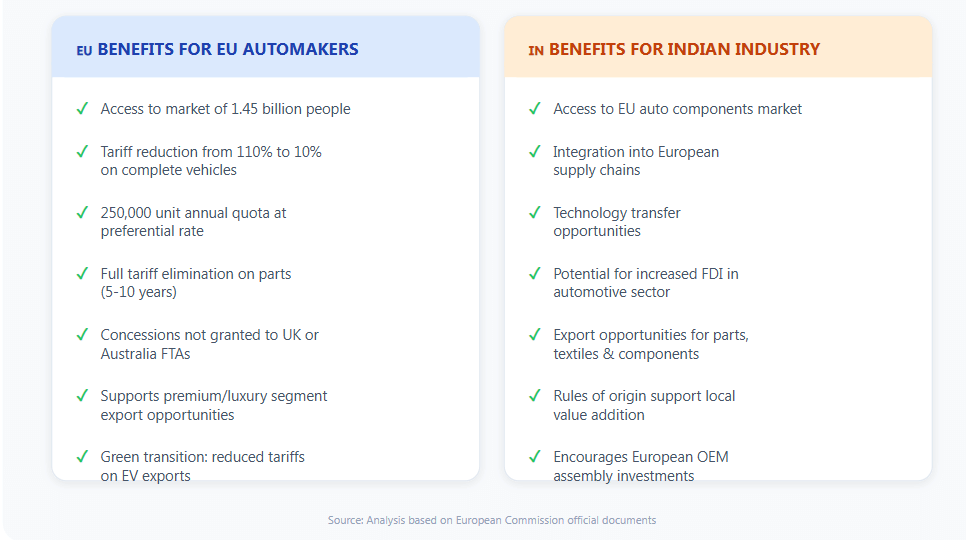

Tariffs on cars will be reduced from the current 110% to as low as 10%, implemented through a quota system of 250,000 units. This represents a dramatic reduction that fundamentally changes the economics of exporting European vehicles to India.

The European Commission's official documentation consistently uses the word "gradually" to describe the tariff reduction for complete vehicles but does not specify the exact staging timeline (i.e., over how many years the reduction from 110% to 10% will occur).

A dedicated "Car Annex" is listed among the EU's textual proposals, which likely contains detailed staging schedules, but the full negotiated text had not been published at the time of writing. The Commission has indicated that draft texts will be published shortly and undergo legal revision.

Automotive Components and Parts

In contrast to complete vehicles, the staging timeline for automotive components is explicitly stated in official EU documents. The agreement provides for the complete elimination of tariffs on car parts after five to ten years. This is particularly significant as it supports the integration of European automotive suppliers into Indian manufacturing operations and may encourage European OEMs to establish or expand assembly operations in India.

A dedicated SME chapter requires publication of information on how to access and do business in each other's markets through one publicly accessible digital platform. Both sides will establish SME contact points to help small companies benefit from the agreement's opportunities.

Implications for the Automotive Industry

Market Access Transformation

The reduction from 110% to 10% tariff represents a reduction of nearly 91% in the duty rate applied to imported vehicles. For European manufacturers, particularly those in the premium and luxury segments (German, Italian, British, and Swedish marques), this opens substantial new opportunities in a market of 1.45 billion people with a rapidly expanding middle class.

Supply Chain Integration

The elimination of tariffs on automotive components facilitates deeper integration between European and Indian automotive supply chains. European Tier 1 and Tier 2 suppliers can export to Indian assembly plants without tariff burdens, while Indian component manufacturers gain tariff-free access to EU markets under the agreement's reciprocal provisions.

Comparison with Other FTAs

The European Commission explicitly notes that India will grant the EU tariff reductions that none of its other trading partners have received. This includes the FTAs India has concluded with the UK and Australia. The automotive concessions thus represent a unique competitive advantage for European manufacturers.

Green Transition Linkages

The agreement's Trade and Sustainable Development chapter commits both parties to work together on climate change issues. The Commission notes that through its market access commitments, the deal will make trade and investment in low-carbon goods, services, and technology easier, including reduced tariffs on green goods. For the automotive sector, this has implications for the export of electric vehicles and EV components from Europe to India.

Other Provisions

The EU will protect its agricultural sensitivities. No concessions will be granted for sugar and ethanol, rice and soft wheat, beef and poultry, milk powders, and bananas and honey. Well-calibrated quotas will limit imports of table grapes and cucumbers.

Trade in services between the EU and India amounted to €59.8 billion in 2024, with EU exports of €26 billion and imports of €33.8 billion. The agreement expands opportunities for service providers on both sides.

The Digital Trade chapter contributes to a predictable, secure, and fair digital trade environment. It integrates the majority of rules agreed under the WTO Electronic Commerce Joint Initiative, of which India is not a member.

The SPS chapter ensures that all imports from India to the EU will continue to adhere to the EU's strict safety and sanitary rules, with no exception. The EU retains its full right to provisionally adopt sanitary or phytosanitary measures based on available pertinent information where relevant scientific evidence is insufficient.

The TBT chapter incorporates commitments under the WTO Agreement on TBT and makes them subject to bilateral dispute settlement. It upholds MFN and national treatment principles, requires 60 days for public consultations on new technical regulations, and creates a dedicated Working Group on Conformity Assessment to address issues including India's Quality Control Orders system.

The rules of origin are closely aligned with those in recent EU FTAs, ensuring that only products significantly processed in one of the parties can benefit from tariff preferences. The documentation system follows the latest standards based on self-certification by businesses, with proof of origin in the form of statements that exporters upload to a verification portal.

The agreement provides a high level of protection and enforcement of IP rights, covering copyright and related rights, trademarks, designs etc. The IP chapter specifies relevant international agreements that the parties are required to comply with and includes comprehensive enforcement measures.

Alongside the FTA, the EU and India launched negotiations for two separate agreements: a Geographical Indications (GI) Agreement and an Investment Protection Agreement. These negotiations are still ongoing. The EU and India will also sign a Memorandum of Understanding establishing an EU-India platform for cooperation on climate action, with €500 million in EU support envisaged to help India's green transition.

RELATED ARTICLES

BEV Sales in Europe Jump 30% to 1.88 Million in CY2025, Hybrids up 14%, Decline Continues for Petrol, Diesel

The EU’s top four battery electric car markets registered double-digit growth in a year which saw the BEV share rise to ...

Skoda Kylaq to Zip Past 50,000 Sales 13 Months After Launch

On January 27, Skoda Auto India rolled out the 50,000th Kylaq from its Chakan plant in Pune. With the game-changing comp...

Renault Sold 200,000 First-Gen Duster SUVs in India, Third-Gen Model Marks Comeback

The Renault Duster, which kickstarted the monocoque midsize SUV segment in July 2012 and bowed out a decade later as a r...

By Arunima Pal & Angitha Suresh

By Arunima Pal & Angitha Suresh

30 Jan 2026

30 Jan 2026

421 Views

421 Views

Ajit Dalvi

Ajit Dalvi