Electric PV Sales Rise 51% in January to 18,000 Units, Tata Motors Hits a New High

CY2026 opens with strong demand for zero-emission cars, SUVs and MPVs. Tata Motors sells a record 7,852 e-PVs for a 43% market share of the 18,042 units that make January the third best-selling month for India Electric PV Inc after October and August last year.

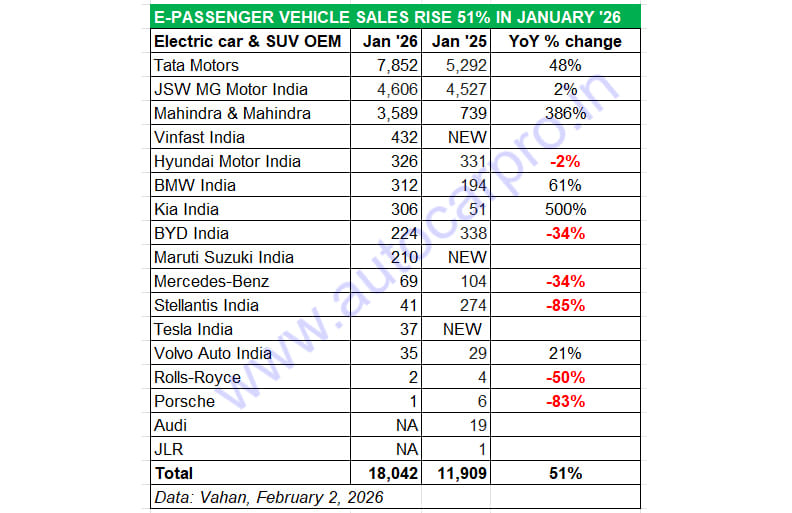

The Indian electric passenger vehicle segment has opened CY2026 with robust sales of 18,042 units in January, up 51% YoY (January 2025: 11,909 units). This performance comes on the back of the segment clocking record annual sales of 177,415 units in CY2025.

Leading the charge is market leader Tata Motors which has clocked its highest monthly sales yet. In January 2026, the company delivered 7,852 electric cars and SUVs, up 48% YoY (January 2025: 5,292 units). This total, which gives Tata EV a market share of 43.52%, beats the previous best of 7,701 units in October 2025 when the company had a 40% share of the e-PV market. The surge in retail sales can be attributed to the new Harrier EV which has helped revive demand even as the Nexon EV, Tiago EV and Punch EV continue to have their share of buyers. The Curvv coupe-SUV, however, is yet to achieve proper sales traction for Tata Motors, whose EV portfolio also has the Tigor (XPres-T). Tata has been impacted mainly by two OEMs – JSW MG Motor India and Mahindra & Mahindra, both of whom have launched new EVs in the past year and with much success.

Second-ranked OEM JSW MG Motor sold 4,606 units last month, up 2% YoY (January 2025: 4,527 units) for a 25.52% share. The company, which has made inroads into Tata Motors’ market share with the Windsor EV and its BaaS option, has expanded its portfolio with the M9 MPV, which marks its foray into the premium EV segment, along with the Cyberster electric roadster . Both models are retailed through the new MG Select network. JSW MG Motor also sells the ZS EV and Comet EV.

Mahindra & Mahindra delivered 3,589 e-SUVs last month, up 386% YoY (January 2025: 739 e-SUVs). This gives it a 20% market share for January 2026, which is more than a three-fold jump over the 6% M&M had a year ago. While the two Born Electric SUVs – BE 6 and XEV 9e – launched in early 2025 are the key growth drivers, sales would have received a fillip from the recently launched XEV 9S, M&M’s first three-row, born-electric SUV based on the modular INGLO skateboard platform. The XEV 9S slots above the stylish XEV 9e and the radical BE 6 SUVs, both of which are two-row EVs. With battery options spanning 59 kWh, 70 kWh, and 79 kWh.

Vinfast India, with 432 e-SUVs delivered to customers in January, has vaulted ahead of Hyundai. This gives the company a 2% e-PV market share in only its fourth month of sales with cumulative retails between October 2025 and January 2026 at 1,268 units. Sales of the locally assembled VF6 and VF7 have risen month on month, starting with 136 units in October, 310 units in November and 384 in December. With both these e-SUVs receiving a five-star Bharat NCAP crash test rating, expect monthly numbers to further grow this year. Recognising the potential of the growing market for electric MPVs and the demand for the Kia Carens Clavis EV and the BYD eMax 7, Vinfast India has confirmed plans to launch its third premium EV – the seven-seater Limo Green electric MPV – in February-March 2026.

Hyundai Motor India with 326 units, five fewer than January 2025’s 331 units, saw sales decline 2% YoY. The company, which markets the Creta EV and the Ioniq 5, is finding slow offtake for its two models and is now ranked fifth amongst the 17 e-PV players.

BMW India, the luxury e-PV market leader, maintains its strong growth with retail sales of 312 units, up 61% YoY (January 2025: 194 units). The German carmaker, which sold 3,207 e-PVs in CY2025 and recorded 160% YoY growth, continues to benefit from growing demand. The company recently delivered the 1,000th unit of its flagship electric sedan, the BMW i7 which sits at the top of its India line-up.

Kia India has clocked a five-fold increase in sales last month on a low-year-ago base. The 306 units sold in January 2026 are a 500% jump over the 51% units sold a year ago. However, this is the lowest monthly total in the past six months after August (465 units), September (530 units), October (630 units), November (477 units) and December (314 units). Kia India’s EV portfolio comprises the mass-market Carens Clavis EV MPV, and the EV6 and EV9 which are imported as CBUs into the country.

BYD India, the Chinese EV major’s Indian arm, registered new EV sales of 224 units last month, down 34% YoY. The company, which sells the Atto 3 SUV, Seal sedan, eMax 7 MPV and the Sealion 7 SUV, increased prices of the premium Sealion 7 from January 1. This move is likely to have impacted sales.

Maruti Suzuki India, which unveiled its first electric vehicle, the e-Vitara SUV on January 17, is listed by the Vahan portal with 210 units to its name. Considering prices for the e-Vitara have yet to be announced, these 210 units could likely be sales to dealers. The Maruti e-Vitara will have three variant options and will be sold in three trim levels. The 49kWh battery pack will be sold with the Delta trim, while the 61kWh battery pack will be sold in the Zeta and top Alpha trims.

Luxury EV makers sell 456 units in January, up 28%

The eight electric luxury car and SUV manufacturers have together sold a total of 456 units in January 2026, up 28% YoY (January 2025: 357 units). The Vahan portal, however, has not listed sales data for Audi and JLR last month. BMW India tops the table with 312 units, which is a 61% YoY increase and gives it a commanding 68% share of this e-PV category.

Mercedes-Benz India registered sales of 69 zero-emission PVs last month, down 34% on the 104 units it sold a year ago. The company thus has a 15% market share for January 2026.

Tesla, which is the newest entry in the Indian luxury market, pips Volvo India to be ranked fourth with 37 units of the Model Y e-SUV and an 8% market share. The Model Y, imported as a CBU for the India market, is currently available in India starting at Rs 59,89,000, with home charging support included for customers. This takes total five-month sales since market entry in September 2025 to 263 units, far less than what was expected from the American EV maker.

While Volvo India sold 35 zero-emission cars and SUVs, up 21% on the 29 units it sold a year ago, Rolls-Royce sold two units of its all-electric model – the Spectre – which is literally the Rolls-Royce of EVs. Priced from Rs 7.50 crore through to Rs 9.50 crore for the Spectre Black Badge.

Tata EV a market share of 43.52%, beats the previous best of 7,701 units in October 2025 when the company had a 40% share of the e-PV market.

FY2026 is best-ever fiscal for e-PVs

January 2026 with 18,042 units delivered to customers makes it the third best-selling month for the segment after October 2025 (19,195 units) and August 2025 (18,563 units). Last month’s sales take the cumulative 10-month score to 160,762 units, up 48% YoY (FY2025: 108,820 units). Add an expected 35,000-odd units for the next two months of the current fiscal and FY2026 could even close in on the 200,000 milestone for the first time.

ALSO READ: Upcoming electric car and SUV launches in CY2026

RELATED ARTICLES

TVS Opens CY2026 With Highest Monthly E-2W Sales of 34,440 Units

Bolstered by the launch of the Orbiter, electric 2-wheeler market leader TVS Motor Co’s retail sales hit a new high in J...

India-EU FTA: What We Know so Far

Two of the world’s top economies ink a mega trade deal that can supercharge growth in a multitude of sectors, including ...

BEV Sales in Europe Jump 30% to 1.88 Million in CY2025, Hybrids up 14%, Decline Continues for Petrol, Diesel

The EU’s top four battery electric car markets registered double-digit growth in a year which saw the BEV share rise to ...

By Ajit Dalvi

By Ajit Dalvi

02 Feb 2026

02 Feb 2026

465 Views

465 Views

Arunima Pal

Arunima Pal