Eight Charts That Capture India's Car Market in 2024

A visual journey through the highs and lows of the fast-growing Indian car market in 2024.

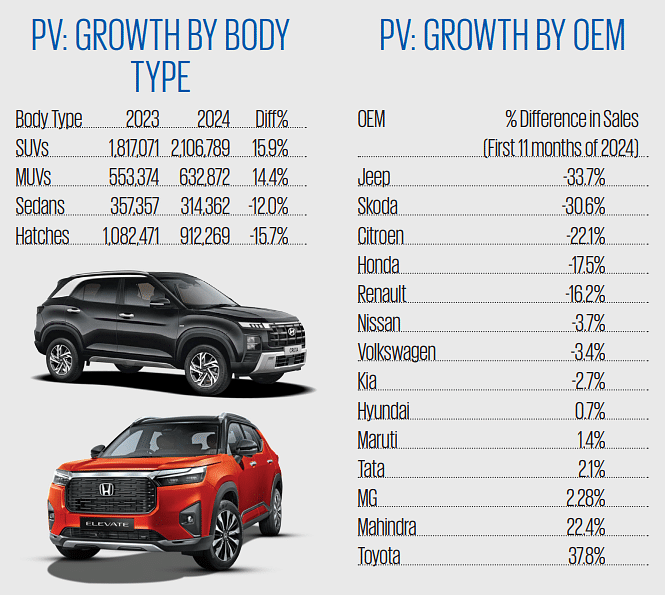

Car sales in the first 11 months of 2024 have been a mixed bag with a lot of back and forth between OEMs and dealers who have struggled to sell off stock in their yards.

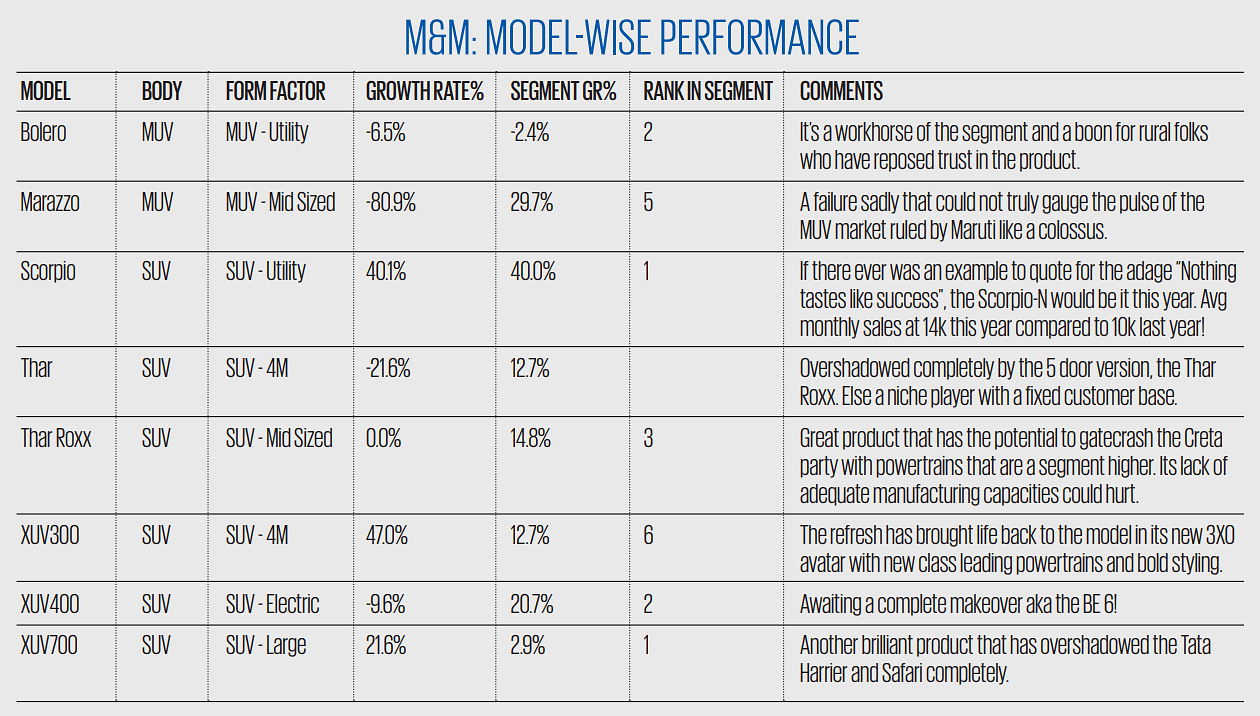

Mahindra crossed the magical 500,000 mark for the trailing 12 months. The company contributed to over half of the growth in the industry. Just the Scorpio brand accounted for a quarter of the growth seen in the industry as a whole.

The top six players in the Indian markets—Maruti, Hyundai, Tata, Toyota, Kia and Mahindra, control 93.4% of the total dispatches. The remaining seven players, including the likes of Volkswagen, Skoda, Honda, Citroen, MG, Nissan, and Renault, fight over the remaining 6.6%.Struggling even in strong segments like the mid-size SUVs are the Citroen Basalt and the C3 Aircross. In fact Citroen, with five models under its belt sold a measly 6,882 units this entire calendar year.

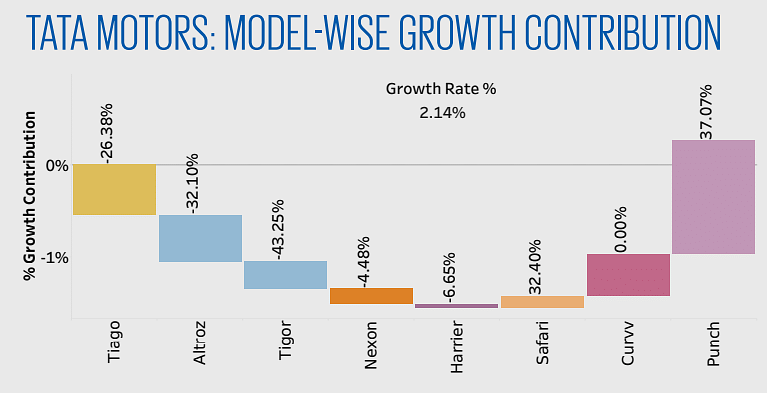

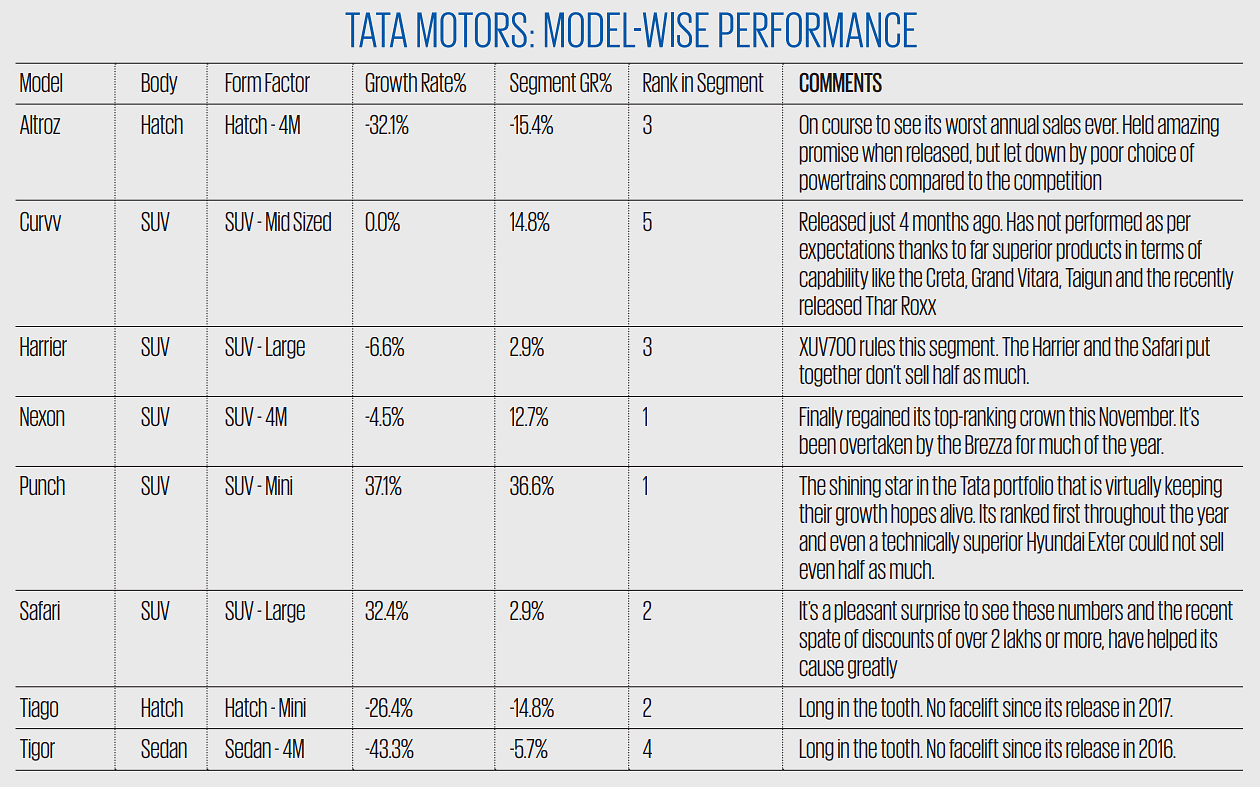

Tata Motors' Struggles

Tata has struggled these last 11 months with a growth of 2.14% while the overall market grew 4.09% in the same period. In segments such as the 4-meter SUV which grew by 12.7%, the Nexon's volumes actually shrunk by 4.5%. Volumes of the Tigor, the Altroz, and the Tiago reduced by 43.3%, 32.1% and 26.4% respectively. These changes are massive. Their saving grace was the Safari that grew by 32.4% and the Punch, which as a segment leader, grew by 37.1%.

Tata has struggled these last 11 months with a growth of 2.14% while the overall market grew 4.09% in the same period. In segments such as the 4-meter SUV which grew by 12.7%, the Nexon's volumes actually shrunk by 4.5%. Volumes of the Tigor, the Altroz, and the Tiago reduced by 43.3%, 32.1% and 26.4% respectively. These changes are massive. Their saving grace was the Safari that grew by 32.4% and the Punch, which as a segment leader, grew by 37.1%.

Unless they improve in critical areas like quality and developing class-leading powertrains, achieving the 2nd spot in the Indian car market will remain a distant dream. While their strengths in design and safety work in their favour, the shortcomings in these key areas could derail their ambitions.

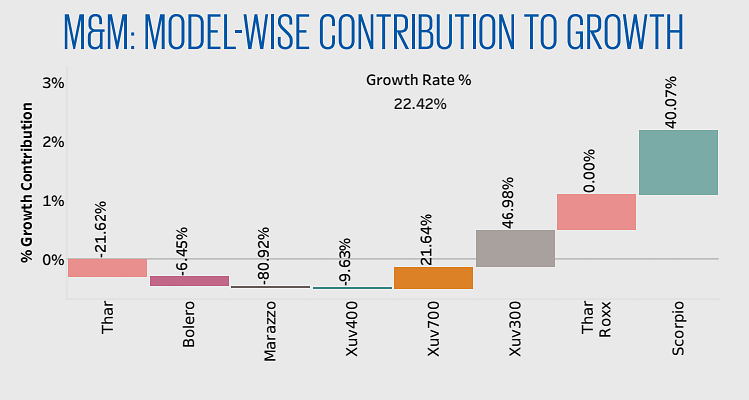

Mahindra’s Rise and Capacity

Crunch Mahindra has emerged as a dark horse, rising like a phoenix over the past three years. Their unwavering focus on SUVs and dedicated efforts to build in-house capabilities in design and powertrains have paid off. Lack of adequate capacities for the Thar Roxx will hurt. In around an hour of bookings being open for the Thar Roxx, it garnered over 176,000 in numbers. With the current capacities of around 9,000 for both the Thar Roxx and the Thar, the customers will be waiting in a long line to get their car.

Crunch Mahindra has emerged as a dark horse, rising like a phoenix over the past three years. Their unwavering focus on SUVs and dedicated efforts to build in-house capabilities in design and powertrains have paid off. Lack of adequate capacities for the Thar Roxx will hurt. In around an hour of bookings being open for the Thar Roxx, it garnered over 176,000 in numbers. With the current capacities of around 9,000 for both the Thar Roxx and the Thar, the customers will be waiting in a long line to get their car.

The need to miniaturise the XUV700 platform, the way the Scorpio-N was to bring about the Thar Roxx, has never felt a greater urgency than now. Their completely indigenous and home grown portfolio of powertrains with great vendor-partners such as Aisin and Bosch have the potential to shake the competition like never before.

In the last 11 months, their individual growth of 22.4% has contributed to over 50% of the growth in the Indian car industry at 2.18% of the total of 4.09%.

Growth is imminent and in a big way from their large SUV portfolio and this has ensured that Mahindra in its individual capacity contributed to more than 50% of the growth that we have seen so far in the entire industry. It says a lot. Just the growth in the sales of Scorpio-N contributed to 25% of the growth of the industry!

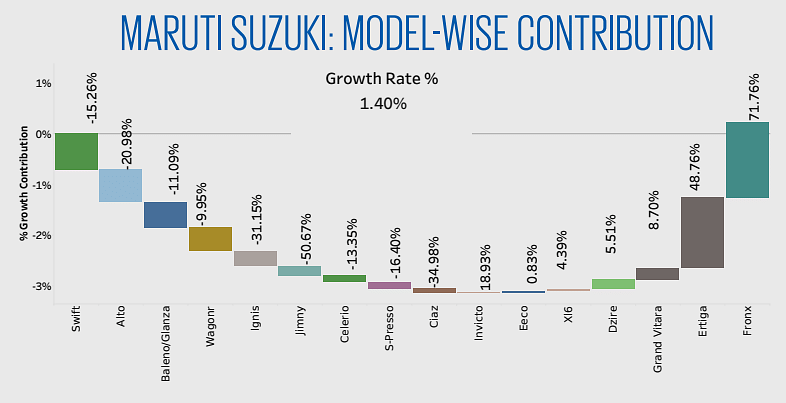

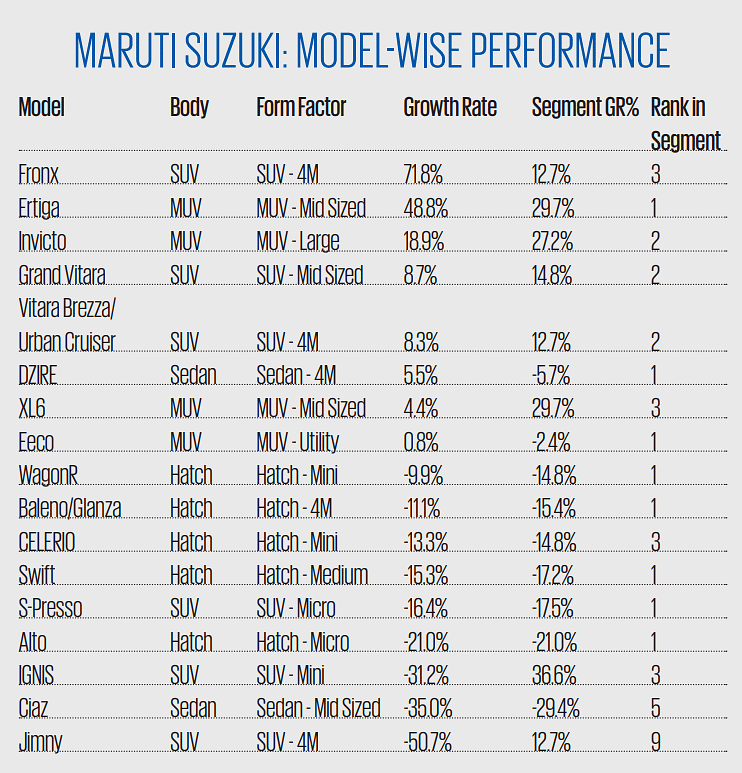

Maruti’s Challenges and Star Models

The chart demonstrates how Maruti models performed over the last 11 months compared the same period in 2023. The hatches are weighing on Maruti’s growth. Even the famed Baleno is no exception. Just the Swift and Alto shaved off 1.35% of their growth which ended up at just 0.55% of overall growth. Their UV portfolio saved them the blushes. The Fronx with 1.5% and the Ertiga and XL6 with another 1.5% together account for 3%. The obvious albatross around the neck of Maruti are the hatches, which brought down Maruti’s growth by 2.45%.

The chart demonstrates how Maruti models performed over the last 11 months compared the same period in 2023. The hatches are weighing on Maruti’s growth. Even the famed Baleno is no exception. Just the Swift and Alto shaved off 1.35% of their growth which ended up at just 0.55% of overall growth. Their UV portfolio saved them the blushes. The Fronx with 1.5% and the Ertiga and XL6 with another 1.5% together account for 3%. The obvious albatross around the neck of Maruti are the hatches, which brought down Maruti’s growth by 2.45%.

The two charts in this page tell a tale that is there for all to see. Their one-time hero, the Swift, for which customers waited in yearlong queues, which they refused to share with Toyota like the way they did the Baleno (Toyota Glanza), is down massively by over 15%. The downfall of the hatch segment is massive. For Maruti itself, this fall has been at -13.7%.

Overall, the segment is down by 15.7%. The sales are just hurtling downwards and the segment as a percentage of the entire car market is now at a measly 21.7% with a negative 3-year CAGR of - 5.3%. A decade ago, it was at over 50% of the market.

SUVs, which a decade ago were at 8% of the total market stands at over 56% today! On the positive side, the Ertiga which has shown growth of 48.8% has shown one of the highest growth rate this year across models.

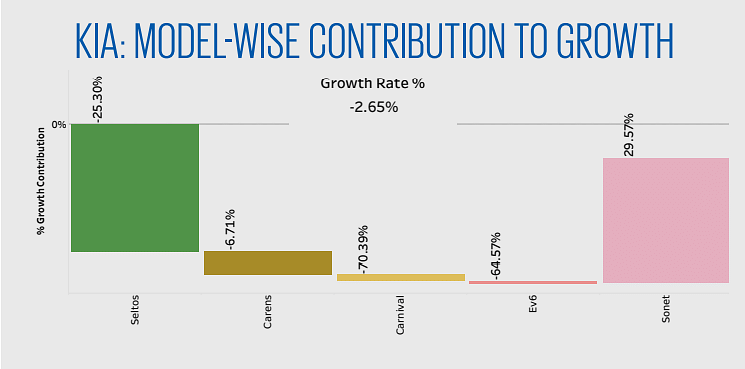

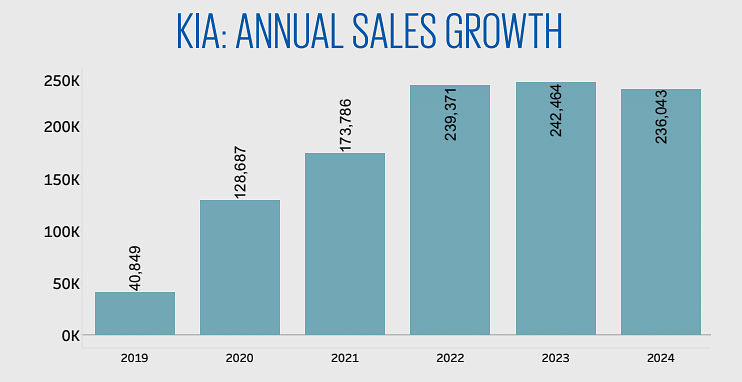

Kia’s Hit a Wall

After a brilliant four years of coming to the Indian markets, Kia has slowed down and how! Growth over the same period last year is down by 2.65%.

After a brilliant four years of coming to the Indian markets, Kia has slowed down and how! Growth over the same period last year is down by 2.65%.

The sales of Seltos are down by a quarter from last year making it the worst performing model across OEMs. However, the sales of Sonet are up 30%. It’s been a mixed bag for Kia and the overall growth numbers showing in the negative are surely a dampener. The lack of enthusiasm to sell what is probably the best MUV product on this side of the Rs 20-lakh bracket, the Carens, has truly been a disappointment when you look at its potential.

Hopefully the facelift will bring in the much-needed respite in better numbers. The lack of a CVT in the 1.5-liter NA engine version has allowed Ertiga to have an unchallenged ride in this segment. The mid-sized SUV segment is truly hot (growth of 14.8%) and the damp performance of the Seltos (down 25.3%) requires some serious introspection. Is it the new styling cues that have not gone well with potential customers? On the features front, it is as good as it can get. It is still at no. 4 in the rankings.

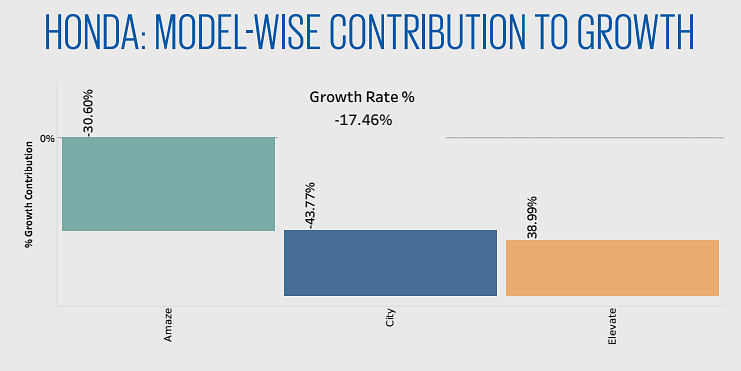

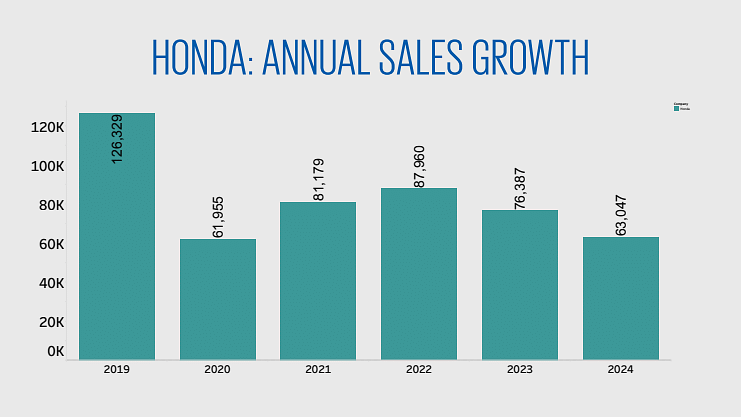

Honda Hits a New Low

Overall sales in the same period over last year is down a massive -17.5%. Other than the Elevate, which has seen volume growth, there is little hope for them from their sedans. The only hope is that the new Amaze will show some traction and give them better results in this coming year.

Overall sales in the same period over last year is down a massive -17.5%. Other than the Elevate, which has seen volume growth, there is little hope for them from their sedans. The only hope is that the new Amaze will show some traction and give them better results in this coming year.

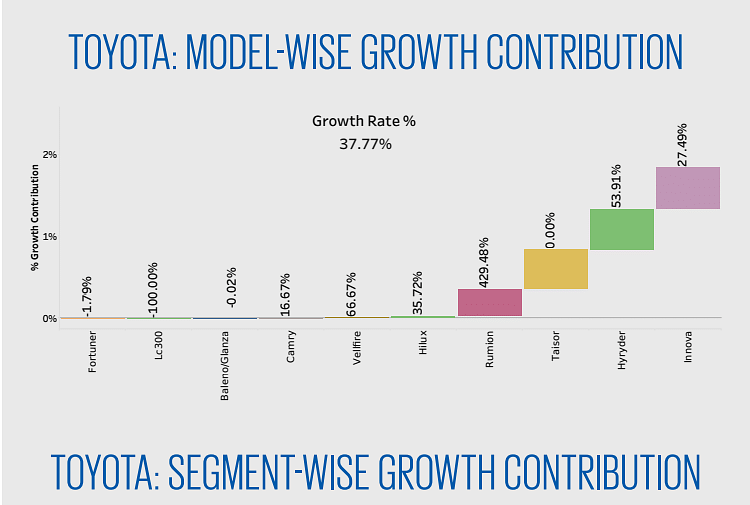

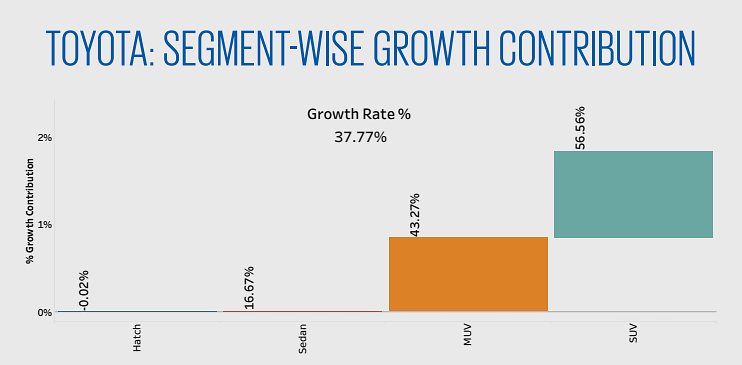

Toyota Hits an All-Time High

Toyota had sales of over 275,000 in the first 11 months of the year, and is poised to hit over 300,000 for the full year, is a revelation. It's an all time high for the group, and to a great extent this has been due to Maruti’s help, where, out of the 10 models listed above, four are co-branded with Maruti.

Toyota had sales of over 275,000 in the first 11 months of the year, and is poised to hit over 300,000 for the full year, is a revelation. It's an all time high for the group, and to a great extent this has been due to Maruti’s help, where, out of the 10 models listed above, four are co-branded with Maruti.

Other than the brilliant Hycross whose sales get clubbed along with the Innova while reporting, the other three big models reflect the role played by Maruti in propping up Toyota sales. Only 48.7% of Toyota’s sales this year have been Toyota Models. Last year in the same period it was 56.3%.

The Rise and Rise of the SUV

The SUVs in 2024 comprise 53.1% of the Indian car markets. They were 48.1% last year and just 32.4% in 2020. The hatches have been beaten up even worse. From 41.9% in 2020 to 23.0% this year, sedans have moved from 14.1% in 2020 to 7.9% this year. That is almost halving the share! The image above explains exactly how the sands have shifted in the last five years.

Niranjan N Prabhu is the founder of Cargraphical Analytics Solutions. Author's views expressed are personal.

RELATED ARTICLES

Hero, Honda, TVS, Bajaj and Royal Enfield Target India’s Nascent Electric Motorcycle Market

Even as scooters dominate the electric 2W market, legacy ICE motorcycle OEMs are already pushing the innovation and R&D ...

Which is Cheaper over 14 Years of Use: Maruti Suzuki e Vitara or Victoris?

Maruti Suzuki's first EV has arrived, promising low running costs and a clever Battery-as-a-Service plan. But how does t...

Bajaj Chetak Retail Sales Cross 600,000 Units, 227,000 In Last 10 Months

Since the launch of the zero-emission Chetak six years ago, Bajaj Auto has delivered 602,673 units to customers in India...

13 Jan 2025

13 Jan 2025

54802 Views

54802 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal