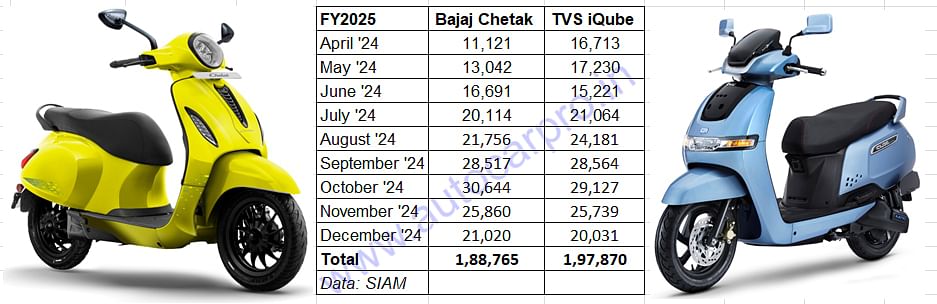

TVS iQube and Bajaj Chetak sales gap narrows down to 9,105 units in April-December

The competition between the top two legacy players in the electric scooter market has increased in the current fiscal. Between April and December 2024, while TVS has dispatched 197,870 iQubes to its dealers, the Bajaj Chetak has clocked 188,765-unit wholesales.

The stiff battle for supremacy between the top two Indian two-wheeler legacy players – TVS Motor Co and Bajaj Auto – in the EV market continues to grip the industry in the current fiscal year.

As per the latest SIAM wholesales (dispatches to dealers) numbers, the sales gap between the two electric scooters for the April-December 2024 period has narrowed down to 9,105 units. In FY2024, the two models were separated by 74,194 units, both having hit their all-time highs – TVS with 189,896 iQubes and Bajaj with 115,702 Chetaks.

Both OEMs registered their best-ever sales in the festive month of October 2024 – 30,644 Bajaj Chetaks and 29,127 TVS iQubes.

While TVS Motor Co has dispatched 197,870 units in the first nine months of FY2025, up 37% YoY (April-December 2023: 144,126 units), Bajaj Auto has shipped 188,765 units in the same period, up 148% YoY (April-December 2023: 75,999 units). Both OEMs registered their best-ever sales in the festive month of October 2024 – 30,644 Bajaj Chetaks and 29,127 TVS iQubes. In the period under review, Bajaj Auto has outsold TVS Motor for five months – May, July, October, November and December 2024.

The TVS iQube, which is currently retailed with three options – 2.2kW, 3.4kW and 5.1kW – and has five variants, maintains a strong resonance in the market. On the marketing network front, TVS Moor Co currently has around 750 dealers and sub-dealers spanning over 450 cities across India. The company, which has ample manufacturing capacity on hand, is strategically expanding the iQube dealer network. The company, which expects two-wheeler EV sales in India to reach 30% market penetration by CY2025, plans to roll out a new electric scooter before the end of FY2025.

What has given Bajaj Auto fresh verve in FY2025 is the rollout of the new Chetak 2901, priced at Rs 96,000 in June 2024. This strategic move to drop below the Rs 100,000 pricing has helped the Bajaj EV address the sub-Rs 100,000 segment, which accounts for nearly 50% of the overall e-two-wheeler market. On December 20, 2024, Bajaj Auto expanded its Chetak model portfolio with the launch of the new 35 Series which comprises three variants: 3501 (Rs 127,000), 3502 (Rs 120,000) and 3503 with an enhanced 153km range. The Bajaj Chetak portfolio now spans four variants – 2903 (Rs 99,999), 3202 (Rs 115,000), 3502 (Rs 120,000) and 3501 (Rs 127,000), all ex-showroom Mumbai.

RETAIL MARKET DIFFERENCE: iQUBE AHEAD BY 11,203 UNITS

The battle between the two legacy OEMs remains intense on the retail front too. As per Vahan data, while the 163,989 TVS iQube have been delivered to customers in the April-December 2024 period, a total of 152,786 Bajaj Chetaks have been bought. The retail sales difference is 11,203 units in favour of the TVS iQube. While Ola Electric remains the market leader in terms of cumulative retails, the Bajaj Chetak was the best-selling e2W in December 2024 for the first time, and TVS Motor is currently leading the charts in January 2025.

BRAND MATTERS

With stiff petrol prices and most Indian states offering plenty of incentives to accelerate electric mobility, both the Bajaj Chetak and TVS iQube should continue to see robust demand in the coming months, even as another legacy OEM – Honda – has just checked into the market with its Active:e and QC1 electric scooters. In an expanding marketplace with new products, what ticks the boxes for both TVS and Bajaj is their strong brand image, reliable aftersales support and innovative in-house R&D activity.

ALSO READ: E2W sales jump 33% to 1.14 million units and 59% of India EV market in CY2024

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

15 Jan 2025

15 Jan 2025

20620 Views

20620 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi