TVS and Suzuki maintain momentum, grow scooter market share, Suzuki beats Hero to take No. 3 slot

While the Jupiter and NTorq 125 continue to bring home the goods to TVS Motor Co, Suzuki shines in the first six months of the fiscal and is the sole OEM to score positive sales.

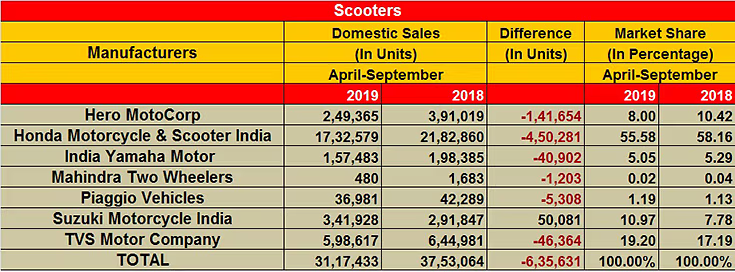

Even as Bajaj Auto is all set to take the covers off its new electric scooter and launch the Urbanite brand on October 16, the conventional IC-engined scooter is facing troubled times in sync with the rest of the industry. September 2019 sales are down 16.60% to 555,829 units and April-September numbers down a similar 16.94% to 3,117,433 units. The first half of FY2020 has seen three -- TVS Motor Co, Suzuki India and Piaggio India -- of the seven scooter makers register market share gains, even as the others lost theirs, albeit marginally.

HMSI's market share marginally down to 55.58%

Honda Motorcycle & Scooter India (HMSI), the longstanding scooter market leader, remains unassailable mainly due to the powerful brand presence of the Activa. Nonetheless, the Activa's sales are slowing which has resulted in HMSI's reduced year-on-year numbers: 1,732,579 units in H1 FY2020, down 20.62% (H1 FY2019: 2,182,860). This performance is reflected in the company's market share falling from 58.16% to 55.58%.

The company is aggressively working to make the transition to BS VI and on September 11, launched the BS VI Activa 125. The new Activa 125 will be available in three variants - Standard, Alloy and Deluxe. The Standard is priced at Rs 67,490, while Alloy and Deluxe cost Rs 70,990 and Rs 74,490, respectively. This means the base variant of the BS VI Activa 125 is an additional Rs 2,478 over the top-spec disc variant of the current model that currently retails at Rs 65,012 (all prices, ex-showroom Delhi).

The scooter maker is also driving new growth strategies and is targeting semi-urban and rural India. Earlier this year, it has tied up with Cholamandalam Investment & Finance Co for offering retail finance. What will help is Cholamandalam’s strong nationwide presence with over 1,000 branches, most of them rural and semi-urban areas, and a base of a million consumers.

Hero MotoCorp feels the heat too

In the scooter market, it's said when HMSI sneezes, the others catch a cold. While TVS, Suzuki and Piaggio seem to be bucking that theory, Hero MotoCorp has seen its scooter market share fall from 10.42% to 8%. The company has reported sales of 249,365 units in H1 FY2020, down a sizeable 26 percent.

Hero MotoCorp is looking to cash in on the growing demand for 125cc scooters. In May this year, the company launched the Maestro Edge 125 offering it in three variants – a carburettor drum brake variant priced at Rs 58,500, a carburettor disc brake variant at Rs 60,000 and a fuel-injected variant at Rs 62,700 (prices ex-showroom, Delhi). Hero’s second offering in the 125cc segment, after the Destini 125, faces competition from other similarly conceptualised scooters like the TVS NTorq (Rs 59,900) and the Honda Grazia, for which prices start from Rs 60,723.

TVS market share nears the 20% mark

TVS Motor Co, the No. 2 scooter OEM in terms of volumes, has seen its share grow by two percentage points in H1 FY2020. The company sold 598,617 units, down 7.18% YoY, albeit has increased its market share to 19.20% from 17.19% a year ago.

The Chennai-based OEM has been busy launching a flurry of variants of top-selling models, in an effort to rev up sales, and it looks like the move is working. In September, it launched the new Jupiter Grande, priced at Rs 62,346 (ex-showroom, Delhi). The Bluetooth console-equipped Grande becomes the most expensive one in the range, Rs 2,446 more expensive than the Jupiter Grande Disc SBT at Rs 59,900 and Rs 8,855 more than the standard Jupiter. This variant also gets feature functions like call and text notifications, an over-speeding alert, among other regular data, like the trip and odometer.

On September 19, it launched the NTorq 125 Race Edition at Rs 62,995 (ex-showroom, Delhi). The new model features a new LED headlight with a T-shaped diffused LED DRL, as well as a few other changes. With the Jupiter and NTorq 125 maintaining good sales traction in the market, the company would be looking forward to the festive season to notch higher numbers.

Suzuki makes the most market share gains: 3%, beats Hero

The biggest market share gainer though is Suzuki Motorcycle India with a sterling performance in April-September 2019. With 341,928 scooters sold in the six-month period, it is the sole scooter maker to post positive numbers and notches strong 17.16 percent growth YoY. Actually, call it robust performance given the existing market conditions.

This performance sees the company make the highest gains of 3.19 percentage basis points to take 10.97% market share, compared to 7.78% year ago. The company has been on a growth trajectory and looks set to maintain the same momentum.

This has also helped the company to increase its market share beyond that of Hero MotoCorp, making it the new No. 3 scooter market share OEM behind HMSi and TVS Motor Co.

The Access 125 has turned out to be a game-changer for the company. This popular buy and Suzuki's best-selling scooter seems to be closing the gap with the Jupiter and is a consistent No. 3, after the Activa and Jupiter. On July 16, Suzuki launched a refreshed version, the Access 125 Special Edition (SE) equipped with a disc brake variant. It is powered by the same all-aluminium, four-stroke, single-cylinder 124cc engine which develops 8.7ps at 7000rpm and 10.2 Nm of torque at 5000rpm.

Yamaha readies for BS VI era

Meanwhile, India Yamaha Motor is doing its bit to stay above water in the tough scooter market. With sales of 157,483 units, the company's H1 numbers are down 20% YoY (H1 FY2019: 198,385). The company is hard at work on the BS VI transition and its scooters with the BS VI tech upgrade will roll out in January 2020.

The festive season is underway and scooter manufacturers, like the motorcycle OEMs, are fervently hoping the tide turns in their favour. With the government recently announcing an increase in DA for scores of its employees, it is felt some of the gains will percolate into two-wheeler purchases.

Also read: New SUV launches rev up market share for Hyundai, Kia, Renault and MG

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

13 Oct 2019

13 Oct 2019

19900 Views

19900 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau