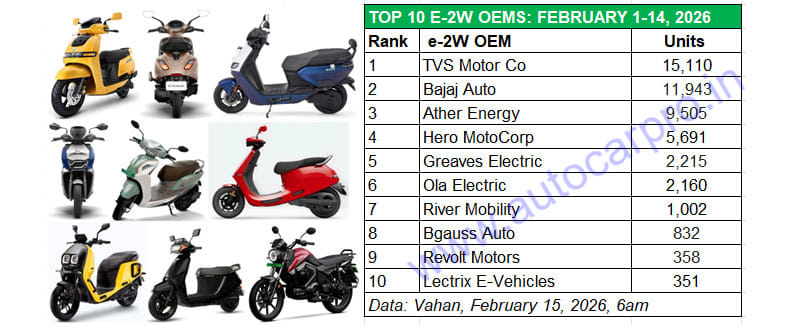

New products always energise the market and drive growth for their manufacturers . . . and that’s just what the recently launched Chetak 2501 seems to have done for Bajaj Auto. After the first 14 days of February, the Pune-based e-2W OEM has sold 11,943 Chetak e-scooters including the new C2501. This total is 3,167 units shy of its arch rival TVS Motor Co (15,110 units).

As of today (February 15, 2026) India 2W Inc is just 1,292 units away from hitting its highest-ever retail sales in a fiscal year. From April 1, 2025 through to February 14, 2025, the industry has sold 11,49,474 units and will overtake FY2025’s 11,50,766 units in a single day.

The Top 10 OEMs account for 94% of the 52,007 electric 2Ws sold in the first 14 days of February.

The Top 10 OEMs account for 94% of the 52,007 electric 2Ws sold in the first 14 days of February.

TVS Motor Co though maintains the leadership it has displayed right since April 2025 (barring October 2025 when it lost to Bajaj Auto). Of the 52,007 electric scooters, motorcycles and mopeds sold between February 1-14, TVS with 15,110iQubes and Orbiters accounts for a 29% share. Given the continuing robust customer demand for its e-scooters, TVS is exploring expansion of its e-2W manufacturing capacity. The company currently produces around 30,000 iQubes a month while Orbiter production is nearing the 10,000-units-a-month mark.

Longstanding No. 2 e-2-wheeler OEM Bajaj Auto is looking to wrest the crown from TVS Motor Co.

Having launched its most affordable EV – the aggressively priced Chetak 2501 – on January 14, 2026 which expands the Chetak portfolio to five models, Bajaj Auto sold 11,943 units in first-half February, which gives it a 23% market share. The aggressively priced Chetak 2501 (Rs 87,100 ex-showroom Bengaluru) costs Rs 22,000 less than the TVS iQube 2.0 (Rs 109,000, 2.2 kWh battery). Powered by a 2.5kWh battery, the Chetak C2501 has a claimed IDC range of 113km on a full charge and goes head-to-head against the TVS iQube 2.2kWh and the Hero Vida VX2 Go. Meanwhile, Bajaj Auto continues to expand its Chetak network which now stands at nearly 400 exclusive stores and 4,000 points of sale in 800 cities across India.

Ather Energy, the firm No. 3, continues to witness strong salesand has retailed 9,505 units in first-half February for an 18% market share. The Rizta family scooter, which accounts for around 70% of Ather’s monthly sales, has benefited from the Battery AsA Service (BaaS) business model which has enabled a reduction of the upfront price of the Rizta S to Rs 76,000, making the premium family scooter far more affordable. Ather also sells the 450X and 450S e-scooters.

Fourth-ranked Hero MotoCorp, which has sold 5,691 units in first-half February, is well set to clock its eighth straight month of 10,000-plus retail sales. The company has recently expanded its Vida VX2 portfolio with the 3.4kWh variant (Rs 84,800) which joins the VX2 Go 2.2 kWh (Rs 73,850) and the VX2 Plus (Rs 94,800). Hero Vida also sells the V2 Pro (Rs 140,000) and V2 Plus (Rs 104,800).

Interestingly, as per Vahan data, Greaves Electric Mobility (GEM) which markets the Ampere brand of e-scooters, has risen toNo. 5 rank for the first time. With retails of 2,215 units, GEM has edged ahead of Ola Electric (2,160 units) and currently has a slender lead of 55 units. GEM currently has a five-model portfolio comprising the Nexus, Magnus Neo, Magnus Grand and the Reo 80 / Li Plus. The latest model is the Magnus G Max launched on January 19 at Rs 94,999. Powered by a 3 kWh LFP battery, the Magnus G Max delivers over 100km real-world range in Eco mode, with a certified range of 142km. It remains to be seen if GEM holds onto its lead over Ola in the second half of this month or Ola regains its fourth rank.

Ola Electric, which has clocked retail sales of 2,160 units in the past 14 days of February, finds itself in No. 6 position for the first time and is working to revive numbers. Founder, chairman and MD Bhavish Aggarwal recentlypointed out the company’s sales slowdown is due to service execution challenges rather than product quality issues, and fixing service gaps is key to improving sales. He said, “We do have a service challenge which we are working through that has impacted brand trust and hence sales are down in the last couple of quarters.We are fixing the service challenges in a very structural, institutional way. It will take some time.”

Ola Electric’ portfolio comprises S1 scooters and Roadster X motorcycles. The premium S1 Gen 3 portfolio includes S1 Pro+ in 5.2kWh (with 4680 Bharat Cell), and 4kWh battery pack configurations, and S1 Pro in 4kWh, and 3kWh battery pack configurations respectively. The mass market offerings include Gen 3 S1 X+ (4kWh), and Gen 3 S1 X (4kWh, 3kWh, 2kWh). The Roadster motorcycle portfolio includes Roadster X+ in 9.1 kWh (with 4680 Bharat Cell), and 4.5kWh battery pack configurations respectively. The Roadster X comes with 4.5kWh, 3.5kWh, and 2.5kWh battery packs.

Bengaluru-based River Mobilityis ranked seventh with sales of 1,002Indie e-scooters which takes its total sales to date to over 21,000 units since October 2023. January 2026 (2,602 units), when it crossed 2,000-unit monthly sales for the first time, is its highest retails score yet.

Mumbai-based startup Bgauss Autotakes eighth position with 832 units of its RUV 350 and Max C12.

Revolt Motors, which was amongst the earliest OEMs to launch an electric motorcycle in India in CY2019, is in penultimate position with 358 units, and is followed by Lectrix E-Vehicles with 351 units.

Finally, the moot question: With 14 days including today left in the shortest month of the year, will Bajaj Auto overtake TVS? It’s early days yet for the new Chetak C2501 and it remains to be seen if the newest iteration of the Bajaj EV helps the company intensify the battle for leadership with the market leader. Stay plugged in as we bring you up-to-date with the latest numbers in the two-wheeled EV arena.

ALSO READ: Bajaj Chetak retail sales cross 600,000 Units, 227,000 in last 10 months

South India Is No. 1 Buyer of Electric 2-Wheelers in CY2025 With 34% Share

EV Sales in India Hit Record 2.27 Million in CY2025, All 4 Segments Scale New Highs

The Top 10 OEMs account for 94% of the 52,007 electric 2Ws sold in the first 14 days of February.

The Top 10 OEMs account for 94% of the 52,007 electric 2Ws sold in the first 14 days of February.