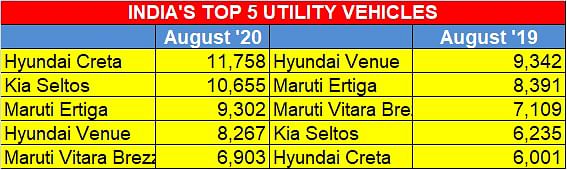

Top 5 UVs in August 2020 | Creta fires on all cylinders, Seltos close on its heels, Ertiga and Venue spar, Vitara Brezza revs up

In what is easily the most exciting vehicle segment and the torchbearer of growth for PVs, August 2020 proved to be quite an august month.

Passenger vehicle sales are back in action and August saw the segment, which comprises cars, utility vehicles and vans, clock sales of 215,916 units which constitutes a smart 14.16% year-on-year uptick. What’s helping this positive movement is the surging demand for UVs which sold a total of 81,842 units or 38 percent of total PVs last month.

This means the segment has more or less regained traction, even in the difficult year – in August, UVs (70,837) had accounted for a similar 37.45% of the PV pie (189,129). Let’s find out the movers and shakers in the UV segment this August.

No. 1 Hyundai Creta: 11,758 units

Hyundai Motor India’s new Creta it seems can do no wrong. Demand continues to surge for this midsized SUV and August saw it go home to 11,758 buyers. As much as 56% of these (6,540 units) were diesel variants as compared to 5,218 petrol variants, indicative that the Korean carmaker’s strategy to remain bullish on diesel is paying off.

In the April-August 2020 period, a total of 33,726 Cretas have been sold (20,844 diesel and 12,882 petrol), comprising for 62% of total Hyundai UV sales in the first five months of FY2021: 54,402.

The Creta’s pack of powertrains comprises 1.5-litre petrol, 1.5-litre diesel and a 1.4-litre turbocharged petrol engine options. Clearly, the new BS VI-compliant diesel motor has outpaced the other two when it comes to market pull. As per a press statement issued in July by the Chennai-based OEM, 60 percent of the 55,000 bookings received for the new Creta comprise the diesel fuel option, which is offered with either a 6-speed manual or a 6-speed torque converter automatic transmission.

The new Creta has been riding on the credentials of its predecessor which was launched in July 2015. It became the segment leader in the midsized SUV space and clocked sales of 466,839 units in the domestic market until January 2020 before the second-generation model was unveiled at the Auto Expo in February. And, in a time of social distancing, Hyundai's digital 'Click To Buy' campaign seems to have clicked with consumers. The company also states that the Creta is the most researched car on its online retail platform with 30 percent buyers enquiring about the SUV and over 76 percent of bookings of the car coming online.

The new Creta, which competes with the Kia Seltos, MG Hector, Renault Duster and Nissan Kicks, is very much on the upswing. With the festive season around the corner, Hyundai will be doing all to ensure that the Creta stays where it is right now – at the top. It helps that the Creta has helped Hyundai to lead the UV market share table too at 24.59%, just ahead of Maruti Suzuki India which has 24.23 percent.

No. 2 Kia Seltos: 10,655 units

At 1,103 units behind the segment leader is the Kia Seltos with 10,655 units comprising 5,987 petrol variants and 4,668 diesel, which shows that 56.18% of buyers plumped for the petrol model. In the April-August 2020 period, the fuel-wise demand situation is similar. Of the total 27,650 units sold in these five months, 55% of buyers (15,302 units) opted for petrol compared to diesel variants (12,348 units). The Seltos, Kia’s first product in India, accounts for an overwhelming 97.73% of total April-August 2020 sales with the Carnival MPV accounting for the balance 641 units.

At 1,103 units behind the segment leader is the Kia Seltos with 10,655 units comprising 5,987 petrol variants and 4,668 diesel, which shows that 56.18% of buyers plumped for the petrol model. In the April-August 2020 period, the fuel-wise demand situation is similar. Of the total 27,650 units sold in these five months, 55% of buyers (15,302 units) opted for petrol compared to diesel variants (12,348 units). The Seltos, Kia’s first product in India, accounts for an overwhelming 97.73% of total April-August 2020 sales with the Carnival MPV accounting for the balance 641 units.

On June 1, Kia rolled out a 10-feature re-jig to the crossover’s variant line-up with pricing of the refreshed Seltos starting at Rs 989,000 ex-showroom, India. While it is premature in the auto industry for a carmaker to be bringing any updates to a model as fresh as nine months old, Kia’s step can be assumed to have come in response to the launch of the Creta from Hyundai – its sister company giving it the home-grown competition, which starts at Rs 999,000 ex-showroom.

The Seltos has been instrumental in giving Kia a strong foothold in the Indian market and the company currently has a 12.79% UV market share – not bad for a year-old company and fourth in the pecking order among 16 UV players.

No. 3 Maruti Ertiga: 9,302 units

Maruti Suzuki India's MPV, which was a surprising and a speedy mover in FY2020 with total sales of 90,543 units (39% YoY growth) is maintaining good sales momentum. In August 2020, it sold a total of 9,302 Ertigas, accounting for 11.36% of total UV sales and 44% of total Maruti Suzuki India’s UV sales in August 2020 (21,030 units). These 9,302 units comprise 3,050 CNG variants and 6,252 petrol.

The Ertiga’s April-August 2020 sales tally is 23,465 units, which is 25% of the carmaker’s total UV sales (92,684) in the first five months of FY2021. Clearly, moving out of diesel has impacted demand – in the year-ago April-August 2019 period, total Ertiga sales were 42,127 units including 22,035 diesel. But the positive news for Maruti is that demand is gradually growing for its CNG variant: a 10-fold increase from the 618 units in August 2019 to 6,507 units in August 2020.

No. 4 Hyundai Venue: 8,267 units

Like the Ertiga, sales of the Venue are improving month on month. Demand for Hyundai’s first compact SUV has been impacted by the surging demand for its sibling, the new Creta. So much so that the Venue, which was the UV market leader in August 2019, is now down to fourth place.

In August 2020, the Venue sold a total of 8,267 units, down 11.5% on year-ago sales of 9,342 units.

As compared to its sibling Creta which is seeing strong demand for its diesel powertrain model, the Venue has strong buyer preference for petrol. In August 2020, 73% of buyers (6,045 units) drove home a petrol-engine Venue. Likewise, in the April-August 2020 period, of the total 20,372 Venues sold, 69.37% buyers (14,134) voted for petrol.

The recent past has seen Hyundai introduce minor updates to the Venue. In addition to the upgrade to BS VI, the company has added a new ‘Sport’ trim and a clutchless manual gearbox, or intelligent manual transmission (iMT) in Hyundai-speak, to the model’s line-up. But new competition in the form of the Kia Sonet and Toyota Urban Cruiser has just arrived.

No. 5 Maruti Vitara Brezza: 6,903 units

The Maruti Vitara Brezza, which was the harbinger of SUV change in the country which it was launched in March 2016, is now revving up in petrol format only, the company having driven out of diesel. Last month, a total of 6,903 units were bought in India, taking the company’s April-August 2020 total to 19,824 units. Compare that with the April-August 2019 total of 41,848 units, when the Brezza was sold as a diesel-only model.

The Vitara Brezza shares its 105hp and 138Nm, 1.5-litre K15B petrol engine with other Marutis like the Ciaz, Ertiga and XL6. A 5-speed manual gearbox is standard, while a 4-speed torque converter-equipped auto is available as an option. Interestingly, Suzuki’s SHVS Smart Hybrid tech is reserved for automatic versions of the compact SUV only. ARAI fuel-efficiency figures rate variants with the 5-speed manual at 17.03kpl while the automatic, with the mild-hybrid tech, has an ARAI-rated 18.76kpl.

The company is banking on growth returning to the model, given the sharp UV consumer shift to petrol. From 26% a year ago, demand for petrol-engined UVs has jumped to 56% in the April-August 2020 period, with demand for diesel UVs dropping sharply from 74% to 44 percent. The mark-up in BS VI diesel engine prices and the diminishing price differential between the two fuel costs have only reinforced the switch to petrols.

Maruti feels it holds a definite edge is its sales and service experience. In a recent interaction with Autocar India, Shashank Srivastava, executive director, sales and marketing, Maruti Suzuki India, commented: “For any product to be successful and to get the large numbers as the Vitara Brezza has, it is first and foremost about the product. But it is also about the marketing, network, aftersales and consumer retention and satisfaction.”

The Brezza is retailed through the company’s Arena network, which has around 2,600 outlets spread across 1,900 cities. The massive footprint, combined with the automaker’s brand image, is expected to continue being a significant force behind the Brezza’s sales.

Exciting times ahead for the UV segment

While August 2020 proved to be an august month for UV sales, the coming months should see plenty of action. Two new compact SUVs – the Kia Sonet and the Brezza-based Toyota Urban Cruiser – have just been launched. While the new Mahindra Thar will be launched on October 2, there’s also the Renault Kiger slated for launch soon while the Nissan Magnite will follow in January 2021.

While there’s little doubt that the ongoing fiscal will see overall reduced demand for PVs, expect the UV segment to continue to be the torchbearer of growth in difficult times.

READ MORE

Top 10 Scooters in August 2020

Top 10 Motorcycles in August 2020

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

27 Sep 2020

27 Sep 2020

28340 Views

28340 Views

Shahkar Abidi

Shahkar Abidi