Top 10 UVs: Maruti Brezza No. 1 in September, Tata Nexon tops in first-half FY2023

With both monthly and half-yearly toppers being compact SUVs, it’s no surprise that demand is strongest for this sub-segment even as midsize SUVs see growing consumer interest.

The hottest segment in the Indian passenger vehicle market is easily that of utility vehicles (UVs). With UVs now accounting for every second passenger vehicle sold in the country, every automaker worth its wheel wants to have a slice and more of this booming segment, which has been seeing a wave of sustained, surging demand over the past two years, and similar to global trends.

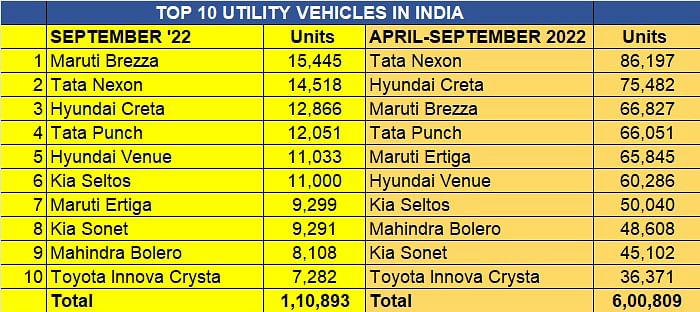

With six months of the ongoing fiscal over, a quick check of the Top 10 models, for September 2022 and the April-September 2022 makes for some interesting revelations. First off, the same 10 models dominate the monthly as well as the half-yearly sales charts.

The Maruti Brezza, with 15,445 units, has topped the chart last month, going ahead of SUV market leader Tata Nexon (14,518), as it also did in August 2022 – the Brezza (15,193 units) had pipped the Nexon (15,085 units) by 108 units. However, the Tata Nexon is ahead of the Brezza in H1 FY2023 by a fair margin of 19,370 units – with 86,197 units in April-September, the Nexon has averaged monthly sales of 14,366 units versus the Brezza’s 11,137 units a month.

The Hyundai Creta, third-placed in September with 12,866 units, is in No. 2 position in first-half FY2023 with 75,482 units and a monthly ‘run rate’ of 12,580 units.

Proof that the Tata Punch is the ‘dark horse’ in the UV race is the fact that it has maintained its fourth position – both in September 2022 (12,051 units) and in April-September 2022 (66,051 units), which makes for average monthly sales of 11,008 units.

The Hyundai Venue takes fifth place in September with 11,033 units and is sixth in H1 FY2023 with 60,086 units.

Small is big in India’s SUV market

Within the overall UV market, the compact SUV sub-segment rules the roost. Of the Top 10 models, five are compact SUVs – Tata Nexon and Punch, Maruti Brezza, Hyundai Venue and Kia Sonet. The midsize trio are the Hyundai Creta, Kia Seltos and Mahindra Bolero. The Maruti Ertiga and Toyota Innova Crysta are the MPVs in the best-selling UVs chart.

Number-crunching reveals that the five compact SUVs have more than half of the Top 10 UV share – 56% in September 2022 and 54% in April-September 2022 (see data table below). The growing demand for midsize models is also seen in their near-29% contribution for both September and H1 FY2023 while MPVs make up the balance.

With six months to go for FY2023 to end and the SUV-driven passenger vehicle segment firing on all cylinders, SUV manufacturers will be looking to maximise demand in festive October and beyond. Most of the sizeable pending orders across OEMs represent SUVs, and with the semiconductor supply crisis having eased for most, assembly lines will be pressed hard to roll out what the consumer wants. In the value-conscious Indian marketplace, it's the SUV-vival of the fittest.

ALSO READ Tata Nexon sales in India surpass 400,000-unit milestone

India’s top five Global NCAP five-star-rated cars sell over 900,000 units

Tata Motors on track to sell 500,000 PVs, 50,000 EVs in FY2023

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

10 Oct 2022

10 Oct 2022

17122 Views

17122 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau