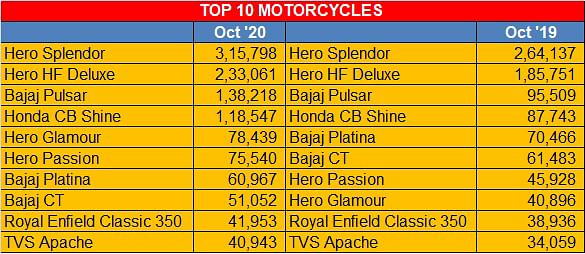

Top 10 Motorcycles in October 2020 | Hero Splendor and HF Deluxe clock 550,000 units, Bajaj Pulsar powers on, Honda CB Shines

At 1,154,518 units, these Top 10 motorcycles contributed to 83% of total motorcycles sold in October.

If the Indian two-wheeler industry crossed the 2-million despatches mark in October 2020, then the 17% year-on-year boost has to be attributed to the motorcycle segment. Last month, OEMs upped the ante with 1,382,749 motorcycles (23.80%) delivered to showrooms. At 1,154,518 units, these Top 10 motorcycles contributed to 83% of total motorcycles sold in October. That’s the kind of weight they command in the motorcycle scheme of things. Here’s looking at how they fared.

No. 1 Hero Splendor: 315,798 units

Hero MotoCorp, the world’s largest two-wheeler OEM derives its power of numbers from the Splendor, which is easily the world’s highest-selling motorcycle and product on two wheels. In October, the company despatched 315,798 units to its dealers across the country, hoping to make the most of the festive season. That’s 35,548 bikes more than September’s 280,250 units and August’s 83,497 units. How many were actually retailed remains to be seen.

One of India’s first BS VI-compliant two-wheelers, the Splendor range comprises three models – the Splendor Plus, Splendor iSmart and the Super Splendor. The Splendor Plus continues to be the most affordable with a starting price of Rs 59,600. The Super Splendor is the most expensive, starting at Rs 67,300. The Splendor iSmart is priced at Rs 67,100.

The Splendor uses a new engine – a 113.2cc, single-cylinder, fuel-injected unit which develops 9.1hp at 7,500rpm and 9.89Nm torque at 5,500rpm. India’s best-selling bike, which features Hero’s i3s start-stop technology, uses a 240mm front disc and 130mm rear drum brake as standard.

What’s driving demand for the Splendor range is the uptick from rural India which has seen a good kharif season. The coming months, which will see farmers increase their transport operations, demand for fuel-sipping commuter bikes will only grow.

No. 2 Hero HF Deluxe: 233,061 units

The HF Deluxe is the second Hero commuter bike with sales of over 200,000 units in a month. October’s 233,061 units is marginally higher than September’s 216,201 units but substantially more than August’s 177,168.

Early in January 2020, Hero launched the BS VI HF Deluxe and priced the base variant at Rs 55,925 and the i3S variant at Rs 57,250 (both prices, ex-showroom, Delhi).

The updated HF Deluxe features a fuel-injected 100cc single-cylinder engine, which develops 7.94hp and 8.05Nm; Hero claims the new engine is 9 percent more fuel efficient and better performance, with 6 percent faster acceleration. The new HF Deluxe also features Hero’s i3S (idle start-stop system).

No. 3 Bajaj Pulsar: 138,218 units

The Bajaj Pulsar, with 138,218 units in October has moved up from its No. 4 ranking in September (102,698). August sales were 87,202 units, which indicates the upswing for Bajaj Auto is rather strong. The company has reported the highest-ever monthly Pulsar sales this October, as well as exports.

The sporty Pulsar family is all of nine variants strong – Pulsar 125, Pulsar 150, 150 Neon, 150 Twin Disc, Pulsar 180F, Pulsar 220, NS160, NS200, and RS200 andwhat could have helped accelerate Pulsar sales was the rollout of the refreshed Pulsar NS and RS series on October 16. The Pulsar NS 200 and NS 160, which get new all-white alloy wheels, are available in four new colour schemes: Burnt Red (Matte Finish), Metallic Pearl White, Pewter Grey and Plasma Satin Blue. While the Pulsar NS 200 costs Rs 131,219, the Pulsar NS 160 is priced at Rs 108,589 (ex-showroom-New Delhi). They went on sale on October 23.

Between May and July 2020, Bajaj Auto has hiked its product portfolio prices twice – first by Rs 500 to Rs 4,500 and two months ago from just under Rs 1,000 to just over Rs 2,400. But that has done little to dampen the enthusiasm of buyers, who still want to have that feeling of a Pulsar.

No. 4 Honda CB Shine: 118,547 units

The CB Shine has slipped from third place in September to fourth in October, when it clocked 118,547 units – a little more than the 118,004 units in September and August’s 2020’s 106,133.

This Honda was among India’s first bikes to get the BS VI treatment. The same 124.73cc, air-cooled, single cylinder engine has been upgraded to BS VI-spec, which has seen the power figure rise from 10.31hp 10.88hp. While the hike in power is marginal, the BS VI CB Shine features electronic fuel injection which translate into crisp and smooth throttle response. The engine is paired to a 5-speed transmission.

No. 5 Hero Glamour: 78,439 units

It looks like the Hero Glamour’s recent entry into the 125cc segment is giving it a new charge. This Hero is seeing an uptick, month on month. October saw 78,439 units compared to September’s 69,477 units and August’s 54,315 units.

It faces stiff competition in the form of some popular motorcycles like the Honda SP 125 and the Bajaj Pulsar 125 but clearly it is going places. While it displaces an identical 124.7cc, the single-cylinder engine powering the new Glamour is new but gets a 5-speed gearbox in place of the 4-speed unit on the older bike.

The Glamour is available in two variants – one with a drum brake at the front and the other with a disc brake – priced at Rs 69,750 and Rs 73,250, respectively, which is just Rs 2,300 more than their corresponding fuel-injected BS IV models. At the price point, the Glamour costs around Rs 1,500 less than the Pulsar 125 and a little over Rs 4,000 less than the Honda SP 125. For not a lot extra, Hero is giving more refinement and features, in addition to all that the Glamour previously had to offer, which is a pretty good deal.

No. 6 Hero Passion: 75,540 units

With the motorcycle market leader going all out to stock its dealerships in the festive season, the fuel-sipping Passion clocked 75,540 units, compared to September’s 63,296 units and August 2020’s 52,471.

The Passion’s been around for two decades now and Hero has recently introduced the 2020 Passion Pro to introduce more passion into the commuter bike arena. This machine now gets the updated BS VI 113cc engine from the Splendor iSmart and develops 9.15hp and 9.9Nm of torque.

No. 7 Bajaj Platina: 60,967 units

Maintaining its seventh position as in September, this Bajaj commuter motorcycle totted up 60,967 units last month, improving on September’s 55,496 units and August 2020’s 40,294 units.

In early July, Bajaj has added a new ES (Electric Start) Disc Brake variant to the Platina 100’s line-up, taking the total number of variants to three. This new variant is priced at Rs 59,373 while the KS Alloy Drum Brake and ES Alloy Drum Brake variants are priced at Rs 49,261 and Rs 55,546, respectively (all prices, ex-showroom, Delhi).

Powering the Platina 100 is a BS VI-compliant 102cc, single-cylinder engine with peak output figures of 7.9hp and 8.34Nm. This engine is mated to a 4-speed gearbox.

The Platina 100 is now one of the only 100cc commuter bike to feature a disc brake, though the additional money it demands puts it in the same price bracket as some 110cc commuters like the TVS Radeon, prices for which start at Rs 59,742.

No. 8 Bajaj CT: 51,052 units

India’s most affordable motorcycle sold a total of 51,052 units improving on September’s 45,105 units and August 2020 sales of 34,863 units. At a starting price of Rs 42,790, the Bajaj CT100 is a refined, good quality product and is a true representation of the affordable engineering that India Inc can deliver. It is actually surprising how the company manages to price it so low.

No. 9 Royal Enfield Classic 350: 41,953 units

At ninth position is the sturdy Classic 350 with 41,953 units and the mainstay of the Royal Enfield range, which has recently been expanded with the launch of the new Meteor 350. The 41,953 units in October better September’s 38,827 units and August 2020’s 34,791 units. The Classic 350 is Royal Enfield’s most popular motorcycle and FY2019 saw the company sell 656,651 motorcycles with the Classic 350 accounting for 60% of them.

In BS VI form, the Classic 350 gets a fuel-injection system that develops 19.8hp and 28Nm of torque. With prices starting at Rs 178,000, the new Classic is about Rs 11,000 more expensive than it was in BS IV spec.

No. 10 TVS Apache: 40,943 units

TVS Motor Co’s flagship motorcycle and premium bike brand Apache continues to see an uptick in sales. In October, the Apache range comprising five models – Apache RTR 160, RTR 180, RTR 160 4V and RTR 200 4V – clocked 40,943 units. This is an improvement over September’s 37,788 units and August’s 33,540 units.

On October 12, total Apache sales rode past the four million unit sale milestone globally. This premium brand was launched in 2005, which makes it the ride from zero to 4,000,000 units has taken 15 years. Interestingly, the last million or 10 lakh unit unit sales have come in just two years. The TVS Apache crossed the three-million-sales milestone on September 10, 2018.

Growth outlook

Having felt the heat of the Covid-induced loss of sales in the first six to seven months of the fiscal, OEMs despatched increased volumes to their dealers. The retail market reality seems to be a different story. On November 9, dealer body FADA and president Vinkesh Gulati said that the

entry-level motorcycles witnessed lean demand. He said that with a supply-side mismatch, most of the passenger vehicle dealers ended with limited stock of high-selling products and odd variants which did not attract much demand. In addition, there were lower discounts compared to the 2019 festival season, which also played spoilsport. FADA estimates overall two-wheeler retail sales were down 26% YoY last month.

Nonetheless, most OEMs are producing all they can, hoping that the need for social distancing will give a fillip to motorcycle sales. Scooter sales, in comparison, continue to be flat what with a fair portion of urban India still in WFH mode. The coming months will be the real indicator whether the promise of October translates into sustainable demand.

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

21 Nov 2020

21 Nov 2020

37833 Views

37833 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi