Tata Motors sells 48,076 cars and SUVs in January, EV sales down 25%

Tata Motors’ overall passenger vehicle wholesales continue to be dragged down by the decline in demand for its EVs, which have been impacted by the increased competition and product choice in the marketplace.

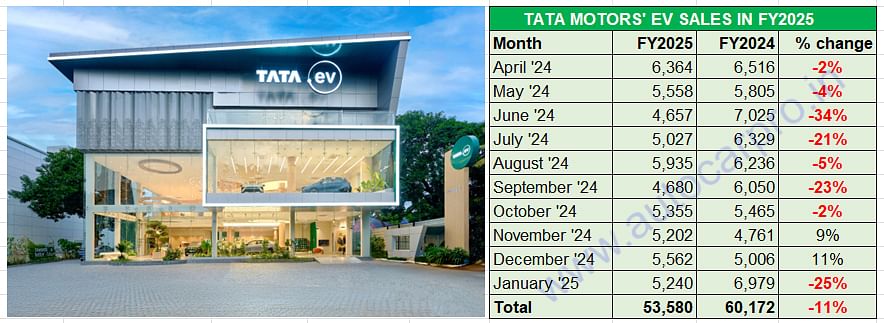

Tata Motors has announced wholesales of 48,076 passenger vehicles in January 2025, down 10% year on year (January 2024: 53,633 units). This includes 5,240 electric vehicles, whose sales are down 25% YoY (January 2024: 6,979 EVs).

The company, which retails eight passenger vehicles – Altroz, Tigor, Tiago, Nexon, Punch, Harrier, the Safari and the Curvv – in the domestic market, has been under pressure for the past eight months.

Tata Motors, the No. 3 PV OEM in overall sales after Maruti Suzuki and Hyundai Motor India, is ranked No. 2 in CNG-powered car and SUV sales. The company, which had first introduced its innovative twin-CNG-cylinder technology in the Tata Altroz hatchback, has now standardised the technology in its entire CNG line-up which comprises the Tiago CNG, Punch CNG, Altroz CNG, Tigor CNG and most recently, the Nexon CNG launched in September 2024. In CY2024, with retail sales of 115,432 vehicles, the company increased its CNG share to 16 percent.

As the 10-month wholesales data (see passenger vehicle and EV sales data above) reveals, the company’s market performance in the current fiscal has been impacted considerably by the slowed-down sales in the first two quarters.

Q1 FY2025’s (April-June 2024) dispatches of 138,104 PVs were down 1% YoY and Q2 (July-September 2024) at 129,930 units were down 6% YoY. Sales returned to the black in Q3 (October-December 2024) at 139,424 units, up 1%, as a result of demand picking up in the festival months of October and November last year.

EV sales slowdown impacts overall numbers

EV sales slowdown impacts overall numbers

Tata Motors’ accelerated growth over the past few years has been a result of its first-mover advantage in the electric vehicle market, where it once had an over 70% market share albeit that has dropped to around 65 percent. Of the mainstream PV OEMs, the company continues to have the largest e-PV portfolio in India comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV.

Tata Motors’ EV wholesales of 5,240 units in January 2025 are down by a sharp 25% YoY (January 2024: 6,979 units), making it the eighth out of 10 months in the current fiscal to witness a decline. For the April 2024-January 2025 period, total EV dispatches of 55,580 units are down 11% on year-ago wholesales of 60,172 units. Clearly, the drop in EV sales is dragging overall PV sales numbers for the company and also resulting in reduced EV penetration level.

For the first 10 months of FY2025, Tata Motors’ EV penetration level stands at 12% compared to 13% in the year-ago period. In the ongoing fiscal year, Tata Motors has seen an unprecedented sales decline for seven months in a row – from April through to September (see EV sales data table above). According to the company, fleet volumes had declined in the October-December 2024 quarter due to the expiry of the FAME 2 subsidy.

The company’s share of the ePV market, which was not too long ago upwards of 75%, has been continually reducing, reflecting the growing competition from rival EV OEMs and increased product choice for buyers. Nevertheless, there continues to be a big difference in numbers between Tata Motors and the rest of the competition.

The Harrier EV, which is slated for market introduction in the first-half of CY2025, should give a boost to Tata Motors' EV sales this year.

The Harrier EV, which is slated for market introduction in the first-half of CY2025, should give a boost to Tata Motors' EV sales this year.

The company, which is on track to deliver 10 all-new EVs by FY2026, has outlined plans to invest between Rs 16,000-18,000 crore in its EV business by FY2030. While the Curvv EV coupe-SUV has been the first to roll out, the Harrier EV is slated for market introduction in the first-half of CY2025. Following these two will be the Sierra EV and Avinya EV – both slated for introduction in FY2026 – between April 2025 to March 2026. Tata Motors aims to leverage its two ground-up EV platforms - Acti.ev and the JLR-derived EMA platform – to address the key barriers of extended range, and advanced technology in modern-day EVs.

With two months left to go in FY2025, Tata Motors, which registered record sales of 582,915 passenger vehicles including a record 73,833 EVs in FY2024, is 127,381 PVs and 20,253 EVs away from last fiscal’s sales. With the Union Budget offering big benefits through income-tax relief, the automobile industry stands to gain. Will some of those gains translate into higher sales for Tata Motors in the coming months?

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

01 Feb 2025

01 Feb 2025

15570 Views

15570 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau