Tata Motors increases UV market share to 19 percent

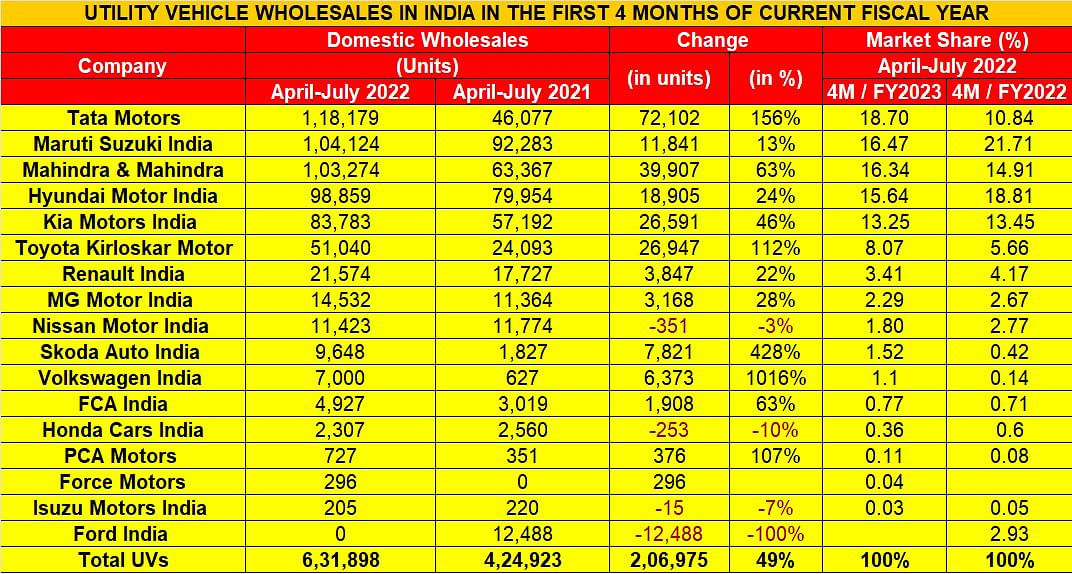

Tata Motors, which was the No. 3 UV OEM in FY2022 with a 15% share, has taken top spot with 18.70% in a market teeming with new products and stiff competition.

Tata Motors continues to expand its market share in the utility vehicle (UV) market. The company, which took the lead in Q1 FY2023 (April-June 2022) with wholesales of 97,943 UVs, maintains its No. 1 position, ahead of Maruti Suzuki India and Mahindra & Mahindra. In a span of just four months, the company has jumped to No. 1 position – in FY2022, Tata Motors was the No. 3 UV OEM with sales of 226,151 units and a 15.19% UV market share.

With total despatches of 118,449 units in the first four months of FY2023, Tata Motors has registered robust YoY growth of 157% (April-July 2021: 46,077) and also substantially increased its UV market share to 18.70% from 10.84% a year ago. To achieve this in an extremely competitive market environment is clearly laudable and speaks for the surging demand for the company’s SUVs – the Nexon, Nexon EV, Punch, Harrier and Safari.

The premium Harrier and Safari SUVs though seem to have been somewhat impacted by the introduction of the Mahindra XUV700, a product that has emerged superior in terms of overall attributes and technology.

Where the company has an advantage over its rivals is in its electric vehicles, particularly the Nexon EV – India’s best-selling e-passenger vehicle, which has no real competition as of now. That is till September 8, when Mahindra will launch its all-electric XUV400.

Passenger vehicle market leader Maruti Suzuki is currently in second place with 104,124 UVs despatched in April-July 2022 (up 13% YoY), which is 14,325 units behind Tata Motors and just 850 units ahead of No. 3 player, Mahindra & Mahindra.

Like some other OEMs, Maruti Suzuki has seen its production substantially impacted over the past year by the chip supply chain crisis but is expected to bounce back soon with the market rollout of its new Brezza and midsized Grand Vitara, whose deliveries are slated to begin around the festive season. Nevertheless, the numbers reveal that the company has lost a fair bit of UV market share – currently at 16.47%, down from the 21.71% it had in April-July 2021. The company is understood to have an order bookings backlog of 387,000 units.

Utility vehicle major Mahindra & Mahindra is at third position and hot on Maruti’s heels with 103,274 units, up 63% YoY. The company, which has an estimated order backlog of 273,000 units, has seen its UV market share grow to 16.34% from 14.91% a year ago. In FY2022, M&M had a share of 15% (223,682 units) in India’s UV market. With a flurry of new models like the recently launched Scorpio-N, Scorpio Classic and the huge demand for the XUV700 and Thar, M&M will be looking to ramp up production at its plants.

Hyundai Motor India, like Maruti Suzuki, has lost UV market share – from 18.81% a year ago to the current 15.64 percent. The Chennai-based OEM despatched 98,859 units in April-July 2022, up 24% YoY. The Creta continues to be its mainstay with 50,039 units and accounting for 50.61% of total UV sales. The Venue is next with 39,013 units, followed by the Alcazar (9,243). The Tucson and the Kona EV contributed 564 units to the April-July total.

Hyundai’s Korean sibling Kia is in fifth place with 83,783 units, up 46% YoY, which gives it a market share of 13.25%, slightly down from the 13.45% a year ago. The Seltos, its first product for India, remains its best-seller with 21,847 units in April-July 2022, followed by the Sonet compact SUV withg 20,758 units.

Toyota Kirloskar Motor has put up a strong show in the past four months. With 51,040 units, it has recorded 112% YoY growth and increased its UV market share to 8.07% from 5.66% a year ago. The popular Innova Crysta MPV with 22,783 units remains its best-seller and accounted for 44% of sales, followed by the Urban Cruiser with 18,677 units and 37%. The butch Fortuner and luxurious Vellfire MPV contributed the balance 9,580 units to the total.

Skoda Auto India with its Kushaq and Volkswagen India with the Taigun are the other UV players which have benefited from new model launches. Skoda with 9,648 units (Kushaq: 9,266 units) has increased its market share to 1.52% from 0.42% a year ago while Volkswagen India, with 7,000 units, now has a 1.1% share compared to 0.14% a year ago.

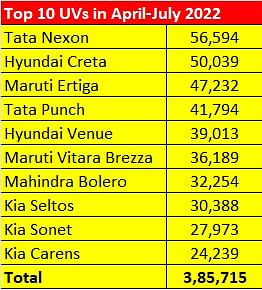

Best-selling SUVs in April-July

Here are the 10 best-selling UVs in the first four months of FY2023, which account for 63% of total UV sales (601,662 units). The Tata Nexon leads the chart with 56,594 units or 9.4% of total industry sales. It is the only model here which has an EV variant, which gives it a sizeable advantage in a market which is witnessing a gradual shift to e-mobility.

The Hyundai Creta, with 50,039 units, has gone past April-June’s No.2 model the Maruti Ertiga, which is now in third place with 47,232 units. The Punch, the youngest member of Tata's 'New Forever' range, is on a roll and clocked its best-ever monthly sales of 11,007 units in July, and in the process crossed the 100,000-unit wholesales mark in a scant 10 months.

OEMs await festive season charge

SUVs is a growth story which can only get better by the day. Of the 15 OEMs in the fray, only three show a decline in sales numbers in the April-July 2022 period. A close look at the wholesales data amply shows that the surging demand for UVs in India is a democratising affair.

With every second car being sold in India being a utility vehicle, there is room for all given that what’s on offer ticks the right boxes. While the top six UV makers account for 88.5% of the market, there is a strong fight underway for the other 11.5% UV market share.

Given the sizeable UV order backlog for Maruti Suzuki, Mahindra and Hyundai, the marked improvement in supplies of semiconductors should see OEMs speedily ramping up production to ensure they make the most of the festive season that begins later this month.

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

21 Aug 2022

21 Aug 2022

45885 Views

45885 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi