Suzuki, TVS, Yamaha, Ather and Bajaj increase scooter market share in April-August 2023

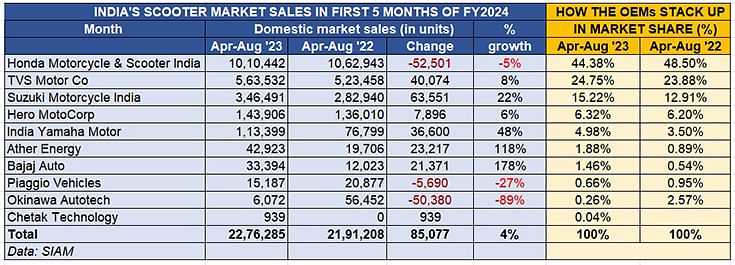

August 2023 wholesales up 9% as OEMs rev up for festive season; cumulative 2.27 million units in first five months of FY2024 up 4% YoY; market leader Honda sells over a million units but sales down 5% YoY and market share to 44% from 44.50% a year ago.

After seeing tepid sales for over two years, India's scooter market is finally seeing some green shoots of recovery as per the August 2023 and cumulative April-August 2023 wholesales numbers released yesterday by SIAM.

Given its 9% year-on-year growth with 549,290 units (August 2022: 504,146 units) last month, the scooters sub-segment can be credited with having saved the blushes for the overall two-wheeler category, which saw just 1% YoY growth at 1.56 million units. That’s because sales of motorcycles, the biggest contributor, were down 4% at 980,809 units (August 2022: 10,16,794 units).

However, on the cumulative April-August 2023 front, the motorcycles category redeems itself with total sales of 45,35,363 units, a 5.66% YoY increase (April-August 2022: 42,92,050 units). Meanwhile, scooters, with total sales of 22,76,285 units, were up 3.88% (April-August 2022: 21,91,208 units).

The top five OEMs among SIAM 10 scooter members account for 21,77,770 units or an overwhelming 95% of the total scooter sales in the first five months of FY2024. However, pare this further and the top three players – Honda Motorcycle & Scooter India, TVS Motor Co and Suzuki – cumulatively have 19,20,465 units or 84% of the industry numbers. In terms of volume increase amongst these 10 SIAM member companies, five OEMS – Suzuki, TVS, Yamaha, Ather and Bajaj Auto – stand out.

Scooter market leader Honda Motorcycle & Scooter India (HMSI) with its Activa brand remains unassailable – it sold over a million units (10,10,442 units) but that was not enough to prevent a 5% decline (April-August 2022: 10,62,943 units). Increased competition and also the fact that it is yet to have an EV means HMSI’s share is down to 44.38%, four percentage basis points fewer than the 48.50% it had a year ago.

Suzuki Motorcycle India sold 63,551 scooters more in August 2023 than it did a year ago, up 22%, which is reflected in its market share growing to 15.22% from 12.91% in August 2022.

TVS Motor Co, with sales of 563,532 units including 75,795 all-electric iQubes, sold 40,074 scooters more in August 2023 versus August 2022, increasing its share to 24.75 percent. While the popular Jupiter and NTorq will be the top two best-selling products for the company, this also means that TVS’s sole EV has a 13.44% penetration level in its overall scooter sales. This should rise, given the recent launch of the premium TVS X e-scooter.

India Yamaha Motor, with sales of 113,399 units, saw volumes rise 48% and by 36,600 units, giving it a share of 5%, up from 3.50% a year ago. Two electric vehicle OEMs – Ather Energy and Bajaj Auto – have witnessed strong sales in April-August 2023. While Ather sold 42,923 units, 23,217 EVs more than it did a year ago to double its market share to 1.88% scooter market share, Bajaj Auto sold 33,394 Chetaks, 21,371 more than in August 2022, for a market share of 1.46%, up on the 0.54% it had 12 months ago.

The electric two-wheeler market leader though is Ola Electric, which retailed 106,418 units in the first five months of FY2024 (as per Vahan data) and commands a 30% share. However, with the company not being a member of SIAM, Ola is not represented in this April-August 2023 wholesales analysis of scooter manufacturers, which is specific to SIAM members only.

WILL THE SCOOTER MARKET SEE BETTER DEMAND?

In FY2023, 5.19 million scooters were sold, up 26% on FY2022’s 41,12,672 units. However, this was well below the pre-Covid FY2020 total of 5.5 million units (55,66,036 units) and way below the record 6.71 million units (67,19,811 units) of FY2018 and 6.70 million units of FY2019.

While there is no doubt that the domestic market scenario is much improved since a year ago, the scooter market in tandem with motorcycles is yet to see fulsome demand come its way. The cost of two-wheeler ownership has increased over the past year and the demand in the critical entry-level segment continues to be impacted. Furthermore, sales from rural India are yet to deliver sustained growth.

Automobile retail body FADA India too has a cautionary comment in its growth outlook, stating that in the two-wheeler market, while a broader range of models is now available, subdued rural demand due to insufficient rainfall could temper sales growth. Nevertheless, with the festive season underway in India, two-wheeler OEMs and the overall industry would be expecting demand to grow substantially during the Navratri and Deepawali festival.

ALSO READ:

EV sales in India cross a million units for second year running

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Autocar Professional Bureau

By Autocar Professional Bureau

12 Sep 2023

12 Sep 2023

12574 Views

12574 Views

Ajit Dalvi

Ajit Dalvi