Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, registered retail sales of 201 units in its first month and a 0.16% share of the 123,062 e-2-wheelers sold in India in January.

Suzuki Motorcycle India (SMI), which officially entered the Indian electric two-wheeler market with its e-Access seven and a half months after it began production of its first electric scooter on May 23, 2025, has had a muted response in its first month of sales.

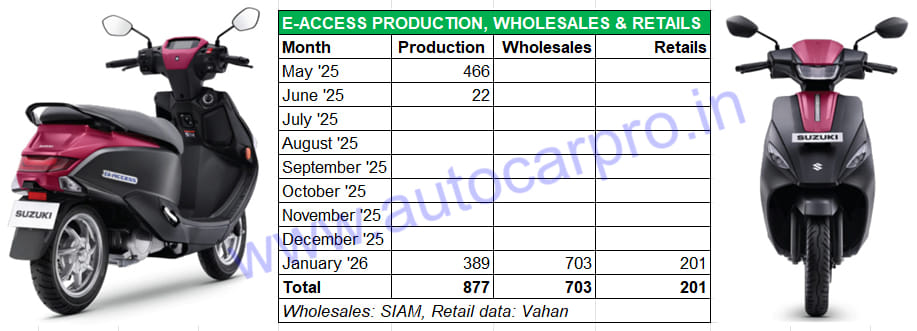

As per apex industry body SIAM’s wholesale numbers, SMI registered factory dispatches of 703 e-Access scooters in January 2026. Of this lot available at its showrooms across India last month, Vahan retail sales data show that 201 units were delivered to customers in January. This gives the company a 0.16% share of the 123,062 e-2Ws retailed in January 2026. In the first half of February (1–14), as per Vahan, an additional 169 e-Access scooters were delivered to buyers. Over the past nine months, SMI has produced 877 units of its first e-scooter: 466 units in May 2025, 22 in July 2025, and 389 units in January 2026 (see data table below).

The 201 e-Access scooters delivered to customers gave Suzuki a 0.16% share of the 123,062 e-2Ws retailed in India in January 2026.

One of the reasons for the slower-than-expected offtake of the premium Suzuki e Access is its stiff pricing. At Rs 188,490 (ex-showroom Delhi), the zero-emission avatar of Suzuki’s popular ICE Access 125 scooter costs substantially more than the top two best-selling e-2Ws in India.

While the top-spec TVS iQube ST 5.3kWh costs Rs 158,000 (Rs 30,000 less), the top-end Bajaj Chetak 350 has a sticker price of Rs 123,000 (Rs 65,000 less). The comparable Ather Rizta Z 3.7kWh costs Rs 153,000 (Rs 35,000 less). The Suzuki e-Access slots in terms of price between the recently launched Simple One Gen 2 (Rs 170,000) and the Ather 450 Apex (Rs 190,000). The just-launched Yamaha EC-06 is priced at Rs 167,000 (Rs 21,000 less).

Nevertheless, in an effort to reduce the e-Access’ total cost of ownership, SMI offers a 7-year/80,000 km extended warranty coverage at no extra cost and also a buyback assurance of 60% for 3 years. Suzuki is marketing the e-Access through its expansive network of over 1,200 dealerships across India, all manned by certified EV technicians. While DC fast chargers are currently available at more than 240 outlets, portable AC chargers are offered across the entire network. The e-Access is also available for purchase through the e-commerce portal Flipkart.

The e-Access is built around Suzuki’s in-house electric architecture, branded as Suzuki e-Technology. Central to this is a 3kWh Lithium Iron Phosphate (LFP) battery, which the company claims offers a significantly longer service life than conventional NMC batteries.

Suzuki’s e-scooter for India has a claimed IDC range of 95 km. The company states that the battery and drivetrain have been subjected to extensive testing, including water submersion, thermal stress, vibration, and drop tests, in line with its global validation standards.

Power comes from a 4.1kW swingarm-mounted motor producing 15 Nm of torque. The scooter features three riding modes – Eco, Ride A, and Ride B – along with regenerative braking and a reverse assist function. Suzuki claims a consistent throttle response even at low battery charge levels, a key concern for urban EV users.

The chassis uses a lightweight frame with the aluminium battery case integrated into the structure, aimed at improving rigidity and stability. It gets a belt final drive, which Suzuki says is maintenance-free and rated for up to 70,000 km or seven years.

With India Yamaha Motor having launched its EC-06 in early February 2026 and Honda present with its Activa-e and QC1 since February 2025, all three Japanese 2W majors now have a presence in the Indian e-2W market.

Like Suzuki’s e-Access, the Yamaha EC-06 has taken a premium positioning. Let’s see if the premium-product-pricing strategy works in a market which is seeing growing demand for affordable e-2Ws. Watch this space for regular updates on zero-emission vehicle sales… on two and more wheels.

ALSO READ: Record 1.28 million e-2Ws sold in CY2025: TVS, Bajaj, Ather and Hero clock best-ever retails

South India Is No. 1 Buyer of Electric 2-Wheelers in CY2025 With 34% Share

TVS iQube and Bajaj Chetak sales cross 1.45 million units six years after launch

RELATED ARTICLES

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

TVS And Bajaj Auto Spar for E-2W Leadership, Ampere Outsells Ola

Powered by demand from the new and aggressively pricedChetak 2501 which takes on the popular TVS iQube2.2 kWh variant, B...

16 Feb 2026

16 Feb 2026

1 Views

1 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi