TVS iQube and Bajaj Chetak Sales Cross 1.45 Million Units Six Years After Launch

India’s best-selling electric scooters, which were launched in January 2020, have been the key drivers of the growth in the Indian electric two-wheeler industry. Surging demand for the TVS iQube and Bajaj Chetak will see both these EVs register record wholesales in FY2026.

Today is January 26, 2026, India’s 77th Republic Day. Six years and one day ago, on January 25, 2020, the TVS iQube was launched and a few days before that, the Bajaj Chetak. Combined domestic market sales of these two zero-emission scooters have surpassed 14.58 lakh or 1.45 million units.

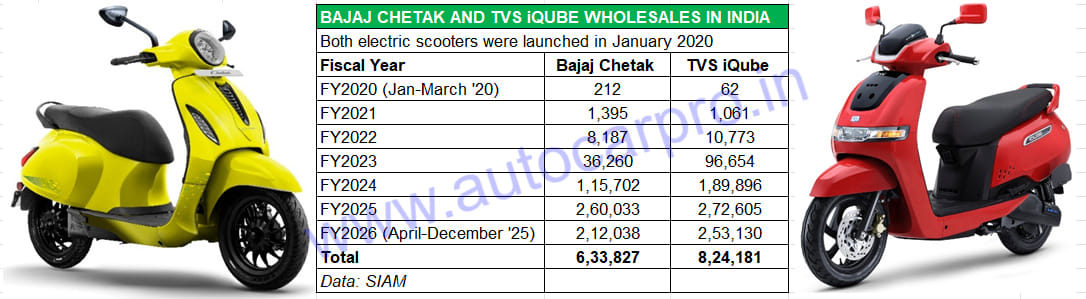

As per apex industry body SIAM’s wholesales data, the TVS iQube and Bajaj Chetak have together sold 14,58,008 units from January 2020 till end-December 2025 are. This is 41,992 units away from the 1.5 million milestone which will be surpassed in January 2026, given the rapid pace of sales for both these two-wheeled EVs.

These two zero-emission vehicles have been among the key drivers of the strong growth in the Indian electric two-wheeler industry and account for an estimated 34% of the 4.19 million (41,94,236) e-two-wheelers retailed between CY2020 and mid-January 2025.

As the six-year fiscal year wholesales data depicts, the TVS iQube has sold 824,181 units, accounting for a 57% share of the combined sales of 1.45 million units till end-December 2025. The Bajaj Chetak, with 633,827 units, has the remaining 43% share. TVS’ sizeable cumulative wholesales lead of 190,354 units is because it had in place a wider sales network for its EV much earlier than Bajaj Auto for its Chetak.

TVS’ lead of 190,354 units over six years is because it had a wider sales network for its EV much earlier than Bajaj Auto. However, the sales gap has narrowed considerably in the past two fiscals.

However, the sales difference between the two legacy OEMs’ EVs has substantially narrowed, particularly in the past two fiscal years. In FY2024, TVS sold 189,896 iQubes (up 96% YoY) to Bajaj’s 115,702 Chetaks – a difference of 74,194 units. FY2025 was a stellar year for both companies as they each clocked their best-ever fiscal year sales and rode past the 200,000 milestone for the first time.

In FY2025, TVS sold a record 272,605 units, up 44% (FY2024: 189,896 units) and Bajaj Auto dispatched 260,033 units, up 125% YoY (FY2024: 115,702 units), with the sales gap reducing to 12,572 units.

FY2026 is set to be a benchmark fiscal year for the TVS iQube and Bajaj Chetak. While the iQube should cross 300,000 units, the Chetak is expected to clock record wholesales of 285,000 units.

BOTH ELECTRIC SCOOTERS TO ACHIEVE RECORD SALES IN FY2026

FY2026 will be the fiscal year when the TVS iQube and Bajaj Chetak will hit new sales highs. In the first nine months of the current fiscal, the TVS Motor factory has dispatched 253,130 iQubes, up 28% YoY (April-December 2024: 197,534 units) to showrooms across India. This total is already 93% of its FY2025 sales and 19,475 units short of its FY2025 total (272,605 units). This difference will have already been bridged and surpassed in the first three weeks of January 2026.

What has given iQube sales a boost is TVS Motor Co slashing prices by up to Rs 26,000 to take on GST 2.0-fuelled ICE competition and also increasing the battery capacity of some iQube variants. Due to surging demand for the flagship EV, the iQube has seen a strong rise in factory dispatches which has crossed 30,000 units for the past four months (see April-December 2025 wholesales data above). In fact, they hit a new monthly high in November (38,191 units), with Q3 FY2026 (October-December 2025) witnessing average monthly wholesales of 35,119 units.

The fourth quarter of the current fiscal is still to be counted and given a similar sales momentum, it can be surmised that the iQube will achieve the 300,000-unit wholesales milestone for the first time in FY2026. This would also translate into India’s best-selling e-scooter, which is retailed from over 900 TVS dealers across 500 cities, crossing the 900,000 cumulative sales mark.

The Bajaj Chetak, in the same April-December 2025 period, has clocked wholesales of 212,038 units, up 12% YoY (April-December 2024: 188,765 units). This translates into a sizeable wholesales difference of 41,092 units with the TVS iQube. This is mainly because Bajaj Auto’s Chetak manufacturing operations in July and August 2025 were adversely impacted by inadequate supplies of critical heavy rare earth (HRE) magnets. As a result, July (11,584 units, down 42% YoY) and August (14,014 units, down 36% YoY). The Chetak to iQube wholesales difference which was just 6,870 units in Q1 FY2026, rose to 22,127 units in Q2 but has reduced to 12,095 units in Q3 (October-December 2025).

Cognisant of the need to ensure no future production disruption due to inadequate HRE magnet supplies, Bajaj Auto shifted to more secure LRE-based components as well as alternate geographic sources, restoring supplies by end-September and fully in October when it topped retail sales after a gap of six months. As a result, production was ramped up and Chetak wholesales soon went on to scale a new monthly high of 38,022 units (up 47%) in November 2025.

With the launch of the new and more affordable Chetak C2501 priced at Rs 91,399 (ex-showroom Bengaluru) on January 14, Bajaj Auto will be looking to up the ante in the e-scooter segment and also close the sales gap with the iQube. Powered by a 2.5kWh battery, the Chetak C2501 has a claimed IDC range of 113km on a full charge and goes head- to-head against the TVS iQube 2.2kWh and the Hero Vida VX2 Go.

Bajaj Auto and the Chetak are well set to register best-ever fiscal sales. The 212,038 units, up 12%, in the first nine months of FY2026 are 81% of FY2024’s 260,033 units. With the new Chetak C2501 along with other siblings in the market, expect Bajaj Auto to pump up the volumes in Q4 FY2026 and end the fiscal with estimated record wholesales of 285,000 units. The company’s Chetak network currently stands at around 400 exclusive stores and 4,000 points of sale in 800 cities.

In FY2025, the sales difference between the TVS iQube and the Bajaj Chetak was 12,572 units, the closest since launch. Will this narrow down further in FY2026 or will Bajaj spring a surprise over its arch EV rival? Keeping watching this space for in-depth number-crunching analysis.

ALSO READ: TVS iQube rides past 800,000 sales, last 100,000 units sold in 3 months

RELATED ARTICLES

Hyundai Alcazar Crosses 100,000 Units 55 Months After Launch, Sees Lowest Sales in December

Launched in June 18, 2021, the Creta-based Alcazar has taken four-and-a-half years to achieve the 100,000 sales mileston...

Royal Enfield Sells Record Million-Plus Motorcycles in CY2025

Midsize motorcycle market leader sells 10,71,809 units in the domestic market in CY2025 to achieve the million milestone...

Skoda Sells a Million Vehicles Globally in CY2025, Kylaq Success Makes India a Key Growth Market

Germany remains Skoda’s largest market, with 211,100 vehicle deliveries, followed by the Czech Republic, the United King...

By Ajit Dalvi

By Ajit Dalvi

26 Jan 2026

26 Jan 2026

273 Views

273 Views