Strong Q2 sales help Bajaj Auto buffer two-wheeler export decline in H1 FY2023

Sustained demand for Pulsar series along with new N160 sees Q2 volumes being nearly twice of Q1; macro-economic challenges in select overseas markets impact exports.

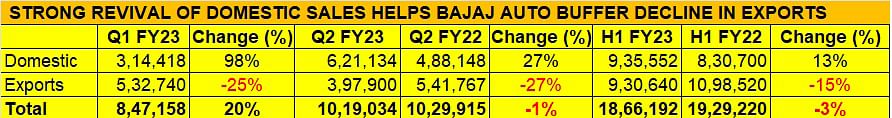

Bajaj Auto’s two-wheeler sales have registered a strong domestic market performance in the second quarter of FY2023. Q2 numbers at 621,134 units were nearly double (97%) that of Q1 FY2023: 314,428 units. Cumulative sales for the first-half of FY2023 (April-September 2022) are 935,552 units, up 13% year on year.

With sustained demand for the popular Pulsar series of motorcycles as well as customer interest picking up for the recently launched N160 and its sportsbike portfolio, overall motorcycle sales were 919,494 units, up 11% YoY (H1 FY2022: 827,971), giving the company a motorcycle market share of 17% of total industry sales of 5,406,717 units. This, however, is a 2% decline over the 19% market share it had in H1 FY2022: 827,971 units out of industry’s 4,351,484 motorcycle sales.

According to the company, “Continued improvement in semiconductor supplies enabled a healthy build-back of channel inventory, ahead of the festive season.”

The revival in domestic market sales have helped buffer the double-digit (15%) decline in two-wheeler exports for Bajaj Auto. Quarter on quarter, overseas sales are down, with means that H1 FY2023 exports despite being over a million units (10,98,520 units) are still under pressure. The company which cited “macro-economic challenges in select overseas markets” as the reason for the subdued exports billing volume, has reported a strong performance in ASEAN markets, particularly the Philippines where it registered its highest sales.

Motorcycle sales could have been higher but demand is yet to return in a stronger manner from key rural India markets, which account for a substantial share of entry-level, fuel-efficient commuter sales. Last month, FADA president Manish Raj Singhania, said the two-wheeler industry is bearing the brunt of increased prices and expensive loans. “Due to increased input costs, two-wheeler OEMs raised prices by five times in the past year. Apart from this, RBI’s fight with inflation saw rate hikes, which continued to make vehicle loans expensive. While India is showing revival signs, Bharat is yet to perform. Two-wheelers, especially entry level vehicles, are finding extremely few buyers.”

Demand for Chetak e-scooter on the rise

On the electric vehicle front, and Bajaj Auto’s sole presence in the scooter market with its Chetak, the company despatched a total of 16,058 units, up 488% albeit on low year-ago (H1 FY2022: 2,729) sales.

As per FADA retail sales numbers for H1 FY2022, Bajaj Auto retailed 12,263 Chetaks with the company recording month-on-month growth right from April through to September 2022. The company says the electric scooter, which is currently sold through a dealer network spanning 39 cities, has a robust order book.

ALSO READ:

Indian automakers sell nearly 11 million vehicles in first-half FY2022

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

15 Oct 2022

15 Oct 2022

5737 Views

5737 Views

Ajit Dalvi

Ajit Dalvi