September PV, CV & 2W sales better than August: are the green shoots of recovery here?

From the initial sales numbers released by OEMs for last month, September looks to be better than the not-so-august August, and October bids fair to be better than both, what with Navrati, Dassera and Diwali packed into the same month.

The beleaguered India Auto Inc, which has seen over a year of tepid and declining sales, finally may be seeing some sort of a recovery, driven by marginally improved consumer sentiment, heavy discounting on vehicles by OEMs, ushering in of the festive season and a feel-good corporate tax cut by the finance minister.

Nonetheless, it's early days yet and it will take some time for the industry to be out of the woods. From the initial sales numbers released by OEMs for last month, September looks to be better than the not-so-august August, and October bids fair to be better than both, what with Navrati, Dassera and Diwali packed into the same month.

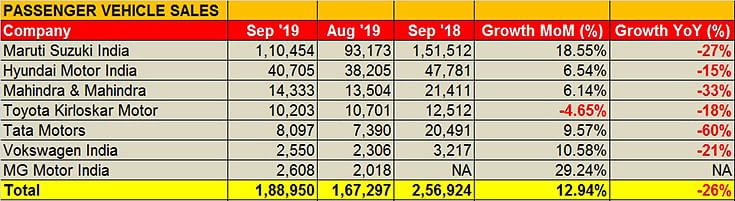

PV SALES STILL DOWN BUT ARE UP, MONTH ON MONTH

A quick analysis of seven PV OEMs reveals that their cumulative sales for September are nearly 13 percent better than the numbers in August 2019 albeit 26 percent down on year-ago sales.

Maruti Suzuki India, the bellwether of the passenger vehicle industry, reported total domestic PV sales of 110,454 units, down 27.1 percent on year-ago sales (September 2018: 151,512). However, this is better than the July (98,274) and August (93,173) numbers when sales had fallen below the 100,000-unit mark. The company will be looking to the just-launched S-Presso to add some fizz to its entry level car sales, given that its overall passenger car numbers are down 31.5 percent on year-ago sales. UV sales were better in September (21,526) over August (18,522) although YoY they point to a 0.5 percent decline.

Hyundai Motor India announced sale of 40,705 PVs in September, down 14.8 percent (September 2018: 47,781) but better than August's 38,205 units. The Chennai-based Korean OEM is currently riding high on pent-up demand for its Venue compact SUV.

Mahindra & Mahindra, which announced a joint venture with Ford Motor Co, reported total PV sales of 14,333 units, down 33 percent (September 2018: 21,411), but better than August's 13,504 units. Commenting on the numbers, Veejay Ram Nakra, Chief of Sales and Marketing, Automotive Division, M&M said, “We are positive that this festive season, with the onset of Navratra, will augur well for us and the automotive industry. This, in addition to factors such as the good monsoon and recently announced positive government initiatives should help revive the industry in the short term.”

Meanwhile, Toyota Kirloskar Motor has reported sales of a total of 10,203 units in the domestic market in September 2019, down 18.45 percent year on year (September 2018: 12,512 units) and slightly down on August's 10,701 units.

Commenting on the sales performance, N Raja, deputy MD, Toyota Kirloskar Motor said, “The consumer sentiment continued to be subdued in September which has reflected in the sales slowdown in the industry. Thanks to the Navratri and Diwali festive sparkle around, we expect the consumer demand will see the much-needed revival resulting in better retails. To further add to the festive fervour, we have launched the enhanced version of the Yaris and the Celebratory Edition of Fortuner TRD. Customers are appreciating the new products with more style and distinctive looks. With the Navratra beginning, customer orders have been slightly encouraging. We hope the pace continues and the sluggishness in sales withers away in the festive season. The industry expects improvement in customer demand in the month of October.”

Tata Motors, in comparison to other OEMs, saw a larger YoY drop in September with sales of 8,097 units, down 56 percent YoY. But like the other automakers, the September numbers are an improvement over August 7,390 units. According to Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, “Towards the end of the month, there was an encouraging response in terms of customer footfalls. The customers have responded well to our festive offers as reflected in 11 percent more retail in September 2019 compared with August. However, the industry continued to decline in September.

"Our focus continued to be on retail in line with our strategy of 'New Paradigm'. In September 2019, our retail was 31% more than off-take as a result dealer stock came down by around 10 percent. During H1 of FY2019, network stock has been reduced by 21%, the lowest in the last 10 quarters. This helped in rotation of dealer working capital and preparing the network for the upcoming festival season.

With continued focus on the retail capability enhancement, we have added 82 sales outlet and 3000+ sales executives in the system in this fiscal. Our new launches, Harrier Dark Edition and Nexon Kraz+ received encouraging response. We are hopeful that the upcoming festival season will bring positive momentum in the market and we are prepared to embrace it,” said Pareek.

Meanwhile, MG Motor India said it retailed 2,608 units of the Hector SUV in September 2019. The company had sold 2,018 units in August. The company has re-opened its bookings on September 29, backed by its plans to ramp up production. With increased supplies from its global and local component suppliers, the company is starting second-shift operations from November.

For Volkswagen India, the new Polo and Vento launches have helped provide an uptick to sales. At 2,550 cars sold in September 2019, the carmaker has reported a month-on-month growth of 4 percent (August 2019: 2,306). In line with the Volkswagen Group’s India 2.0 project, Volkswagen plans to increase its current 132 sales touch-points to 150 by end-2019 and is undergoing a mega training and development program for sales and aftersales teams across the network in India.

While another 9-odd OEMs have still to reveal their numbers for September, what's amply clear is that there is a slight uptick in demand, albeit not as brisk as OEMs and their dealers would like it to be. October has begun, bringing with it hope of higher footfalls in automobile showrooms.

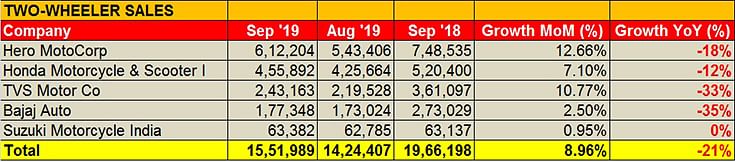

TWO-WHEELER OEMS MAKE DECENT GAINS

Taking the domestic sales statistics of five leading motorcycle and scooter manufacturers for September 2019 and comparing them with their August 2019 performance indicates a 9 percent month-on-month growth. The year-ago comparison points to a 21 percent decline but that story is the same for nearly all vehicle segments.

Like PV market leader Maruti Suzuki, Hero MotoCorp is the bellwether of the two-wheeler industry. The world’s largest two-wheeler manufacturer has reported sales of 612,204 units of motorcycles and scooters in 2019, down 18.21 percent on year-ago sales (September 2018: 748,535). However, September 2019 sales are a 12.66 percent growth over August 2019 sales of 545,406 units.

Sanjay Bhan, Head of Sales, Aftersales & Parts, Hero MotoCorp, said “Growth in the market is driven by first-time buyers, and to attract this segment we have introduced a host of special schemes including low down-payment, aggressive interest rates and easy EMIs. There is also a big segment of customers who are looking to replace their existing two-wheelers, so we have introduced a festive exchange bonus of Rs 3,000 on our scooter range. Also, customers looking to upgrade to the Xtreme range in the premium motorcycle category can avail of a special exchange bonus of Rs 5,000. Customers can also get attractive financial benefits by making the purchase through specific apps."

Honda Motorcycle & Scooter India, which has recently launched its Honda Activa in BS VI guise, clocked total sales of 455,892 units, which marks a 12.39 YoY sales decline (September 2018: 520,400). However, with August 2019 numbers at 425,664, September 2019 sales constitute a 7.10 month-on-month increase, indicating that demand is gradually inching up for the company's scooters and motorcycles. In a bid to accelerate sales in the festive season, Honda buyers can get benefits up to Rs 11,000 on any two-wheeler model. An additional Rs 7,000 can also be had with online payment through Honda's collaboration with payment gateway Paytm.

TVS Motor Co says it has registered sales of 243,163 two-wheelers in September 2019, down 32.65 percent YoY (September 2018: 361,097). The company says, "Planned rationalisation of BS IV stocks is reflecting in the sales growth difference between September 2018 and September 2019." However, last month's domestic market performance is 10.76 percent better than August 2019's 219,528 units.

Pune-based motorcycle major Bajaj Auto, which is gunning for a 25 percent share of the Indian motorcycle market in FY2020, has reported a 20 percent drop in its total sales for the month of September 2019. Total motorcycle at 177,348 sales were a YoY drop of 35 percent (September 2018: 273,029 units). However, this number is 4,324 units more than what it sold in the previous month (August 2019: 173,024) and marks 2.49 percent MoM growth.

As regards the first half of FY2020 fiscal year (April-September 2019), Bajaj Auto saw a YoY drop of 12 percent (1,132,286 units as against 1,287,133 units in 2018) in its domestic market for motorcycles whereas it reported a growth of 8 percent (934,581 units) in its exports as compared to the same period in 2018 (869,373 units).

Suzuki Motorcycle India claims to have clocked its highest-ever monthly domestic sale of 63,382 units during September 2019, which is 0.38 percent flat growth (September 2018: 63,137) but importantly not a decline as most other OEMs. In August 2019, the company sold 62,785 units, which means September numbers are about 1 percent month-on-month growth.

CV SALES FEEL THE STING OF SLOW GROWTH BUT SEE MARGINAL UPTICK

Akin to the overall tepid sentiment in the economy and the automobile sector, commercial vehicle sales stayed weak in September. However, the month-on-month number indicates a ray of hope for the battered CV segment. Total sales of 57,942 units in September, reported by four leading OEMs, are down by 41 percent YoY (September 2018: 98,099). But take a close look at the month-on-month growth for the past two months and the 21 percent looks heartening. This should certainly give solace to CV OEMs, who are also battling with higher levels of inventory.

With pre-buying of BS IV trucks and buses, ahead of the BS VI deadline of April 2020, slated to begin later this year and no sign yet of the scrappage policy, CV OEMs are adopting a wait-and-watch strategy.

According to Girish Wagh, president, Commercial Vehicles Business Unit, Tata Motors, “With the ongoing subdued demand, we continued our focus on system stock correction by driving retail and aligning production. Retail sales are estimated to be ahead of wholesale by over 16% in September and over 27% in Q2, reducing the overall stock level to the lowest for the last 6 quarters. We are monitoring the impact of the relief package announced by the Government, and look forward to improved demand from a revival in consumption and spend in infrastructure projects.”

The Indian Foundation of Transport Research and Training (IFTRT) reported a 3-4 percent increase in freight rates in September. “As against August 2019, when diesel price drop by around Rs 2/litre, September 2019 witnessed a quantum hike of $6-$8/bbl during the last fortnight. As a consequence, after bottoming out of truck rentals in teh last 10 months, the freight rates for full truckload had gone up by 3-4 percent, coupled with a positive undercurrent of improved consumer spending on an account of ensuing peak festival season and improved cargo offering due to buoyant arrival of apples in the APMCs,” said IFTRT.

CV market leader Tata Motors recorded a drop of 45 percent in September with total domestic sales of 28,079 units. Its M&HCV truck sales saw a massive drop of 69 percent to 5,082 units (September 2018: 16,239). The ILCVs were down by 35 percent at 3,528 units, while cargo SCVs and pickups registered a fall of 32 percent to 13,510 units. Tata's commercial passenger carrier (bus) segment sales too dropped 53 percent to 2,159 units.

Ashok Leyland’s domestic sales too fell sharply, dropping 57 percent to 7,851 units. (September 2018: 18,078). Its M&HCV sales slid a massive 69 percent to 4,035 units; the trucks were down 74 percent while the buses declined by 26 percent. The LCVs were down by 24 percent to 3816 (September 2018: 5,022).

Mahindra & Mahindra’s overall CV sales were down by 18 percent to 18,872 units (September 2018: 19,885). The M&HCVs tanked 62 percent to 408 units. The below-3.5T GVW segment sold 17,998 units down 15 percent. (September 2018:21,223), and those in the above-3.5T GVW segment were declined by 26 percent with a sale of 466 units.

VE Commercial Vehicles sales declined by 44.8 percent in the month; the company sold 3,140 units in the domestic market. (September 2018: 5,685 units).

2W & CV INVENTORY STILL HIGH, FADA BATS FOR a SCRAPPAGE POLICY

At halfway stage in FY2020, India Auto Inc still faces a challenging year, what with BS VI emission norms six months away, a fair number of OEMs and dealerships having to contend with high inventory levels, which also leads to discounting.

In a recent interview with Autocar Professional, Ashish H Kale, president of the Federation of Automobile Dealers Associations (FADA), said: "While PV inventory levels have reduced quite significantly and is close to our suggested 21 days' range, two-wheeler and CV inventory is yet at alarming levels."

Both two-wheeler and CV OEMs probably need to continue regulating their production even when festive demand kicks in to ensure reduction of the high level of inventory by reducing wholesale billing to dealers, like PV OEMs did. We are advising our members to ensure that, by end-October, the inventory for two-wheelers and CVs and CV is down to 40 days and reducing further to the FADA-advocated 21 days by end-November, which will ensure a smooth transition for dealers into BS VI."

Commenting on his growth outlook for FY2020, Kale said: "FY2020 will be a mixed bag, what with so many disruptions and policy changes coming into play. With BS VI implementation not too far away, the Indian auto market will be challenged to show substantial growth in sales for the year. More clarity will emerge after the festive season, which is quite crucial and will show us how H2 will progress. Our immediate focus is also to minimise high inventory as we approach the April 2020 BS VI deadline.:

"A good scrappage policy, if introduced soon, will definitely uplift the mood for CV fleet buyers as it will incentivise their purchases. But overall, this fiscal year is going to be challenging. One positive for the second half of the year is that last year it was quite low; so if the festive demand is good and we see a revival in overall demand, we can be hopeful of clocking positive growth over FY2019 but in low single digits."

Autocar Professional has learnt that the vehicle scrappage policy, which is being worked upon, will apply the polluter-pays principle, and impose a 1900% hike in fee for re-registered vehicles to deter owners from using them and driving them towards purchase of new and greener vehicles,

Full interview with FADA president Ashish Kale in Autocar Professional's October 1 print edition

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

02 Oct 2019

02 Oct 2019

21605 Views

21605 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal