Scooters power two-wheeler industry’s best-ever October dispatches of 2.16 million units

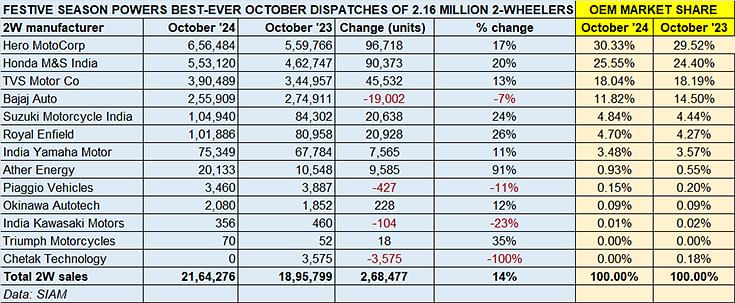

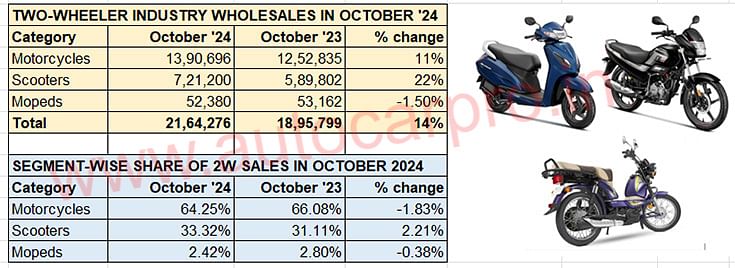

Two-wheeler dispatches in October 2024, which celebrated Navratri, Dussehra and Diwali, beat previous best of 2.05 million units in October 2018. Of the three sub-segments, scooters are the only one to achieve a YoY increase. Last month saw scooters take a 33.32% share of the two-wheeler market, up from 31.11% in October 2023. In comparison, motorcycle share at 64.25% was down 1.83% YoY while moped wholesales were down marginally.

The festive month of October 2024, which had both Dussehra and Diwali embedded in it, turned out to be the best-ever October volume-wise for the Indian two-wheeler industry. Understandably so, given that the leading vehicle manufacturers would have ensured that their dealers across the country were stocked with the best-selling and popular models, even as they pumped up the excitement with handsome discounts.

The 21,64,276 units dispatched last month were a 14% year-on-year increase (October 2023: 18,95,799 units). October 2024’s 2.16 million wholesales beat the previous best of 20,53,497 two-wheelers in October 2018.

October 2024’s 2.16 million wholesales, which are a 14% YoY increase, beat the 2W industry's previous best of 20,53,497 two-wheelers in October 2018.

October 2024’s 2.16 million wholesales, which are a 14% YoY increase, beat the 2W industry's previous best of 20,53,497 two-wheelers in October 2018.

While motorcycles remain the largest sub-segment in terms of volume – 1.39 million units, up 11% YoY and an additional 137,861 units – what stands out is the growing contribution of scooters to the overall two-wheeler pie. At 721,200 units dispatched in October 2024 – an additional 131,398 scooters YoY (October 2023: 589,802 units), the scooter industry clocked YoY growth of 22%, double that of motorcycles. What’s more, despite its volumes being nearly half that of motorcycles, the additional scooters dispatched last month were just 6,463 units less than the additional 137,861 motorcycles sent to dealers across India. Clearly, this acceleration in OEM scooter dispatches has helped power the Indian two-wheeler industry’s record October month wholesales of 21,64,276 units, up 14% YoY.

In October 2024, the scooter category was the only one to record YoY growth in dispatches. Scooters clocked 22% growth (twice that of bikes), and the additional 131,398 scooters dispatched were just 6,463 units less than the additional 137,861 motorcycles shipped to dealers.

In October 2024, the scooter category was the only one to record YoY growth in dispatches. Scooters clocked 22% growth (twice that of bikes), and the additional 131,398 scooters dispatched were just 6,463 units less than the additional 137,861 motorcycles shipped to dealers.

A quick look at the sub-segment-wise market share split of the motorcycle, scooter and moped wholesales last month reveals that the scooter segment is the sole one to achieve a YoY increase. In October 2024, scooters had a 33.32% share of overall two-wheelers, up 2.21% from the 31.11% in October 2023. In comparison, motorcycle share at 64.25% last month was down 1.83% on October 2023 dispatches. Moped wholesales too were down marginally by 0.38% to 2.42% from 2.80% in October 2023.

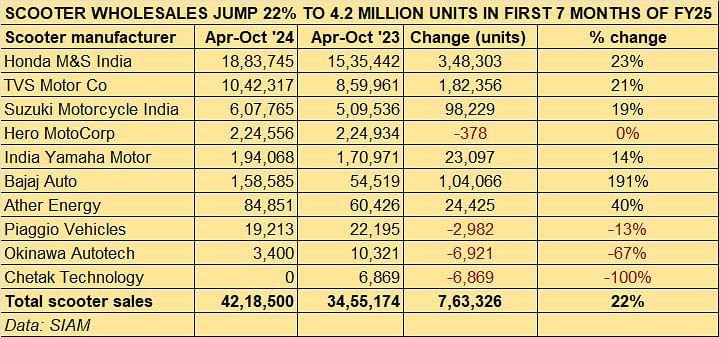

HOW SCOOTER MANUFACTURERS FARED IN OCTOBER 2024, HONDA SHARE AT 44%

Sustained demand for India’s best-selling scooter in its 110 and 125cc avatars meant market leader Honda registered 19% YoY growth in October. HMSI’s market dominance continues unabated. With 1.88 million Activas dispatched to its dealers in the first seven months of FY2025, HMSI has clocked strong 23% YoY growth on a high year-ago base. HMSI’s seven-month scooter market share is at 44.65%, up from 44.43% a year ago. In FY2024, HMSI had sold a total of 25,30,667 Activas – this means its tally in the fiscal to date is already 61% of that total albeit that’s considerably below the 3.15 million Activas sold in FY2018 or 3 million sold in FY2019.

TVS Motor Co, the longstanding No. 2 scooter OEM, dispatched 188,354 units in October 2024, up 22% YoY. The dispatches comprise 1,59,227 units of the flagship Jupiter and NTorq scooters, and 29,127 iQube electric scooters. For the April-October 2024 period, TVS’s scooter shipments are 1.04 million units, up 21% YoY, which gives it a current market share of 24.70 percent.

Suzuki Motorcycle India posted wholesales of 102,484 scooters in October 2024, up 25% YoY. Its cumulative April-October 2024 wholesales at 607,765 units are up 19% and give it a market share of 14.40 percent. The company, which sells the 125cc Access, Avenis and Burgman, would have seen strong demand for the Access 125 which remains a popular buy.

Hero MotoCorp, with 41,801 units, saw demand decline 3% YoY last month while its April-October 2024 tally at 224,556 units translates into flat sales and a resultant decline in scooter market share to 5.32% from 6.51% a year ago.

India Yamaha Motor, which retails three scooters – the 125cc Ray and Fascino, and 155cc Aerox – sold 32,606 units last month, up 16 percent. Its seven-month total at 194,068 units is up 14% and gives the company a market share of 4.60% at present.

Bajaj Auto, which was ranked seventh a year ago, moves up one place to sixth. The company, whose sole scooter is the electric Chetak, had a strong October – the 30,644 units are its highest monthly dispatches yet while the April-October 2024 total at 158,585 units is a massive 191% jump over year-ago dispatches of 104,066 units. This translates into its market share doubling to 3.75% from 1.57% a year ago.

Ather Energy, the other fast-growing all-electric scooter maker, clocked wholesales of 20,133 units, in October, up 91% YoY. The 84,851 units in the first seven months of FY2025 give Ather a market share of 2% compared to 1.74% a year ago.

How will demand shape up for the scooter and the overall two-wheeler industry in the months to come? From the looks of it, there should be good growth to be had what with the revival of demand from rural India, new model availability as well as an uptick in urban consumer buying.

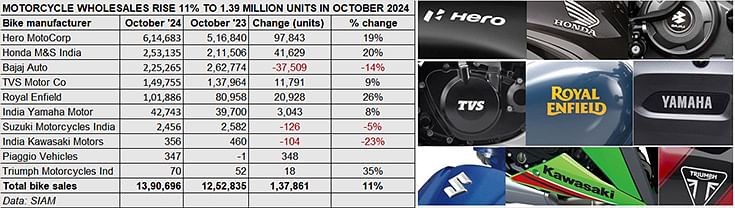

HERO MOTOCORP DISPATCHES 614,683 BIKES FOR A 44% MARKET SHARE

HERO MOTOCORP DISPATCHES 614,683 BIKES FOR A 44% MARKET SHARE

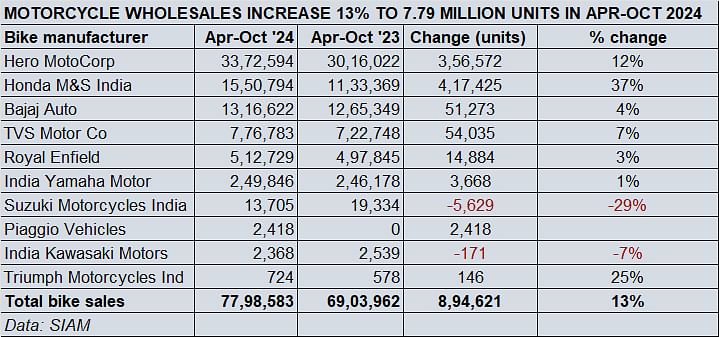

Motorcycle market leader Hero MotoCorp left no doubt as to who is leading the charge in the bike market. With dispatches of 614,683 units, the company registered 19% YoY growth and has a current bike market share of 44 percent. The 97.2cc HF Deluxe, Splendor + and Passion Plus account for the bulk of its sales – 5,12,762 units, up 15% and comprising 83% of the company’s total dispatches in October 2024. In the 110-125cc category, the Passion XTEC, Super Splendor and Glamour together clocked 95,203 units, up 56 percent. In the 125-150cc category, the XPulse and Xtreme sold 4,290 units, down 39 percent YoY. The company’s recent entry into the 350-500cc segment with the Harley-Davidson 440 and Mavrick 440 saw it sell 2,396 units, down 4 percent. Hero’s first seven months sales at 3.37 million units are up 12% YoY.

Honda Motorcycle & Scooter India, with 253,135 units, posted 20% growth. The company’s bike market share in October 2024 is 18%, down from the 26% it had a year ago. The 125cc Shine – the best-selling product in the 125cc executive segment – continues to deliver the highest volumes to HMSI – the 1,58,471 Shines dispatched in October were up 20% YoY and accounted for 62% of HMSI’s bike wholesales. The entry level duo of the Shine 100 and CD110 Dream sold 50,102 units, up 8 percent. While the 149cc Unicorn sold 31,768 units, HMSI saw demand fall 75% in the 150-200cc segment – CB 200X, Hornet 2.0, XBlade – with sales of 7,520 units (October 2023: 29,878 units). HMSI’s April-October 2024 bike sales at 1.55 million units are up 37% (April-October 2023: 1.13 million).

Bajaj Auto is the sole OEM amongst the six-figure sales achievers to register a YoY decline. The 225,265 units of October 2024 are down 14% – dispatch of 37,509 fewer bikes – on October 2023’s 262,774 units. Demand in entry-level 110-110cc segment was down 16% at 70,192 units, while that in the 110-125cc segment was also down by 1.77% to 98,671 units. In the 125-150cc category, sales were down 35% to 21,438 units. It’s a similar scenario in the 150-200cc segment – the 20,287 units are down 31% YoY. And it continues in the segment above – 200-250cc – where the 8,298 units are down 23% YoY. The sole respite is in the 350-500 segment where the 6,379 units dispatched are up 12 percent. Nevertheless, in the cumulative first seven months analysis, Bajaj Auto is in positive territory – 1.31 million units, up 4% on year-ago 1.26 million bikes.

TVS Motor Co dispatched 149,755 motorcycles in October 2024, up 9% YoY. In the entry level segment, the trio of the 100cc Sport and the 110cc Star City Plus and Radeon sold 43,677 units, down 8 percent. The Raider 125, with 51,153 units, clocked 8% growth. The Raider, which was TVS’ best-selling motorcycle in FY2024 with 398,354 units, was beaten by the Apache series of bikes (50,097 units, up strongly by 28%). The Apache series, which spans 160, 165, 180 and 200cc capacity, is witnessing a resurgence of demand. TVS also sold 4,163 Ronins (up 59% YoY) and 665 units of the RR 310, down 36 percent YoY. For the April-October 2024 period, TVS cumulative bike wholesales at 776,783 units are up 7% on year-ago dispatches of 722,748 units.

Midsize motorcycle market leader Royal Enfield dispatched 101,886 bikes last month, up 26% on year-ago dispatches of 80,958 units. The company, which commands a huge leadership in the 250-350cc segment which saw total dispatches of 99,138 units, saw RE’s share at 94% or 93,274 units of its 349cc Bullet and up 26% YoY. The recently launched Guerilla 450, along with the 452cc Himalayan adventure bike, sold 3,783 units, up 28% YoY. The 650cc twins (Continental GT 650 and Interceptor 650) along with the Super Meteor 650 and Shotgun 650, all powered by the same 648cc engine, continue to see strong demand – the 4,829 units dispatched in October are up 22 percent.

TWO-WHEELER INDUSTRY'S GROWTH OUTLOOK

October 2024 was expected to be a good month for wholesales. With the month celebrating Navratri, Dussehra and Diwali, OEMs had ensured that their showrooms across India were well stocked particularly with popular, in-demand models. What added to the festive fervour were the many attractive discounts offered by OEMs as well as a fair number of new model launches. Buoyant market conditions, which have recently received a fillip from the revival of demand in the key rural India market, served as a growth accelerator.

Total two-wheeler wholesales in the first seven months of FY2025 at 1,23,29,256 units (12.32 million) are up 16% YoY. FY2024 had seen total dispatches of 17.97 million units, which means the April-October 2024 total is 69% of last fiscal’s motorcycle, scooter and moped dispatches. With five months left to go in FY2025 and given the current double-digit growth momentum, riding past the FY2024 figure should be a cinch.

ALSO READ:

Electric 2W sales in India hit one million units annually for the first time

Legacy OEMs TVS, Bajaj, Hero outsell Top 10 two-wheeler EV startups in October

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

14 Nov 2024

14 Nov 2024

13434 Views

13434 Views

Shahkar Abidi

Shahkar Abidi