Royal Enfield 650 Twins, Super Meteor and Shotgun capture 96% of 500-800cc market in Q1

The 500-800cc bike category is the only one of three where the midsize motorcycle market leader saw year-on-year growth in April-June 2024, selling 11,943 units out of total segment dispatches of 12,408 units.

Midsize motorcycle market leader Royal Enfield, which has registered total wholesales of 204,686 motorcycles in the first three months of FY2025, down 1% on year-ago dispatches to its showrooms (April-June 2023: 207,171 units), is ruling the roost in the 500-800cc market in India.

The 650cc twins (Continental GT 650 and Interceptor 650) along with the Super Meteor 650 and Shotgun 650, all powered by the same 648cc engine, continue to see strong demand, and helped prevent Royal Enfield from a higher rate of quarterly sales decline in the first quarter of FY2025.

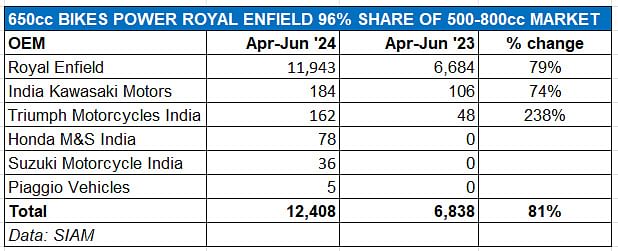

As per the latest SIAM industry wholesales data, between April-June 2024, the Chennai-based bikemaker sold a total of 11,943 units, up 79% YoY (Q1 FY2024: 6,684 units) and commanded 96% of the 500-800cc sub-segment’s total dispatches of 12,408 units.

With dispatches of 11,943 of its 648cc motorcycles in April-June 2024 and strong 79% YoY growth , Royal Enfield commands 96% of this sub-segment.

With dispatches of 11,943 of its 648cc motorcycles in April-June 2024 and strong 79% YoY growth , Royal Enfield commands 96% of this sub-segment.

The 500-800cc sub-segment is the only one where Royal Enfield has seen growth. Despite being the market leader (94% share) in the 250-350cc segment with 183,450 of its 349cc motorcycles, sales in Q1 FY2025 were down YoY by 3% (April-June 2023: 189,647 units). Likewise, in the 350-500cc sub-segment, where it has the Scram 411 and the 452cc Himalayan, RE saw its Q1 FY2025 sales down by 14% to 9,293 units from 10,840 units a year ago.

India Kawasaki Motors, with 184 units and 74% YoY growth (Q1 FY2024: 106 units) is ranked second in this bike category. The company currently retails the Ninja 650, Versys 650, Vulcan S, Z650, Z650RS and the ZX-6R).

Twenty-two units behind Kawasaki is Triumph Motorcycles India, which retails the Trident 660, Tiger Sport 660, with 162 units, up 238% YoY on a low year-ago base of 48 units.

Honda Motorcycle & Scooter India with 78 units of the XL750 is ranked fourth on the ladder-board, followed by Suzuki Motorcycles India with 36 units of the V-Strom DL800DE.

Of the midsize motorcycle sub-segments, the 500-800cc category is the one which has seen the highest YoY growth – 81% compared to 73% in the 350-500cc segment and 250-350cc segment (down 3.50%).

ALSO READ:

Royal Enfield launches Guerrilla 450 at Rs 239,000

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

23 Jul 2024

23 Jul 2024

7475 Views

7475 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau