REVEALED: India’s Top 25 SUVs and MPVs in CY2024

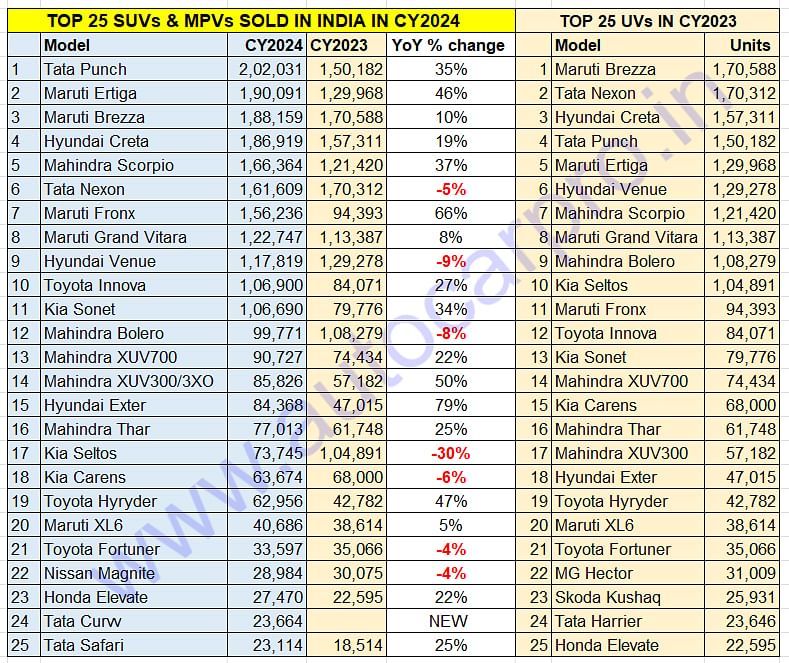

Of the total 2.74 million utility vehicles sold in CY2024, these Top 25 models with cumulative wholesales of 25,21,160 units accounted for an overwhelming 91% share. Compact SUVs continue to win over UV buyers with a 48% share of the best-selling models, followed by midsize SUVs (36%) and MPVs (16%).

If the passenger vehicle industry in India hit its best-ever annual wholesales of 4.27 million units I CY2024, up 4% YoY (CY2023: 4.10 million units), then it is thanks to the unabating demand for utility vehicles, which comprise SUVs and MPVs. The UV sub-segment continues to be the shining star and helped buffer the sizeable 14% decline in sales of hatchbacks and sedans.

With dispatches of 27,49,932 units last year, the UV segment not only achieved handsome 17% YoY growth (CY2023: 23,53,605 units), but also increased its share of overall PV sales to 64% from 57% in CY2023. Of the cars, vans and UV sub-segments in the overall PV segment, UVs is also the most competitive too with every OEM worth its wheel fighting for a share and slice of the action, with the battle for supremacy highest in the compact SUV and midsize SUV categories. These two sub-segments are also where the Top 25 best-selling models reside.

The UV arena is a tough one, what with 32 SUV and MPV manufacturers, 128-odd individual models and over 1,000 variants. Buyers are really spoilt for choice which makes the performance of these best-selling models important in the overall scheme of things. Let’s take a close look at the movers and shakers and their performance (Top 25 UV data table at the end of this analysis).

TATA PUNCH PACKS A PUNCH AND MORE. . . IS BESTSELLING PV AND SUV

The battle to be the UV boss in CY2024 was intense but the Tata Punch, which was No. 4 in CY2023, finally won top honours with a record 202,031 units, up 35% YoY (CY2023: 150,182). Not only did this performance give it the No. 1 UV rank but it was also the best-selling passenger vehicle last year, beating the longstanding leader, the Maruti Wagon R. The Punch, sold in petrol, CNG and electric avatars, will see fresh competition in CY2025, particularly on the electric front.

Surging customer demand for the Maruti Ertiga (ranked fifth in CY2023) saw the popular family MPV sell 190,091 units, up 46% YoY (CY2023: 129,968). It’s been a very strong performance given that the Ertiga sold an additional 60,123 units in CY2024.

The game-changing Maruti Brezza, which kicked off the compact SUV juggernaut all those many years ago, and the No. 1 in CY2023 dropped down two ranks to be No. 3 in CY2024 with 188,159 unit, up 10% YoY (CY2023: 170,588).

The Hyundai Creta, which is India’s best-selling midsize SUV and was the third best-selling UV in CY2023, sold a record 186,919 units in CY2024, up 19% YoY (CY2023: 157,311). Demand for the Creta took off after the launch of the new-gen model in January 2024. What will add tailwinds to the Creta’s sales will be the launch of the Creta EV, which will challenge the Tata Curvv EV and the Mahindra BE 6, in early 2025.

The Mahindra Scorpio has had a stellar year. In CY2024, the best-selling Mahindra model – the Scorpio N and Scorpio Classic – sold a total of 166,364 units, up 37% YoY (CY2023: 121,420), which translates into an additional 44,944 units. This performance sees the Scorpio twins rise two ranks to No. 5 position from No. 7 in CY2023.

The first of the seven UVs in the Top 25 chart to see a YoY sales decline is the Tata Nexon. This compact SUV, which has been India’s best-selling SUV for three straight fiscals – FY2024, FY2023 and FY2022 – has dropped all of four ranks to No. 6. The Nexon clocked estimated wholesales of 161,609 units, down 6% YoY (CY2023: 170,312), having seen demand down by 8,703 units. This in a market hungry for compact SUVs. The launch of the Nexon CNG in September as well as the Nexon ICE model acing the Bharat NCAP crash test with a 5-star rating were expected to help the Nexon recover market momentum but that didn’t happen. Sibling Punch has been outselling the Nexon right since January 2024.

Another strong performer has been the Maruti Fronx compact SUV at No. 7. With 156,236 units and handsome 66% YoY growth (CY2023: 94,393), the Fronx has risen four ranks from CY2023’s No. 11 position. In September 2024, the Fronx became the second Nexa SUV to achieve 200,000 sales, after the Grand Vitara.

In comparison, sales growth for the Maruti Grand Vitara, which has crossed cumulative wholesales of 250,000 units since its launch in September 2022, has been tepid. At 122,747 units sold in CY2024, the YoY increase was 8% (CY2023: 113,387). This sees the midsize SUV retain its No. 8 rank. There’s a three-row Grand Vitara in the pipeline but it won’t be available till end-2025.

CY2024 sales of 117,819 units for the Hyundai Venue, the Korean manufacturer’s first compact SUV, were down 9% YoY (CY2023: 129,278). This sales decline sees a resultant drop in ranking to No. 9 from No. 6 in CY2023. Demand has been flagging for the Venue, particularly since sibling Exter rolled in and with the next-gen Venue, which will up the model’s desirability quotient, slated for launch only by end-2025 or early 2026, sales will most likely continue to be tepid in the next 12-odd months.

Toyota Kirloskar Motor’s best-selling product remains the Innova MPV. Ranked No. 10, the Toyota Innova MPV with its Crysta and Hycross variants – clocked estimated wholesales of 106,900 units, up strongly by 27% YoY (CY2023: 84,071 units). Demand for the Innova Hycross has been particularly strong, which has helped accelerate sales for this popular people transporter and move up two ranks from CY2023.

The Kia Sonet is ranked 11th with 106,690 units, which marks robust growth of 34% YoY (CY2023: 79,776) and a two-rank move up the UV ladder-board. The rollout of a new model has clearly accelerated demand for this compact SUV. The Sonet is now the best-selling Kia model in India, having outsold the longstanding No. 1, the Seltos.

The Mahindra Bolero is the sole SUV from the five Mahindra SUVs in this Top 25 list to see a sales decline. At 99,771 units, demand was down 8% YoY (CY2023: 108,279). This performance sees the Bolero’s ranking drop down to No. 12 from No. 9 in CY2023.

One rank behind the Bolero is the Mahindra XUV700 flagship SUV, which continues to witness strong demand. What helped power best-ever annual sales of 90,727 units, up 22% YoY (CY2023: 74,434), is the attractive festive season deals M&M offered on the popular model. This gives the XUV700 the No. 13 position amongst the Top 25 UVs, up one rank from CY2023.

At No. 14 is yet another M&M SUV. The Mahindra 3XO, the facelifted version of the XUV300, has been one of the best performers in CY2024. With sales of 85,826 units and handsome 50% YoY growth (CY2023: 57,182), the Mahindra 3XO has jumped into 14th position from No. 17 in CY2023.

The Hyundai Exter compact SUV maintains the 15th position it had in FY2024 in April-November 2024 with 54,812 units, up 39% YoY.

The Mahindra Thar retains its No. 16 ranking with a strong showing of 51,434 units, up 24%. The recent launch of the five-door Thar Roxx, which won Autocar India’s Car of the Year 2025 award, has given a fresh charge to sales.

The Kia Seltos midsize SUV, is ranked 17th as a result of having dropped seven ranks from its 10th position in CY2023. At 73,745 units, the Seltos’ wholesales are down by a sizeable 30% YoY (CY2023: 104,891) and this model has lost its longstanding position as the company’s best-seller to its sibling Sonet, which has outsold it every month since January 2024.

The Kia Carens, the third Kia UV in this list, is at 18th position. Demand seems to have slowed down for this MPV and the 63,674 units old in CY2024 are down 6% YoY (CY2023: 68,000). The Carens was ranked 15th in CY2023, which means it is down three ranks last year. Nevertheless, with the facelifted Carens, which has been snapped testing and sporting significant design changes, slated for mid-2025 launch, demand for this Kia MPV should once again take the fast road.

The sporty looking Toyota Urban Cruiser Hyryder midsize SUV, which scores high on fuel efficiency with its strong-hybrid petrol engine, is at No. 19 with a stellar performance – 62,956 units, up 47% YoY (CY2023: 42,782). In October, the Hyryder became the second Maruti-rebadged model to surpass the 100,000 sales milestone.

The Maruti XL6 MPV is the fifth model from the passenger vehicle and SUV market leader in this Top 20 UV list. The XL6 sold 40,686 units in CY2024, up 5% YoY (CY2023: 38,614).

COMPACT SUVs CONTINUE TO RULE THE UTILITY VEHICLE MARKET

Of the total 27,49,932 utility vehicles sold in CY2024, these Top 25 models with cumulative wholesales of 25,21,160 units accounted for an overwhelming 91 percent, which clearly depicts their strength in a competitive marketplace teeming with 32 OEMs, 128 models and over 1,000 variants!

Of the total 2.52 million units that these Top 25 UVs comprise, the compact SUV segment accounted for an estimated 12,08,735 units or 48 percent share. The top six best-selling compact SUVs – Tata Punch, Maruti Brezza, Tata Nexon, Maruti Fronx, Hyundai Venue and Kia Sonet – have each sold in six-figure numbers and their cumulative sales add up to 932,544 units. The Tata Nexon (down 5% YoY) and the Hyundai Venue (down 9% YoY) were the two compact SUVs to register a YoY sales decline.

The midsize SUV segment, starting with the Hyundai Creta, contributed 911,074 units to the Top 25 cumulative total for a 36% share. The Creta (186,919 units), Mahindra Scorpio (166,364 units) and Maruti Grand Vitara (122,747 units) were the one which crossed the 100,000 sales mark for the year. The standout midsize SUVs, performance-wise, were the Creta (up 19%), Mahindra Scorpio (up 37%), Mahindra XUV700 (up 22%) and the Toyota Hyryder (up 47%). Meanwhile, the recently launched Tata Currv coupe-SUV has entered the best-sellers list with 23,664 units, ranked 24th.

The MPV segment also benefited from the unabating demand for UVs in CY2024. The Top 25 models include four MPVs – Maruti Ertiga, Toyota Innova Crysta / Hycross, Kia Carens and Maruti XL6 – whose combined sales of 401,351 units give them a 16% share of the Top 25 UVs in CY2024.

In terms of OEM model-wise share, Maruti Suzuki and Mahindra & Mahindra have five models each, and Tata Motors four. While Korean automakers Hyundai and Kia have three each. Toyota Kirloskar Motor has three models, and Honda and Nissan one each.

With the passenger vehicle market so heavily tilted towards SUVs and UVs, it was imperative that the companies with strong UV portfolios would do well in CY2024. Sustained demand for its SUVs and MPVs saw Maruti Suzuki dispatch over 700,000 utility vehicles in a calendar year for the first time. The 25% YoY growth in UV sales, which comprised 40% of the company’s total wholesales in CY2024, helped buffer the 10% fall in sales of its passenger cars and sedans.

Mahindra & Mahindra crossed the 500,000 sales milestone for the first time in a calendar year, Hyundai Motor India sold a best-ever 605,209 PVs, Tata Motors with 562,468 PVs, surpassed the half-a-million-units milestone for the third year in a row, and Toyota Kirloskar Motor also set a new record for annual sales, surpassing the 300,000 mark.

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

16 Jan 2025

16 Jan 2025

11379 Views

11379 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi