Maruti Suzuki CY2024 sales up 3% at 1.75 million, 710,651 UVs buffer 10% decline in cars

Sustained demand for its SUVs and MPVs sees Maruti Suzuki dispatch over 700,000 utility vehicles in a calendar year for the first time. The 25% YoY growth in UV sales, which comprised 40% of the company’s total wholesales in CY2024, has helped buffer the 10% fall in sales of its passenger cars and sedans.

Maruti Suzuki India, the bellwether of the Indian passenger vehicle industry, has had a somewhat tepid calendar year 2024. At 1.75 million units (17,55,425), year-on-year growth is 3% (CY2023: 17,07,668 units). In comparison, CY2023’s 1.70 million units were a much higher 8.35% YoY increase.

As the detailed 12-month wholesales table (below) reveals, Maruti Suzuki witnessed zero growth or flat sales for two months (April and May) and a sales decline for four months in a row (July through to October). The passenger vehicle and utility vehicle market leader’s best month was January 2024 which it dispatched 166,802 units, up 13% YoY.

Maruti Suzuki witnessed zero growth or flat sales for two months (April and May) and a sales decline for four months in a row (July through to October)

Maruti Suzuki witnessed zero growth or flat sales for two months (April and May) and a sales decline for four months in a row (July through to October)

Providing the sales charge for the company in CY2024, as in CY2023, has been the company’s SUV and MPV range. The seven-model utility vehicle (UV) portfolio, comprising the Brezza, Grand Vitara, Fronx, Jimny, XL6, Ertiga and the new Invicto, together sold 710,671 units, which is a handsome 25% YoY increase (CY2023: 566,545 units).

This is the first time that Maruti Suzuki has clocked 700,000 UV wholesales in a calendar year. This vehicle category contributed to 40% of Maruti Suzuki’s sales in CY2024, compared to 33% in CY2023 and 21% in CY2022, clearly depicting just how strong customer demand has been for the company’s UVs and premium Nexa SUVs/MPV.

The sustained demand for all these utility vehicles has not only helped the company top the SUV charts and market share but notably helped buffer the decline in sales of its two hatchbacks, seven compact cars and the sole premium sedan.

While combined sales of passenger cars and sedans at 906,049 units were down 10% YoY (CY2023: 10,05,113 units), UVs sales rose 25% to 710,671 units in CY2024.

While combined sales of passenger cars and sedans at 906,049 units were down 10% YoY (CY2023: 10,05,113 units), UVs sales rose 25% to 710,671 units in CY2024.

A close look at the company’s segment-wise split (shown above) reveals that total dispatches of its hatchbacks (Alto, S-Presso, Baleno, Swift, Wagon R, Celerio, Ignis) and sedans (Dzire and Ciaz) at 843,261 units are down 12% YoY at 906,049 units are down 10% YoY (CY2023: 10,05,113 units). This translates into 99,064 fewer passenger vehicles being sold in CY2024. The share of passenger cars and sedans in CY2024 was 52% compared to 59% in CY2023.

In comparison, the sustained demand for Maruti Suzuki’s nine-model portfolio of SUVs and MPVs has seen the company dispatch an additional 144,126 units in CY2024. Had it not been for this stellar performance, overall sales would have slipped into the red.

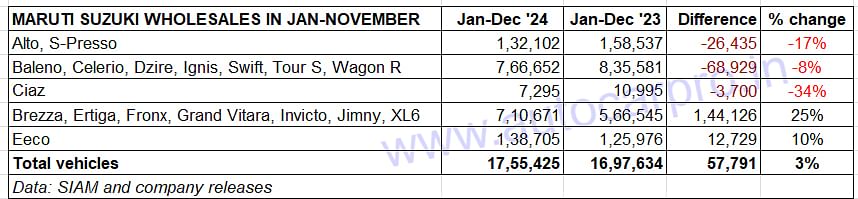

Since the model-wise sales statistics for December 2024 will only be released in mid-January 2025, a quick look at the January-November 2024 numbers reveals that Maruti Suzuki’s UV sales have grown from strength to strength just as demand for its passenger cars and sedans has fallen.

HOW MARUTI SUZUKI’S 17 MODELS STACK UP IN JANUARY-NOVEMBER 2024

Of the 655,020 UVs sold in the January-November 2024 period, four models with six-figure sales stand out. The Ertiga leads with 174,035 units, just 3,212 units ahead of the Brezza (170,823 units), and Fronx (145,484 units) compact SUVs, and the Grand Vitara (115,564 units). The fifth model in Maruti Suzuki’s UV pecking order is the XL6 MPV (38,199 units), followed by the Jimny (7,634 units) and the premium Invicto MPV (3,191 units).

Meanwhile, the Wagon R (173,552 units) leads the rest of the 10-model Maruti Suzuki portfolio. At No. 2 is the premium Baleno (162,982 units) just 595 units ahead of sibling Swift. The Dzire sedan (151,415 units) is the No. 4 passenger car model, followed by the Eeco van (127,027 units). The Alto (98,512 units), Celerio (35,299 units), S-Presso (26,172 units), Ignis (26,111 units) and the Ciaz (6,831 units) make up the rest.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

01 Jan 2025

01 Jan 2025

15660 Views

15660 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi