Tata Motors sells 562,468 cars and SUVs in CY2024, EV sales flat at 68,980 units

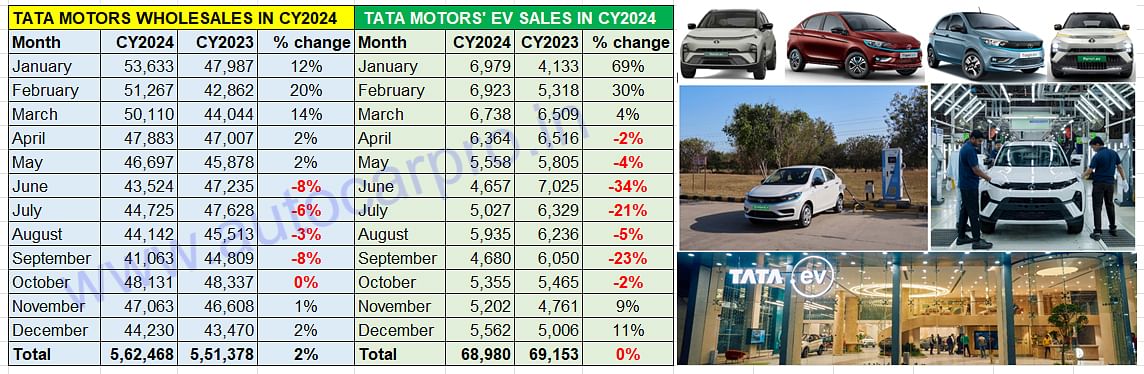

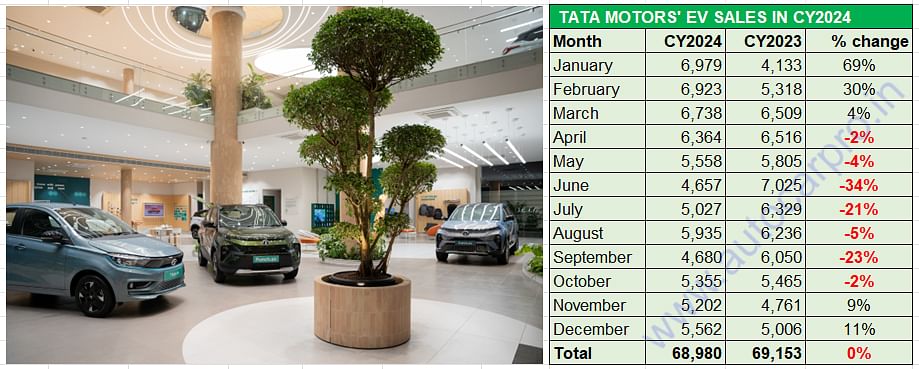

While the car and SUV manufacturer has surpassed the half-a-million-units milestone for the third year in a row and sold 562,468 units, its growth rate at 2% is slower than in 2023 and 2022, reflecting the increased competition in the marketplace. The fewer EVs sold – 68,980 units, down 0.25% on CY2023’s 69,153 EVs – hasn’t helped either.

For the third calendar year in a row, Tata Motors has surpassed the half-a-million milestone and also registered its best-ever annual wholesales. In CY2024, the car and SUV manufacturer dispatched a total of 562,468 units, which marks flat sales of -0.25% (CY2023: 551,378 units), and lesser than the previous year’s growth rate of 4.66 percent.

The company, which retails eight passenger vehicles – Altroz, Tigor, Tiago, Nexon, Punch, Harrier, the Safari and the Curvv – in the domestic market, has found the going slower than it expected in CY2024. As the 12-month wholesales data (see CY2024 passenger vehicle data below) shows, demand has dropped quarter on quarter for the first nine months. Tata Motors sold 155,010 units in Q1, 138,104 units in Q2, 129,930 units in Q3. Q4 though marked a recovery with 139,424 units in Q4 CY2024.

Tata Motors saw demand drop quarter on quarter for the first nine months before making a recovery in the fourth quarter (October-November 2024).

Tata Motors saw demand drop quarter on quarter for the first nine months before making a recovery in the fourth quarter (October-November 2024).

What continues to benefit the company is that its passenger vehicle portfolio covers petrol, diesel, CNG and electric powerplants, thereby considerably expanding its consumer reach compared to most of its rivals.

CY2024 opened on a strong note with record sales in January: best-ever monthly sales of 53,633 passenger vehicles including best-ever monthly EV sales of 6,979 units. January 2024 was also the first time ever that Tata Motors had sold over 50,000 units in a single month. However, the monthly numbers since then have belied the promise of sustained growth. Four straight months of sales decline (June to September) followed by flat sales in the festival month of October have seen demand plateau, even if the company reduced its shipments to optimise dealer inventory.

In CY2024, Tata Motors' EV dispatches dropped 0.25% to 68,980 units, which has also resulted in a marginal decline in its EV penetration level to 12.26% from 12.55% in CY2023

In CY2024, Tata Motors' EV dispatches dropped 0.25% to 68,980 units, which has also resulted in a marginal decline in its EV penetration level to 12.26% from 12.55% in CY2023

EV sales slowdown impacts overall numbers

Tata Motors’ accelerated growth over the past few years has been a result of its first-mover advantage in the electric vehicle market, where it once had an over 70% market share albeit that has dropped to around 65 percent. Of the mainstream PV OEMs, the company continues to have the largest e-PV portfolio in India comprising the Nexon EV, Tigor EV, Tiago EV, Xpres-T (for fleet buyers), Punch EV and the recently launched Curvv EV.

In CY2024, total EV dispatches dropped by 0.25% to 68,980 units (CY2023: 69,153 units), which has also resulted in a decline in its EV penetration level to 12.26% from 12.55% in CY2023. Tata Motors had an EV penetration level of 8.24% in CY2022. In CY2024, Tata Motors saw an unprecedented sales decline over seven months in a row, from April through to September (see EV sales data table below). According to the company, fleet volumes have declined in the October-December 2024 quarter due to the expiry of the FAME 2 subsidy.

The company’s share of the ePV market, which was not too long ago upwards of 75%, has been continually reducing, reflecting the growing competition from rival EV OEMs and increased product choice for buyers. Nevertheless, there continues to be a big difference in numbers between Tata Motors and the rest of the competition.

Commenting on the company’s performance, Shailesh Chandra, Managing Director, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said: “CY2024 was the fourth consecutive year of highest-ever annual sales with 565,000 units sold. We registered strong growth in our SUV portfolio with successful product introductions built on our proven multi-powertrain strategy. CNG volumes grew a substantial 77% with over 120,000 CNG vehicles sold in CY2024. SUV volumes grew a robust 19%, with Punch selling over 200,000 units to emerge as the highest selling car model in India in CY2024. Looking ahead, we remain optimistic about the outlook for the PV industry. With multiple product launches, innovations and a strengthened multi-powertrain strategy, Tata Motors is well poised for further growth in CY2025.”

The company, which is on track to deliver 10 all-new EVs by FY2026, has outlined plans to invest between Rs 16,000-18,000 crore in its EV business by FY2030. While the Curvv EV coupe-SUV has been the first to roll out, the Harrier EV is slated for market introduction in FY2025. Following these two will be the Sierra EV and Avinya EV – both slated for introduction in FY2026 – between April 2025 to March 2026. Tata Motors aims to leverage its two ground-up EV platforms - Acti.ev and the JLR-derived EMA platform – to address the key barriers of extended range, and advanced technology in modern-day EVs.

To ensure it is future-proofed on the manufacturing capacity front, Tata Motors’ acquisition of Ford India’s plant in Sanand, Gujarat, will help unlock additional capacity of 300,000 units per annum, expandable to 420,000 units per annum.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

02 Jan 2025

02 Jan 2025

20560 Views

20560 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau