PV, 2- and 3-wheeler wholesales up 18% in August, OEMs eye festive season gains

With the festive season underway till end-October and improved production OEMs are keen to make the most of the business opportunity.

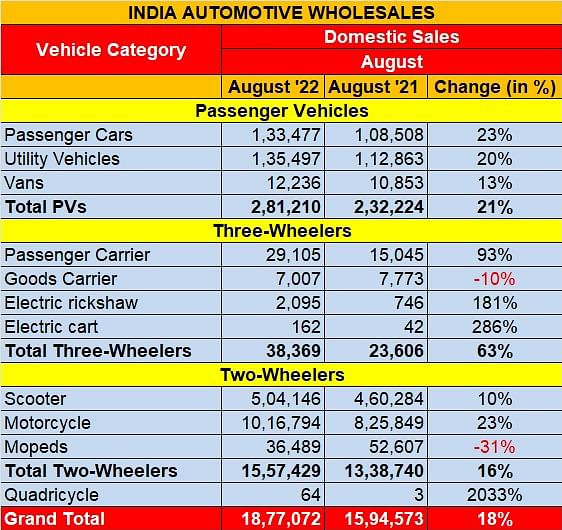

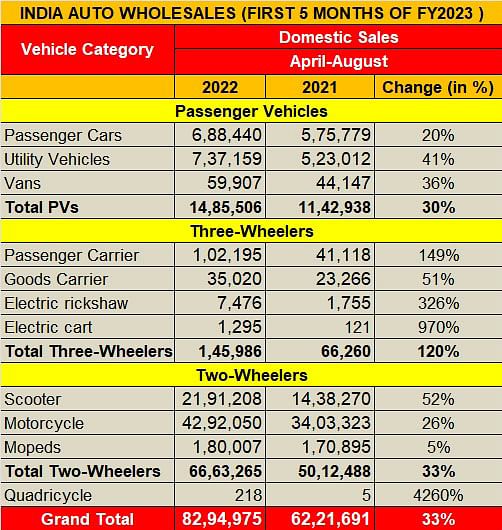

The automobile wholesales numbers for August 2022 are out, released by apex industry body Society of Indian Automobile Manufacturers (SIAM). Total despatches of three vehicle segments – passenger vehicles, two- and three-wheelers – add up to 18,77,072 units, up a strong 18% year on year (August 2021: 15,94,573 units). SIAM did not release the data for commercial vehicle despatches for August 2022.

The double-digit YoY growth for all these three segments is a pointer to the fact that vehicle manufacturers are all geared up to make the most of the two-month festive season in India that began in end-August with Ganesh Chaturthi, goes to Navratri in September and continues to Diwali in the second half of October. The festive season is when vehicle buyers prefer to make a purchase and often benefit from good deals in the competitive marketplace.

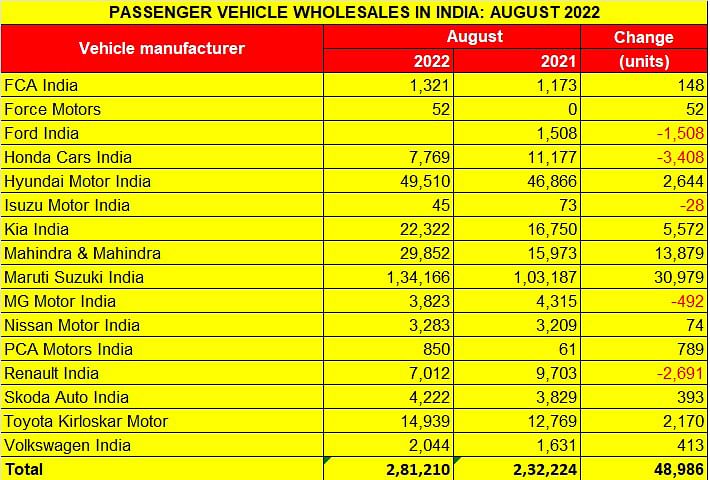

Passenger vehicles: 281,210 units / 21%

Autocar Professional’s estimate (on September 2) of overall wholesales of 330,000 units is very close to the actual number released by SIAM on September 9: 281,210 units. Add Tata Motors’ 47,166 units and what you get is 328,376 units. (Tata Motors provides only cumulative quarterly numbers to SIAM.

The PV segment is on a roll, primarily riding on the sustained demand for utility vehicles and all its three sub-segments have registered strong YoY increases.

Of the 281,210 PVs (up 21% YoY) despatched to dealers last month, UVs (135,497) account for 48%, while cars with 133,477 units (up 23%) have a 47% share. However, demand for entry-level cars is yet to pick up and remains a concern for OEMs. The remaining five percent was contributed by vans with 12,236 units (up 13%).

PV market leader Maruti Suzuki India, with 134,166 units, took 47% of total despatches while Hyundai Motor India, with 49,510 units, is next best with 17.60%. Tata Motors is hot on Hyundai’s heels and it will be interesting to see how the battle pans out in the coming year.

On the retail front, as per dealer body FADA, 274,448 units were sold in August (up 6.5%). The average dealer inventory for PVs at present ranges between 30 to 35 days. With the chip crisis abating, vehicle availability has considerably improved albeit the waiting period for some high-end, feature-rich variants continues to be rather long.

Two-wheelers: 15,57,429 units / 16%

The two-wheeler segment recorded wholesale despatches of 1.55 million units, up 16% YoY (August 2021: 13,38,740 units). This is more or less split into a million motorcycles (10,16,794 units / up 23%) and half-a-million scooters (5,04,146 units / up 10%). Demand for mopeds though saw a decline to 36,489 units, down 31%.

Within the motorcycle segment, market leader Hero MotoCorp with 419,615 units accounted for 41%, followed by Bajaj Auto with 231,076 units (23%), HMSI with 172,369 units (17%), and TVS Motor Co with 87,414 units (8.5%). SIAM numbers reveal that all major players have substantially improved on their year-ago despatches, understandable given that August 2021 was a pandemic-impacted month.

Compared to motorcycles, YoY growth in scooters is more subdued: 504,146 units and 10%. The opening up of urban India, schools, colleges and offices has revived demand for mobility and scooter OEMs are keen to make the most of the opportunity. The scooter market has been lagging for quite some time now. The next couple of months will reveal if OEM expectations are fulfilled.

Three-wheelers: 38,369 units / 63%

Growth-wise, the three-wheeler segment has notched the best YoY increase of 63% – 38,369 units – albeit on a much lower-base compared to the other two vehicle segments. The opening up of the economy means demand is back strongly for passenger-ferrying three-wheelers – 29,105 units are a 93% increase on August 2021’s 15,045 units. Demand, surprisingly, is marginally down for ICE goods carriers – a James-Bond-like 7,007 units from the 7,773 units a year ago.

Where the three-wheeler segment is making waves is in its electric avatar and across both passenger and cargo variants. The mantra of low cost of ownership that electric three-wheelers, which are mostly single-owner or fleet owned, is what is driving demand. A total of 2257 units were sold last month, up 186% on August 2021’s 788 units.

Growth outlook

Autocar Professional’s estimate (on September 2) of overall wholesales of 330,000 units is very close to the actual number released by SIAM on September 9: 281,210 units. Add Tata Motors’ 47,166 units and what you get is 328,376 units. (Tata Motors provides only cumulative quarterly numbers to SIAM.

August 2022 with 328,376 units was the best month for PVs and sets the tone for the festive season. It’s the same for the two- and three-wheeler industry. A gaggle of new models and OEMs ramping up production with the easing of the semiconductor supplies means that dealers are well stocked. India’s two-month festive season has begun with Ganesh Chaturthi on August 31 while Onam, the popular 10-day harvest festival, opened on August 30. The nine-day Navratri festival begins on September 26 and ends on October 4, and Diwali opens on October 21.

ALSO READ

August retails grow 8%, FADA revises growth outlook to 'optimistic'

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

10 Sep 2022

10 Sep 2022

5952 Views

5952 Views

Shahkar Abidi

Shahkar Abidi