August retails grow 8%, FADA revises growth outlook to 'optimistic'

Over 1.52 million vehicles sold in August 2022; other than tractors, all other vehicle categories record YoY growth albeit on a low year-ago base. Compared to pre-Covid August 2019, PVs and CVs show rise

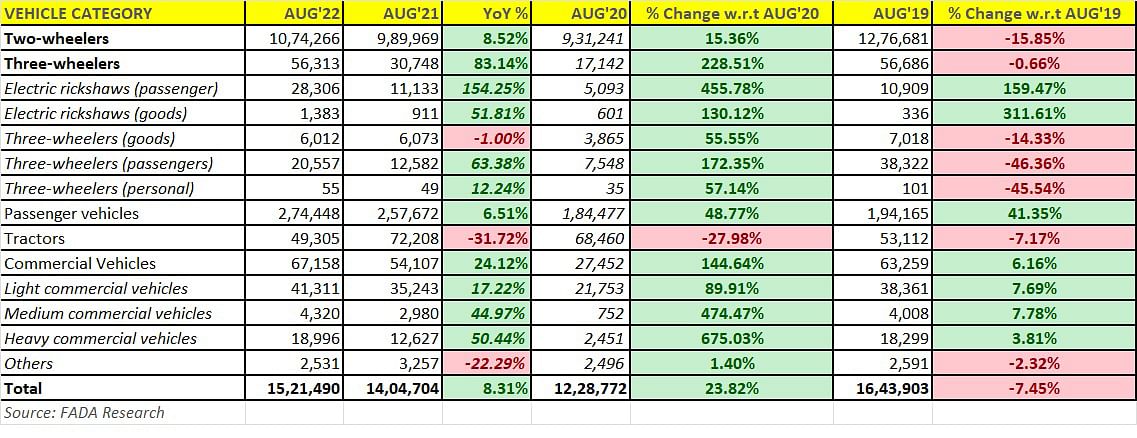

The real-world sales numbers for the month of August 2022 are out, courtesy the Federation of Automobile Dealers Associations (FADA). Cumulative sales across five vehicle categories – two-wheelers, three-wheelers, passenger vehicles, tractors and commercial vehicles were 15,21,490 units, up 8.31% YoY (August 2021: 14,04,704 units).

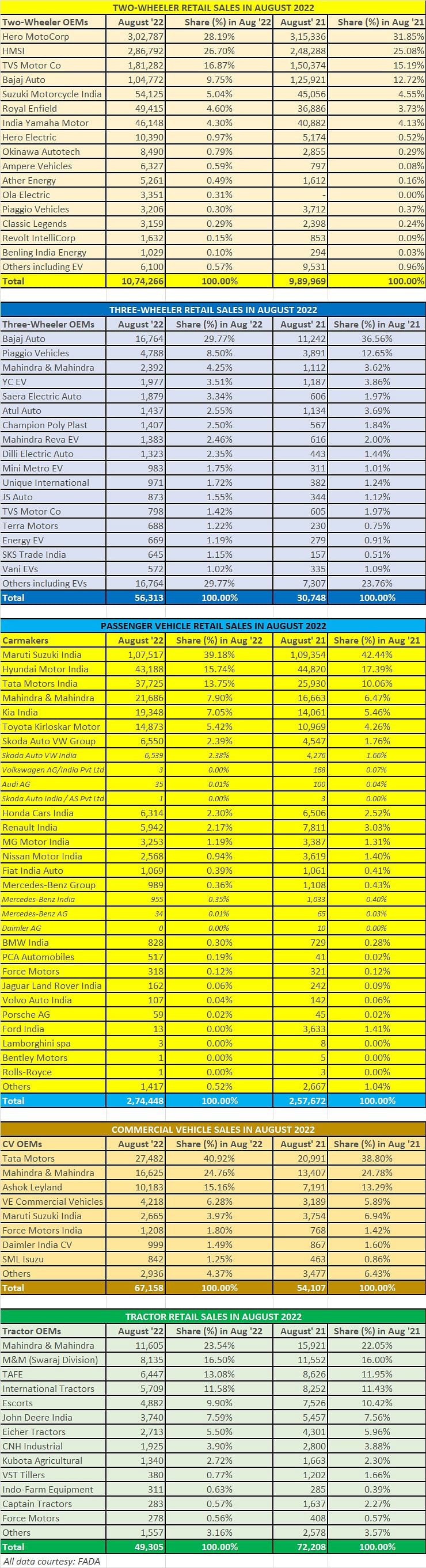

Except tractors, whose numbers decreased by -32%, all the other categories are in positive territory – two-wheelers (8.5%), three-wheelers (83%), passenger vehicles (6.5%) and commercial vehicles (24%). However, it is to be noted that this growth is on the lower year-ago base of a pandemic-impacted August 2021.

Commenting on the market performance in August 2022, FADA President Manish Raj Singhania said: “August opens the door for the festival season to kick in. While dealers anticipated good a Ganesh Chaturthi, the results thus far has not been encouraging. In spite of good monsoons, the festive season began with a dampener during Ganpati.”

“When compared with August 2019, a pre-Covid month, total vehicle retails fell by -7%. While PV outperformed handsomely by growing 41%, CVs also turned positive by growing 6% and thus came out of the Covid blues. All the other segments were in the red with two-wheelers, three-wheelers and tractors down by -16%, -1% and -7% respectively.”

“While the two-wheeler segment has grown by 8.5% YoY (in August 2022), it continues to face Covid blues due to underperformance of Bharat and is still not above 2019 levels. This, coupled with price hikes, has made two-wheelers out of reach for most entry level customers. With erratic monsoon, the crop realisation has been low and flood-like situation has restricted customer movement.”

Singhania added, “The three-wheeler space continues its healthy double digit-growth (83% YoY) and has equalled 2019 sales for the first time. Electrification is also the highest in this category as e-rickshaws are leading the way. There is a clear indication that customers are now preferring electric vehicles over ICE vehicles as ICE three-wheelers continue to see double digit de-growth when compared to pre-Covid levels.”

The CV segment continues to witness an upswing in economic activities post monsoon and saw a growth of 24% YoY. This along with government’s infrastructure push, new launches by OEMs and better conversion in fleet operations has kept the segment in green. Apart from this, the Passenger Carrier segment is also showing good demand due to increased buying from Educational Institutions.

The PV segment continues to be on a bull run (grows 6.5% YoY) as demand for all sub categories of vehicles except entry level remained strong. This is also aided by new feature rich launches which OEMs are doing since last few months. With semi-conductor shortage slowly becoming a passe, vehicle availability has definitely improved but waiting period continues to remain due to high demand in higher feature rich variants.”

Near-term outlook: Optimistic

The FADA president believes the coming months should drive new gains for automakers in India. He said: “While September 2022 brings with it the festivals of Onam and Navratri, there is also the 15-day period of Shraadh, generally considered as an inauspicious period for buying vehicles in India. With easing of supply chain issues, the PV segment will definitely see the best-ever festivities (Navratri and Diwali) in the past decade. Along with this, if vehicle prices continue to remain stable and there are no new health-related threats, we may see an uptick in the two-wheeler market, which has not shown the required growth since the festive season last year.

With the government’s continuous push in infrastructure spending, we will also see an uptick in the CV market.”

Given the current market scenario and the improved sentiment, FADA has changed its stance for the industry’s growth outlook from ‘cautiously optimistic’ to ‘optimistic’ as it enters the festive period.

RELATED ARTICLES

Cosmo First diversifies into paint protection film and ceramic coatings

The Aurangabad, Maharashtra-based packaging materials supplier is leveraging its competencies in plastic films and speci...

JSW MG Motor India confident of selling 1,000 M9 electric MPVs in first year

The 5.2-metre-long, seven-seater luxury electric MPV, which will be locally assembled at the Halol plant in Gujarat, wil...

Modern Automotives targets 25% CAGR in forged components by FY2031, diversifies into e-3Ws

The Tier-1 component supplier of forged components such as connecting rods, crankshafts, tie-rods, and fork bridges to l...

By Autocar Professional Bureau

By Autocar Professional Bureau

08 Sep 2022

08 Sep 2022

5492 Views

5492 Views