Ola first Indian e2W maker to sell 400,000 units in a year

Ola Electric has become the first electric two-wheeler manufacturer in India to clock retail sales of 400,000 units in a calendar year. While it has a 36% market share of the 1.10 million e-two-wheelers sold in India between January and first-half December, its monthly retails and share have fallen in the past couple of months.

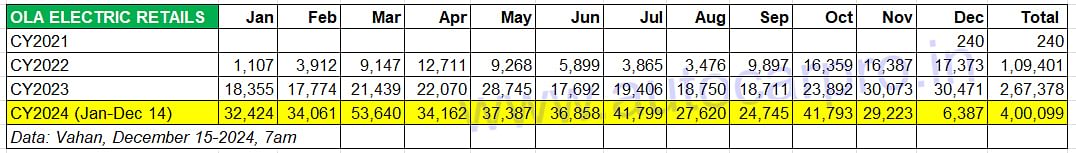

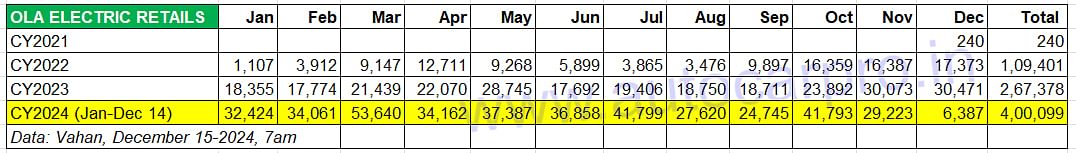

Ola Electric, the electric two-wheeler industry market leader in India, has become the first EV maker in India to achieve retail sales of 400,000 units in a single calendar year. As per the latest Vahan data (as of 7am on December 15, 2024), Ola has clocked a total of 400,099 units, confirming Autocar Professional’s September 10’s forecast when the company had achieved 300,000 sales. Fittingly enough, Ola had achieved the 300,000-units milestone on September 9 – World EV Day.

400,099 units between January-December 14, 2024 are a handsome 50% YoY jump over CY2023 sales, and translate into an additional 132,371 units.

400,099 units between January-December 14, 2024 are a handsome 50% YoY jump over CY2023 sales, and translate into an additional 132,371 units.

TOTAL OLA RETAILS CROSS 777,000 UNITS SINCE LAUNCH

Since its entry into the Indian EV market, Ola Electric’s cumulative retail sales have gone past the 775,000-units mark, with the bulk of them coming this year.

Cumulative retails for the company, which commenced sales in December 2021, are 777,118 units till the first half of December 2024, the largest for any e2W OEM in India. And, of the 2.62 million e-two-wheelers (2,627,889 units) sold in the country since December 2021 till mid-December 2024, Ola has a market share of 30 percent.

Vahan-sourced data reveals that the company sold 109,401 units in CY2022, its first 12 months of sales. This was more than the combined sales of Ather Energy (51,808 units), which was the then No. 2 OEM, and TVS Motor Co (47,812 units).

Ola Electric, which commenced sales in December 2021, has sold 777,118 units till first half of December 2024, the largest for any e2W OEM in India.

Ola Electric, which commenced sales in December 2021, has sold 777,118 units till first half of December 2024, the largest for any e2W OEM in India.

In CY2023, Ola sold 267,378 units, which constitutes handsome 144% year-on-year growth, which gave it a huge lead of 100,799 units over its immediate rival, TVS Motor Co which sold 166,579 iQubes.

Now, in the first 11-and-a-half months of this year (January to December 14), Ola with 400,099 units has registered a handsome 50% YoY increases over its CY2023 sales, having sold an additional 132,371 units in the year to date.

With the Indian e-two-wheeler industry having clocked total retails of 1,109,432 units or 1.10 million units, Ola currently has a leading 36% share of the e-two-wheeler market, well ahead of TVS Motor Co (210,666 iQubes and 19% market share), Bajaj Auto (184,577 Chetaks and 17% market share) and Ather Energy (120,721 units and 11% market share).

Expect Ola Electric, which launched two new products in November – the S1 Z priced at Rs 59,999 and the S1 Z+ which costs Rs 64,999 – as well as the Ola Gig, a dedicated product for the gig economy, priced at an extremely affordable Rs 39,999, to see a strong 2025. Deliveries of the S1 Z, S1 Z+, Gig and Gig1 are slated to begin only next year, around April-May.

TVS, Bajaj Auto, Ather and Greaves Electric also clock best-ever annual retails

The electric two-wheeler segment, which has already surpassed a million-unit sales for the first time in a calendar year, is headed towards a record 1.15 million units in CY2024. As of December 15, it has clocked 1.10 million units.

The e-two-wheeler industry is the largest contributor to EV sales in India and currently accounts for a 59% share of the 1.87 million EVs (1,871,133 units) sold between January and December 14.

It's been a good year and Ola, TVS Motor Co, Bajaj Auto and Ather Energy are the four OEMs to have recorded six-figure sales numbers. All these four OEMs, as also Greaves Electric Mobility, have already hit their best-ever annual sales, with a fortnight still left before 2024 comes to a close.

While Ola remains the market leader by a wide margin, the battle between the two legacy players – TVS Motor Co and Bajaj Auto – which launched their e-scooters in the same month (January 2020), has turned intense. The sales gap between TVS and Bajaj, which was 94,642 units in CY2023, currently stands at 26,089 units, with 16 days more for CY2025 to dawn. Stay tuned for the latest updates on the electric vehicle industry.

Lead pic: Ola Electric/X

ALSO READ:

Scooter sales jump 21% in April-November, slower 10% growth for motorcycles

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

15 Dec 2024

15 Dec 2024

28354 Views

28354 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi