OEMs dispatch record 393,074 PVs in January to feed SUV-hungry market

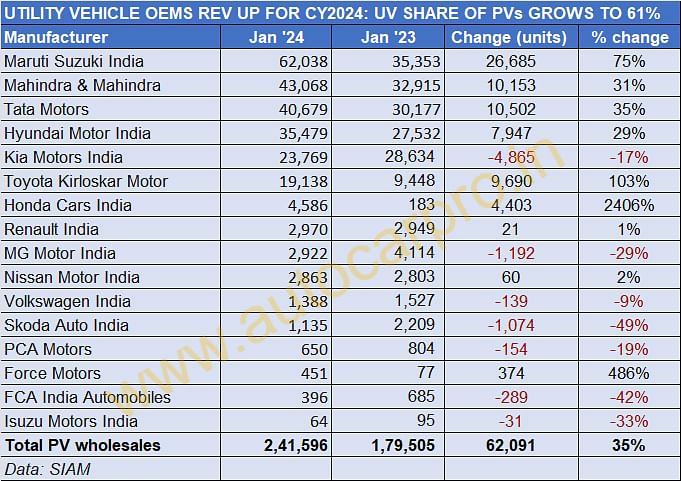

Unabating demand for SUVs and MPVs in India continues to power passenger vehicle dispatches to dealers; 241,596 utility vehicles in January 2024 accounted for over 61% of total PV shipments to dealer showrooms last month.

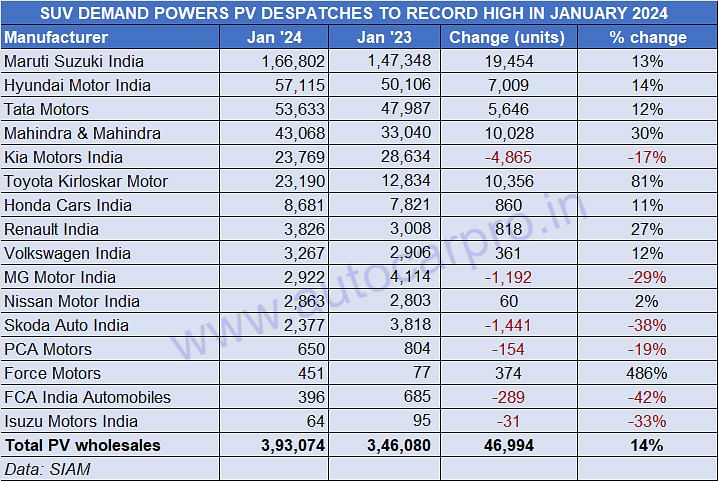

If CY2023 closed on a very strong note for the Indian passenger vehicle industry with record wholesales of 4.10 million units (up 8%), then CY2024 bids fair to go beyond that. The first month of this year saw PV (cars, utility vehicles and vans) manufacturers dispatch a record 393,074 units to their authorised dealers across the country. This constitutes a solid 14% year-on-year increase (January 2023: 346,080 units) and a measure of OEM eagerness to cater to customer demand for new vehicle registrations early in the new year.

What continues to power PV dispatches is the unabated demand for utility vehicles (UVs) which at 241,596 units in January 2024 accounted for 61.46% of total PV shipments to showrooms. This marks a rise from the UV share of 57% in CY2023 and 51% in CY2022 and also helps buffer the sharp decline in demand for entry-level hatchbacks and tepid growth for other cars and sedans.

PV growth continues to be powered by UV demand: 241,596 UVs in January accounted for 61.46% of total PV shipments to dealer showrooms last month.

PV growth continues to be powered by UV demand: 241,596 UVs in January accounted for 61.46% of total PV shipments to dealer showrooms last month.

Maruti Suzuki maintains its UV leadership with a 26% share, followed by Mahindra (18%), Tata Motors (17%), Hyundai (15%), Kia (10%), Toyota (8%).

With the wave of UV demand continuing, it’s not surprising that the companies with SUV-heavy portfolios continue to make gains month after month in the overall PV market. Maruti Suzuki maintains its UV leadership with a 26% share (up from 20% a year ago), followed by Mahindra & Mahindra (18%), Tata Motors (17%) and Hyundai Motor India (15%). While Kia India's UV share is down to 10% from 16% a year ago, Toyota Kirloskar Motor has increased its share to 8% from 6% in January 2023. Honda Cars India, which was missing the action big-time, is back in the game with the Elevate, which has helped increase its UV share to 2% from 0.1% a year ago.

HOW THE TOP PASSENGER VEHICLE MANUFACTURERS FARED

Maruti Suzuki India led the charge in January 2024 with 166,802 units, up 13%, making last month its second-best monthly sales performance in the ongoing fiscal year – just 1,245 units fewer than October 2023’s 168,047 units. The eight-model utility vehicle (UV) portfolio, comprising the Brezza, Grand Vitara, Fronx, Jimny, S-Cross, XL6, Ertiga and the new Invicto, together sold 62,038 units, which is the company's second-best UV monthly yet – an agonising 11 units short of the best ever monthly UV sales of 62,049 UVs in July 2023. This means UV dispatches were 37% of its overall PV dispatches.

Hyundai Motor India, with 57,118 units (up 14%), clocked its best-ever monthly dispatches in January 2024. UVs with 35,479 units accounted for 62% of the company’s total PV wholesales last month. Demand continues to be powered by the Creta midsize SUV and the launched-in-August-2023 Exter compact SUV (which has received over 100,000 bookings). For Hyundai, whose SUV line-up comprises the Creta, Venue, Alcazar, Exter and the Tucson along with the Ioniq 5 and Kona electric SUVs, last month’s wholesales would have received a boost from the launch of the new Creta on January 16. Priced at Rs 11 lakh, the new Creta costs Rs 80,000 more than the pre-facelift model and has already received close to 50,000 bookings since January 2.

Like Hyundai, Tata Motors had a strong CY2024 opener. The company registered its best monthly wholesales for PVs (53,633 units, up 13%) and for EVs (65,979 units, up 69%). This is the first time that the company has clocked over 50,000-unit sales in a month. The UV wholesales, at an estimated 40,679 units, account for 76% of Tata Motors’ overall PV dispatches in January 2024. The company, which retails seven PVs – Altroz, Tigor, Tiago, Nexon, Punch, Harrier and the Safari – has capitalised on surging demand for its SUVs, particularly the Nexon and Punch compact SUVs as well as the fact that with a PV portfolio that spans petrol, diesel, CNG and electric powerplants, thereby considerably expanding its consumer reach compared to most of its rivals. The recent slashing of Nexon.ev and Punch.ev prices, as well as the new Nexon acing the Global NCAP crash test with a top 5-star rating will provide more sales ammo in the months to come.

Mahindra & Mahindra, whose product portfolio comprises eight SUVs (Bolero, Bolero Neo, Scorpio, Scorpio N, Scorpio Classic, Thar, XUV300, XUV400 and XUV700) and a sole sedan (eVerito), continues to make the most of the surging demand for SUVs. In January 2024, the company sold 43,068 SUVs, a strong 31% YoY increase (January 2023: 32,915 units). What reflects the continued strong level of demand for Mahindra models is the fact that as of February 1, the auto major has 226,000 bookings in hand and is ramping up production to 49,000 units a month in Q4 FY2024.

M&M, which has, is clearly making the most of the surging wave of demand for UVs amidst an ultra-competitive market. And it is driving towards setting a new record for fiscal-year sales in FY2024.

Kia Motors India, which is fifth in the OEM rankings with 23,769 units in January 2024 saw demand decline 17% YoY (January 2023: 28,634 units). This is likely because the Korean carmaker would have already revved up dealer inventory in December 2023 ahead of the January 2024 launch of the new Sonet compact SUV. Last month’s dispatches comprised 11,530 Sonets (up 25% YoY), 6,391 Seltos (down 39% YoY) and 5,848 Carens MPVs (down 26% YoY).

Toyota Kirloskar Motor, with 23,190 PVs dispatched in January 2024, recorded handsome 81% YoY growth (January 2023: 12,834 units). This strong performance is a a result of sustained demand for its MPVs and SUVs as also Maruti Suzuki-rebadged models like the Glanza, Urban Cruiser Hyryder and Rumion, ramped-up production at its Bidadi plant, and a host of customer-friendly initiatives. In January 2024, UVs (19,138 units) accounted for 82.52% of TKM’s total PV sales.

Honda Cars India’s latest product – the Elevate midsize SUV – has given the company a new charge in the domestic market. Growing customer demand for the Elevate meant that it was the highest In Honda dispatches in January 2024 – 4,586 units, ahead of the Amaze (2,972 units) and the City (1,123 units). This means the Elevate alone accounted for 53% of the Japanese car and SUV maker’s wholesales last month.

As with the record PV wholesales last month, the retail sales scenario too was a robust one in January 2024. At 393,250 units and 13.30% YoY growth, January 2024 is now the new benchmark for best-ever monthly retails for India PV Inc, surpassing the previous best in November 2023 (360,431 units).

According to FADA president Manish Raj Singhania, surging demand for SUVs, along with regular introduction of new models, greater availability, effective marketing, consumer schemes and the auspicious wedding season, have underpinned this strong performance. However, he added that “serious concerns remain regarding PV inventory levels, now in the 50- to 55-day range. This calls for immediate recalibration of production from OEMs to better align with actual market demand and avoid future oversupply issues. As adaptability is crucial in this dynamic industry, OEMs must balance innovation with strategic production planning to ensure sustained success and overall market stability."

ALSO READ: India’s Top 25 utility vehicles in CY2023

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

15 Feb 2024

15 Feb 2024

8668 Views

8668 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal