Record PV sales of 393,250 units, strong 2W, 3W demand power January’s 2.12 million retails

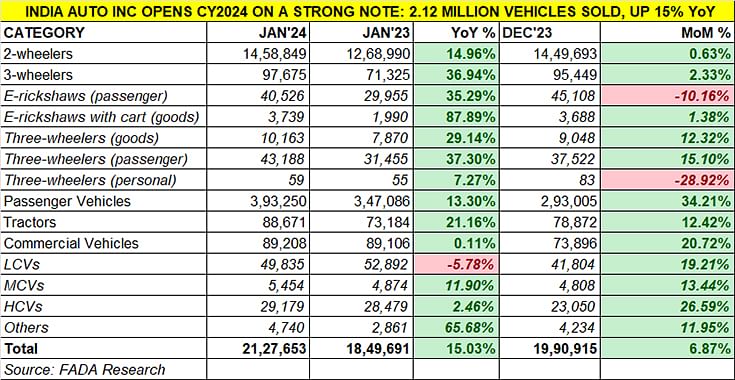

India Auto Inc opens CY2024 on a good note with double-digit growth across all but the commercial vehicle segment; overall industry retail sales at 21,27,653 units were up 15% year on year.

The real-world market numbers are out, released by the Federation of Indian Automobile Dealers Associations (FADA). India Auto Inc’s retail sales for the opening month of CY2024 at 21,27,653 units are up 15% (January 2023: 18,49,691 units). What’s gratifying is that strong growth is visible across all vehicle categories.

In percentage-growth terms, while two-wheelers (1.45 million units) recorded 15% YoY growth, by three-wheelers (97,675 units) to achieve 37% YoY growth. The passenger vehicle segment, which has been on a roll for a long time and surfing a wave of demand for SUVs, recorded its best-ever monthly retails of 393,250 units, up 13.30 percent. While commercial vehicle retails were flat at 89,208 units (up 0.11%), tractor sales have bounced back after a slowdown in previous months, likely driven by anticipation of a good rabi crop output and favourable weather conditions for wheat cultivation.

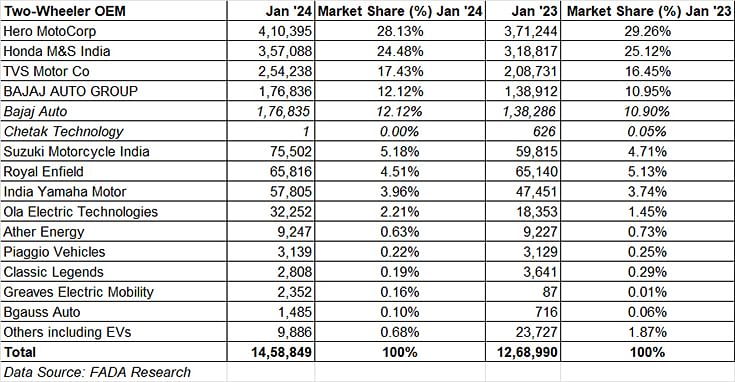

Two-wheeler retails: 14,58,849 units, up 14.96% YoY

Retail sales of motorcycles and scooters remained steady in January 2024, mainly due to the continued strength of demand emanating from rural India, which is a key buyer of fuel-efficient commuter motorcycles. This segment, which is likely to benefit from the government’s good crop production estimates and continued support for the rural economy, should be able to maintain the growth trajectory in the coming months and the year.

According to FADA president Manish Raj Singhania, “Several positive trends in the two-wheeler market signalled a robust start to the year. Improved vehicle availability, due to adjustments post-OBD 2 norm implementation, introduction of new models and a shift towards premium options all contributed to increased demand. This, combined with a good harvest, a positive marriage season and effective follow-ups and offers, indicate a favourable trajectory for the sector. Furthermore, despite supply shortages, increased interest in electric vehicles highlights evolving consumer preferences within this segment.”

A look at the company-wise performance in January 2024 reveals that while all the top players – Hero MotoCorp, Honda, TVS, Bajaj, Suzuki, Royal Enfield and Yamaha – have seen smart YoY increases, TVS, Bajaj, Suzuki and Yamaha have witnessed a YoY market share increase (see data table below). Of the two pure EV SIAM members, electric two-wheeler market leader Ola Electric with 32,252 units not only recorded its best-ever monthly retails but has increased its share to 2.21% in the overall two-wheeler market. Ather Energy, with 9,247 units has a 0.63% share at present.

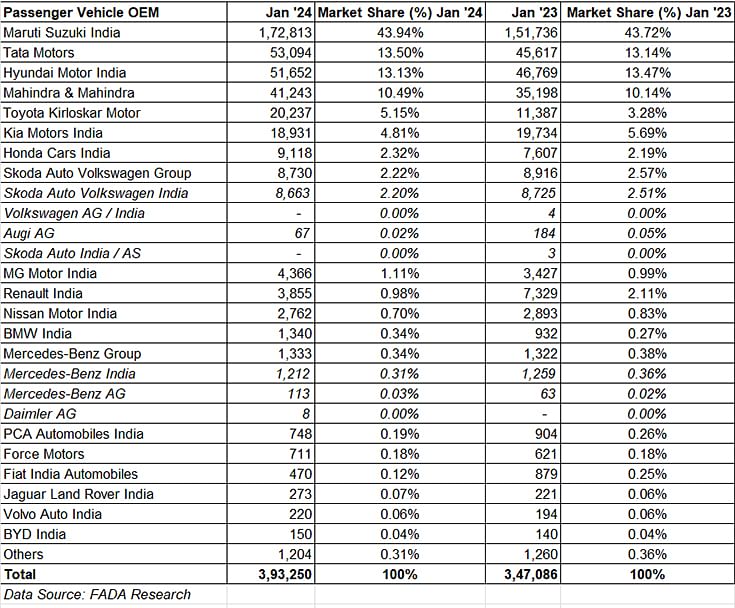

Passenger vehicle retails: 393,250 units, up 13.30%

The passenger vehicle (PV) segment, which had recorded retails of 3.86 million units in CY2023 (up 10.61% YoY), has begun CY2024 on a very strong note. At 393,250 units and 13.30% YoY growth, January 2024 is now the new benchmark for best-ever monthly for India PV Inc, surpassing the previous best in November 2023 (360,431 units).

According to FADA, surging demand for SUVs, along with regular introduction of new models, greater availability, effective marketing, consumer schemes and the auspicious wedding season, have underpinned this strong performance.

However, the FADA president states that “serious concerns remain regarding PV inventory levels, now in the 50- to 55-day range. This calls for immediate recalibration of production from OEMs to better align with actual market demand and avoid future oversupply issues. As adaptability is crucial in this dynamic industry, OEMs must balance innovation with strategic production planning to ensure sustained success and overall market stability."

That January 2024 would be a strong retail month for the PV industry was known from the strong vehicle despatches by market leading companies --- Maruti Suzuki, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Toyota Kirloskar Motor and Honda Cars India. The on-ground retail performance reflects just that, thanks to the massive demand for utility vehicles.

FADA Research’s PV sales data reveals Maruti Suzuki sold 172,813 units last months, 21,077 PVs more than it did in January 2023, improving its market share to 43.94% from 43.72% a year ago. Interestingly, Tata Motors, with 53,094 units, is the second-best-selling PV OEM in January 2024 and 1,442 units ahead of Hyundai Motor India (51,652 units) and sees its PV share improve to 13.50% from 13.14% a year ago. Mahindra & Mahindra (41,243 units) and Toyota Kirloskar Motor (20,237 units) have also recorded strong growth and market share of 10.49% and 5.15% respectively (see PV retail sales data below).

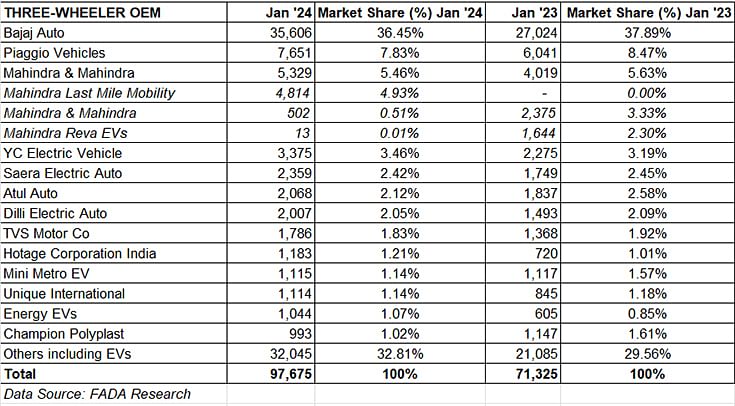

Three-wheeler retails: 97,675 units, up 37% YoY

The three-wheeler category, comprising passenger-transporting and cargo-carrying vehicles, continues to record strong double-digit growth. In January 2024, a total of 97,675 units were sold, making for robust 36.94% YoY growth (January 2023: 71,325 units).

Like the two-wheeler segment, the ongoing transition to electric mobility is strongly reflected in three-wheelers. A total of 44,265 EVs were sold, accounting for a 45.31% share of the overall three-wheeler market, up from 44.78% a year ago.

Bajaj Auto, which has expanded its portfolio with electric three-wheelers, continues to have commanding market leadership – the company sold 35,606 units for a market share of 36.45%. While Piaggio Vehicles is ranked second with 7,651 units, Mahindra & Mahindra sold 5,329 units, followed by YC Electric with 3,375 units.

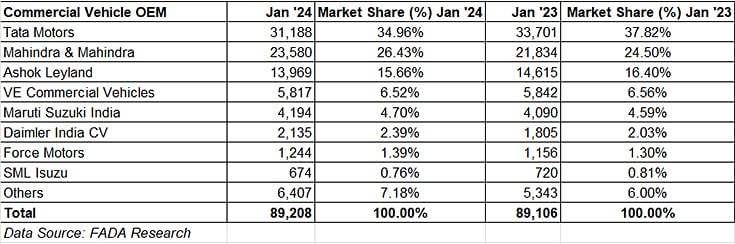

Commercial Vehicle retails: 89,208 units, up 0.11% YoY

The critical commercial vehicle sector, which is a barometer for the country’s economic growth, witnessed retail sales of 89,208 units in January 2024, which makes for flat sales (January 2023: 89,106 units).

According to FADA president Manish Raj Singhania, “January 2024 presented a complex scenario for the CV segment, demonstrating limited YoY growth. On one hand, increased infrastructure development, port activity and positive crop yields fuelled certain market segments. However, this momentum was hindered by extreme weather, tightened liquidity, high vehicle costs and more restricted financing.”

He added, “The commercial vehicle segment might experience a slight demand taper in the fourth quarter due to a high base effect and upcoming elections. However, long-term fundamentals remain positive, with expectations of a post-election rebound as underlying industries resume tender processes.”

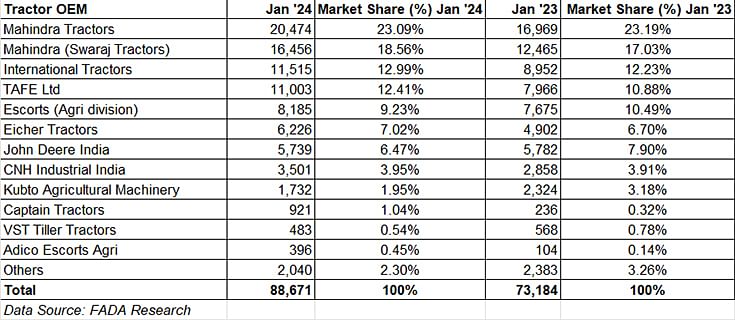

Tractor retails: 88,671 units, up 21.16% YoY

Tractor manufacturers have farmed good growth in the opening month of CY2024. The retail sales of 88,671 units are an additional 15,487 units over the year-ago sales of 73,184 units and indicate a welcome uptick after a slowdown in previous months. This upward demand movement is likely have been driven by expectation of a good Rabi crop output and favourable weather conditions for wheat cultivation. What augurs well for the segment is the government’s optimistic crop production estimates and continued support measures that are expected to boost the rural economy, potentially leading to even higher tractor demand and also increased sales of entry-level two-wheelers in rural India.

Near-term outlook: cautiously optimistic

According to FADA, February 2024 presents a multi-faceted outlook for India Auto Inc -- while dealers anticipate growth, there are prevailing challenges that require to be monitored and can impact growth.

The demand drivers in the coming months are the ongoing marriage season, anticipated income from agricultural sales particularly for entry-level two-wheelers and tractors, new product launches across all segments, and favourable post-Union Budget policies are expected to drive growth in the CV sector, particularly within infrastructure-related industries

The challenges could be in the form of the upcoming elections which may introduce caution among consumers, affecting purchasing decisions across vehicle segments. Meanwhile, there continue to be persistent supply bottlenecks for specific high-demand models which present a risk factor for consistent growth across the two-wheeler, CV and PV segments, highlighting the need for OEM optimisation of production lines. Furthermore, fluctuating market liquidity and the potential for tighter financing in the CV sector require a focus on consumer financing solutions to support overall sales. Overall, India Auto Retail Inc’s near-term outlook leans towards cautious optimism in the months ahead.

RELATED ARTICLES

Maruti Ertiga and Brezza Each Surpass 1.4 Million Sales in February

Launched four years apart, India’s highest-selling MPV and compact SUV each notch individual milestones, account for a 6...

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

13 Feb 2024

13 Feb 2024

8979 Views

8979 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau