Auto retails increase 11% in CY2023 to 23.8 million units, all segments record growth

CY2023 saw democratised growth for all vehicle segments and the retail sales momentum should continue in CY2024.

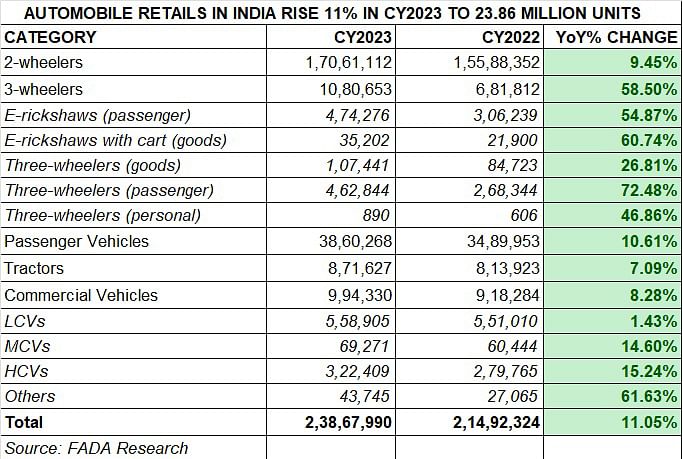

CY2023 has been a good year for India Auto Inc and the real-world sales growth story is revealed in the retail sales figures released by the Federation of Indian Automobile Dealers Associations (FADA). A total of 2,38,67,990 vehicles across all segments (two- and three-wheelers, passenger vehicles, commercial vehicles and tractors) were sold in CY2023, up 11% year on year (CY2022: 2,14,92,324 units).

While two-wheeler demand rose 9.45% to 17 million units (CY2022: 1,55,88,352 units), three-wheeler retails at 10,80,653 units, crossed the million-units mark for the first time in a calendar year, jumping 58.50% YoY (CY2022: 681,812 units). Continuing strong demand for electric three-wheelers at 509,478 units accounted for 47% of total sales and recorded robust 55% YoY growth (CY2022: 328,139 units).

Passenger vehicle sales maintained their double-digit growth at 3.86 million units, up 10.61% (CY2022: 34,89,953 units) and commercial vehicle sales took the growth road with sales of 994,330 units, up 8.28% (CY2022: 918,284 units). Tractor sales at 871,627 units were up 7.09% (CY2022: 813,923 units).

With all vehicle segments witnessing growth, CY2023 has turned out to be a solid year of sales advancement for India Auto Inc.

Commenting on December 2023 and CY2023 retails, FADA president Manish Raj Singhania said, “December'23 was an overall good month as total retails saw a growth of 21% YoY. All categories closed in the green, with two-wheelers, three-wheelers, PVs, tractors and CVs growing on a YoY basis by 28%, 36%, 3%, 0.2% and 1.3% respectively.

Similarly, for CY2023, the year ended with double-digit growth as total retails during the year saw an increase of 11% YoY. Here also, all categories closed in the green, with two-wheelers, three-wheelers, PVs, tractors and CVs growing on a YoY basis by 9.5%, 58.5%, 11%, 7% and 8% respectively.

In the two-wheeler category, key drivers included an abundance of marriage dates and the distribution of harvest payments to farmers, which enhanced purchasing power. Additionally, the availability of a wide range of models and variants, coupled with favourable weather conditions and a generally positive market sentiment, contributed to this robust growth. Enhanced product acceptance, particularly among the youth, and lucrative financial options, coupled with the anticipation of price increases in January 2024, spurred purchases.

The CV category experienced positive growth as increased industrial activity and infrastructure development continued to fuel demand for M&HCVs. The bus segment also saw a rise, particularly in tourism and transportation, aided by orders from various state transport departments. Additionally, robust liquidity in rural areas and the financial boost from crop sales supported customer purchases, although retail cases remained somewhat subdued despite some pre-buying in bulk.

In the PV category, SUVs in particular saw strong demand, with extended waiting periods for key models. This surge was fuelled by aggressive year-end promotions and the introduction of new models. However, a significant concern was the high inventory levels, reflecting over-supply. This ongoing issue of high PV inventory, despite a slight decrease by the year's end, remains a critical area for OEMs to address, emphasizing the need for further moderation in inventory management."

POSITIVE GROWTH TRAJECTORY TO SUSTAIN IN CY2024

For CY2024, India Auto Inc should see positive growth trajectory across categories. According to Singhania, the two-wheeler industry “expects a boost from new model launches, especially in the first half of the year, and an overall better economic condition coupled with higher EV participation. Improved customer sentiments, due to factors like lower fuel prices and crop payments to farmers, are likely to drive demand.”

PVs are expected to see growth with new product launches and stable market sentiments. The market is hopeful about improved vehicle availability and demand driven by new models with many OEMs launching their EVs. However, caution should be exercised regarding excess inventory as well, he said.

As regards, CVs, the positive outlook is driven by expectations of increased government spending due to elections, infrastructural projects and demand in key industries like coal, cement, and iron ore. The market is also expected to benefit from the replacement of older vehicles.

ALSO READ:

EV share of auto sales in India grows to over 6% in CY2023

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

08 Jan 2024

08 Jan 2024

10502 Views

10502 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi