Motorcycle sales exceed million units for third straight month as rural demand kicks in

At nearly 8 million units sold in April-November 2023, motorcycle sales have recorded 11% growth, benefiting from a host of new product launches, ramped-up production and also improved liquidity in the key rural India market. Bajaj Auto, TVS and Royal Enfield increase their market share in first eight months of FY2024.

The two-wheeler segment is back on growth road and November 2023 wholesales are ample proof of that. At 16,23,399 units, year-on-year growth is a solid 31% (November 2022: 12,36,282). It helped that the first fortnight of the month was the closing round of the 42-day festive season in India, which helped power sales for the past three months.

Last month, the motorcycle segment (10,70,798 units), which is witnessing demand for commuter bikes return belatedly from rural India, had a 66% share (10,70,798 units). Scooter sales (509,119 units) accounted for a 31.36% share of the overall two-wheeler market (16,123,399 units) and logged solid 23% YoY growth. while mopeds (43,482 units) had a 2.67% share.

The growth trajectory is also reflected in the fact that motorcycle sales have gone past the one-million mark for three straight months, hitting a high of 12,52,835 units in September, and scooters crossing the half-a-million mark four months in a row.

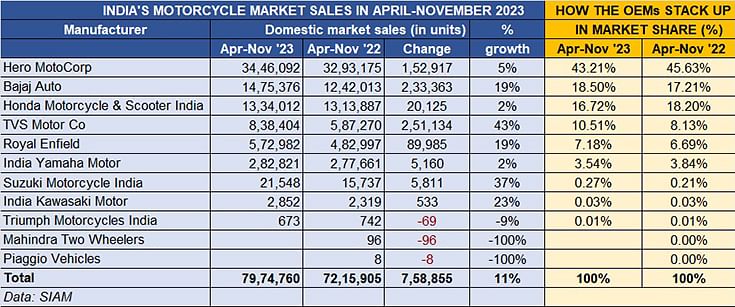

From a cumulative sales perspective, April-November 2023 wholesales for motorcycles at 79,74,760 units (up 11%) were just 25,240 units shy of the 8 million-units mark, while scooter sales in the first eight months of FY2024 at 39,64,293 units (up 7%) were 35,707 units short of the 4-million mark. Clearly, growth is democratised for both these sub-segments of the two-wheeler industry. Interestingly, mopeds – where TVS is the sole player – with 319,551 units has also seen YoY growth of 4 percent.

Motorcycle sales in India have surpassed the one-million mark for three months in a row, hitting a high of 12,52,835 units in September.

Motorcycle sales in India have surpassed the one-million mark for three months in a row, hitting a high of 12,52,835 units in September.

A close look at the wholesales data for both November and April-November 2023 reveals that the growth story for the motorcycle segment is here to stay. November was when the overall two-wheeler segment also clocked all-time-high retail sales of 2.24 million units, up 21% YoY. Thanks to increased agricultural income, the strong rural market sentiment is driving demand for fuel-efficient commuter bikes along with a good number of new product launches in the past three months and ramped-up production on the part of OEMs.

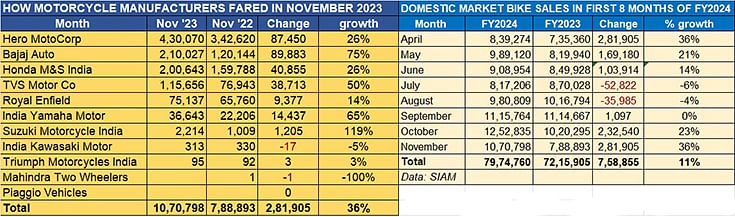

As a result, in November, all the top seven OEMs registered strong double-digit YoY growth with four of them, led by market leader Hero MotoCorp, clocking six-figure sales. Hero MotoCorp with 430,070 bikes had 40% of the bike market, followed by Bajaj Auto with 210,027 units and a 19.61% market share. Honda, just 9,384 units behind Bajaj with 200,643 units, has an 18.73% share while TVS Motor Co, with 115,656 bikes, has a 10.80 share. Royal Enfield (75,137 units, up 14%, 7% share) and India Yamaha Motor (36,643 units, up 65%, 3.42% share) also did well in November.

BAJAJ, TVS, ROYAL ENFIELD INCREASE THEIR BIKE MARKET SHARE

While each of these four bike makers have achieved strong numbers in November, when one looks at company-wise performance and the YoY difference therein, Bajaj Auto stands out – at 210,027 units, the company has sold 89,883 units more in November 2023 than it did in November 2022 (120,144 units). This makes for robust 75% YoY growth (see comparison data table above).

It's the same scenario with the April-November 2023 numbers albeit with a slight difference. TVS Motor Co is the one which has achieved the best gains in terms of more motorcycles sold versus the year-ago period. In the first 8 months of FY2024, TVS dispatched 838,404 units, selling 251,134 units more than it did in November 2022 (587,270 units). Bajaj Auto is next up on this performance front – with 14,75,376 units, it sold 233,363 units more than in November 2022 (12,42,013 units).

At a massive 34,46,092 units, Hero MotoCorp sold 152,917 units more that it did in the April-November 2022 period (32,93,175 units). Midsize motorcycle market leader Royal Enfield has also done well – its 572,982 units are up 19% YoY and make for 89,985 units more than it sold in the year-ago period.

These market dynamics are amply reflected in each company’s motorcycle market share. The data table above shows that of the 11 OEMs, four – Bajaj Auto, TVS Motor Co, Royal Enfield and Suzuki Motorcycle India – have increased their market share.

Bajaj Auto’s strong showing in the past eight months sees it increase it bike market share to 18.50% from 17.21% in April-November 2022 – a difference of 1.29 percent. TVS’s motorcycle share has risen by 2.38% to 10.51% from 8.13% a year ago. Royal Enfield, which is seeing strong demand for many of its bikes, has increased its share to 7.18% from 6.69% a year ago.

The near-term growth scenario for the overall two-wheeler industry looks good. As per FADA president Manish Raj Singhania, this vehicle category is poised to benefit from a liquidity boost, particularly in agricultural regions and the ongoing marriage season, with around 38 lakh marriages expected to drive vehicle sales.

Scooter sales near the 4-million mark in first 8 months of FY2024

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

14 Dec 2023

14 Dec 2023

13294 Views

13294 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi