Maruti Super Carry gains market share in a tough Q1 FY2020

In Q1 FY2020, Maruti Suzuki retailed 6,568 Super Carrys, marking 34.7 percent YoY growth and expanding its market share to 14.1 percent.

At a time when overall commercial vehicle sales are falling massively, with all key segments including M&HCV and LCV goods and passenger carriers seeing a sales decline, Maruti Suzuki India’s mini-truck – the Super Carry – has gained market share in the 2-tonne mini-truck segment. This, while the mini-truck market leader Tata Motors and Mahindra & Mahindra have both registered sales declines.

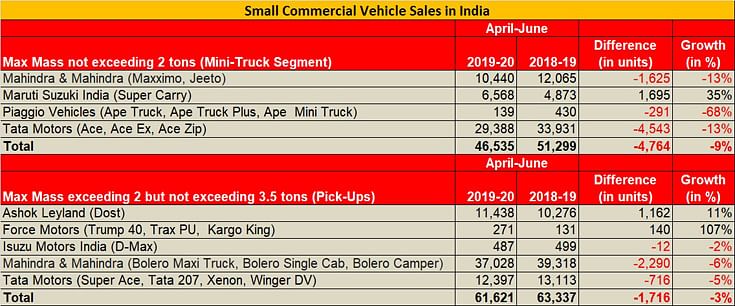

Between April-June 2019, the total LCV segment has fallen by 5 percent to 133,927 units. The goods carrier segment, which has the lion’s share in the segment, sold a total of 118,059 units (-5.4%). The 2T mini-truck segment, the second largest behind the pickups, has declined by 9.2 percent to 46,545 units in Q1.

Tata Motors with its Ace range of small trucks is the segment leader with 63 percent market share with sales of 29,388 units, a drop of 13 percent year on year. Autocar Professional’s data suggests the Ace small CV, which sold 9,911 units in April, dropped significantly to 7,642 units in May and crossed the 9,000-unit mark in June.

Mahindra & Mahindra, the second-largest player in the segment, which retails the Jeeto small truck registered a market share of 22.4 percent with a sale of 10,440 units, down 13.4 percent. The Jeeto clocked its best Q1 FY2020 sales of 2,606 units in April, after which numbers dropped to 2,355 in May and 1,903 in June 2019.

The Maruti Suzuki Super Carry, a late entrant in the segment, has now emerged as No. 3 in the segment, growing its market share in the process. In Q1 FY2020, Maruti Suzuki retailed 6,568 Super Carrys against 4,873 units in the same period a year ago, marking 34.7 percent growth and expanding its market share to 14.1 percent. The monthly numbers are relatively steady for the Carry which sold 2,319 units in April, followed by 2,232 and 2017 units respectively in May and June. During the same period, the company has also shipped 1,019 units to overseas markets including some African countries.

Ashok Leyland Dost sees improved sales traction

The 2-3.5T pickup segment, which comprises the bulk of the small CV sales, sold a total of 61,621 units in Q1 FY2020, down 2.7 percent (Q1 FY2019: 63,337 units.). In this high-growth segment, M&M with its popular Bolero range of pickups remains way ahead of its rivals with a market share of 60 percent. M&M sold a total of 37,028 units, down 5.8 percent. Tata Motors, which retails the Super Ace and Xenon pickups in the segment, sold 12,397 units (-5%) garnering a market share of 20 percent. On the other hand, Chennai-based Ashok Leyland which only retails the Dost small CV, has emerged the No. 3 player. Ashok Leyland sold a total of 11,438 Dosts in Q1 FY2020 (+11%) to have a market share of 18.5 percent.

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

06 Aug 2019

06 Aug 2019

15325 Views

15325 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau