Made-in-India car and SUV exports rise 3% in April-December, 2Ws, 3Ws and CVs still in the red

Of the four vehicle segments, passenger vehicles (+3%) are only the sole category to register growth on the export front. While two-wheelers (-14%), three-wheelers (-24%) and CVs (-17%) are still down, their rate of decline is slowing down in the face of improving demand in key overseas markets.

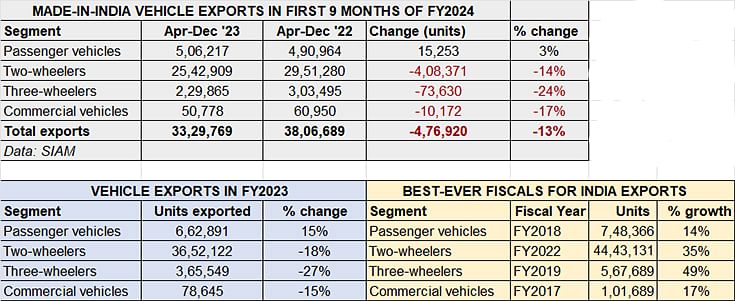

The latest data for export of made-in-India vehicles was released by industry body SIAM (Society of Indian Automobile Manufacturers) on January 12. A quick glance at the export numbers for the first nine months of FY2023reveals that at 3.32 million units, exports are down 13% YoY (April-December 2022: 3.80 million units), which means overall exports comprising two- and three-wheelers, passenger vehicles and commercial vehicles are not out of the woods yet.

Of the four segments, only passenger vehicles are in positive territory (+3%) while two-wheelers (-14%), three-wheelers (-24%) and CVs (-17%) continue to see a sales decline compared to their year-ago performance.

With three months left for FY2024 to close, passenger vehicle OEMs exported 506,217 units are 156,674 units behind FY2023’s 662,891 units, which marked 15% YoY growth. The PV sector’s best-ever fiscal was FY2018 when overseas shipments of cars and SUVs had hit 748,366 units, up 14% YoY.

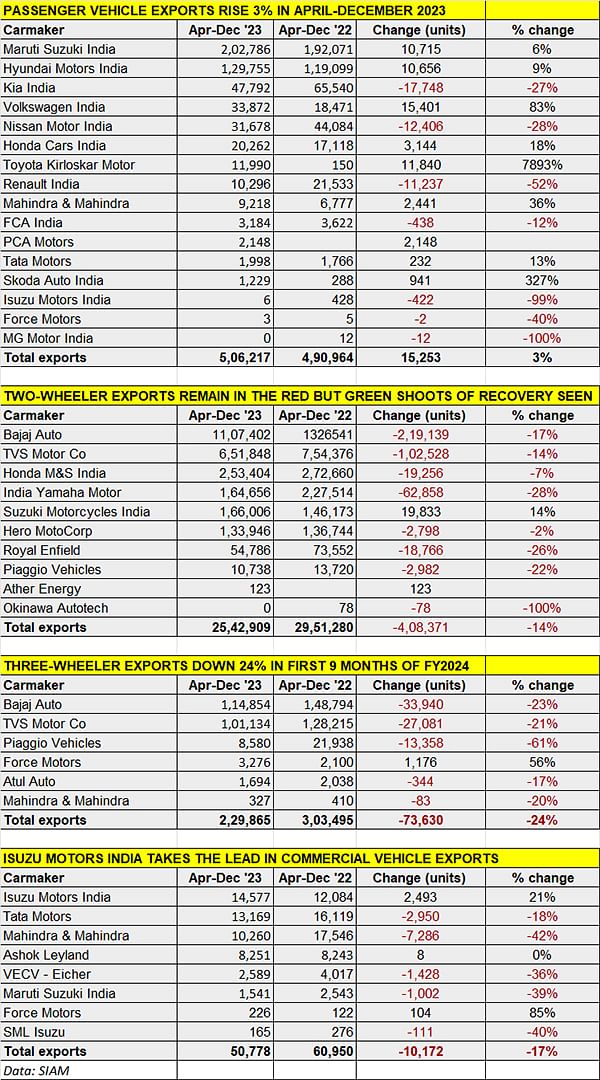

Maruti Suzuki India maintains its lead as the export market leader in the ongoing fiscal with a big lead (see India Auto Inc export data table at the end of this analysis). The company has shipped 202,786 units, up 6%, and has a sizeable lead of 73,031 units over Hyundai Motor India (129,755 units). This mean Maruti Suzuki will go on to be the export market leader for FY2024.

The two-wheeler industry, which is the largest volume provider of export numbers, has exported 2.54 million units in April-December 2023 (-14%), which is at present 1.1 million units short of FY2023’s million units (-18%). The Indian scooter and motorcycle OEMs’ best-ever export performance was in FY2022 when it saw overseas demand soar 35% to 4.44 million units.

The impact of the slowed-down exports can be seen in the performances of all the biggies barring Suzuki which, with 164,656 units, has logged 14% YoY growth. While export leader Bajaj Auto has shipped 11,07,402 units (-17%) in April-December 2023, TVS Motor Co with 651,848 units is down 14% and Honda Motorcycle & Scooter India (253,404 units) is also down 7 percent. India Yamaha Motor (164,656 units) is down 28% YoY. Hero MotoCorp (133,946 units) is down 2% and Royal Enfield (54,786 units) is down 26 percent.

Total three-wheeler exports in April-December 2022 at 229,865 units are down 24% YoY and still 135,684 units shy of FY2023’s 365,549 units (-27%). This segment had its best fiscal in FY2019: 567,689 units, up 49 percent.

Bajaj Auto, which leads the three-wheeler sector in domestic market sales, is also the export leader. At 114,854 units dispatched overseas in April-December 2023, its exports are down 23% while those of TVS Motor Co (101,134 units) are down 21 percent.

The commercial vehicle industry’s April-December 2023 export tally is 50,778 units, down 17% YoY, and 27,867 units away from its FY2023 exports of 78,645 units / -15%). The CV sector’s best-ever export sales were in FY2017 when it had shipped 101,689 units overseas and recorded 17% growth.

There is a big change in the CV export rankings. Isuzu Motors India has wrested the No. 1 export title from Tata Motors for the April-December 2023 period with shipments of 14,577 units (up 21%) compared to Tata’s 13,169 units).

As can be seen, the rate of decline is slowing down for two- and three-wheeler exports, which in FY2023 and the first quarter of FY2024 had witnessed a marked decline in sales in their key markets, especially Africa and some emerging countries. This had, at the time, been attributed to the devaluation of currencies, as well as forex challenges, in some of those markets.

What is helping the cause of Indian OEMs is the booming domestic market, which has seen retail sales increase 11% in CY2023 to 23.8 million units, and that too with all segments recording strong growth.

ALSO READ:

Industries minister Piyush Goyal urges India Auto Inc to aim for 50% export share of sales

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

14 Jan 2024

14 Jan 2024

9872 Views

9872 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi