Legacy OEMs outsell Top 20 electric 2W startups, command 55% market share in April

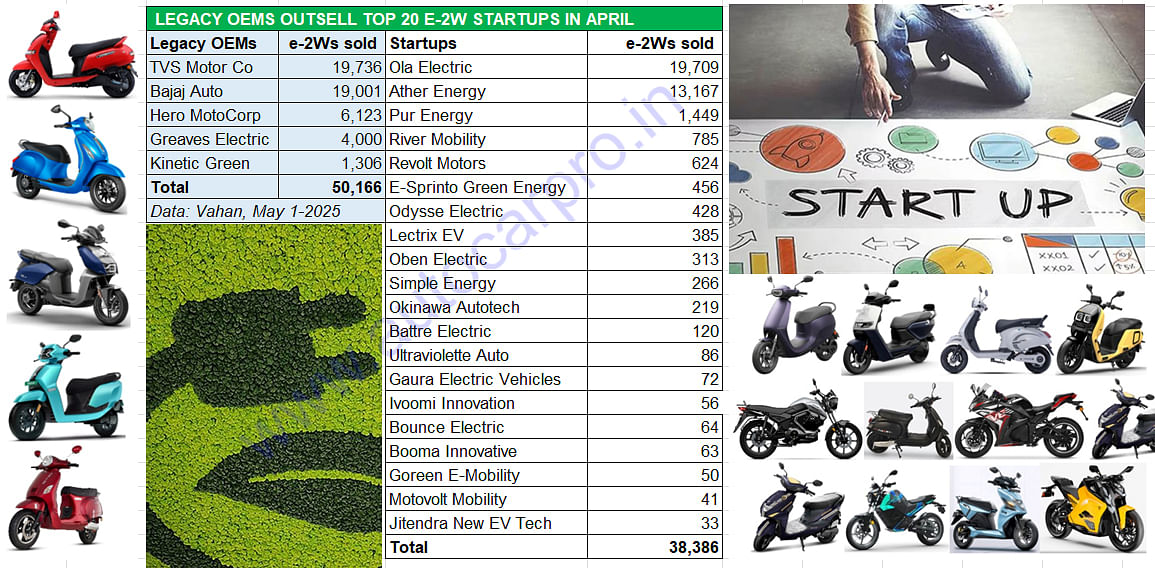

With sales of 50,166 electric scooters in April 2025 and a 55% share of the 91,791 e-two-wheelers sold in April 2025, TVS Motor, Bajaj Auto, Hero MotoCorp, Greaves Electric and Kinetic Green have stamped their dominance over 20 of their startup rivals led by Ola, Ather Energy, Pur Energy and Revolt Motors which together sold 38,386 units, thereby showcasing their resilience, product power, brand connect and marketing strength.

FY2026 has opened on a strong note for the Indian electric two-wheeler industry which has all of 188 companies, a minuscule few of which are legacy two-wheeler OEMs while a good lot are startup companies. In April 2025, the first month of the new fiscal, a total of 91,791 electric scooters, bikes and mopeds were sold, which makes for stellar 40% YoY growth and beats the previous best of 66,878 units in April 2023. TVS Motor Co has topped the monthly sales for the very first time with 19,736 units, pipping Ola Electric and Bajaj Auto which also sold over 19,000 units last month.

The Indian e-2W industry, which is the mover and shaker of the overall EV industry in terms of volume, has for long been populated by startups led by Ola Electric and Ather Energy along with a host of smaller players. Now, particularly since the past three years, this segment is witnessing legacy ICE players, which have diversified into EVs on two wheels, banish the startup competition in the zero-emission game.

Arch rivals Bajaj Auto and TVS Motor Co were the first legacy OEMs to bite the EV bullet, both having launched their products – the Bajaj Chetak and TVS iQube – in January 2020. Since then, both companies have taken giant strides with their two-wheeled EVs.

Hero MotoCorp, the world’s largest two-wheeler OEM, entered the fray rather belatedly with its Vida brand in early 2022 albeit it had invested in Bengaluru-based smart e-scooter startup Ather Energy in 2016, starting with a 30% equity stake. More recently, Honda Motorcycle & Scooter India and Suzuki India have plugged into the e-2W market albeit it is early days for them yet.

While Autocar Professional’s comprehensive e-2W retail sales analysis of April 2025 sales is a deep dive into the market performance of the Top 6 OEMs – Ola, TVS, Bajaj Auto, Ather Energy, Hero MotoCorp and Greaves Electric Mobility, last month also saw the top five legacy ICE OEMs (TVS, Bajaj, Hero MotoCorp, Greaves Electric Mobility and Kinetic Green Energy) outsell their Top 20 EV startup rivals by fair margin.

The battle between the legacy players (TVS, Bajaj Auto, Hero MotoCorp, Greaves Electric Mobility and Kinetic Green) and the leading startups led by Ola and Ather Energy will continue in right earnest in FY2026.

The battle between the legacy players (TVS, Bajaj Auto, Hero MotoCorp, Greaves Electric Mobility and Kinetic Green) and the leading startups led by Ola and Ather Energy will continue in right earnest in FY2026.

FIVE LEGACY OEMS COMMAND 55% OF INDIA’S E-2W MARKET vs 42% BY 20 STARTUPS

As the legacy OEM-wise and startup-wise retail sales table above indicates, the Top 5 legacy OEMs with combined sales of 50,166 units have outsold their startup rivals by 11,780 units – the 20 startups’ combined sales add up to 38,386 units.

Arch ICE and now EV rivals TVS (19,736 iQubes) and Bajaj Auto (19,001 units) have both sold over 19,000 units in April and are separated by just 735 units. While Hero MotoCorp has opened FY2026 with strong sales of 6,123 Vida 1 and 2 e-scooters, Greaves Electric Mobility saw 4,000 of its EVs beng bought last month. And Kinetic Green Energy, which sells a clutch of e-scooters and India’s sole ero-emission moped, the e-Luna, sold 1,268 units.

Together, these five OEMs command a 55% share of the total e-2Ws sold in April 2025 comprising TVS’ 22% share, Bajaj Auto 21%, Hero MotoCorp 7%, Greaves Electric Mobility 4% and Kinetic Green a 1% share. The balance 45% market share is made up of a 42% share belonging to the Top 20 startups and the remaining 3% fought over by 163 other players.

Ola Electric leads the Top 20 Startups table with 19,709 units (21% share of e-2W sales in April), followed by Ather Energy (13,167 units, 14% share). Pur Energy is third with 1,449 units and a 2% share of India e-2W sales last month. The remaining 17 startups add another 4,061 units to the startup total of 38,386 units.

While the 5 legacy OEMs have a 55% share of the 91,791 e-two-wheelers sold in April 2025, the Top 20 e-2W startups rivals with 38,356 units account for 42%, leaving the remaining 3% to 163 othe players.

While the 5 legacy OEMs have a 55% share of the 91,791 e-two-wheelers sold in April 2025, the Top 20 e-2W startups rivals with 38,356 units account for 42%, leaving the remaining 3% to 163 othe players.

Not very long ago, it was felt that EV startups on two wheels, with their perceived absence of legacy issues, IT technology prowess, venture capital investments and the ability to burn cash to get a foothold in the market, would stamp their dominance on this segment of zero-emission mobility. However, TVS Motor, Bajaj Auto and Hero MotoCorp, the top three legacy ICE OEMs which have diversified and plugged into e-mobility, are proving to be a resilient lot and are giving the two-wheeler startup world a run for their money and more. These three companies, which have a strong R&D setup and component supplier base, are clearly benefiting from their growing localisation levels, introduction of new variants, brand power and the marketing strength that comes from a large dealer network spread across the country.

Where startups have a head-start in the Indian e-2W industry is in the electric motorcycle arena. While none of the five legacy OEMs barring TVS (with its X motorcycle which is yet to be introduced in the market) and Hero MotoCorp, which is collaborating with the USA’s Zero Motorcycles for electric bikes, have launched a zero-emission motorcycle, a number of startups including Ola Electric, Revolt Motors, Oben Electric, Odysse EV and Ultraviolette Automotive (in which TVS has a stake) have launched their products with varying degree of success.

The battle between old and new OEMs for the electric two-wheeler buyers will continue in FY2026. Stay plugged in as we bring you the latest news, views and analysis on this exciting eco-friendly segment of two-wheeled motoring.

AUTOCAR INDIA DEEP DIVE PODCAST:

Legacy giants & startups battle for electric 2-wheeler supremacy

<>

RELATED ARTICLES

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

02 May 2025

02 May 2025

18241 Views

18241 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal