India’s best-selling UVs this April-July, Hyundai breezes ahead in market share

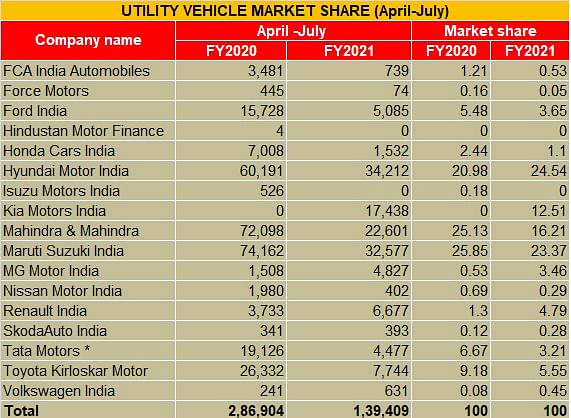

Hyundai Motor India is upping the UV ante with every passing month. In the first four months of FY2021, it leads with 24.54%, followed by Maruti (23.37%), M&M (16.21%) and Kia (12.51%)

FY2021 has had a dismal start what with the Covid-induced lack of demand, social distancing norms that have led to a shift in OEM marketing strategy, reduced production and the generally dampened economy. The passenger vehicle sector has felt the heat and how: the April-July 2020 period has seen total sales of 336,513 units, down a massive 62.73% year on year. Cars are down 67% (182,824), UVs down 51% (139,409) and vans down 72% (14,280). However, not all is doom and gloom.

The rate of decline is slowing for the PV segment and sub-segments, month on month, and as July numbers revealed, the utility vehicle (UV) is back in the black (the sole one of the three sub-segments) and how. At 71,384 units sold in July, the YoY growth was a smart 14%. Driving this growth are a few standout models from four major UV players who, going forward, will continue to make a difference in the UV sales chart. All these four OEMs are also the only vehicle manufacturers to have UV market share in double digits. Let’s take a closer look at them and their performance in April-July 2020, first four months of FY2021.

Hyundai Motor India: 34,212 units

UV market share: 25.54% (up from 20.98% YoY)

Hyundai Motor India usurped the No. 1 UV market share position from Maruti Suzuki India in June itself. Now, it has further upped the ante. With total sales of 34,212 units, which constitute 24.54% of total UV industry sales (139,409), Hyundai is the best-selling UV manufacturer in the April-July 2020 period. Leading the charge for the company are its two key models, the new Creta and the Venue compact SUV.

Hyundai sales

Creta: 21,968

Venue: 12,105

Tucson: 93

Kona: 46

Total: 34,212

The new and second-generation Creta, launched in end-March, just before the nation-wide lockdown kicked in, is the star performer for the carmaker. With a strong 11,549 units sold in July 2020, which is 75% year-on-year growth (July 2019: 6,585), this SUV accounted for 16% of total UVs sold in the domestic market last month (71,384). Importantly, sales are rising month on month. The new Creta was India’s No. 1 UV in the Covid-impacted May with 3,212 units, and more than doubled that score with 7,207 units in June. The SUV sold a total of 21,968 units in the first four months of FY2021.

The Venue has contributed 12,105 units to Hyundai’s overall tally but sales are slowing down for this model. Year on year, Venue numbers are down 52.33% (April-July 2019: 25,397). The surging demand for the new Creta as well as growing competition in the compact USUV market could be the reason but expect Hyundai to pull out a few smart moves to get the Venue’s momentum going again. Hyundai's digital 'Click To Buy' campaign seems to have clicked with consumers, which is a pointer to the company’s current strong position in the UV chart.

Maruti Suzuki India: 32,577 units

UV market share: 23.37% (down from 25.85% YoY)

Just 1,635 units separate India’s largest carmaker and passenger vehicle market leader from UV market share leader Hyundai Motor India. Maruti Suzuki India, which has strategically divested itself from the diesel engine, would have lost some sales to competitors on this account. But the company is fighting back with petrol power.

With total sales of 32,577 units in the April-July 2020 period, the company is seeing a resurgence of demand. July 2020 saw the carmaker sell a total of 97,768 units (1.3%), putting it back in the black. Importantly, for Maruti Suzuki, the buzz is back where it matters: the UV segment. The five-car lot of the Gypsy, Ertiga, S-Cross, Vitara Brezza and XL6 sold a total of 19,177 units, up 26.3%, last month (July 2019: 15,178). Let’s see how they performed in the April-July period.

Maruti Suzuki sales

Ertiga: 14,163

Brezza: 12,921

XL6: 3,783

Gypsy: 1,259

S-Cross: 451

Total: 32,577

The past few months have seen the introduction of the petrol-only S-Cross and the Vitara Brezza.

Mahindra & Mahindra: 22,601 units

UV market share: 16.21% (down from 25.13% YoY)

Mahindra & Mahindra has seen the growing UV competition eat substantially into its market share, which has dropped by nearly nine percentage points. The rapid market shift from diesel-engined UVs to petrol power could be said to have impacted Mahindra adversely. In the April-July 2020 period, the share of diesel UVs in India has dropped from 76% to 45% while that of petrol UVs has risen from 24% in April-July 2019 to 55% now.

Having recognised this change in consumer preference early on, M&M is speedily changing the perception of being a predominantly diesel-driven automaker to one that has also embraced the latest in petrol-engine technology. At Auto Expo, the company revealed the all-new range of turbo-gasoline-direct-injection (TGDI) petrol engines that will power upcoming Mahindra models. Here’s looking at the models that sold for M&M between April and July 2020.

M&M sales

Bolero Power Plus: 6,614

Scorpio: 6,422

XUV300: 5,588

Bolero: 2,753

XUV500: 1,080

KUV100: 124

Marazzo: 20

Total: 22,601

On August 15, M&M took the covers off the soon-to-be-launched Thar, which gets a petrol engine for the first time in the form of the 2.0-litre ‘mStallion’ turbo-petrol powerplant. There’s also a new diesel (2.2 MHawk) which kicks off a new generation of efficient diesel engines from M&M. The Thar, which will be sold in two versions – AX and LX – is now more of a mainstream product with several comfort features. Expect the Thar to add some fizz and more to Mahindra sales numbers after it is launched on October 2.

Kia Motors India: 17,438 units

UV market share: 12.51%

If there is a company that has firmly implanted its stamp on the Indian market in recent times, then it is Hyundai sibling Kia Motors. Right from its entry last August with the Seltos SUV and later with the Carnival MPV, Kia Motors India seems to have ticked all the right boxes.

It may be recollected that in FY2020, in a short span of 8 months, Kia grabbed an 8.97% share of the UV market with sale of 84,903 units (81,716 Seltos SUVs and 3,187 Carnival MPVs), becoming the new No. 4 UV player after Maruti Suzuki India (24.87%), Mahindra & Mahindra (18.96%), Hyundai Motor India (18.69%) and ahead of more well-established OEMs like Toyota Kirloskar Motor (7.07%), Tata Motors (6.28%) and Ford India (4.68%).

Now, it looks to be taking that performance further. In the first four months of FY2021, with sale of 17,438 units, the company’s UV market share has increased to 12.51 percent – a remarkable performance for an automaker which has just turned a year old in the competitive Indian market. And it has recently revealed its third product – the snazzy Sonet compact SUV – which going from the robust bookings has all the makings of a standout performer in FY2021. In the April-July

2020 period, Kia sold 17,438 units.

Kia sales

Seltos: 16,998

Carnival: 443

Total: 17,438

Hyundai-Kia UV market share now 38%

The Korean combine of the Hyundai and Kia brands is making a strong statement in the overall Indian PV market, more so in UVs. The combined market share of the two OEMs is a strong 38.05% (Hyundai Motor India: 25.54% and Kia Motor India: 12.51%), 10 percentage points more than the 27.66% the two Korean carmakers had in FY2020. How will FY2021 pan out for these two challengers?

The thriving UV market is set to turn even more exciting in the coming months, what with the launch of the Kia Sonet and the Toyota Urban Cruiser compact SUVs in September, the new Mahindra Thar in October and other new products later in the year. Watch this space for more.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

29 Aug 2020

29 Aug 2020

12026 Views

12026 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal