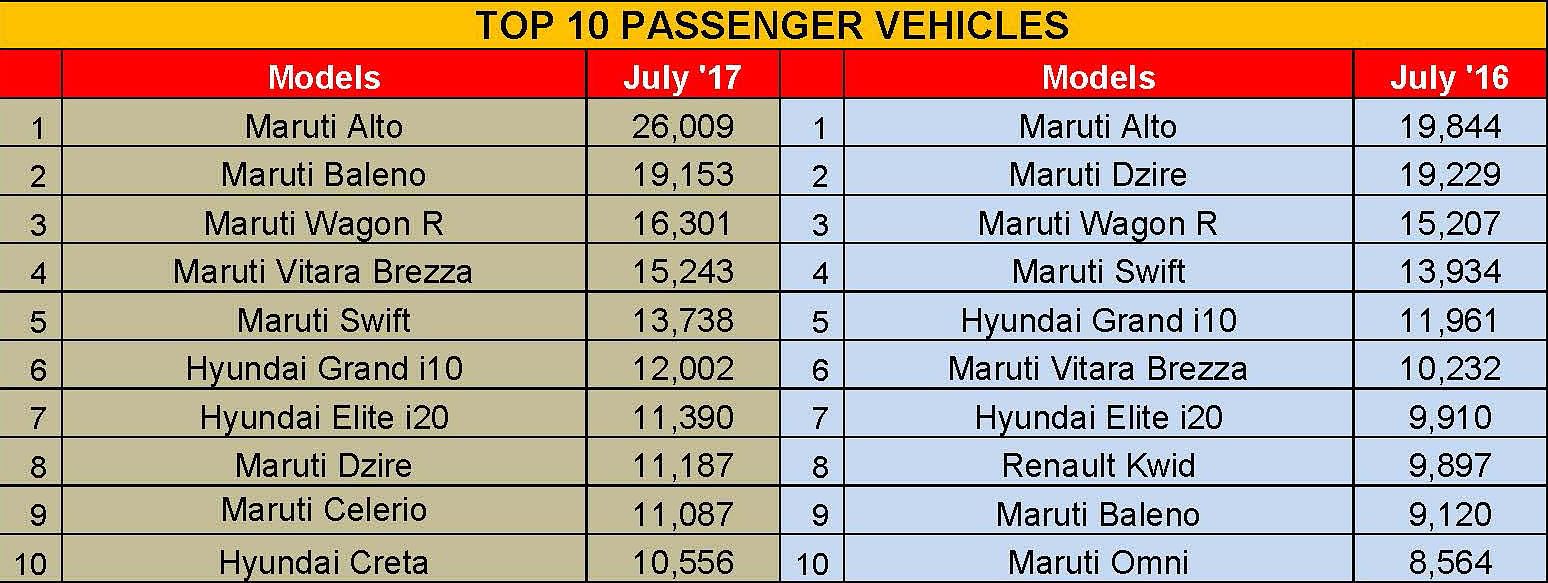

India Sales: Top 10 Passenger Vehicles – July 2017 | A Maruti and Hyundai show of strength

As GST-driven price cuts help boost PV sales to a record high, the country’s largest carmaker further strengthens its stranglehold on the domestic market. The Vitara Brezza, Celerio and Hyundai Creta notch their best-ever monthly sales.

With GST-driven price reductions kicking in from July 1, it was a no-brainer that sales of passenger vehicles (PVs) in the month would accelerate, what with pent-up demand from June and huge bargain buys to be had, particularly in the SUV segment.

Overall PV sales in the month rose 15.12% to 298,997, just 1,003 units shy of the 300,000 mark, posting a new monthly highly for the domestic PV industry. This translates into 9,645 vehicles sold on each day. Maruti Suzuki India accounted for 153,298 of that overall PV industry total, or an overwhelming 51.27% of sales. Not surprising considering the first four months of fiscal year 2017-18 have seen the company increase its market share to 50.72% from 46.83% a year ago. With sales of 520,684 units in April-July 2017, out of a cumulative industry total of 1,026,655 units, every second PV sold in India is a Maruti.

Maruti Suzuki’s unrivalled dominance of the domestic market is amply seen in the monthly Top 10 sales chart, which is swamped with six to seven of its models. It’s the same show in July 2017 with seven Marutis – five hatchbacks, one sedan and one SUV – in the top-selling PVs list, leaving the remaining three to Hyundai Motor India.

The top five cars are Marutis and ruling the Top 10 chart is the Alto which remains a popular entry-level buy and the longstanding budget champion. The 26,009 units sold in July 2017 constitute the highest monthly sales for the hatchback since September 2016’s 27,750.

At No. 2 is the premium Maruti Baleno, the largest of the company’s hatchbacks. This car, which comes with ABS and dual airbags as standard across the 11-variant range, sold a total of 19,153 units, its best-ever monthly total since launch in October 2015, and ahead of the 17,530 units sold in April 2017. At the end of July 2017, the Baleno has sold a total of 225,870 units since launch. Over the 22-month period, this translates into average monthly sales of 10,266 units.

The Maruti Wagon R takes third place with 16,301 units. This user-friendly, easy to drive and easy to live with hatchback for reasonable money continues to draw both urban and rural buyers into showrooms.

At No. 4 is the game-changing Maruti Vitara Brezza which has notched its best-ever monthly sales: 15,243 units, ahead of May 2017’s 12,375 units which was the best until now. This takes the Brezza’s cumulative domestic market sales to 160,767 units. For Maruti, its first crack at the sub-four-metre segment has proved to be among its most successful launches in the recent past, ticking all the right boxes in terms of cabin space, equipment, safety and fuel economy.

On July 20, Autocar Professional broke the news about the Brezza breezing past the 150,000 unit sales landmark in 17 months since launch on March 8, 2016. Thanks to the surging consumer demand for the model, the Vitara Brezza has been in the Top 10 PV and Top 5 UV charts across 15 months.

The snazzy Maruti Swift drives in at No 5 in July 2017 with 13,738 units sold. This hatchback has been around for some time but buyers can’t seem to get enough of it. It remains desirable due to its styling, the strong engines, tight handling and smart interiors. It is down on space compared to most rivals, but if space isn’t a concern, it is the best hatchback for the money.

Hyundai Motor India enters the Top 10 chart at No. 6 with its Grand i10 hatchback which went home to 12,002 buyers. According to Autocar India, this is one of Hyundai’s best cars – a practical, well-built hatch which, with the recent round of updates, offers even more. The top-spec variants get more features, the petrol engine has been made more efficient and the diesel now provides greatly improved performance.

No. 7 is the Grand i10’s sibling – the Hyundai Elite i20 which sold 11,390 units last month. Between January-July 2017, the car has sold a total of 79,602 units, which makes for an average monthly sale of 11,371 units and a key contributor for the Korean carmaker in India.

The new Maruti Dzire, which sold 11,187 units, is the sole sedan in the Top 10 list and takes eighth place. The third-generation model, which was launched on May 16 this year, offers more interior and boot space along with increased safety features and premiumness. It is targeted at a young India and is aimed at reviving sales of India’s best-selling sedan, which has sold a cumulative 1.38 million units from launch in 2008.

With sales of 11,087 units, the Maruti Celerio is at No. 9. This is yet another Maruti product which has notched its best-ever monthly sales. The previous best was 10,879 units in January 2017, exactly three years after the hatchback’s launch.

The Hyundai Creta SUV wraps up the Top 10 list with sales of 10,556 units in July 2017, its best-ever sales yet in a month and the second time that it has sold over 10,000 units since its launch in June 2015. The first landmark was in March 2017 when the Creta was bought by 10,001 buyers – 5,947 diesel and 4,054 petrol variants.

Overall, July was a month which revealed the real potential in the market for PV sales, given the right incentives. India’s PV industry, which clocked its best-ever fiscal sales in FY2017 of 3,046,727 (+9.23%) and drove past the 3-million mark for the first time, will have to contend with a sales speedbreaker in the form of the additional 10% GST cess. Before the proposed hike from 15% to 25% was announced earlier this month, it was felt that apex industry body would have to revise its FY2018 growth forecast of 7-9%. Now it looks set to be the same, much to the chagrin of PV manufacturers and the automotive industry at large.

Data: Courtesy SIAM

Also read: Maruti Suzuki and Honda increase PV market share in April-July 2017

India Sales: Top 10 Scooters | Exciting battle underway between Hero Maestro and Honda Dio

India Sales: Top 5 Utility Vehicles – July 2017: Vitara Brezza, Creta & Innova clock best-ever sales

India Sales: Top 10 Two-Wheelers in July 2017 | TVS Jupiter outsells XL Super & Bajaj Pulsar

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

20 Aug 2017

20 Aug 2017

10778 Views

10778 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi