INDIA SALES ANALYSIS: OCTOBER 2016

While a capacity-crunched Maruti Suzuki sees only 2.2% growth, Hyundai Motor India and Tata Motors post their highest-ever monthly sales in October.

November opened with a flurry of Indian automakers releasing their domestic sales numbers for October 2016. What’s amply clear is that most OEMs have benefited from much-improved customer sentiment, even as other factors like the lifting of the diesel ban in Delhi-NCR, festive season demand and the better-than-expected monsoon across the country gave a fillip to overall numbers.

The stronger festive demand has come on the back of the payouts of the Seventh Pay Commission, a marked improvement in consumer buying trends from rural India, following a good monsoon season, new models and a high level of discounting on older models.

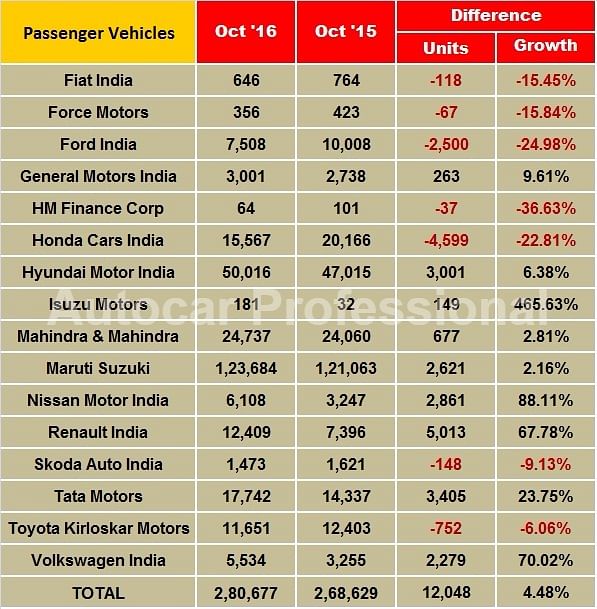

Contrary to expectations that festive demand would drive a sales surge for its models, Maruti Suzuki India has seen marginal sales growth of 2.2% in October 2016 with total domestic sales of 123,764 units (October 2015: 121,063). The manufacturing capacity crunch at its Gurgaon and Manesar plants as well as demand for rival products, with attractive discounts on offer, seem to have taken their toll on the sales performance of the country's largest carmaker.

The bread-and-butter duo of the Alto and Wagon R sold a total of 33,929 units, down 9.8% year on year (October 2015: 37,595). Meanwhile, the Swift/Ritz/Celerio/Baleno/Dzire quintet sold a total of 50,116 units last month, down 1.8% (October 2015: 51,048).

Demand for the Dzire Tour taxi was also down at 2,481 units, down 27.4% (October 2015: 3,418).

The premium Ciaz sedan though saw 8% year-on-year growth with 6,360 cars going home to new buyers last month (October 2015: 5,890).

Overall, the company’s passenger cars sold a total of 92,886 units, down 5.2% year on year (October 2015: 97,951).

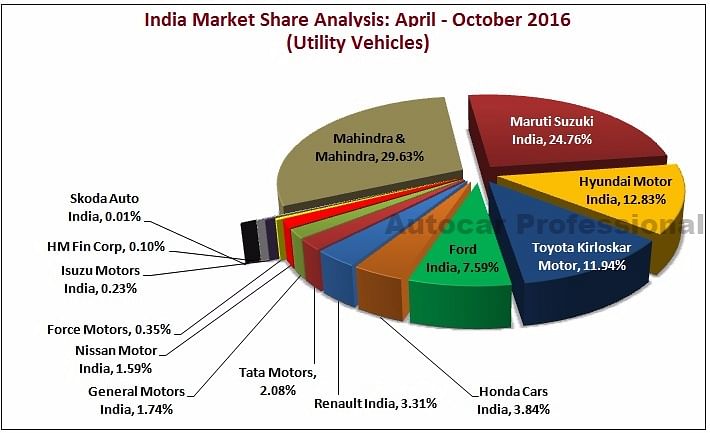

What helped Maruti Suzuki was the surging demand for the popular Vitara Brezza which, along with the Gypsy, Ertiga and S-Cross, sold 18,008 units, a 90.9% year-on-year increase (October 2015: 9,435).

In the case of the Vitara Brezza SUV, the current waiting period is a uniform 6 months across variants. Earlier the top-end ZDi and ZDi+ trims, which are very popular with buyers, had a waiting period of close to 9 months. The reduction in the waiting period is due to Maruti Suzuki ramping up capacity to 9,000-10,000 units per month for the Vitara Brezza at the Gurgaon plant and to 11,000-12,000 units a month for the premium Baleno hatchback at Manesar.

The Omni and Eeco vans, which typically post decent growth, saw demand slide 6.5% to 12,790 units (October 2015: 13,677). The Super Carry LCV, which was launched on September 1, sold 80 units in October.

Maruti Suzuki’s exports too have taken a hit in October 2016, with total despatches to overseas markets totaling 10,029 units, down 23.7% (October 2015: 13,146). What’s clear is that the carmaker has given preference to production for the domestic market in view of the festive demand for its cars. All put together, the carmaker's domestic and exports add up to 133,793 units in October 2016, pointing to flat growth (-0.3%).

Given the considerable demand for key models like the Baleno and the Vitara Brezza, Maruti Suzuki will be eagerly looking forward to the opening of the new Gujarat plant in early 2017. This will help free up capacity and give the stretched-for-capacity manufacturer new dynamics of production.

No. 2 player Hyundai Motor India posted its highest-ever domestic sales – 50,016 units. A year-on-year growth of 6.4 percent (October 2015: 47,015). Exports at 14,356 units, however, were down by 2.2%.

Commenting on the October sales, Y K Koo, MD and CEO, Hyundai Motor India, said, “Hyundai with a highest-ever domestic volume of 50,016 units registered record cumulative sales of 64,372 units in October 2016. Hyundai achieved the highest and fastest domestic sales of 50,000 units mark within 15 months from the earlier milestone of 40,000 units.”

“The recently launched new Elantra received an overwhelming response with 1,509 bookings resulting in a 4-5-month waiting period,” he added.

Mahindra & Mahindra’s (M&M) passenger vehicle sales in October 2016 stood at 24,737 units, up 3% YoY (October 2015: 24,060).

Demand for the company’s UVs, particularly the Bolero, Scorpio and TUV300, at 23,399 units were also a 3% increase over year-ago sales (October 2015: 22,664)

According to Pravin Shah, president and chief executive (Automotive), M&M, “The festive season has brought about some cheer for the automotive industry with improved sentiment, on the back of a near- normal monsoon, rural surge in demand and some new vehicle launches. Some of our power brands such as the Bolero, Scorpio, TUV300 and the pickups have performed well. At Mahindra we are happy to achieve a 28% growth in our exports. We have expanded our electric vehicle portfolio (zero emissions) over the last one month by adding the eSupro range and the e2oPlus. We have a cumulative growth of 12% in UV, 19% in Exports and a 9% overall growth and hope to see the growth momentum continue for the remaining part of the year.”

October 2016 was a good month for Tata Motors, which has seen a good market response to the Tiago hatchback. The company sold a total of 16,311 units last month, up 28% YoY (October 2015: 12,747). This is its highest monthly sales number for the past four years and includes a sharp increase in sales of the Zest sedan.

In the April-October 2016 period, Tata Motors has recorded cumulative sales of 88,976 passenger vehicles, a growth of 15% (April-October 2015: 77,465).

According to Mayank Pareek, president, Passenger Vehicle Business, Tata Motors, “We have recorded the highest sales in the past four years with a growth of 28% in October 2016. While we have been growing month-on-month, the festive season has further ushered in strong growth impetus for us. The Tiago continued to receive a strong response and the Tata Zest retails were the highest ever since launch, during this festive season. All our other products also saw increased traction in the market. Also, we secured the second highest score in the J D Power 2016 Syndicate Customer Service Index Study, which is the highest increase in score in the industry, this year. We are also receiving encouraging feedback on the Tata Hexa and are gearing up for the launch in January 2017. We remain committed to offering our customers an exciting product and service experience with best-in-class purchase and aftersales service across our dealerships. These achievements are a proof of our consistently focused efforts towards achieving our vision to be among the top three in the domestic passenger vehicle market by FY2019.”

Honda Cars India, which sold 15,567 units in October 2016, saw sales dip 23% (October 2015: 20,166). The product-wise breakup is The company registered monthly Domestic Wholesales of 15,567 units and Exports of 289 units in October 2016.

The City sedan was Honda’s best-seller with 6,378 units, followed by the Amaze with 4,009 units and the Jazz hatchback with 3,011 units. The other contributors to the monthly sales were the BR-V (1,070), Mobilio (498), CR-V (41) and the Brio (535). The recently launched Accord Hybrid has sold 25 units.

Toyota Kirloskar Motor sold a total of 11,651 units, down 6.06% (October 2015: 12,403) in the domestic market. The company also exported 974 units of the Etios series in October 2016, down 18.69% (October 2015: 1,198).

Commenting on the monthly sales, N Raja, director and senior VP (Sales & Marketing) said: “Sale in the festive months of September and October put together has helped us clear most of our inventory in the plant as well as at our dealerships. We have seen a huge pull from the market in the last two months, especially for the Innova Crysta which has been doing phenomenally well ever since its launch in May 2016.

The Innova Crysta has registered 45% growth from May to October 2016 when compared to sales in the same period last year. The Crysta still has a waiting period of a month in certain parts of the country and we are trying our best to bring this further down. Our newly launched Platinum Etios has also received a good response from the market.”

Ford India sold a total of 7,508 vehicles, down 25% (October 2015: 10,008) in the domestic market. Its exports of 14,535 units rose 40% compared to 10,412 units in October 2015.

“The automotive industry is seeing the impact of a good monsoon, Seventh Pay Commission and other macroeconomic indicators like inflation. As we look for the industry momentum to sustain, Ford remains committed to its strategy of product-led innovation, a differentiated customer experience, and breaking the myth on our cost of ownership,” said Anurag Mehrotra, executive director (Marketing, Sales & Service), Ford India.

Nissan Motor India has reported sales of 6,108 units in October 2016, up 88% (October 2015: 3,246). Commenting on the sales results, Arun Malhotra, managing director, Nissan Motor India, said, “Our solid performance and overall growth of 88 percent in October has been possible with the continued robust performance of the Datsun Redigo and the tremendous response to the recently launched Redigo Sport version.”

For the April-October 2016 period, the company has posted overall growth of 54 percent with sales of 35,147 units (April-October 2015: 22,180).

Volkswagen India, which launched the Ameo Diesel on September 30, has seen marked sales growth in October 2016. It could be surmised that the diesel variant of the made-for-India, made-in-India Ameo compact sedan has given a fillip to overall numbers. The Pune-based carmaker sold 5,554 units, up 70% (October 2015: 3,255).

According to Michael Mayer, director, Volkswagen Passenger Cars India, “With our recent launches, we are well on course to give customers, even more, reasons to visit Volkswagen showrooms. We are confident in continuing to improve our performance in sales and service in the coming months along with exciting new products on the anvil.”

Volkswagen attributes the increase in sales to a larger bouquet of product portfolio that the brand is now offering to the Indian audience combined with the growing demand this festive season. Volkswagen recently announced Volksfest 2016, with special festive offers that garnered a tremendous response and welcomed several new customers to the Volkswagen family.

Domestic PV sales growth to accelerate to 10-12% in FY2017

The smart overall auto industry growth in September (+20.16) has seen industry pundits revise their growth forecasts. ICRA has revised upward its growth outlook for FY2017 from 8.5%-9.5% earlier to 10%-12% range for FY2017, in the backdrop of better than expected ramp-up in demand momentum.

The ratings agency expects domestic PV sales growth to accelerate to 10%-12% during FY2017 and maintains a 9%-10% CAGR estimate over the next five fiscals. While it sees overall capacity utilisation level in the industry as modest, the statistics vary significantly across OEMs. While some carmakers like Maruti Suzuki India and Hyundai Motor India are currently operating at near full capacity, other OEMs are operating below 30% capacity and incurring operating losses. In order to address the capacity utilisation issue, OEMs like GM India, Volkswagen India, Ford India and Nissan Motor India have, since long, been using their Indian operations as an export hub for small cars. A move which has helped them improve the overall utilisation of the Indian operations.

Barring exception of a few players, the industry’s profitability metrics are unlikely to witness material improvement in the near term, despite improved prospects of sales volume growth in view of the need for expenses towards new product development, increase in employee expenses and likely sustenance of discounts-led sales push resulting from restricted pricing power in the wake of intense competition.

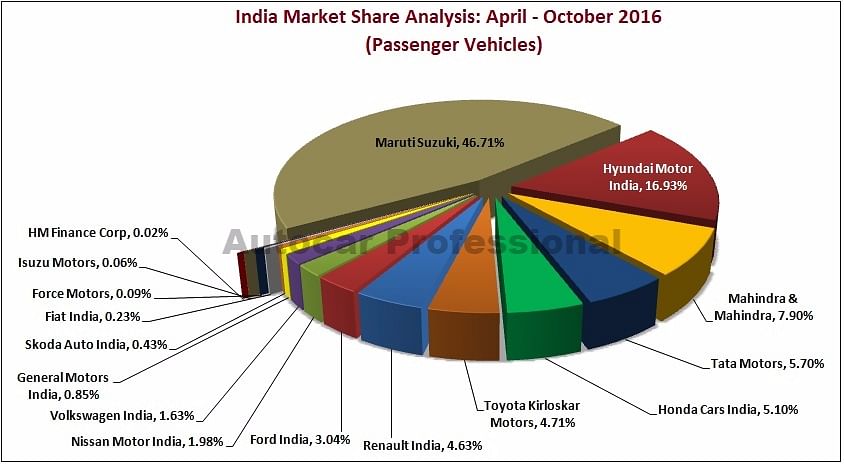

According to ICRA, the market share in the domestic PV segment is expected to remain concentrated over the medium term, with the top five players constituting over 80% of the overall market (Maruti Suzuki currently has an overwhelming 47.21% market share, Hyundai Motor India 16.77%, Mahindra & Mahindra 7.7%, Tata Motors 5.58% and Toyota Kirloskar Motor 4.82%). This implies that profitability pressures on the relatively low volume players may be even higher, resulting in sustained dependence on external financing to fund losses and capital expenditure requirements. Nevertheless, players having low volume in the domestic market can leverage on labour arbitrage present in the Indian market and develop Indian facilities as an export hub for their small car requirements globally.

SALES LIGHT UP TWO-WHEELER OEMs IN OCTOBER

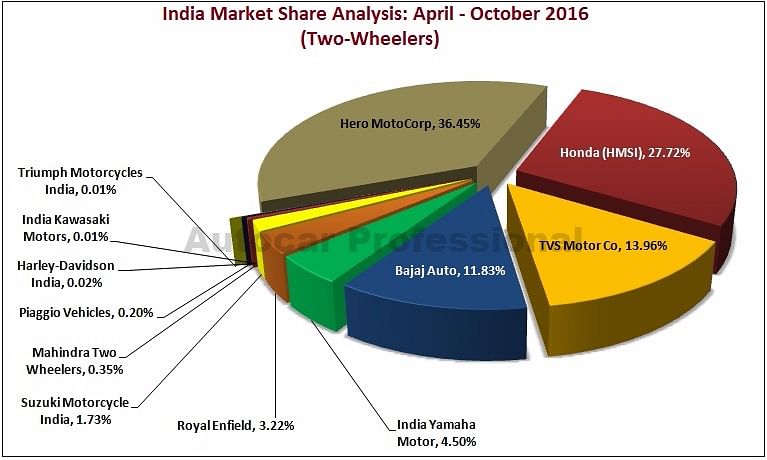

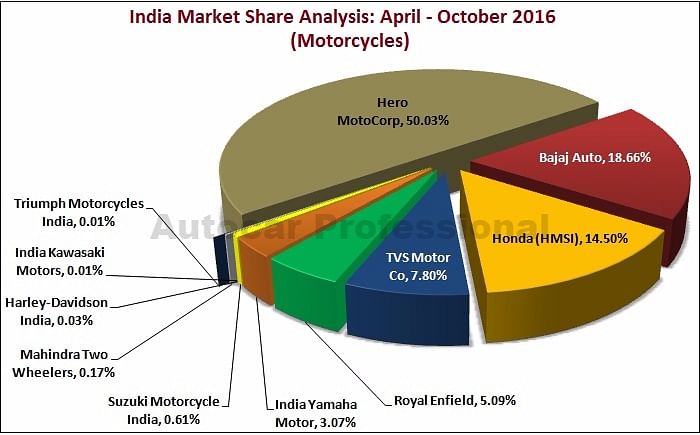

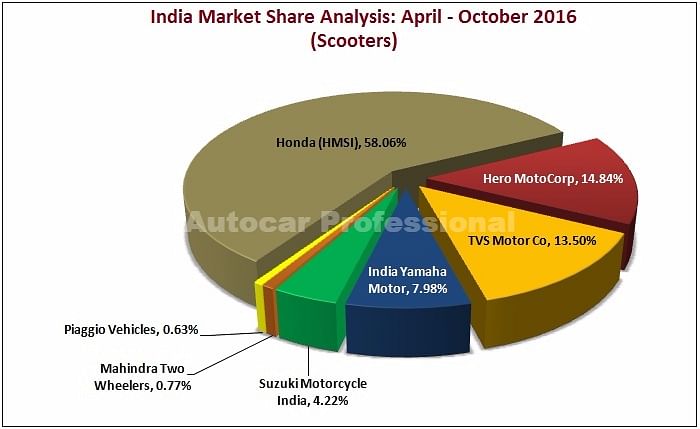

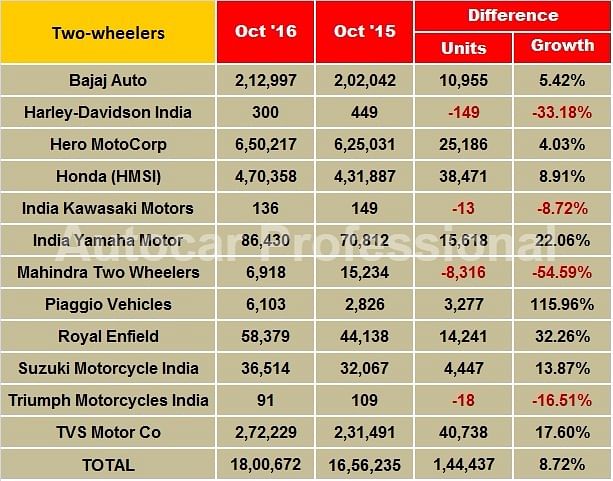

If both the passenger vehicle OEMs and the three-month-in-a-decline M&HCV sector can post handsome gains in October 2016, the buoyant two-wheeler segment cannot be different. With a bountiful monsoon giving a new surge to rural market demand, most commuter motorcycle manufacturers have seen an uptick in their sales numbers. And, the scooter market is maintaining its accelerating act.

Two-wheeler majors continued to register impressive growth in October 2016 on the back of Navratri, Dhanteras and Diwali. While Hero MotoCorp, TVS Motor Company and Royal Enfield recorded their best monthly sales in October 2016, Honda Motorcycle & Scooter India (HMSI) packed a mean punch. However, Bajaj Auto and India Yamaha Motor registered a sub-par performance when compared to their sales in September 2016.

Hero MotoCorp, the largest two-wheeler manufacturer by volumes, recorded its best month with sales of 663,153 units (including exports) in October, growing 3.65 percent YoY (October 2015: 639,802). The company, which recorded its third consecutive month of over 600,000 sales, claims to have sold more than a million units during this year’s festive season even before the Dhanteras day (October 28, 2016). An official release says, “This has overall been a record festive season for Hero MotoCorp. With this performance, the company’s dealer inventories have come back to normal levels.”

Hero MotoCorp has now recorded five months of over 600,000 unit sales in the first 10 months of CY2016.

Honda Motorcycle & Scooter India (HMSI) recorded total despatches of 492,367 units (including exports) during October 2016, less than its domestic sales in September (539,473 units). The company, however, registered a growth of 9 percent YoY over October 2015 when it had sold 431,865 units.

Domestic sales stood at 470,488 units, which comprised 302,946 scooters and 167,542 motorcycles. It is interesting to note that Honda has now sold more than 300,000 scooters consecutively for four months including October 2016.

The company has also breached one million unit-sales mark during this year’s festive season (September and October) with total sales of close to 1,250,000 units. This includes a dominating contribution by its top two bestsellers – the Activa scooter with over 700,000 units and the 125cc CB Shine motorcycle with over 200,000 units.

Commenting on his company’s performance during the period, Keita Muramatsu, president and CEO, HMSI said; “To meet the overwhelming demand this festive season, we started our preparations almost six months ago. We have been consistently growing month-on-month this year. As a trend, automatic scooters are clearly driving the two-wheeler industry growth and with the new scooter-only plant in Gujarat (HMSI’s fourth plant in India) achieving peak production capacity in September, Honda strategically met festive demand with seamless dispatches over two months. This planning resulted in Honda’s record performance and we acquired more than a million customers in the two festive months. What is more encouraging is that we have added 260,000 customers only on the Dhanteras day.”

On the cumulative sales front, Honda has recorded an industry leading growth of 21 percent YoY between April-October 2016. “With advanced preparations, aggressive marketing, new additional network and ensuring availability of products right up to the last-mile network, Honda’s festive retails grew a phenomenal 25% to stand at 1,250,000 units in the festival. Moreover, Honda also closed its April to October 2016 YTD despatch with 21% growth which is nearly double that of the 12% industry growth,” said YS Guleria, senior vice-president (Sales & Marketing), HMSI.

The company has now sold more than three million units (3,301,297 units) during the April-October 2016 period. Notably, while Honda’s scooter sales surpassed sales of two million units during this time frame, its motorcycle sales too delivered sales of more than one million units.

HMSI’s YTD sales include sales of 2,101,168 scooters (26 percent growth YoY) and 1,042,301 motorcycles (12 percent growth YoY) in seven months.

TVS Motor Company, the third largest OEM in the two-wheeler industry, sold 272,229 units last month, up 17.6 percent YoY (October 2015: 231,491). The company, which sells scooters, motorcycles and mopeds, sold 121,550 motorcycles (up by 14.48 percent YoY) and 92,417 scooters (up by 1.08 percent YoY) in October 2016, with both numbers including export business.

The 110cc Victor commuter motorcycle, which was launched in Q1 CY2016, has contributed impressive numbers to overall motorcycle sales. The Victor, which primarily competes with Honda’s Dream series and Livo, Hero’s Splendor iSmart 110 and Yamaha’s Saluto RX, has cumulatively sold more than 100,000 units within eight months of its rollout.

Bajaj Auto, the No. 4 player, despatched 212,997 motorcycles in October 2016, up by 5.42 percent YoY (October 2015: 202,042). This is slightly below its domestic performance in September 2016 when it recorded sales of 230,502 units.

Although the company is expected to roll out its 375cc model under an all-new brand later this month, it now has the Avenger and V as independent marques that are already garnering respectable monthly sales besides the popular Pulsar line-up.

The company expects to lure existing as well as new buyers of the mass (100cc) and executive (125cc) commuter motorcycle segments to the bigger 150cc and 180cc displacement categories by offering value-for-money models. The 150cc Avenger 150 and V15 are examples of this strategy. The company continues to dominate the 150cc-200cc motorcycle category in the Indian two-wheeler market.

On the year-to-date (YTD) front, although the exports have remained a sore area for Bajaj Auto, the domestic despatches have recorded an impressive 16 percent YoY growth. The company had sold 1,341,422 motorcycles during the April-October 2016 period as against 11,57,190 motorcycles sold during April-October 2015.

India Yamaha Motor reported sales of 86,428 units in October, up by 22.05 percent YoY (October 2015: 70,812). The company, however, scored relatively lower than its September 2016 sales, which stood at 89,423 units. The two festive months put together have delivered very good results for the company, which registered over 100,000 unit sales (including exports) for both the months for the first time ever.

Commenting on the monthly performance, Roy Kurian, vice-president (Sales & Marketing), Yamaha Motor India Sales, said: “October started with a positive sentiment for the two-wheeler industry. We continue to build on the growth momentum by reaching 86,428 units of sale during this festive season. Additionally, the good monsoon has also added growth to sales. Yamaha has received a fantastic response for its line-up of scooters like the Fascino, Cygnus Alpha (disc brake variant) and newly introduced Cygnus Ray-ZR.”

Burgeoning demand for scooter models and the 150cc FZ series comprise major volumes for Yamaha. The company is targeting a million unit sales in CY2017 and according to company officials plans to aggressively expand its all-India distribution network. Interestingly, Yamaha has silently rolled out its three-cylinder, 847cc naked MT-09 over the previous months. The model, which Yamaha globally positions as a lightweight midsize motorcycle, was earlier unveiled during the Auto Expo in February 2016. According to the company, it took a few months to have the model cleared by the authorities for commercial sales in the domestic market. Nonetheless, powered by robust growth, scooters remain the focus area for the company for the remaining part of the year.

Royal Enfield reported domestic sales of 58,379 motorcycles in October 2016, marking its highest ever for any month. The company registered YoY growth of 32.26 percent, reiterating the fast-moving brand’s resurgence in the market. It had sold 44,138 units in October last year. Royal Enfield’s September sales stood at 56,958 units in the domestic market.

On the other hand, RE exports almost doubled for the last month at 748 units. The company had exported 384 units in October 2015. Beating growth estimations, Royal Enfield has now neared monthly despatches of close to 60,000 units. These volumes were earlier forecasted for February-March 2017 period by the company officials. Meanwhile, Royal Enfield continues to expand its production capacity to cater to the exploding demand.

Additionally, selectively expanding its global footprint, it has now reportedly opened three retail stores in Spain with footprints in Barcelona and Valencia.

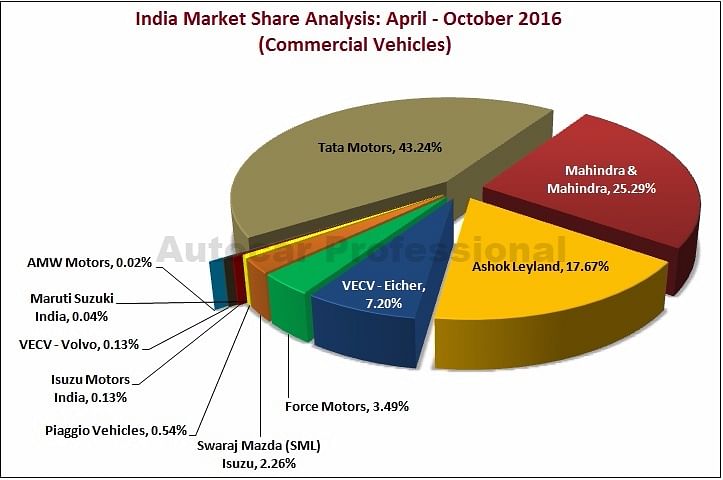

M&HCV SALES RECOVER AFTER 3 STRAIGHT MONTHS OF DECLINE

In what is good news for the Indian auto industry, sales of the medium and heavy commercial vehicle (M&HCV) segment – considered to be a barometer of the economy – which has seen a sustained decline over the past three months, have turned positive in October 2016.

Demand for M&HCVs last month saw an improvement across various sectors including construction, auto logistics, cement, petroleum products and FMCG / consumer durables segments.

Lead players Tata Motors and Ashok Leyland have both witnessed strong growth in their M&HCV numbers. After recording consistent growth for almost two years, both OEMs has seen M&HCVs sales dip in July, August and September as a result of slackening replacement demand and hampered movement due to monsoon in parts of the country.

Now, with the improved market sentiment, gradual resurgence of demand from rural India following a near-normal monsoon across the country, and improvement in fleet buying, M&HCV manufacturers will be keeping their fingers firmly crossed, hoping that the positive trend continues.

The return of M&HCV numbers to the black confirms what senior industry personnel have been saying. In a recent interview to Autocar Professional, RT Wasan, vice-president (Sales and Marketing), Commercial Vehicle Business Unit, Tata Motors, HAD said: “The drop in M&HCV numbers is due to very high growth last year. The sharp drop in the cargo segment in June, July and August 2016 is due to the monsoon, freight availability and freight rates and the replacement demand slowing down. But the tipper segment, which did not have a strong growth base last year, is doing quite strongly at over 30% and continuing to grow. We see the market bouncing back. With the monsoon season over, agriculture will also pick up, the festival season is coming up and typically demand in the second half of the fiscal is better.”

Read more: How slowing M&HCV sales impacted overall CV numbers in H1 FY2017

The Indian Foundation of Transport Research & Training (IFTRT), which tracks truck movements in the country, in its mid-month truck rental update, said: “With businesses at their peak due to the festival season, kharif harvest and consumer spending buoyant , low inflation for food items and consequent cargo offerings from agriculture, factories and improved foreign trade volume pushed up truck rentals during October 2-17 by 3-3.5 percent. The maximum demand for freight movement came from SME units, car and two-wheeler transportation, consumer durables, FMCG, general merchandise , cement ,timber and various high value marble and tiles.”

However IFTRT cautioned that “fleet owners are still not in truck fleet expansion mode and are in wait-and-watch mode because of the incoming GST and BS-IV buying, among other issues, which may unfold during January- March 2017.”

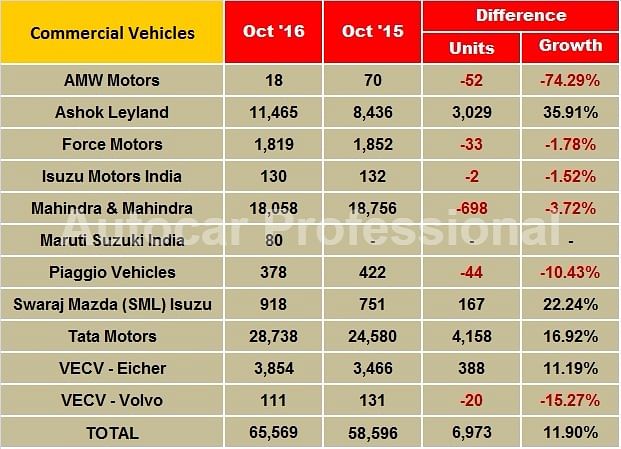

How the truck makers fared

M&HCV sales numbers for October 2016 from various OEMs are a clear indication of a strong recovery. Ashok Leyland, Tata Motors and VE Commercial Vehicles have reported higher sales for the month.

Tata Motors recorded its highest-ever CV sales this year, selling 28,738 units in the domestic market in October 2016, up 17% (October 2015: 24,580). Sales of its M&HCVs recovered by 9% after posting dips for the last three months. M&HCV demand saw an improvement across various sectors including construction, auto logistics, cement, petroleum products and FMCG / consumer durables. The company’s LCV sales continued their upward trend by notching 21% growth in October 2016.

Ashok Leyland’s domestic sales increased substantially by 36% YoY with sales of 11,456 units (October 2015: 8,436). After three months of a sales decline, its M&HCV numbers rose 33% to 9,574 units (October 2015: 7,176). The company’s LCV sales were up 13% at 2,959 units (October 2015: 2,627).

Mahindra & Mahindra’s total CV sales dropped 4% at 18,058 units (October 2015: 18,756). M&HCV numbers were down by 19% with sales of 471 units (October 2015: 581). The below-3.5T GVW products saw a dip of 3% with sales of 17,182 units (October 2015: 17,770), while those in the above-3.5T GVW segment comprised flat sales at 406 units (October 2015: 405 units).

VE Commercial Vehicles maintained its double-digit growth with 11.2% with total domestic sales of 3,854 units (October 2015: 3,466 units).

FY2017 growth outlook for the sector

According to apex industry body SIAM, in FY2017, M&HCV sales expected to remain flat. Despite the dip in sales in the first half of the fiscal, an improvement in the overall economy led by an increase in industrial and agricultural output is expected to aid demand.

As a result of well distributed rainfall after three consecutive years, rural consumption is expected to revive. What will lead to higher volumes will be buyers advancing sales in Q4FY17 due to all-India mandatory BS IV implementation from April 1, 2017. Replacement cycles of 2011 models will also lead to higher volumes.

On the GST front, there are a few aspects which are making transporters circumspect regarding their buying decision: There is uncertainty around the discounts which transporters can avail in FY2018, owing to GST. Warehouse re-alignment is also expected and hence transporters are unsure about the type of vehicle which will be required to serve demand. Also keeping in mind the shift in warehouses at end-user level, transporters fear a loss in business and hence might delay their buying decision.

SIAM says tractor-tipper demand in 2016-17 is expected to grow in double digits on a high base. This is because end-use segments like cars, cement and steel are expected to do well in H2 albeit weak growth in EXIM and declining replacement demand can drag growth

Tippers are expected to post healthy growth due to speedier execution of construction of National Highways as well as a pick-up in the pace of infra and construction segments after the monsoon.

Also read: India Sales Analysis in September 2016

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

By Autocar Professional Bureau

By Autocar Professional Bureau

02 Nov 2016

02 Nov 2016

42772 Views

42772 Views

Shahkar Abidi

Shahkar Abidi