Slowing M&HCV sales impact overall CV numbers in H1 FY2017, LCVs back in the black

Improved LCV sales numbers help save the blushes for the overall CV sector as M&HCVs face a slowdown in the first half of 2016-17.

If it weren’t for the slowing down of sales for the past few months that pulled down M&HCV numbers, then the overall sales picture in the commercial vehicle segment in India would have been far better.

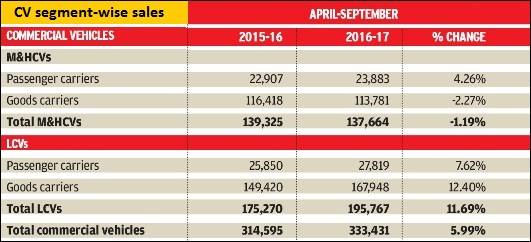

During the April-September 2016 (H1 FY2016), combined M&HCV and LCV sales were 333,431 units, up 6% (April-September 2015: 314,595 units.

The medium and heavy commercial vehicle (M&HCV) segment, which is the largest contributor to the industry in value terms, saw a marginal sales decline. This can be attributed to tapering down of replacement demand, ambiguity on the final GST rate and hampered movement of goods due to the monsoon in various parts of the country.

During April-September 2016, overall M&HCV sales stood at 137,664 units, down 1.1% (April-September 2015: 139,325). After posting strong double-digit growth for 18 months, the M&HCV segment’s sales started falling from July 2016, and saw sharp declines of 10.7% and 20% in August and September respectively.

Within the M&HCV segment, passenger carriers sold 23,883 units in H1 (+4.2%) while good carriers, which account for a larger share of the segment, sold 113,781 units (-2.2%).

In a recent interview to Autocar Professional, RT Wasan, vice-president (Sales and Marketing), Commercial Vehicle Business Unit, Tata Motors, said: “The drop in M&HCV numbers is due to very high growth last year. The sharp drop in the cargo segment in June, July and August 2016 is due to the monsoon, freight availability and freight rates and the replacement demand slowing down. But the tipper segment, which did not have a strong growth base last year, is doing quite strongly at over 30% and continuing to grow. We see the market bouncing back. With the monsoon season over, agriculture will also pick up, the festival season is coming up and typically demand in the second half of the fiscal is better.”

According to the Indian Foundation of Transport Research & Training (IFTRT), which tracks truck movements in the country, “While fleet operator consignments, freights and margins are improving, they are still not in truck fleet expansion mode. Instead, they are in in wait-and-watch mode, due to the upcoming GST implementation programme and BS IV emission norms. The events may unfold during January-March 2017.”

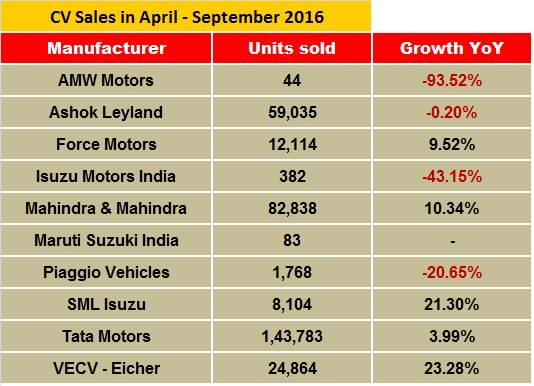

From the CV manufacturers’ point of view, their performance in H1 2017 has been a mixed bag. Tata Motors sold a total of 143,783 units (+4%). Ashok Leyland saw almost flat growth with sales of 59,035 units while Mahindra & Mahindra sales at 82,838 units drove a 10% growth. Meanwhile, VE Commercial Vehicles registered 23% growth with sales of 24,864 units. Force Motors’ sales at 12,114 units were up 9.5% and SML Isuzu recorded 21% year-on-year growth with sales of 8,104 units.

Commenting on the fall in the M&HCV segment, Sunny Manjani, consultant, Forst & Sullivan India, said, “The replacement demand has come down significantly. Also, the GDP numbers of Q1 are below expectations and reduction in coal production has impacted the sales of M&HCVs. However, due to a good monsoon and pre-buying due to upcoming BS IV emission norms, the segment should post growth of about 12-15% for FY2017.”

LCVs drive into growth mode

The light commercial vehicle segment, which has been seeing growth since November 2015 after a sustained two-year sales slowdown, is clearly benefitting from the green shoots of recovery. In August and September 2016, sales were up 11% and 16% respectively. For H1 FY2017, LCV sales at 195,767 units were up 12% (April-September 2015: 175,270). Importantly, the LCV sector’s improved performance has saved the blushes for the overall CV segment.

Both passenger and good carrier LCVs have seen an uptick. While passenger carriers sold 27,819 units (+7.6%), a total of 167,948 good carriers were bought (+12%).

Going forward, LCV sales are expected to see faster pace thanks to the boom in the e-retailing market all across the country, fueling demand for last-mile transportation. Growing demand from rural and semi-urban India should also help accelerate LCV sales.

Exports in H1 up 10.24%

On the export front, overall CV despatches posted YoY growth of 10%. During the April-September 2016, a total of 55,946 units were shipped to overseas markets as compared to 50,749 units in the year-earlier period.

RELATED ARTICLES

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

By Kiran Bajad

By Kiran Bajad

27 Oct 2016

27 Oct 2016

7677 Views

7677 Views