INDIA SALES ANALYSIS: OCTOBER 2015

Indian carmakers rejoice as festive consumer demand boosts PV sales, while overall CV sales in India turn positive in October.

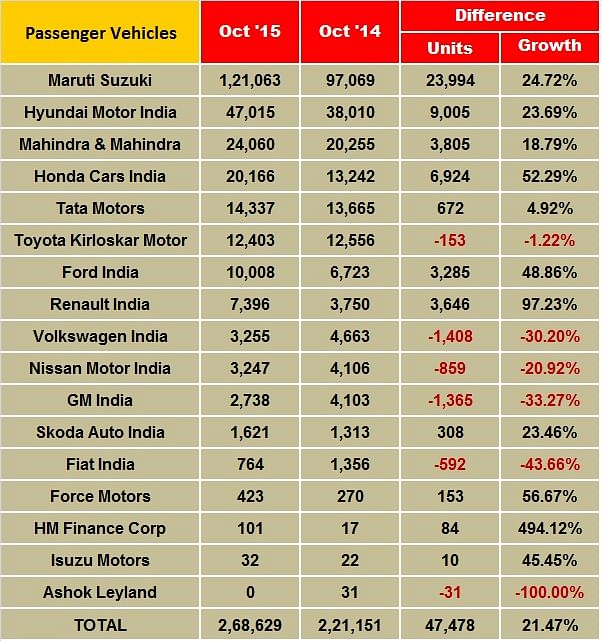

As we get into the thick of the festive season in October, Indian passenger vehicle manufacturers seem to have hit the jackpot as sales skyrocketed in the month with the top automakers in the country witnessing double-digit growth.

Low fuel costs, festival discounts, falling interest rates and fresh model launches all together seem to have worked in favour of the OEMs as they witnessed a surge in despatches.

The surprise interest rate cut of 50 basis points by the Reserve Bank of India just before the start of the month set the tone for the days to come and led to a spike in consumer demand. To bank upon the renewed interest, OEMs also introduced festive discounts and fresh models to lure customers, which further provided a boost to sales.

Sales in the first half of October were weighed down by the Shradhh period, a fortnight considered inauspicious for buying products, but picked up sharply in the second half with the onset of Navratri and Dussehra festivals.

The festive season and fresh launches augured well for Maruti Suzuki as the domestic sales of the country’s largest carmaker grew a whopping 24.7% in October 2015 to 121,063 units against 97,069 units sold a year ago. This is also the company’s highest domestic sales in 2015 so far.

The carmaker saw growth in almost all segments, barring the mid-size segment, as dispatches rose significantly. Sales of Maruti Suzuki’s mini segment, which comprises of the Alto and the Wagon R, rose 5.2% to 37,595 units in the month.

Sales of compact cars, which include models like the Swift, Ritz, Celerio and Dzire, grew sharply by 37.7% in the month to 51,048 units. October also marked the inclusion of the much-awaited Baleno to Maruti’s compact segment.

Demand for the Dzire Tour (for cabs and fleet operators) also remained strong and the company sold 3,418 units as compared to 1,408 units in October 2014.

Sales of the utility vehicles segment which comprises of Gypsy, Ertiga, Grand Vitara and the new S-Cross also rose significantly by 56.5% to 9,435 units. It is interesting to note that due to the slow off-take of the S-Cross, Maruti had started offering discounts of up to Rs 90,000 on the car last month.

On the downside, sales of the Ciaz sedan, which comes under the mid-size segment, slowed 7.8% to 5,890 units in October from 6,345 units a year ago. The company had introduced the Ciaz in October itself last year.

Sales of the vans segment, which comprise of the Eeco and the Omni, also rose by 30.8% to 13,677 units against 10,453 units a year ago.

On the export front, Maruti Suzuki saw sharp growth in October as the carmaker shipped 13,146 units, 90.4% higher than the previous year. As a result, total car sales for the company in October grew by 29.1% to 134,209 units.

October was particularly good for Hyundai Motor India as the Korean carmaker recorded its highest-ever domestic sales of 47,015 units and exports of 14,777 units with cumulative sales of 61,792 units for the month.

Commenting on the October sales, Rakesh Srivastava, senior VP (Sales and Marketing), HMIL, said, "Hyundai’s sales of 47,015 units are its all-time highest with an all-time high sales of the Grand i10 with 14,079 units and continued strong performance of the Creta and Elite i20/Active with 18,244 units. We expect the growth momentum to continue in the coming months with improving customer sentiments."

Hyundai Motor India currently has 10 car models across segments – Eon, i10, Grand i10, Elite i20, Active i20, Xcent, Verna, Creta, Elantra and Santa Fe. The company, which is India’s leading exporter, currently exports to around 85 countries across Africa, Middle East, Latin America, Australia and the Asia Pacific.

Honda Cars India reported the highest growth in sales among the top carmakers in the country with a whopping 52% rise in domestic sales of 20,166 units in October 2015 against 13,242 units in the corresponding month last year.

The City emerged as the company’s most sold car in the month with sales of 7,022 units followed closely by the Amaze with sales of 6,971 units. The new Jazz came in next with sales of 4,496 units. The company sold 820 Brios, 770 Mobilios and 87 CRVs in the month.

The cumulative domestic sales of the company were also up and stood at 117,383 units during the April – October period as against 101,442 units for the corresponding period last year marking a growth of 16%.

Speaking on the company’s sales performance, Jnaneswar Sen, senior vice president – Marketing & Sales, Honda Cars India said, “The festive demand has led to a strong growth for HCIL during October where-in we recorded our highest monthly sales of this fiscal year. We are thankful to our customers for their great response and support and hope to continue this momentum.”

Home-grown automaker Mahindra & Mahindra’s passenger vehicles division (which includes UVs, cars and vans) also reported a rise in sales to 24,060 units in October 2015 (October 2014: 20,255 units), a growth of 19% year on year.

Speaking on the auto sales performance for October 2015, Pravin Shah, president and chief executive (Automotive), M&M, said, “The advent of the festive season has provided the much-needed fillip for the auto industry especially on the back of the new launches of most manufacturers which has received an encouraging response. With the drop in interest rates and the fuel prices remaining benign, we expect the industry to maintain a good growth momentum going forward. At Mahindra, we are happy with our performance during October 2015, which has witnessed a positive growth of 20 percent backed by excellent response garnered from the recently launched TUV300 as well as other brands such as XUV500, Scorpio, Bolero and pickups. We are quite hopeful of this positive growth momentum continuing for the rest of the year.”

Tata Motors also reported year-on-year growth of 11% in passenger vehicles sales with 12,798 units, compared to 11,511 units a year ago. The automaker adopted the strategy of introducing special editions of its existing models to drive up sales.

The company introduced limited edition variants of its entire line-up of cars including celebration editions of the Bolt, GenX Nano, Safari Storme, and the Indigo. The company also introduced a special Zest Anniversary edition to mark one year of the Zest in the Indian market. Cumulative sales of passenger vehicles in the domestic market for the fiscal stood at 77,804 units, higher by 14% over last year.

Despite the onset of the festive season and reduced interest rates, Toyota Kirloskar Motor reported a decline in domestic sales in October. The automaker sold 12,403 units in the domestic market against 12,556 units, down 1.21% from a year ago. It exported 1,198 units thus selling a total of 13, 601 units in October 2015.

The company registered a cumulative growth of 9% by selling 119, 095 units in the domestic market from January to October 2015 as compared to 108, 863 units sold from January to October 2014.

According to the carmaker, the Etios series registered a cumulative growth of 12% from January to October 2015 when compared to the same period last year. This growth can be attributed to the overwhelming response received to the recently launched New Liva, it said.

Commenting on the sales performance, N Raja, director and senior vice-president, sales and marketing, said: "With the festive season on, we have seen a growth of 9% in our sales from January to October 2015 when compared to the same period last year. The Etios series has also seen a cumulative growth. The New Liva has received an overwhelming response from buyers. The sale of new Camry continues to grow and has already exceeded the total Camry sales in 2014. Camry Hybrid constitutes 90% of the total New Camry sales.”

Scandal hit automaker Volkswagen Group’s local arm, Volkswagen Passenger Cars India also reported de-growth in sales as uncertainty over the fate of Indian cars and product recalls marred the brand.

The automaker sold 3,255 units in the month, 30% lower than 4,663 units sold in October 2014. The company has still not notified whether its diesel cars sold in India are affected by the emissions cheating scandal and if a recall would happen. The brand has taken a hit with many customers opting for a wait-and-watch approach and despite festive offers and attractive finance schemes, dealers have seen lower footfalls at their showrooms.

While the carmaker’s cumulative sales in the January to October period were higher by 6.5% at 38,633 units, it may take some more time before sales pick up again for the German major.

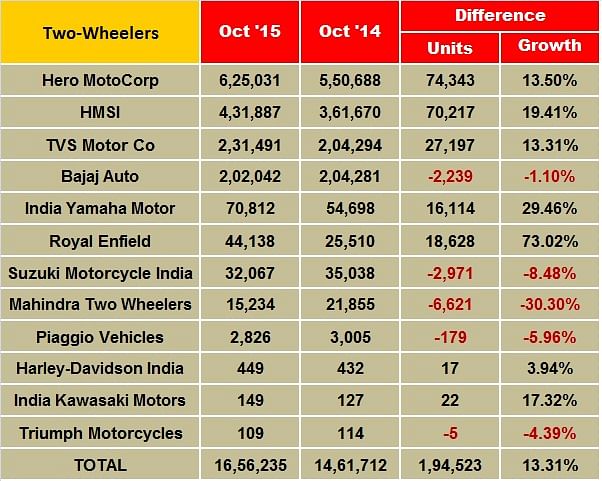

2W sales in October get festive boost

Thanks to the ongoing festive season, vehicle sales are back on the growth track. Of the sales numbers reported by two-wheeler manufacturers, the two-wheeler industry seems to have grown by more than 10 percent YoY for October 2015.

The biggest gainer in terms of the incremental sales volumes YoY was Honda Motorcycle & Scooter India (HMSI), which recorded an incremental sale of 70,402 units on the domestic front over its October numbers from last year.

Hero MotoCorp (HMCL) stood as the second player in the list to have recorded a substantial sales jump YoY. The largest manufacturer reported an incremental sale of 64,746 units (including exports) in October 2015, over its October 2014’s sales.

While HMSI, Hero MotoCorp, TVS Motor Company, India Yamaha Motor and Royal Enfield reported gains last month, Bajaj Auto and Suzuki Motorcycle India’s numbers showed a decline. Reports suggest that Bajaj Auto’s decline in sales numbers for the last month came on the back of weakening exports. On the other hand, it is understood that Suzuki Motorcycle India’s visible decline has come on the back of losing further traction in the booming scooter market.

Having said that, a number of analysts believe that the growth pattern in the overall vehicle market is visible primarily due to the festive season when buyers make purchases in the market. They suspect that continued distress in the rural markets might eventually dilute the growth in numbers.

"Lower interest rates, low fuel prices, pent up demand and new launches at very attractive prices are helping growth; the demand will not be sustainable after Diwali if distress continues in the rural economy," said Abdul Majeed, partner - Price Waterhouse and automotive expert.

In its official sales announcement for October 2015 sales, Hero MotoCorp has reported it has sold 639,802 units last month including exports. This, according to the company, is its highest monthly sales ever. It grew by 11.26 percent over its October 2014 sales, which stood at 575,056 units.

The official release stated that HMCL’s previous highest monthly sales was recorded in October 2013, when it had posted total sales of 625,420 units.

Further, it has reported that it crossed the 100,000 unit sales milestone in scooters last month. HMCL has sold more than 108,000 units last month. “In the domestic market, Hero MotoCorp scooter sales grew by 74.6 percent in October this year over the corresponding month in 2014. With this, the market share of Hero MotoCorp in the domestic scooter market has risen from 13 percent in September to almost 20 percent at the end of October,” stated the company release.

The surge in scooter sales highlight the instant bookings that the company received from the scooter buyers in the market after it recently rolled out two new models – the Maestro Edge and Duet. The company’s scooter portfolio now consists of four models – Maestro and Pleasure besides the two new models.

According to the company, it has crossed the 600,000 sales mark on four previous occasions barring the October 2015 month. HMCL has crossed this milestone in September 2015 (606,744), September 2014 (604,052), May 2014 (602,481) and October 2013 (625,420).

Honda Motorcycle & Scooter India (HMSI), India’s second largest two-wheeler company in terms of domestic sales, has recorded its all-time highest monthly domestic sales of 432,056 units in October 2015. HMSI, which sold 361,654 units in October last year, has registered a YoY growth of 19.47 percent in the domestic market.

It’s no surprise that at the forefront of this growth is HMSI’s scooter portfolio, which is led by the market leader Honda Activa. The company’s domestic scooter sales totaled 270,371 units last month as against the sales of 199,466 units in October last year, thereby marking a big jump of 70,905 units or 35.55 percent YoY.

On the other hand, HMSI’s total motorcycle sales in the domestic market stood at 161,685 units during the last month, down by 0.31 percent. It had sold 162,188 motorcycles in the domestic market in October last year.

On the export front, the company has witnessed a mild growth of 1,625 units or 10.59 percent on its October 2014’s export of 15,347 units. HMSI exported 16,972 units last month.

An official release said, “HMSI grew at 19 percent (domestic and exports put together), which is nearly double than the two-wheeler industry growth of 10 percent in October 2015.”

The official press release also claims that the company is the highest volume gainer and the highest market share gainer for its October 2015’s sales numbers. It says that HMSI’s domestic market share for the last month stood at 26 percent, close to one percent up on the previous month (September 2015).

According to the company, it has also breached the 300,000 unit sales mark for the first time during the Navratri-Dusshera period, an auspicious time considered by the countrymen to purchase vehicles every year. HMSI also retailed more than 90,000 units on the Dusshera day (October 22, 2015), which marked the highest single-day sales for the company for the ongoing year.

The third-largest two wheeler manufacturer, and the largest two-wheeler exporter from India, Bajaj Auto has reported a decline in its October 2015 sales. The company has reported total sales of 308,733 units last month (including exports) as against 336,923 units sold in October 2014. This marked a decline of 8.37 percent. Industry reports suggest that the company has reported a decline on the back of slowing two-wheeler exports, which contribute a substantial chunk to Bajaj Auto’s overall monthly sales. However, this is yet to be verified once more detailed reports are available from the company.

On the domestic front, it is estimated that the sales numbers for the last month might have only improved if not dropped to the tune of the decline in the two-wheeler exports.

The company that launched three new models in its cruiser portfolio last month aims to build its Avenger brand further like other brands such as Pulsar and Discover in its portfolio. It plans to sell close to 20,000 units of the Avenger models (Avenger Cruise 220, Street 220 and Street 150) every month, a five-fold jump to the original sales of close to 4,000 units every month of its Avenger 220 model.

The company is also working on areas to consolidate its Discover brand, and is also gearing up to launch an all-new motorcycle brand soon. While the analysts have a positive outlook of Bajaj Auto in the near term, the company is readying itself to take on the competition from the other big three in the market – HMCL, HMSI and TVS Motor Co.

For TVS Motor Company, the domestic two-wheeler sales for October 2015 stood at 231,491 units as against 204,294 units in October last year, up by 13.31 percent.

The total two-wheeler sales (including exports) grew from 231,990 units in October 2014 to 264,112 units last month, thereby registering a 13.85 percent growth.

The company witnessed bigger growth in its scooter portfolio as it recorded total scooter sales of 91,430 units in October 2015 as against 70,571 units sold in October last year. It reported a growth of 29.56 percent YoY. On the other hand, its motorcycle sales grew by 16.96 percent YoY as it reported total motorcycle sales of 106,175 units in October 2015 as against 90,779 units sold in October 2014.

India Yamaha Motor, which is consistently witnessing a growth in its scooter sales powered by the demand for its latest 113cc stylish scooter model, the Fascino, and the entry level sportsbike, the 320cc YZF-R3, has crossed the domestic monthly sales mark of 70,000 units for the first time ever since its entry in India in 1985.

The company has sold a total of 70,800 units in October 2015 as against its sales of 54,698 units in October last year. This marked a remarkable YoY growth of 29.44 percent, thanks to the spur in vehicle sales due to the festive season.

It can be recalled that the company had crossed the domestic monthly sales mark of 60,000 units for the first time in August 2015.

It can be noted that while the scooters are clearly driving the sales for Yamaha, the well-received Fascino has already become the best-selling scooter model from its stable. The fast growing scooter model rose to the sixth spot in the list of the top 10 best-selling scooters in India for the month of September 2015. India Yamaha had sold 16,882 units of the Fascino in September.

The 113cc Ray scooter models also continue to fetch stable sales for the company every month at an average of close to 10,000-11,000 units.

Commenting on the company’s achievement of scoring the highest domestic sales ever, Roy Kurian, vice-president – sales & marketing, Yamaha Motor India, said, “The overwhelming response of the Fascino in the market due to its glamorous design and fashionable appeal has boasted our confidence to sustain this momentum in the coming days. The month has ended on a very positive note for us as our recent launches of new colour variants of FZ-FI, Fazer-FI and single seat YZF-R15S also made it to the growth trajectory.”

Suzuki Motorcycle India (SMIL) has reported its October 2015 sales of 35,936 units as against its October 2014’s sales of 36,670 units (including exports). This has marked a decline of two percent YoY. While the company is losing traction in the scooter market, its latest motorcycle models in the 150cc segment, the Gixxer series has performed well so far. For the last month, SMIL has recorded Gixxer sales of more than 10,000 units in its overall sales – a first time for the new models. This also hints that Gixxers are now accounting for close to one-third of SMIL’s overall monthly sales.

Masayoshi Ito, managing director, SMIPL, said, “We are happy that our Gixxer series has crossed 10,000 units in market sales in October 2015, which is a testimony to its unmatched appeal amongst discerning young customers and also a sign of positive reception to our overall product portfolio in the market.”

Continuing its strong growth momentum in the domestic market, Royal Enfield has registered sales of 44,138 units in October 2015 as against 25,510 units that were sold in October last year. This marks a remarkable YoY growth of 73.02 percent. The company is riding high on the demand for its 350cc Bullet and Classic models from the Standard Street and Retro Street categories respectively.

It is also learnt that Royal Enfield is working on a clear strategy to boost its export as well as domestic business in the mid-term through a bunch of new upcoming products that are currently under development. It is known that the company, which is not going to participate in the upcoming Auto Expo in February 2016 in New Delhi, aims to become the largest player in the mid-segment bikes globally.

Given the overall momentum, November sales are expected to be good news for most OEMs.

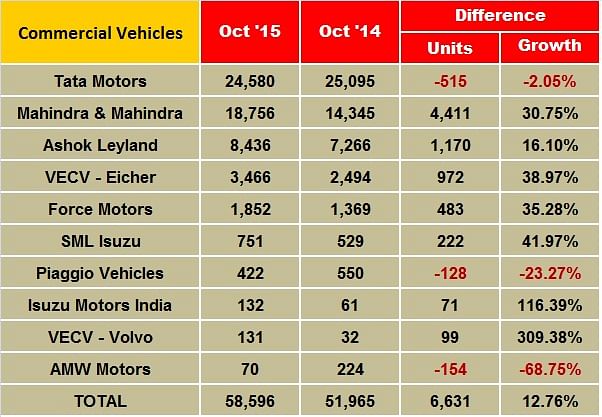

Overall CV sales in India turn positive in October

In an upbeat sign, commercial vehicle sales in October 2015 indicate strong growth in the overall segment. In what is very good news for the industry, like the medium and commercial vehicles (M&HCV) segment, the LCV segment seems to have turned positive last month.

Except for Tata Motors, the LCV segment has recorded strong growth for Ashok Leyland and Mahindra & Mahindra indicating recovery is underway in the segment albeit a slow one for the sector which has seen more than two years of slump.

As regards specific numbers, Tata Motors’ total sales of 26,119 units in the month were down 4 percent (October 2014: 27,249). M&HCVs continued double-digit growth of 20 % with sales of 12,504 units (October 2014: 10,352). The LCV sales remain a negative 19% YoY at 13,615 units (October 2014: 16,897).

Ashok Leyland’s total sales were up 17% at 9,804 units sold (October 2014: 8,402). M&HCV sales rose 22%, selling 7,177 units (October 2014: 5,865). Its LCV numbers were up a marginal 4% with sales of 2,627 units (October 2014: 2,537 units).

Like September, Mahindra M&HCV’s sales remain strong, up 169% selling 581 units (October 2014: 216 units). Bucking the industry trends largely due to the popular pick-up range, the less than 3.5 T GVW segment notched up 29% growth and sold 17,770 units (October 2014: 13,811 units). Similarly the above 3.5T GVW segment has increased by 27% growth selling 405 units (October 2014-318 units).

VE Commercial Vehicles (VECV) saw double-digit growth in the month with sales of 3,466 units for growth of 39% (October 2014: 2,494).

(With inputs from Shourya Harwani, Amit Panday and Kiran Bajad)

Also Read: India Sales Analysis - September 2015

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

By Autocar Professional Bureau

By Autocar Professional Bureau

03 Nov 2015

03 Nov 2015

22770 Views

22770 Views

Ajit Dalvi

Ajit Dalvi